Share

Read Next

Agility Fuel Solutions (Costa Mesa, CA, US) has become a global leader in the manufacture of Type IV composite cylinders and alternative fuel systems in commercial vehicles. These include Class 7 and 8 tractor-trailers, refuse collection trucks, transit buses and medium-duty trucks and buses. When combined with cars and light-duty vehicles, the global fleet totals 25 million vehicles. In the US alone, there are more than 175,000 natural gas vehicles (NGVs, which also include liquid natural gas or LNG), with 50 manufacturers producing 100 models of vehicles and engines.

There’s good reason for growth in CNG adoption. Natural gas can cost up to 60% less than gasoline and diesel fuel and reduces greenhouse gas (GHG) emissions by 30-90%, so the market for these alternative fuel vehicles is significant.

Agility’s leadership position in this high-growth market reaches back to the 1963 founding of Brunswick Composites in Lincoln, NE, US, and around the world to the company’s 50% stakeholder Hexagon Composites (Aalesund, Norway). As Europe moves to ban diesel cars by 2040 and reduce vehicle emissions by 30% in 2030, composite pressure vessels used in CNG and other alternative fuel systems are sure to be a key driver for increased carbon fiber (CF) demand. Composites Forecasts and Consulting LLC (Mesa, AZ, US) predicts this demand will grow to 45 MT per annum by 2025 (see “2017 Global Carbon Fiber Outlook,” presented at CW’s Carbon Fiber 2017 conference) — second only to wind turbine blades for carbon fiber consumption.

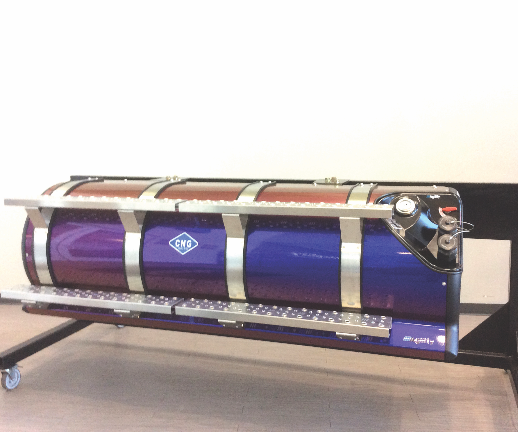

CW recently visited Agility Fuel Solutions’ systems production facility in Salisbury, NC. Carbon fiber-reinforced plastic (CFRP) cylinders are not made here. Instead, they are transformed. Before a vehicle can use them, a system for safe tank enclosure and fuel delivery must be designed, produced and installed. For CNG, this fuel system comprises typically 2-4 cylinders (but as many as 10 can be used), a structural chassis or rack to hold them, plus high and low pressure plumbing, fuel management and pressure regulation devices, safety equipment and crash protection (see Fig. 1). CW got the following close look at how this is done as Agility NC hosted a partially virtual, partially actual walk-through, covering the complete process chain, from filament-wound composite cylinders in Nebraska to installed systems on commercial vehicles across the globe.

Path to vertical integration

First, there was history. Agility Fuel Solutions began in 1996, with the founding of FAB Industries in Ontario, Canada, which then expanded into the US. It merged with EnviroMECH Industries (Kelowna, BC, Canada and Long Beach, CA, US) in 2010 to form Agility Fuel Systems. By 2015, Agility had developed more than 125 fuel system designs for buses and trucks, many based on Type IV all-composite cylinders. It also had become Hexagon Composites’ largest customer.

Hexagon Composites also was becoming a powerhouse, consolidating expertise and production capacity across all NGV and hydrogen fuel segments. It had begun in 1992 as Devold AMT, a Norwegian technical reinforcements producer, and had merged with Norwegian Applied Technology in 2000. Renamed Hexagon Composites, it had then acquired high-volume LPG cylinder producer Ragasco (Ragasco, Norway) in 2001, CNG cylinder supplier Raufoss Fuel Systems (Raufoss, Norway) in 2003 and CFRP expert/Type IV CNG cylinder manufacturer xperion Energy & Environment (Kassel, Germany) in 2016.

