Reinforced Thermoplastics: LFRT vs. GMT

As the suppliers of long fiber-reinforced thermoplastics and glass-mat thermoplastics battle for market supremacy, the winner is … the composites OEM.

Once upon a time, glass-mat thermoplastic (GMT) composites were nearly the only option for engineers searching for increased stiffness, strength, and toughness in a polymeric material with a melt-reprocessable matrix, moderate costs, industrial-scale production capabilities and relatively thin cross-sections. Filled and short fiber-reinforced thermoplastics, primarily nylon were limited to small, nonstructural parts that could be injection molded.

Developed by PPG Industries (Pittsburgh, Pa.) in the mid-1960s, GMTs offered molders, at moderate cost, a compression moldable material with continuous random-fiber reinforcement. This material/process combination was conducive to industrial-scale production and fabrication of large parts with relatively thin cross-sections. Today there are two global GMT suppliers: Quadrant Plastic Composites AG (Lenzburg, Switzerland) and AZDEL Inc. (Forest, Va., a joint venture of PPG and GE Plastics, Pittsfield, Mass.) and a number of small, specialized producers, often selling in a single geography. For almost 30 years, GMTs faced little competition on the thermoplastics side of the composites arena, so their producers were able to focus efforts on converting applications previously produced in metals, fiberboard and sheet molding compound (SMC). The technology, therefore, evolved relatively slowly.

In the last decade, however, GMT producers have faced increasingly serious competition from two newcomers. The first was long fiber-reinforced thermoplastic (also know as LFRT or LFT), precompounded forms that evolved over several decades as a result of work by resin producers that sought to increase the mechanical properties of their short-glass injection-molding grades. Produced by pultruding continuous glass fiber and resin into small-diameter rods and then cutting the rods into pellets based on the desired fiber length, LFRTs offer performance intermediate between GMT and short-glass thermoplastics.

The first LFRTs were commercialized in the mid-to-late 1990s. Today, major suppliers of precompounded LFRTs include GE Plastics’ LNP Specialty Compounds Div. (Exton, Pa.), Ticona Engineering Polymers (Florence, Ky.), Dow Automotive (Midland, Mich.), Chisso Corp. (Tokyo, Japan), SABIC Europe (Sittard, The Netherlands) and RTP Co. (Winona, Minn.).

Late in the ’90s, molding machinery OEMs developed inline compounding (ILC) systems that facilitated development of direct long-fiber thermoplastic (D-LFT) processes. These systems combine, in one system, the previously separate compounding and molding processes. D-LFT systems permit the molder to combine resin, reinforcement and additives at the press, and deliver a measured shot or charge directly to injection or compression molding equipment for processing. ILC eliminates the need to inventory multiple formulations of precompounded product with different glass content. Although D-LFT requires capital investment in special equipment, users claim that ILC-equipped processes produce parts at lower cost than conventional processes that use either precompounded LFRT or GMT. Key suppliers on the injection machinery side include Krauss-Maffei (Munich, Germany) and Plasticomp LLC (Winona, Minn.), while the compression molding side is dominated by Dieffenbacher GmbH & Co. KG (Eppingen, Germany), Coperion Werner & Pfleiderer (Stuttgart, Germany) and Composite Products Inc. (Winona, Minn.).

Together, precompounded and direct-compounded LFRT comprise the fastest growing material category in the plastics industry. They have succeeded in applications where short-glass injection is inadequate but GMT is over-engineered — especially where a higher level of existing part complexity or the potential for parts integration (and resulting cost reduction) offer the opportunity to replace metals.

“LFRT compounds have seen significant growth over the last decade — on the order of 20 to 30 percent per year,” says Ron Babinsky, a senior consultant at Townsend Polymer Services & Information (Houston, Texas). “While GMT still represents the largest segment of thermoplastic composites — about 40 percent — consumption has been slowing due to competition from LFRT pellets and inline compounding.”

