Bucci Composites, based in Faenza, Italy, and located in the heart of Italy’s Motor Valley, got its start in the late 1980s, manufacturing parts for Formula 1. It eventually began making composite parts for high-end automotive OEMs, like Ferrari, Lamborghini and Porsche. Bucci is well known for its technical expertise and high-quality manufacturing capabilities. Photo Credit: CW

Even if the future of high-volume composites use in automotive applications depends on battery electric vehicles (BEV), it’s important to recall that automotive composites got their start — decades ago — in the high-performance market, starting in Formula 1 racing and eventually migrating into the high-end sports car market. The Corvette often comes to mind first as the progenitor of automotive composites use, but serious, sustained and highly engineered use of carbon fiber automotive structures was and continues to be most heartily embraced by a family of automotive OEMs who have become famous for producing high-performance, high-value vehicles —like Lamborghini, Ferrari, Maserati, Porsche, McLaren, Aston Martin, Ducati and more.

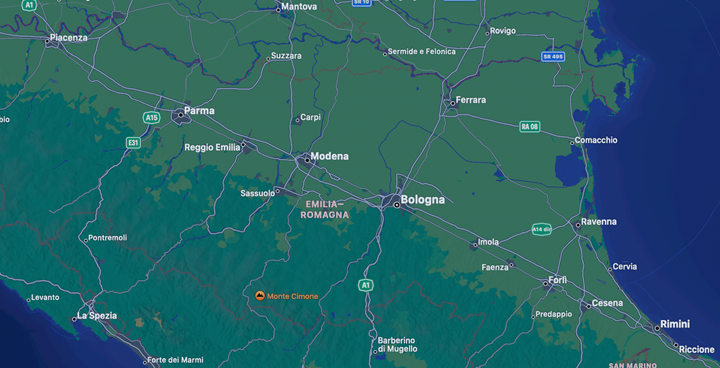

The heart of this high-performance sports car market has, for many years, been the “Motor Valley,” a region in northern Italy that is home to many of the highest profile carmakers, namely Lamborghini, Ferrari, Maserati, Dallara, Pagani and a handful of others. The Motor Valley spans a series of cities and towns that stretch roughly 200 kilometers from Rimini on the country’s east coast, continuing on a straight line north and west through Cesena, Fenza, Forlì, Bologna, Modena, Reggio Emilia and Parma, before ending in Piacenza.

Italy’s famous Motor Valley stretches 200 kilometers from Rimini on the country’s east coast up to Piacenza, just outside of Milan. Many high-performance sports car OEMs, and their supply chains, are located in Motor Valley. Bucci Composites is located in Faenza, southeast of Bologna. Photo Credit: CW

Like Detroit in the U.S., Motor Valley’s high concentration of OEMs has spawned a rich supply chain that enjoys a long and well-established history of manufacturing the parts and structures used to build such iconic sports cars as the Lamborghini Diablo (1990-2001), the Ferrari F40 (1987-1992) and the Maserati GranTurismo (2007-2019). All of these vehicles are famous for their aerodynamic styling, highly contoured bodies and penchant for high speeds. They are also famous for integrating advanced materials that simultaneously enhance vehicle performance as well as aesthetics.

Bucci Composites established

It was in the Motor Valley, in the town of Faenza, between Bologna and Forlì, that the company that would become Bucci Composites, was founded in 1988. The company’s first customers were in Formula 1, and the first street car it worked on was the Ferrari F40, followed in 1994 by the F50. The company grew quickly thereafter, adding other customers and end markets, including some aerospace, marine and industrial parts. Bucci Industries (Faenza) acquired the business in 2000, adding it to a larger portfolio of manufacturing firms — Iemca, Giuliani, Sinteco, Vire — that focus mostly on metals-based fabrication and assembly technologies.

