Reinforced Plastics Mold New Niches In Electronics

For manufacturers and consumers, composites are protecting delicate circuitry and making devices more durable.

The history of composites in the vast and ever-growing electronics industry is unusual. Unlike the equally pervasive automotive industry, where a wide variety of fiber-reinforced thermosets and thermoplastics have begun to replace legacy materials in almost every area of vehicle design and manufacture, the electronics industry, with one notable exception, has been slow to commercialize composite solutions.

Composites are now a commodity in -- and clearly dominate the market for -- printed circuit board substrates or PCBs (see "Update: Printed Circuit Boards," p. 36, this issue). Aside from PCBs, however, applications for fiber-reinforced electronics components are almost universally characterized as niche applications. Electronics manufacturers are well acquainted with many of the polymers used as matrices in composites. Epoxies and nylons, for example, are used as potting materials, to encapsulate electronic components and protect their delicate circuitry. But these are unreinforced, neat-resin applications. Fiber-reinforced polymers have only begun to realize their huge potential in electronic products.

Yet, without question, composites offer electronics manufacturers far more than the marketing image of "space-age materials": they provide unparalleled rigidity, durability and a capacity for molded-in features and cost-saving parts consolidation. As the following illustrate, composites are proving advantageous as components of electronics manufacturing systems and as components in the finished products they produce.

Solder Pallets

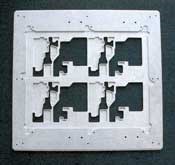

Almost from the time electronic assemblies first entered mass production, composites have come along for the ride -- or more accurately, provided the ride: Composite "solder pallets" carry PCBs as they travel through automated soldering stations, where molten solder is applied to fuse the electronic components' leads to the PCB's etched copper circuitry. In today's most prevalent soldering method -- wave soldering -- a pump in the solder tank creates waves in the molten metal. As the solder pallet and its PCB passenger pass through the tank at a fixed elevation above the solder line, the cresting wave brings molten solder, briefly and precisely, into contact with the exposed leads projecting from the PCB. Solder pallets are engineered for each PCB, because PCBs must be exactly positioned in the pallet, so that only those areas requiring solder are exposed to the molten bath.

Solder pallets are machined from cured glass-reinforced composite blanks, made from a variety of reinforcement forms -- chopped glass, random mat or woven fabrics. Matrices include polyester, epoxy and vinyl ester. One example is QC-8151C Engineered Structural Composite, a sheet molding compound (SMC) from Quantum Composites Inc. (QCI, Bay City, Mich.). Available in thicknesses from 5 mm to 12 mm (0.2 inch to 0.5 inch), the SMC consists of 55 percent chopped fiber in a vinyl ester matrix. QC-8151C dissipates static electricity (protecting delicate electronic components) by employing conductive fibers, explains product manager Matt Douglas.

As engineers choose the grade of pallet material for a particular application, they weigh the material's cost, which ranges from about $12/lb to $20/lb, against manufacturing and performance characteristics. Net-shape molding of pallets is rare (Douglas reports only one customer known to net-shape mold its pallets), because the tooling for each design is costly and the design itself can change with the rapidity one might expect from an industry that advances as quickly as electronics does. Therefore, almost all solder pallets are NC-machined from sheet material. Machinability, then, is a key consideration -- one that has grown in importance as electronic assemblies have become increasingly complex, notes Alan Johnson, business development director at pallet blank manufacturer Norplex-Micarta (Postville, Iowa). "You might have six, eight, ten circuit boards needing cutouts on one solder pallet," he says, "and machining might add $50 to $100 per hour to the pallet's cost." Generally, there is a trade-off between pallet durability and machinability. While pallet material suppliers seek to optimize both, pallets designed for shorter production runs (fewer soldering cycles) tend to machine most easily.