Hexagon had also secured a presence in the US market, acquiring Lincoln Composites (Lincoln, NE, US) in 2005. This icon of filament winding contributed 50+ years of composites experience. Founded as Brunswick Composites, it produced filament-wound missile bodies and pressure vessels for use in manned space flight and obtained its first certification for composite CNG pressure vessels in 1993. Sold in 1994 and renamed Lincoln Composites, it was then acquired in 2002 by General Dynamics (Falls Church, VA, US), which sold the Commercial Products Group to Hexagon.

Agility Fuel Services formed a joint venture with Hexagon Composites in 2013 and merged the following year with Hexagon’s global commercial vehicles businesses, forming Agility Fuel Solutions. “We are vertically integrated from cylinders through to installed systems on vehicles,” says Charlie Silio, Agility Fuel Solutions VP of corporate strategy, development and marketing. “We design CNG fuel systems for a variety of vehicles and customers, and then integrate the composite cylinders with the plumbing and other systems and install these into each vehicle so that it operates seamlessly, reliably and cost-effectively.”

Production of Type IV cylinders

That vertical integration begins in Lincoln, where the original Brunswick Composites company had its roots. The town is now home to Agility Fuel Solutions, General Dynamics and Hexagon Lincoln which house their production in unique facilities. The Agility facility has grown to a 9,290m2 manufacturing footprint and currently includes three filament-wound Type IV composite cylinder production lines.

Compared to Type I steel cylinders, Type IV cylinders — featuring a composite structure wound over a plastic liner — offer a weight savings of up to 70%. This increases payload to more than 85% of the pressure vessel weight and reduces fuel cost more than 60% vs. steel cylinders. Type IV tanks also are lighter than Type II and III cylinders, which are made by winding composites over a metal liner. The Type IV plastic/composite construction resists cyclic fatigue better than metal, offering lower maintenance and operating costs. (Read more about the different types of CNG tanks in the article “CNG tanks: Pressure vessel epicenter”).

Chet Dawes, senior VP of Agility’s Cylinders & Europe business unit, describes Type IV production in Lincoln, “We wind carbon fiber and epoxy resin over a plastic liner, which acts as a mandrel for the composite structure.” (See Fig. 2.) Liners are typically high-density polyethylene (HDPE) for CNG cylinders, but polyamide (PA or nylon) offers improved properties for hydrogen (H2) cylinders and better resistance to the smaller H2 molecules vs. CNG. Agility makes its own plastic liners in the Lincoln facility.

“We also use our own formulations for the epoxy resin,” Dawes continues, “and high-strength carbon fiber. We have longstanding relationships with our carbon fiber suppliers, which include Toray, Teijin, Hyosung and Mitsubishi.” Although a larger tow size — typically 12K or 24K — carbon fiber is used, Dawes says it is not spread. The three production lines use highly automated winding machines that include proprietary inline resin impregnation systems.

“We can wind cylinders that are 229 mm in diameter up to 762 mm in diameter, and in lengths from 0.6m to 3.8m,” notes Dawes. “We have the ability to make much larger vessels with much thicker walls, which would traditionally be painfully slow, but we’ve become experts in production of carbon fiber composite pressure vessels at scale. Our winders are some of the fastest in the world, and our production lines are focused on flexibility for quick changeover to make different products as needed. We can run at a high rate, even with larger cylinders, enabling us to scale while maintaining product performance which keeps production costs low.”