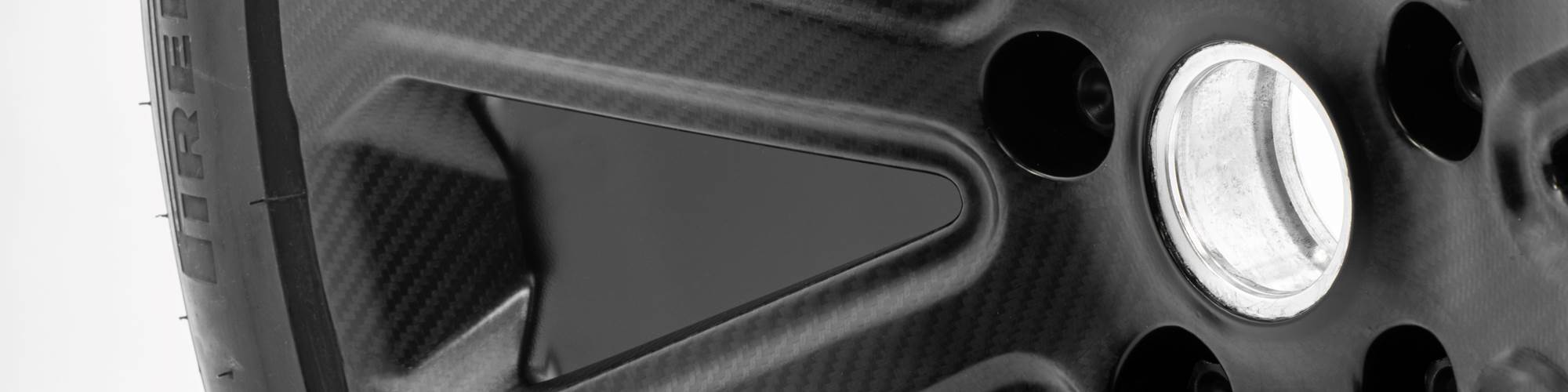

Although the vast majority of Bucci’s revenue is derived from work it does for customers, the company has developed its own carbon fiber wheel in an effort to generate direct revenues. This 22-inch wheel is being offered as an option on the Bentley Bentayga SUV and will be sold into the automotive aftermarket. Photo Credit: Bucci Composites

Andrea Bedeschi, general manager of Bucci Composites and CW’s guide for this tour, was hired in 2004 to manage and grow the composites business. He says that although he came in with plenty of business and manufacturing experience, his knowledge of composite materials and processes (M&P) was nonexistent. It took him a solid year to come up to speed on composites M&P, get a handle on the company’s position in the market and develop a go-forward strategy. The business at the time was relatively small and Bedeschi was tasked with developing a growth plan.

Ultimately, Bedeschi says, he recognized Bucci Composites’ strong heritage as a technically robust and competent designer of composite parts and structures, and combined that with high-quality, medium-volume manufacturing capability. On top of that, he pursued a strategy of strong customer integration — a commitment to customer partnership that has become a hallmark of the company today.

Bedeschi admits that Bucci’s services come at a relatively high price, but argues that the company’s customers get what they pay for; Bucci caters to customers and applications that seek and demand highly competent design, engineering and manufacture of complex composite structures.

Bucci operates two 11,000-square-meter facilities in Faenza, offering prepreg hand layup with autoclave cure, press molding and resin transfer molding (RTM). The company uses four cutting tables, two in each building, to cut plies. Photo Credit: Bucci Composites

Today, Bucci Composites is a premier composites manufacturer with annual turnover of €30 million, 250 employees, two 11,000-square-meter (108,000-square-feet) manufacturing facilities and production capabilities that include compression molding, high-pressure resin transfer molding (HP-RTM), vacuum-assisted RTM (VARTM), sheet molding compound (SMC), bulk molding compound (BMC), hand layup and autoclave cure. About 80% of Bucci’s revenues still come from the high-performance automotive market, with a balance in other markets and applications that fit the company’s profile.

“The reason why we are so focused on automotive is because we started with Formula 1 and because of the Motor Valley,” Bedeschi says. “The 200 kilometers from Piacenza to Rimini is the Disneyland of the automotive industry. It’s just easier to find business working for customers in this valley.”