In wave soldering, the pallets must resist chemical degradation; though only those portions of the PCB that need soldering are exposed to the solder wave, portions of the solder pallet prevent some areas of the PCB from wave exposure and are, therefore, in contact with the molten solder as the wave passes. They also must maintain dimensional stability, exhibiting very low creep, warp or flex over the lifecycle of the pallet, so that the electronic assembly seats properly in the pallet and passes over the solder at precisely the right height. An unusual aspect of wave soldering is that the molten bath temperature is well above the glass transition temperature (Tg) of the solder pallet material. Johnson explains that the pallets can survive the high temperatures because exposure time is short (2 to 12 seconds). Yet he points out that the thermal shock the room-temp pallet receives when exposed to molten solder is only one factor that must be considered. The thermal fatigue that accrues during the soldering cycles is another. Pallets may experience this short exposure thousands of times in their life cycles. Therefore, it is critically important that pallets maintain their durability under extreme thermal cycling. Moreover, in the past, composite pallets with a Tg of 120°C to 150°C (250°F to 300°F) could be used to carry PCBs through solder baths heated to 230°C (450°F), Johnson recalls. However, regulations similar to Europe's Restriction on Hazardous Substances (RoHS) are proliferating throughout the world, prohibiting the use of lead in solder. "Lead lowered the melting temperatures in solder, which typically consisted of lead, tin, copper and silver," Johnson explains. "Now, you've taken the lead out." As a result, solder bath temperatures can range from 290°C to as high as 315°C (550°F to 600°F), he reports. The grade of resin is the critical parameter for surviving this hostile environment, QCI's Douglas says. Less costly grades of pallet material are available for shorter runs (100 to 500 cycles) but grades that will maintain their performance characteristics for 5,000 cycles or more and/or stand up to these higher temperatures can be costly.

To handle the higher temperatures, Norplex-Micarta has introduced WaveMax 5000, a pallet material featuring a high-temperature epoxy matrix reinforced with 40 to 44 percent random glass mat. (The company's previous pallet products, WaveMax 1000 and WaveMax 2000, use woven fiberglass and a lower temperature grade of epoxy.) Reportedly, random mat performs better in the application, due to lack of directionality. Moreover, the mat contains some z-directional fiber, which improves interlaminar strength and helps to justify the cost premium, Johnson says.

To produce WaveMax 5000 and its other grades of pallet material, Norplex-Micarta employs a continuous process that saturates the fiberglass in a resin bath, passes the impregnated reinforcement through a nip roller to control the amount of resin, and then conveys the material through an oven where solvent flashes off and the resin advances to B-stage cure. Multiple B-stage plies are stacked to yield the desired thickness, ranging from 0.8 mm to 12.7 mm (0.03 inch to 0.5 inch). Then, a heated high-pressure press (up to 1,000 psi or 6.89 MPa), molds the thermoset material into its final form. The sheet is trimmed and sanded to a tolerance of +/-0.08 mm/+/-0.003 inch.

The company has two additional products in the works: WaveMax 6000 will upgrade the epoxy to increase the material's Tg by 20C° to 30C° (36F° to 54F°). This will raise the solder temperature that the pallets can endure by 50C° to 60C° (90F° to 108F°), Johnson maintains. WaveMax 7000, still in development, will have higher glass content to increase board rigidity. Although this material will be more difficult to machine, Johnson is quick to add that it will maintain its flatness through more than 5,000 soldering cycles at steeper thermal gradients.

Reinforcing Cell Phones

For composite materials suppliers interested in servicing the electronics market, cell phone covers and housings alone account for what GE Plastic's Eric Timmermans estimates to be 700 million to 750 million units annually. Based in Pittsfield, Mass., GE Plastics recently tapped a portion of that market when Amoi Electronics Co. Ltd. (Xiamen, China) decided that the cover for its new M60 multimedia cell phone should perform more than a decorative function. The new cover design consolidates the previous decorative cover with several other once separate housing components. "The design of our M60 mobile phone presented several challenges that traditional materials could not meet," reports Amoi brand manager Lititia He. The unreinforced PC/ABS (polycarbonate/acrylonitrile butadiene styrene) or toughened PC resins used to make decorative covers were not stiff enough for the new cover design, yet many glass-reinforced composites proved too brittle at room temperature to provide the impact resistance cell phone covers need under the rough treatment cell phone users can dish out. (Impact resistance is tested by dropping the phone from a predetermined height). Amoi ultimately selected Lexan EXL4419 PC injection molding resin.