This performance is certified through testing. “We do almost all of the testing in-house,” says Dawes. This includes proof, burst, leak, permeation and hydrostatic cycle tests. These are required by transportation regulations, notes Silio, because these cylinders are part of commercial transportation systems. The specifications and standards for pressure vessels are different for H2 and CNG, and also vary by geographical region worldwide. Silio says 250 bar is the standard pressure for CNG cylinders used in North America but 200 bar is the norm for the rest of the world. For H2 cylinders, 350- or 700-bar are typical pressure standards for vehicles, but this increases to 950 bar for vessels used in stationary refueling stations. “We have the ability to test per all of these standards, as well as third-party witness requirements and destructive tests,” says Dawes. However, certain tests for cylinder performance are done off site, specifically when tanks are subjected to fire and penetration tests (the latter involving gunfire). “Once validation is complete, we ship the cylinders all over the world, including to our vehicle systems production facilities in North Carolina, California and Norway, and vehicle OEMs and other customers,” says Dawes.

Fuel systems production

CW’s tour of the North Carolina fuel systems production facility is led by Shawn Adelsberger, Agility Fuel Solutions director of plant operations (a position now held by Bryan Mewhort). From the lobby, he enters a large, open space with cubicles in the center, offices on the perimeter and a conference room near the entrance. “We broke ground in December 2014 and started production in December 2015,” he notes. This site is strategically located in the Southeast near key customers, including Daimler and Volvo. Other considerations for choosing this location included community and workforce availability and development programs. “We partnered with Rowan County Community College and the NC Manufacturing Institute to develop an 8-week class focused on manufacturing,” says Adelsberger. Graduates are Certified Production Technicians (CPTs). “We have over 80 graduates now, and 113 employees per shift.” The site typically runs two shifts. Within the 18,580m2 facility, almost 17,000m2 is production space, with room to grow, says Adelsberger, walking through a large employee break area and a door into the open production floor.

He points out that Agility was “entrepreneur-founded and we still have that entrepreneurial spirit. We have a strong engineering prowess and wanted to couple that with manufacturing prowess here.” Although at one time the company purchased all of the system components, “today, we make more of the pieces ourselves and have achieved improvements in lead time, cost and quality,” says Adelsberger, pointing out, “This is the only vertically integrated facility for CNG fuel systems in North America.” Originally, composite tanks were also going to be built in the NC factory. “But after the merger in 2016, we decided to leave all tank manufacturing in Lincoln,” he says. “Once we opened this site, we relocated most of our North American fuel system production here, except for our operation in California that assembles some systems for buses.”

Adelsberger walks through an area titled, “Visual Management,” ringed by various boards and displays that track production metrics. “We use these to drive continuous improvement,” he says. “We have continued evolving our products in collaboration with our customers.”

From this entry point on the north side of the production floor, the tour proceeds toward the rear and long side of the rectangular area, with the paint operations center on the left and eastern short side. Adelsberger notes the paint center takes up about 25% of the floor, and is another key part of the company’s vertical integration strategy. “We have a wet paint line and a powder coat line and can match to any color specification per OEM — and also match OEM paint quality and durability,” he claims.

Beyond the paint area, in the southeastern corner of the production floor, raw aluminum sheet and extrusions are brought in. Stretching from here across the rear half of the factory are the machining cells used to form the parts for the fuel system structures and covers. “We have invested in the latest equipment,” Adelsberger says. “For example, automated drilling centers cut the time to produce some structural parts from 24 minutes per cycle down to 4 minutes.” He also points out robotic tube bending stations. After machining, parts are painted and then supplied as needed to the assembly lines.

Halfway across the floor, Adelsberger turns back to face the north long side of the space and the entry to the assembly area. “We have three independent assembly lines,” he explains. These run left to right (east to west) just in front of the machining cells and occupy the center and front half of the production floor. As is done in Lincoln, production lines here are set up for flexibility and ease of switching between different products. Adelsberger details the day’s product mix: “The number one line on the far left is set up for refuse trucks; the number two line is for behind-the-cab systems (similar to what is displayed in the lobby); and the number three line is side-mounted, or what we call rail-mounted.” (Fig. 1B.)

The process begins with carts that are used to transport the assembly as it is built up through the stations (Fig. 3). Different metal parts are joined to form the system structure, and then a crane is used to place the large CNG cylinders. “We use many different cylinder sizes, depending on the type of vehicle and size of system being installed,” says Adelsberger. The remaining system components are installed, and each completed unit is then tested. “We use nitrogen up to 4,000 psi [275 bar] to proof and leak test the system,” he explains. “The operating pressure is 3,600 psi [250 bar].”