At Bucci, Bedeschi says, “high-volume” is 4,000-5,000 shipsets per year, which represents the high end of the company’s throughput capabilities. The low end is hundreds of shipsets per year. There is a volume calculation here for Bucci, driven primarily by an effort to balance design and engineering cost and effort against revenue from actual manufacturing. A large, complex or highly contoured part, notes Bedeschi, might require commitment of substantial design engineering resources, which only makes sense if there is revenue derived from consistent, enduring production. Conversely, there are some applications and end markets that Bucci tries to avoid — those that require substantial design engineering, but production totals only in the single digits.

Bucci’s 1,200-square-meter cleanroom inside its main facility is where the company does much of the prepreg hand layup for autoclave-cured parts. Photo Credit: CW

Notable applications

So, what kind of programs fit the Bucci profile? Near the top of the list is the Ferrari 488 Pista, for which Bucci makes the composite rear spoiler, engine bonnet (hood), front bumper and aerodynamic wings under the front bumper. Production rate for this car is 20 shipsets per day, with an expected lifecycle volume of 4,200 shipsets. Another good fit is the Maserati Granturismo MC Stradale, for which Bucci makes the carbon fiber composite bonnet and front splitter at a rate of six shipsets per day. Bucci is also a candidate to become a partner to Ferrari for the fabrication of composite parts for the Daytona SP3 sports car, a limited edition mid-engine racer introduced into the market in late 2021 and designed to harken back to the original Daytona, introduced by Ferrari in 1968.

Slightly outside of Bucci’s typical application profile is a product CW first reported on in 2015 — very large carbon fiber arms for the CIFA K45K concrete pumping crane. Bucci makes these via autoclave cure in lengths ranging from 25 to 100 meters at a rate of about 80 shipsets per year. Bedeschi says Bucci won this contract because the company developed a solution for CIFA that enabled 25% weight reduction at boom lengths up to 20% longer than possible with steel booms, and those benefits far outweighed the cost.

Bucci invests heavily in recruitment and training of layup technicians, working closely with regional technical schools, universities and other partners to find talent. It takes about a year for a layup technician at Bucci to achieve full competence. Photo Credit: Bucci Composites

Despite the niche Bucci has established for itself, the company has discovered the same thing every high-technology, low-volume manufacturer has discovered: highly variable and highly volatile revenue cycles that wreak havoc on the balance sheet. Bedeschi says this prompted Bucci, several years ago, to begin development of a carbon fiber automotive wheel that might challenge established aluminum wheels in terms of performance and cost and provide Bucci an in-house product to deliver consistent long-term revenue. Starting in 2015, the company spent several years evaluating a variety of M&P combinations for a carbon fiber wheel, including hand layup prepreg and RTM. Bucci eventually wound up collaborating with R&D specialist Fraunhofer ICT (Pfinztal, Germany), which provided RTM expertise, and the University of Bologna (Italy) on development of a wheel that Bucci thought it could sell — either into an OEM or the automotive aftermarket, or both.

“We needed a customer [OEM] to get the specification for the wheel,” Bedeschi says. “And we started to look around Europe to ask if an OEM would like not to be internal to the project, but on the side of the project. The goal was to receive from the OEM a specification, and use the wheel that resulted if it passed all the tests. All of the costs would be borne by Bucci. In the end, we found Bentley.”

Bucci adapted an off-the-shelf ERP system to create a robust Industry 4.0 data management system to help the company track material, mold and process use for each part. QR codes are used throughout the manufacturing process to provide the traceability Bucci’s customers require. The system also has helped the company improve manufacturing efficiency and reduce errors. Photo Credit: CW

With a specification from Bentley Motors (Crewe, U.K.), Bucci completed development of its wheel. The final product measures 22 inches in diameter and features a carbon fiber rim and 10 carbon fiber spokes. It’s fabricated using a combination of hand layup and high-pressure RTM (HP-RTM) and offers a 6-kilogram weight savings compared to a competitive aluminum wheel. It was thoroughly tested by Bucci to make sure it meets all relevant protocols, including the new TUV standard for non-metallic rims. This, says Bedeschi, wasn’t always easy: “When you decide to make a wheel, you do all of the certification tests and you learn terrible things,” Bedeschi quips, adding, “You can’t imagine all of the performance requirements of a wheel like this one.”