"As an integral part of the new phone structure, the cover required high stiffness in combination with excellent impact strength," explains Timmermans, the product manager for Lexan EXL resins. Lexan EXL4419's 9 percent chopped glass-reinforced PC resin and proprietary additives produce the required stiffness and ductility in one material, he says, and it demonstrates 60 percent greater fatigue resistance and impact strength than other commercially available glass-reinforced PC resins. Lexan EXL4419 covers passed the drop tests and open/close cycle tests that cell phones undergo, and it also provides high flow for ease of injection molding. Further, the formulation provides good surface quality, Timmermans says, adding that Lexan EXL can be painted and does not suffer from read-through of surface imperfections. Therefore, he expects Amoi's M60 phone to be the first of a number of applications for Lexan EXL resins in battery covers, cell phone covers and accessories.

Bio-phones?

In the cell phone market as well as many others now served by composites and plastics made with petroleum-based resin, biomass-based plastics, or bio-plastics for short, may give them a run for their money based on their ability to satisfy public and governmental concerns about the environment. This spring, materials giant UNITIKA and electronics giant NEC Corp., both based in Tokyo, Japan, announced their joint development of a natural fiber-reinforced bioplastic, which phone maker NTT DoCoMo Inc. (Tokyo) is using for the case of its FOMA N701iECO mobile phone.

The phone case is injection molded at about 100°C (212°F) with the new material. The case design is nearly identical to current cases, reports Masatoshi Iji, senior manager at NEC's Fundamental and Environmental Research Labora-tories. However, molding of the new material requires 60 seconds compared to 30 seconds at room temperature for ABS," he acknowledges.

Development of the fiber-reinforced bio-plastic, or bio-composite, came about as NEC researched ways to improve the heat resistance and strength of polylactic acid (PLA), a bio-resin derived from corn. The company found that adding 10 wt-% kenaf fiber (derived from the stalk of a plant of the same name) improved these characteristics sufficiently to make the material a candidate for electronics components. To make the composite, NEC melts the PLA resin pellets in an extruder and then mixes in 5-mm/0.02-inch kenaf fibers and other additives. Heat resistance, indicated by the temperature at which a test coupon deforms under load, was improved by more than 20C°/36F°. UNITIKA, which makes commercial PLA under the name TERRAMAC, then worked with NEC to improve the material's moisture resistance. They also added a flexibilizer to improve impact resistance, and they used proprietary additives and reinforcing fillers, developed for this application, to improve moldability.

The resulting material consists of 90 percent bio-mass -- a higher percentage than in any other bio-plastic currently available to the electronics market, the companies report. Iji believes the combination of high environmental appeal and achieved performance bodes well for the material's future. "We have great expectations for the expansion of its use through more customer agreements," he says.

Speaker Housings

High stiffness-to-weight makes composites an appealing material choice for upper-middle to high-end speaker housings. That was the driver when a leading audio system manufacturer recently specified Nu-Stone 44-1, a 15 percent glass-reinforced polyester BMC, for shelf-type speakers packaged with home-entertainment systems, which currently sell at a rate of more than 100,000 annually. Developed by Industrial Dielectrics Inc. (IDI, Noblesville, Ind.), Nu-Stone is immune to "boom," the acoustician's term for resonance (sympathetic vibration) of traditional wood speaker housing sidewalls, which distorts sound reproduction. "Wood is notorious for this," notes Paul Rhodes, IDI's VP of sales and marketing. Nu-Stone has performed well for several speaker manufacturers, because of its rigidity, Rhodes reports, and also houses outdoor speakers, notably at the Indianapolis 500 Speedway, because of its high corrosion and UV resistance.

Nu-Stone is compression molded to form speaker enclosures that measure approximately 13 cm by 13 cm by 20 cm (5 inches by 5 inches by 8 inches). Although details of this particular molding operation are undisclosed, Nu-Stone 44-1 BMC generally is molded at about 150°C/300°F and between 1,000 psi and 2,000 psi, with cycle times of 30 to 45 seconds per 32 mm/0.125 inch of wall thickness. Since high-performance speakers of light weight still carry the perception of poor quality, marketing constraints dictated a higher specific gravity and greater wall thickness on the home-entertainment system speaker housings than either boom or structural performance demanded. Because Nu-Stone is UL-approved (Underwriters Laboratories Inc., Northbrook, Ill.) for current-carrying parts, back-panel electrical connections can be molded in, eliminating secondary assembly, Rhodes notes. The material also provides molded-in color, eliminating post-mold painting. "All the intricacies of the design could be incorporated in one molded piece," says Rhodes.