Townsend forecasts predicted in 2003 that the 2004-2008 span would see global thermoplastic composites consumption nearly double from 372 million lb to 647 million lb (168,736 metric tonnes to 293,474 metric tonnes), an overall growth rate of 11 percent per year, says Babinsky, the author/team leader of a new Townsend LFRT market study on thermoplastic composites that the company expects to publish in the fourth quarter of 2007. Although the study showed that GMT accounted for 40 percent of global long-fiber thermoplastic consumption in 2003, pelletized LFRTs had earned a 32 percent share, with D-LFT making up the balance. During the following five years, pellet and inline compounding were expected to show a combined annual growth rate of 16 to 17 percent, while GMT would slow to about 3 percent. LFRT/D-LFT consumption is greatest in Western Europe, which represents 54 percent of the global market, followed by North America (30 percent) and Asia-Pacific (16 percent). “Western Europe is also the largest customer of inline compounded product — about 80 percent of global consumption,” he reports. “Interestingly, direct-LFT is currently not used in Asia-Pacific, although it is eventually expected to be adopted there.”

Different in form & function

Although GMTs, LFRTs and D-LFTs can be applied successfully in a wide range of semistructural to light structural applications, they differ significantly in make-up, processability and the properties they bring to the finished part.

Glass mat thermoplastics. GMTs are produced on huge laminators, using a thermoplastic resin and one or more forms of reinforcement. The process yields a lightweight, partially consolidated, semifinished composite in sheet form. Most forms are produced to 1,300 mm to 1,400 mm widths (about 52 inches to 55 inches). However, some newer forms are made to greater but proprietary widths. The sheet stock may be cut to size to suit placement in the tool for a specific application and also can incorporate a decorative or functional surface laminated to one side. GMT makes possible the production of large parts (up to 27.7 ft²/2.58m², with current press technology) with low tooling costs and fast cycle times via compression molding. The potential for parts consolidation presents the opportunity to further reduce weight and cost.

Early GMTs featured a polypropylene (PP) matrix with continuous/randomly oriented glass mat reinforcement. This material has high stiffness in all three axes and exceptional impact resistance, even at low temperatures (-40°C/-40°F), which otherwise would be the Achilles’ heel of glass-reinforced polypropylene. Early uses included compression molded floor pans, seat backs, battery boxes, bumper beams and load floors for passenger vehicles as well as tractor components and military shipping containers.

The continuous glass/PP formulations, however, pose design challenges in some complex parts. Although the sheet is preheated prior to molding, flow in the tool is limited. As a result, the continuous fibers tended to bridge (instead of penetrate and fill) fine and/or deep-draw features, such as bosses, standoffs and thin ribs, producing resin-rich, failure-prone areas. The problem was overcome with the use of chopped glass mats. These feature fibers that range from 25 mm to 100 mm (1.0 inch to 3.9 inches). Their flow characteristics enable them to better infiltrate the intricate design features in complex components, such as instrument-panel carriers (IPCs).

Another form of GMT is the low-density “aerated” type developed for low-pressure thermostamping. All GMT composites take advantage of glass fibers’ tendency to try and return to their initial random orientation upon heating — a phenomenon called memory or back force. When the low-density blanks are heated prior to molding, the glass lofts, actually tearing away from the polymer matrix, yielding a composite that can increase its supplied thickness five to six times by the time it is placed in a tool. Because these products are not fully consolidated during the molding process, mats stay “open” with air spaces between fibers, producing parts with good stiffness at significantly less weight. Tool design and the molding process allow thickness variation across the part to tailor mechanicals without adding more material (and mass). Thermostamping, which is done at much lower pressures than compression molding, permits integration of decorative or functional surfaces (e.g., fabrics, carpet, scrim, paint films and even thin metals) with GMT. These materials may be introduced during either initial sheet manufacture or just prior to thermostamping, without harm to the decorative surface during forming. This enables production of first-surface parts in a single step. Typical applications for low-density materials include automotive headliners, underbody shields, parcel shelves, sun shades and interior trim panels for vehicles. Currently, the aerated-mat GMTs are marketed by AZDEL, Quadrant and Owens Corning (Toledo, Ohio). However, several North American automotive molders produce product strictly for their own use.

For the most demanding applications, textile-reinforced GMTs are used where traditional GMT, LFRT and many thermoset composites cannot compete. These sandwich constructions feature layers of chopped glass mat and highly engineered fabrics, thus providing very-high stiffness, strength and impact resistance as well as an effective path for transferring loads, especially under high creep or fatigue or at high strain rates. Textile-reinforced GMTs are commonly used in spare-wheel wells, liftgates (liftdoors) for hatchback cars, rear-axle support brackets, highly loaded underbody shields for off-road use, pedestrian-protection beams, and new-generation seat structures and bumper beams. Quadrant is the only producer of this type of GMT composite.