In 2020, Bentley agreed to offer the wheel as an option on its Bentayga SUV. “We spent seven years to reach the end of this project,” Bedeschi explains. “We invested a lot of money.”

Bucci operates four autoclaves at its primary manufacturing facility. The widest, at 2.5 meters in diameter, is the largest. Bucci typically uses autoclave cure for highly contoured, low-volume parts. Photo Credit: Bucci Composites

After a month from an initial marketing communication through Bentley sales channels, the automaker received strong interest in the wheels from its dealers. Indeed, customer interest in the Bucci wheel option has exceeded expectations and suggests that there is a viable market for carbon fiber wheels.

Beyond Bentley, Bedeschi says Bucci will also target the automotive aftermarket with a 20-inch wheel, attractive because volumes there can be substantial. Bedeschi estimates the carbon fiber wheel aftermarket is about 50,000 wheels per annum, assuming they are priced appropriately. Bucci’s aftermarket wheels will be $15,000 per set, which Bedeschi calls “reasonable.” But it’s the imprimatur of the OEM that gives a composite wheel legitimacy, and that’s why Bentley was so important. “If you go through the OEM, you can be squeezed by the OEM on price,” Bedeschi notes. “But if you go to the aftermarket, you can manage the price of the wheel a little bit better.”

All of this, the Bentley wheel and the aftermarket wheel, has Bedeschi cautiously optimistic: “I am excited but nervous. Excited because we are very close to sending the first wheels to the market. So, we will see the result and the reaction. What is most important for us is to be on the road with our wheels.”

Bucci operates two Cannon presses. This 700-tonner is used for ply preforming prior to press molding or RTM in a 2,500-ton press. To justify investment in the steel tools used in these processes, Bucci employs press molding or RTM for parts that are not highly contoured and when volumes are relatively high. Photo Credit: Bucci Composites

On the floors

Following the company, technology and product orientation, Bedeschi began our tour with a visit first to the company’s primary manufacturing space at its main location. Again, Bucci is spread over two buildings, about a kilometer apart from each other. Each one is 11,000 square meters.

As with most composites manufacturing operations, we begin at material receiving, where glass and carbon fibers (dry and prepregged), resins and other materials are delivered to Bucci. Bedeschi notes that the company, for several years, has used an “informatics” system to provide tracking for all of Bucci’s manufacturing operations. This Industry 4.0 software, an off-the-shelf ERP system that Bucci customized, uses QR codes applied to materials, processes and products to document manufacturing data points and provide customer traceability. “We made a big investment in a system that provides full traceability of the part,” he says. “So, we know exactly all the things that happened to the part from beginning to the end — material used, tool used, who made that part, everything.”

In addition, the informatics system helps Bucci manage KPIs and conduct robust process control, which has helped Bucci identify and improve procedures — such as vacuum bagging setup, mold cleaning, material handling and scrap management — that were costing the company money. It also allows Bucci to catch process errors before the part is finished, through the use of checkpoints throughout the manufacturing process to make sure that procedures are being followed. “Our customers know we control process very well,” Bedeschi says. “Sometimes they are shocked because we are so reliable and can give them information about what exactly happened to the part. They are confident that we have the process in our hands.”

Bucci’s work for OEMs like Ferrari, Lamborghini, Ducati and others typically revolves around fabrication of fenders like those shown here, roofs, engine bonnets (outers and liners), splitters and interior parts. Photo Credit: Bucci Composites

Next stop is one of two cleanrooms in the facility, which contains two Gerber Technology (Tolland, Conn., U.S.) cutting tables, cutting dry and prepregged fabrics in preparation for layup or molding. The next cleanroom, at 1,200 square meters (13,000 square feet), is the largest and it dominates the manufacturing space. Inside are technicians in lab coats, laying up plies in molds and bagging those that will be autoclave cured. As with material receiving, each layup gets a QR code that identifies who the layup technician was, when the part was laid up, what materials they used, etc. Bedeschi notes here that Bucci’s biggest operations challenge right now is recruiting, training and retaining qualified layup technicians. Bucci pursues employees through a variety of programs, including a cooperative effort with Formula 1 racing team Alpha Tauri and other composites manufacturers, recruitment at a local technical school and through a master class on composites offered at the University of Bologna. “It takes, on average, about one year on this job for a worker to be experienced enough to be able to make parts without any support,” Bedeschi notes. “So, what we are trying to do is to support the schools and to encourage the school to follow the industry.”