Just forward of the assembly lines, along the front or northern long side of the building, is where the fuel management modules (FMMs) are assembled. These comprise various tubes, valves and electronics. FMMs pass through their own quality checks and pressure testing station and are fed into the fuel system assembly lines once completed.

To the right of the assembly lines is the installation area at the western end of the building, where completed CNG fuel systems are integrated into vehicles. Installation runs perpendicular to the assembly lines, with vehicles driving in from the side and exiting the front. Adelsberger explains that quite a bit of installation is done at customer facilities. “Once we finish building the system, we have several options: Ship out to the vehicle OEM factory for installation; ship to one of several third-party installers (such as Fontaine), located across from Volvo in Greensboro, NC; or do the installation here, in which case we fuel up the system and check it out.” Although only one line operates now, there is room to add a second as the market grows.

Ready for growth

The outlook for growth is good. Currently, only 1.5-2% of heavy trucks produced globally are CNG vehicles. The Natural Gas Vehicle Association (NGVA) Europe forecasts a market share of 20-25% for heavy trucks and 30% for buses, while CNG market share in the US is aimed at 10%.

However, Agility Fuel Solutions is adding to its portfolio. Although it has manufactured H2 fuel systems for buses and trucks since 2002, it is now expanding this product line to include fuel systems based on larger-diameter Type IV cylinders for longer-range regional Class 8 trucking applications. One example is Toyota Motor North America’s (TMNA, Plano, TX, US) Project Portal initiative, begun in 2017, which is designed to extend zero-emission H2-powered fuel cell technology into heavy-duty trucks by demonstrating their use at the Port of Los Angeles.

In 2017, Agility launched its Powertrain Systems business unit, which now produces natural gas and propane engines, including the 488LPI, based on its patented liquid propane injection (LPI) technology. Thomas Built Buses has already signed on to use the technology in its school buses. Agility also announced this year a partnership with Romeo Power Technology (Vernon, CA, US) to make high-performance, modular battery packs for commercial vehicles.

“Whether it’s CNG, H2 or electric vehicle technology, commercial vehicles must carry a significant amount of stored energy onboard without excessive weight,” says Silio. “Our composites and systems expertise help us to provide a lower total cost of ownership than a diesel vehicle. As a result, we’re seeing increased interest in our advanced clean vehicle technologies in North America, Europe and, starting last year, in India.”

Dawes reiterates the importance of CFRP composites in this advance. “We share technology leadership and a collaborative R&D relationship with Hexagon, including a jointly funded composites center of excellence in Lincoln. As an example of their continued advancements in accurate, high-performance parts at high-volumes, he cites the Hexagon liquid propane gas (LPG) Type IV tank line that has produced more than 12 million pressure vessels on a fully automated, no-touch line (see “Automated filament winding enables competitive composite cylinders”).

“There are still a lot of steel cylinders out there and an opportunity for CFRP to replace steel in more established CNG markets, as well as capitalize on new markets like hydrogen,” says Silio.

He acknowledges that at the individual cylinder level, CFRP is more expensive when compared to steel, “but you can create more efficiency at the systems level with composites by using fewer, larger, sometimes higher-pressure vessels. This enables a solution that’s cost-effective at the level of a complete system, with much less weight. This is a good composites story but to make it work in the marketplace you have to not only be able to make the cylinders at scale, you have to make it easy for vehicle OEMs to use those pressure vessels by delivering them as part of a complete turnkey engineered solution.” He emphasizes. “We are able to do that and create a pull for CFRP cylinders.”

Related Content

Composites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreAchieving composites innovation through collaboration

Stephen Heinz, vice president of R&I for Syensqo delivered an inspirational keynote at SAMPE 2024, highlighting the significant role of composite materials in emerging technologies and encouraging broader collaboration within the manufacturing community.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More