Today, GMTs with various mat forms (impregnated with the same resin matrix) can be combined in layers during initial sheet lamination by the producer and/or when materials are placed by the molder in a tool. This makes it possible to selectively modify the material’s behavior during the molding process and customize performance in the finished part. Given this flexibility, unidirectional glass products also were developed to increase part stiffness in a single axis in the tool for applications such as bumper beams.

GMT development has moved beyond its glass/PP roots, with new varieties incorporating basalt and natural (plant-based) fibers and an array of matrices, including high-performance engineering plastics — developments covered elsewhere in this issue (see p. 32).

Precompounded LFRTs. These forms evolved from short-glass injection grades and benefit from all the resin and additive diversity and sophisticated compounding and tooling that characterize this large class of polymers. Pelletized LFRTs are capable of being formed into more complicated part designs than are GMTs or D-LFTs. In contrast to GMT and D-LFT, precompounded LFRT can be supplied in fiber lengths (average 12 mm/0.5 inch) short enough to accommodate small, fine design details. In addition, the resulting part surface, though not as resin-rich as injected short-glass materials (6.3 mm/0.25 inch), is considered to be better, generally, than that of other thermoplastic composites because fiber bundles at the part surface tend to be smaller and finer.

Although they are generally processed by injection molding, pelletized LFRTs with longer glass are available from some suppliers for compression molding. Pellets can come highly loaded (up to 70 percent glass) and, therefore, can be diluted like a masterbatch at the press to customize glass loading levels.

The most common forms of precompounded LFRT are glass-reinforced PPs, but a broad range of semicrystalline and amorphous matrices is possible, and a smaller number are commercially available. These include nylon (polyamide or PA) 6 and 6/6 — the second-most common matrices in thermoplastic composites — as well as polyethylene terephthalate (PET), polybutylene terephthalate (PBT), high-density polyethylene (HDPE), polycarbonate (PC), polyphthalamide (PPA), acrylonitrile-butadiene-styrene (ABS), PC/ABS, thermoplastic polyurethane (TPU), and new grades in polyphenylene sulfide (PPS), acetal (polyoxymethylene or POM), and acrylic-styrene-acrylonitrile (ASA) resins.

Of all thermoplastic composites, precompounded LFRT has the narrowest range of commercially available structural reinforcements (most feature glass, but some are produced with either carbon or aramid fibers). Unlike GMT and LFRT, which tend to be basic black, precompounded LFRT has the broadest range of additive and colorant packages.

Inline or direct compounded LFT (D-LFT). The inline compounded products differ somewhat from the precompounded forms. First, D-LFTs are available for injection or compression molding. Most D-LFT systems, for injection or compression systems, feed glass roving (or other fiber) into a twin-screw extruder (TSE), where it is chopped by the screws as it is mixed with molten polymer and additives that have been metered in separately. To improve surface finish, some systems use knives to prechop the roving prior to entrance into the TSE. This method generally yields a shorter fiber, while the direct roving feed produces longer fibers and yields parts with higher structural performance. Each approach uses different and specialized screw designs. For example, the more common direct-feed method involves patented technology that enables screws to “cut” fibers to a defined length in the extruder barrel.

If the compound is to be compression molded, the extrudate exits as a log of preset weight, which is then transferred into the press for forming. Dieffenbacher offers an alternative approach for parts that require a Class A surface: Glass roving is chopped dry and dropped into a feed chute that meters the reinforcement into a “curtain” of melt continuously extruded from a slit die. The falling melt captures and carries the fibers into a second extruder for mixing. The company says the process opens up fiber bundles and provides better dispersion of individual filaments. A third option, developed by Dieffenbacher in conjunction with Fraunhofer ICT (Pfinztal, Germany) to produce parts with localized, continuous-fiber reinforcement, uses robots and needle grippers to automatically insert woven and nonwoven fiberglass reinforcements — such as Twintex sheet, supplied by Saint-Gobain Vetrotex (Chambery, France) — in very specific part locations.