The next stop on the tour is the compression molding/RTM area. Here, Bucci operates two large Cannon SpA (Caronno Pertusella, Italy) presses. One is a 700-ton preforming press, which at the time was preforming carbon fiber bonnet exteriors for one of Bucci’s automotive customers. Following this step, preforms are transferred to an adjacent 2,500-ton machine where the molding process is finished with either RTM or press molding. We leave the molding area and next visit the autoclaves. Bucci operates four autoclaves here, each a different diameter and length. The largest autoclave here is 2.5 meters in diameter and 8 meters long.

When asked about what factors drive Bucci toward hand layup/autoclave cure versus RTM or compression molding, Bedeschi says Bucci considers three variables when deciding the process technology to use to make a part: part geometry, quantity of parts in the shipset and duration of the program. “There is a break-even between the number of parts, where you can say it’s more convenient to make a steel tool,” Bedeschi notes. “Of course, it’s also connected to the geometry of the part, because you cannot make everything with the press.

Bucci does all of its trimming, drilling and finishing on one of four Belotti CNC machines. Two are located at the company’s main facility and two more are at the second plant. Photo Credit: Bucci Composites

Parts with complex geometry, 1,000 shipsets per annum and 1,000-2,000 shipsets total generally will be autoclave cured. As program part count and program duration increase, it becomes easier for Bucci to justify tooling costs for press molding or RTM. Bedeschi says a program of more than 1,500 shipsets per annum and 2,000-3,000 shipsets total will be press-molded. A program of more than 1,500 shipsets per annum and 5,000-6,000 shipsets total will be RTM’d. And, finally, he notes that a part with complex geometry and a Class A finish, even if the quantity is not small, might be autoclave cured.

On our way to the CNC area, Bedeschi stops to point out one of many production boards that Bucci has located throughout the facility. On it the company posts the usual metrics about manufacturing efficiency, productivity, error rates and KPIs. Bedeschi says that just the act of posting such data, and making it easily accessible to all employees, improved the company’s overall performance. “It’s important to let the people be aware of what they are doing,” he says. “And immediately, when we put the information up concerning the activity, without doing anything else, we saw our performance improve. Workers see this data and naturally just want it to be better.”

In the finishing area, Bucci operates two walk-in Belotti SpA (Bergamo, Italy) CNC machines, used to cut, drill and trim molded parts, before they are prepared for shipment to the customer. Before we get in the car for the short drive to Bucci’s second Faenza facility, Bedeschi leads us out of the back of the main plant to identify the space the company has available for expansion. He says Bucci expects to begin construction in summer 2022 for a 6,000-square-meter (64,500-square-foot) extension to accommodate new business. When complete, in summer 2023, he says Bucci plans to hire another 50-60 people to work in the new space.

At Bucci’s second facility in Faenza, the company manufactures concrete pumper crane arms for crane maker CIFA via a joint venture called Top Carbon. The arms range from 25-100 meters long and are shown being laid up here. Photo Credit: Bucci Composites

At Bucci’s second facility, we find many of the same operations and processes. The big difference here is one of scale. It’s in the second facility where Bucci manufactures the carbon fiber concrete pumping crane arms. This work is actually done through a joint venture, called Top Carbon, between Bucci and crane manufacturer CIFA (Senago, Italy). As noted, the crane arms range in length from 25 to 100 meters, thus everything required to fabricate the arms — molds and autoclaves in particular — is notably long. Other differences: Two Bullmer (Mehrstetten, Germany) cutting tables, one Belotti CNC machine (with another on the way) and a robotic bonding system that automatically applies adhesive to mating surfaces. Other automotive manufacturing is done here as well, including fender fabrication for a sports car OEM.