Composite material initially found its way into speaker applications because of its lower labor demands compared to wood, says Rhodes. Yet, despite the superior acoustic performance of composites, Rhodes believes wood speakers likely will sustain the lion's share of the market because of wood's aesthetic and nostalgic appeal, while offshore manufacturing keeps labor costs down. He thinks the biggest obstacle to greater speaker market penetration for composites is education. "We haven't penetrated the way we want to because we haven't gotten people to understand the material," he says. One point of potential customer appeal is Nu-Stone housing's 5 percent recyclate content. "We're the only company that has received UL approval to put recycled content in its material," Rhodes declares.

Automotive Modules

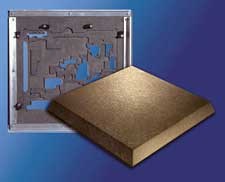

Meanwhile, another IDI bulk molding compound, also featuring 5 percent recyclate, is finding use where the electronics and automotive markets converge. IDI sales engineer Mark Dreslinski says the company's 15 percent glass-reinforced 48-50 polyester BMC is used in the rectangular 20-cm by 15-cm by 2-cm (8-inch by 6-inch by 0.75-inch) control module cover for an engine management system used in a major line of automobiles. Traditionally made from die-cast aluminum, the covers now can be produced less expensively using composites, he maintains, because tooling for the composite version costs 10 to 30 percent less and lasts two to four times longer than tooling for die-cast aluminum. The composite covers also are net molded to variable wall thicknesses -- including internal ribbing -- to a tolerance of +/-0.08 mm to +/-0.13 mm (+/-0.003 inch to +/-0.005 inch) -- critical to the sealing required to protect the control module from the harsh underhood environment -- while die-casting requires overmolding and secondary machining to achieve these tolerances. Machining is further simplified because the composite cover includes molded-in pilot holes for self-tapping screws.

IDI's proprietary compounding procedure enables the company to incorporate a blend of three different glass lengths -- 3.18 mm, 6.35 mm and 12.70 mm (0.125 inch, 0.25 inch and 0.50 inch) -- which enables IDI to tailor the characteristics of the material, balancing manufacturing demands like material flow against performance demands, such as impact strength. The covers are injection molded in a two-cavity tool. Injection temperature is maintained at 160°C to 165°C (320°F to 330°F). A two-second fill time for the 800g/1.75-lb shot, under 8,000 psi injection pressure, initiates a 50-second cycle time. Robotic demolding is followed by hand deflashing. Dreslinski points out that fabrication parameters are carefully controlled to tailor the surface tension of the finished composite for metallizing so that the finished cover can be flash-aluminized for electrical shielding purposes.

From Specialty to Standard?

Historically, wood, metal and unreinforced plastics have satisfied the requirements of many electronics applications, but as performance demands increase, tolerances for error grow smaller and production runs lengthen, composites bring a unique set of performance characteristics that encourage their use. As evidenced by the applications showcased here, lightweight, stable and tailorable composites should be a strong contender in electronics manufacture for the foreseeable future.

Related Content

JEC World 2024 highlights: Glass fiber recycling, biocomposites and more

CW technical editor Hannah Mason discusses trends seen at this year’s JEC World trade show, including sustainability-focused technologies and commitments, the Paris Olympics amongst other topics.

Read MoreEuropean boatbuilders lead quest to build recyclable composite boats

Marine industry constituents are looking to take composite use one step further with the production of tough and recyclable recreational boats. Some are using new infusible thermoplastic resins.

Read MoreAirbus works to improve the life cycle of composites in future aircraft

This companion article to CW's September 2024 Airbus Illescas plant tour discusses recycling, LCA, biocomposites, Fast Track technologies, qualification and more.

Read MoreDuplicor biocomposite cladding aids redevelopment of ABN AMRO office building in Amsterdam

Chosen for low CO2 footprint, RC value >9, fire resistance, light weight and high strength, Duplicor façade structures are key to two-story extension.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More