For injection molding systems, the melt is typically fed from the extruder directly into the injection barrel, where a preset shot weight is injected into the tool for forming. An alternative is the Pushtrusion process developed by Woodshed Technologies and recently acquired by Plasticomp LLC (Winona, Minn.), a company that also produces and sells LFRT pellets and molds parts produced via LFRT pellet or ILC. Unlike extrusion/pultrusion processes, which direct glass roving and melt through a die, the Pushtrusion process combines continuous fiber with molten resin in a chamber mounted atop the screw barrel of an injection molding machine. Inside this Pushtrusion chamber, the resin, under high pressure, impacts the fibers at a right angle. The resulting turbulence promotes fiber wetout. The impregnated fiber is then immediately cut to a user-defined length. The resulting chopped fiber/resin mix is then delivered through a nozzle into the main screw barrel where it’s combined with the primary resin prior to injection.

Not only are processing options different between LFRT pellets and D-LFT, but so, too, are reinforcement options. Fiber lengths for D-LFT compression molding processes can range up to 30 mm/1.2 inch. While fibers are much shorter for D-LFT injection processes, fiber length for either ILC injection or compression can be significantly longer than that seen with precompounded and short-glass injection materials, whose pellets cannot be cut as long because of limitations in the design of current processing equipment, such as feed throat designs, conveying lines, etc. Longer fiber length enables D-LFTs to compete with chopped-mat GMTs in some applications. Unlike with GMTs and LFRT pellets, D-LFT fiber length can be varied on the fly to modify part properties. Moreover, fiber types are more easily varied and multiple types of reinforcements can be fed in simultaneously to create hybrid systems.

To date, however, there are fewer resin systems available for D-LFT than for precompounded LFRT. Likewise, additives suppliers have yet to formulate as broad a range of performance packages (flame retardants, conductive fillers, UV protection, etc.) and colorant packages for D-LFT as are currently available in LFRT pellets. That likely will change as more D-LFT systems are installed and D-LFT is employed outside non-Class A auto applications.

Battling for the marketplace

LFRTs have moved so quickly into the composites marketplace that some proponents believe it is just a matter of time before LFRT can do everything GMT can do at less cost and with greater design versatility. Townsend’s Babinsky notes, “A couple of trends are important factors in LFRT’s current growth. The entrance of large resin companies, such as GE, Dow and Chisso, with their greater application and market-development resources, will open up new markets and applications and be a major driver in the continued high growth of the LFRT market.” He adds that inline compounding technology has been accepted widely in Europe and has started to develop in North America.

While a few doomsayers note the shrinking molder base for GMT materials — particularly in North America — as evidence that GMT could be supplanted, GMT advocates point out that the longer, mat-type reinforcement GMTs will always yield better mechanical performance than either LFRT or D-LFT, making it — in some applications — the only form capable of meeting performance expectations. Cooler heads in each camp, however, see a future for both.

“Given the many advantages of LFRT, coupled with the fact that GMT no longer offers a unique solution in most applications, we believe that total market demand for LFRT will far exceed what GMT had,” Maria Ciliberti, automotive regional sales manager for Ticona Engineering Polymers, contends. But she doesn’t consign GMT to history. “Although it is quite possible for GMT to have a ‘life after LFRT,’ it will not be nearly as big as it once was.”

“LFRT compounds offer more design flexibility and material choices in terms of resin and reinforcements than GMT,” says Jamie Tebay, Americas product manager at GE Plastics’ LNP Specialty Compounds. He adds that some of the same benefits that allow LFRT to replace metal — such as parts consolidation, complex geometries, and increased productivity — also can be used for targeting GMT applications.

Coming to the defense of GMT is Fred Deans, market leader, GMT Products, AZDEL Inc., who says, “Compression-molded GMT products have been around since the 1970s and are a long way from extinction. They offer superior impact, strength, creep and fatigue performance vs. shorter fiber LFRT materials — whether processed by injection or compression molding.” Deans points out that GMTs have a strong future in the area of sheet materials, which can be processed less expensively via low-pressure thermostamping using less costly tooling (see “Related Content,” at left). Although LFRTs also can be used in sheet-type applications, he contends that such use involves higher costs for tooling, processing and quality control and can lead to serious tolerance issues. “We’re in the middle of a true renaissance with GMT,” he maintains. “The use of sheet-type GMT materials clearly is increasing.”