The booms are laid up with prepreg in half tools that are then mated, bagged inside and out, and then autoclave cured. The complication here is the ply layup sequence for each boom, which is specified on large ply schedule drawings located at each mold, showing which ply to place at what location along the length of the boom. In addition to manufacturing booms in this building, Bucci also repairs booms that have suffered in-service damage. “These parts have come back because something has happened to them,” Bedeschi notes, pointing to a couple of booms that clearly have seen use. “We will repair these and return them, and sometimes we go to the customer and do the repair on site.”

Although the Top Carbon booms are a focus of this second facility, the majority of the work done here is for Bucci customers. Bedeschi says the type of work that ends up in this building depends on scale, bonding and trimming requirements of the parts. The Belotti CNC system here, for example, is larger than those at the main location, which means it can accommodate larger parts. The second building also lacks RTM and press molding capability, so the only process performed here is prepreg layup.

A crane boom arm mold is fully assembled and vacuum bagged inside and out just prior to autoclave cure. Photo Credit: CW

What might be

Back at the conference room in the first building, Bedeschi reflects on where Bucci was when he was hired and where it is today. The fact that Bucci has plans to expand operations in 2022 is a testament to the secure place the company has in the supply chains it serves. That said, Bedeschi admits there is uncertainty up and down the Motor Valley about how the transformation of the automotive industry will affect suppliers in the region. The anticipated shift away from internal combustion engines (ICEs) and toward battery electric propulsion raises a lot of questions about where and how automotive OEMs — even the likes of Ferrari — will source the parts their cars will need. Will the Motor Valley remain a fixture of the supercar market? Time will tell.

“The future could be a problem,” Bedeschi says. “The mechanical factory of the German automotive industry is based a lot in Italy. So, the big transition we are facing in the next few years will strongly affect the supply chain as the transition to electrical motors begins.” Doesn’t such a transition also create opportunity? Yes, says Bedeschi, “we are starting to make factories for batteries, but we will close the factories that are doing other mechanical parts that will no longer be needed. So, this is something that will affect the supply chain of the automotive industry.”

Finished crane boom arms are staged in preparation for packaging for shipping. Already-packaged arms can be seen on the racks on the right. In addition to manufacturing new boom arms, Bucci also repairs arms that have been damaged in service. Photo Credit: CW

In the meantime, Bucci has established itself as a reliable, technically astute, well-controlled manufacturer of high-performance composite structures. And it is now bringing its carbon fiber wheel to market in what is hoped will become a significant and positive milestone in the company’s evolution. And beyond that organic growth lies the possibility of growth by acquisition as well. “Bucci is a composites company, but it is also a material company,” he says. “And why not in the future acquire some company that is doing something that could be close to what we do, or exactly what we do, depending on the strategy?”

Related Content

Ballistic protection panels manufacturer relies on automation for high throughput, efficiency

Maine-based CW Top Shops honoree Compotech Inc. recently doubled its manufacturing space and team to produce modular composite panels for defense applications via light resin transfer molding (LRTM).

Read MoreDesigning an infused, two-piece composite baseball bat

With its Icon BBCOR bat, Rawlings leveraged its experience in braided fabrics and RTM to create an optimized, higher-performance two-piece design.

Read MorePlant tour: Aernnova Composites, Toledo and Illescas, Spain

RTM and ATL/AFP high-rate production sites feature this composites and engineering leader’s continued push for excellence and innovation for future airframes.

Read MoreFrom the CW Archives: Fast-cure epoxies for automotive fabrication

Sara Black’s 2015 report on the development of snap-cure epoxies for automotive manufacturing still resonates today.

Read MoreRead Next

CW Trending: Bucci Composites’ Andrea Bedeschi talks F1, cars, cranes and wheels

In the third episode of CW Trending, we chatted with Andrea Bedeschi, general manager of Bucci Composites about the company history and recent carbon fiber developments.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More