Keying on component complexity

A key issue in the GMT/LFRT debate is part complexity, which is increasing as molders seek ways to reproduce designs that consolidate previously separate components. Here, Ticona’s Ciliberti contends, “GMT is being held back as a result of its limitation to the compression-molding process, which has design limitations.” Noting that reinforced thermoplastics often beat out metals on the strength of cost reductions won through parts consolidation, she believes a similar scenario could play out when injection-moldable LFRT and GMT are evaluated for the same application. “If parts integration cannot be maximized because the part must be compression molded, GMT won’t be selected.”

Fraunhofer ICT’s Dr. Henning, however, counters that the design freedom argument may be justified when GMT compression is the alternative but does not apply to D-LFT compression, which offers comparable parts consolidation.

“I have not seen any limitations in geometry with D-LFT compression,” he says, citing a compression molding trial that Fraunhofer was involved with that used a complex injection-compression tool that features both shear edges and more than 16 cascades for production of a complicated instrument panel carrier. “We completely filled that tool with just one log of D-LFT,” he notes. “The result was no warpage and no problems with filling the so-called ‘difficult’ geometries. With inline compounding, the material really flows, filling ribs and challenging geometries more effectively than GMT compression but at lower pressures and with less shear than injection. That allows fiber length to be maintained, producing parts with good mechanicals.”

Joseph George, business development manager at Quadrant Plastic Composites Inc., the North American arm of Quadrant Plastic Composites AG, notes that, in any case, injection molding’s “design freedom” is only available to molders willing to accept a significant trade-off. “Design freedom is not the driving factor in LFRT gaining market share,” he contends, explaining that “LFRT is growing due to customer acceptance of lower mechanical performance vs. GMT in exchange for lower total cost. Based on test results we have seen, to date, LFRT products don’t have the same mechanical performance as GMT when making side-by-side comparisons of materials with equal glass content.” George says LFRT users often compensate by using thicker wall sections. “This results in parts with increased mass and thickness, which can lead to issues with stack tolerances and reduce the advertised cost benefits.”

Deans of AZDEL adds, “The move from continuous-strand to chopped mat reinforcement have allowed GMT materials to achieve complex shapes and designs that previously were possible only in the injection molding domain. Advances in compression mold tooling design and functionality have been instrumental in complex application developments.”

Controlling part consistency

One of the criticisms leveled at D-LFT technologies is that inline compounding’s on-the-fy changeability is a potential source of part variability. But is that a legitimate concern or is it a misunderstanding of the technology?

“D-LFT is used in high volumes for auto parts with exceptional consistency,” says Rob Roe, commercial director – Molding Compounds at Polywheels Manufacturing Ltd. (Oakville, Ontario, Canada), one of North America’s remaining compression molders of GMT, SMC and D-LFT. “Inline compounding equipment has made it possible to make large structural parts that are stronger and lighter and reduce cost. Development of equipment has been, and will continue to be, essential for continued growth of D-LFT.”

Dr. Henning agrees. “My experience is that this is not an issue,” he says. “First of all, modern equipment suppliers provide a manufacturing cell in which all the parameters during material compounding and part production are supervised.” Security levels in system controls prevent unauthorized access to programmed production parameters. “Second, it is a fact that inline compounding provides better mechanical properties at lower masterbatch or additive concentrations.” Henning notes that a leading European masterbatch provider already guarantees its compounds’ mechanical properties if they are processed correctly. “In my opinion, there are as many opportunities to screw up a process running with semifinished materials like GMT as with materials being inline compounded.”

While the battle for market share shows no signs of abating, the heat with which the “war” is waged could be a good sign: It shows GMT, LFRT and D-LFT proponents are passionate about their products. Rather than declare a winner, the better course, from the part manufacturer’s point of view, is to recognize that each product has strengths and weaknesses, which translate to advantages or disadvantages depending on the application requirements. The better informed engineers become about the differences, the more effectively they can maximize design-to-cost initiatives by testing and then selecting the best product and process combination.

Related Content

VIDEO: One-Piece, OOA Infusion for Aerospace Composites

Tier-1 aerostructures manufacturer Spirit AeroSystems developed an out-of-autoclave (OOA), one-shot resin infusion process to reduce weight, labor and fasteners for a multi-spar aircraft torque box.

Read MoreCompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

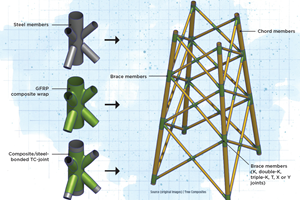

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;width=70;height=70;mode=crop)