SMC: Old dog, new tricks

A sheet molding compound renaissance highlights new reinforcements, new fillers, new matrices, new opportunities.

Sheet molding compound (SMC) has been commercially available since the early 1960s. For much of that time, it has been well used and well understood in the transportation market, in passenger vehicle, truck and bus, recreational vehicle (RV), agricultural, lawn and garden equipment and even aviation applications, as well as in the marine and building/construction sectors. Common transportation uses include a wide range of semi-structural and structural components: body panels, pickup boxes, tonneau covers, front-end modules, cowling, air detectors, under-body shields, aero skirting, floors, skins for panelized siding on truck trailers and RVs, valve covers, oil pans, and electric vehicle (EV) battery covers/boxes.

Throughout most of its history, SMC was defined as a compression moldable, sheet-form, B-stageable thermoset composite — essentially a specialized form of prepreg, with many of the storage and shelf-life limitations that define prepreg products. The earliest SMC formulations featured matrices of unsaturated polyester (UP), and, later, the option to upgrade to higher performing but more costly vinyl ester.

Unusual among composites, however, SMC could be formulated to survive auto industry E-Coat (electrophoretic rust preventative) and paint-line temperatures, enabling assembly line workers to mount Class A and structural SMC parts to a vehicle’s body-in-white (BIW) and let them travel through the normal production process rather than installing them at a later stage, at increased cost and labor (see Composites in Class A body panels: Evolution continues).

Recession, revision, reformulation

SMC’s use in automotive, still its largest market, reached its zenith during the late 1990s, when unprecedented high fuel prices in the US brought equally unprecedented pressure to reduce vehicle mass. SMC had expanded into many applications on numerous vehicle platforms and was suddenly exposed to a much broader range of E-Coat and paintline temperatures at plants owned by multiple automakers. There followed the much publicized blistering and “paint-pop” issues that developed at many plants. These became such a problem that several OEMs threatened to stop using the material. Focused and rapid R&D work within the transportation-composites supply chain produced chemistry innovations that solved the problem between 2001-2003 (see SMC resin and primer advances prevent paint pops). This led to a toughened type of SMC initially developed by ThyssenKrupp Budd Co. (now Continental Structural Plastics, CSP, Auburn Hills, MI, US) and AOC LLC (Collierville, TN, US), and soon offered by major resin suppliers and compounders.

Unfortunately, SMC already had been cancelled on many vehicle programs. By the time it was ready to be specified on the next launch cycles, the industry was in freefall during the 2008 recession. When automakers returned to profitability and higher vehicle builds in 2012, tougher government fuel economy and/or tailpipe emissions mandates were phasing in across North America, the European Union and other key markets for passenger vehicles and commercial trucks. Suddenly, OEMs were as interested in lightweighting as they were in reducing costs. That created new opportunities for composites and newer lightweight metals.

“This time, when SMC’s use picked up again, it wasn’t enough to be lighter than steel,” recalls Robert Seats, North American technology director, Ashland Performance Materials (Dublin, OH, US). “You also had to be lighter than aluminum and magnesium.”

Suppliers also had to contend with an auto industry move toward greater standardization across reduced numbers of global platforms — which meant materials had to be available in multiple locations and had to meet the applicable regulatory mandates in each of those geographies. SMC formulators also had to contend with the emerging “green movement,” which had created interest in low- and no-VOC formulations, biopolymers, recyclability and lifecycle management.

The response to these pressures led to the development of a remarkable range of new SMC technologies that are now effectively reinventing this workhorse composite. In fact, as these advances continue to be commercialized, the line between prepreg and SMC is blurring — so much so that industry leaders are discussing the need to redefine both terms. What follows (Part 1) is an exploration of the reinforcement and filler innovations. See Part 2 for CW’s discussion of resin, compounding and molding innovations.

New reinforcements: Higher mechanicals, thinner parts

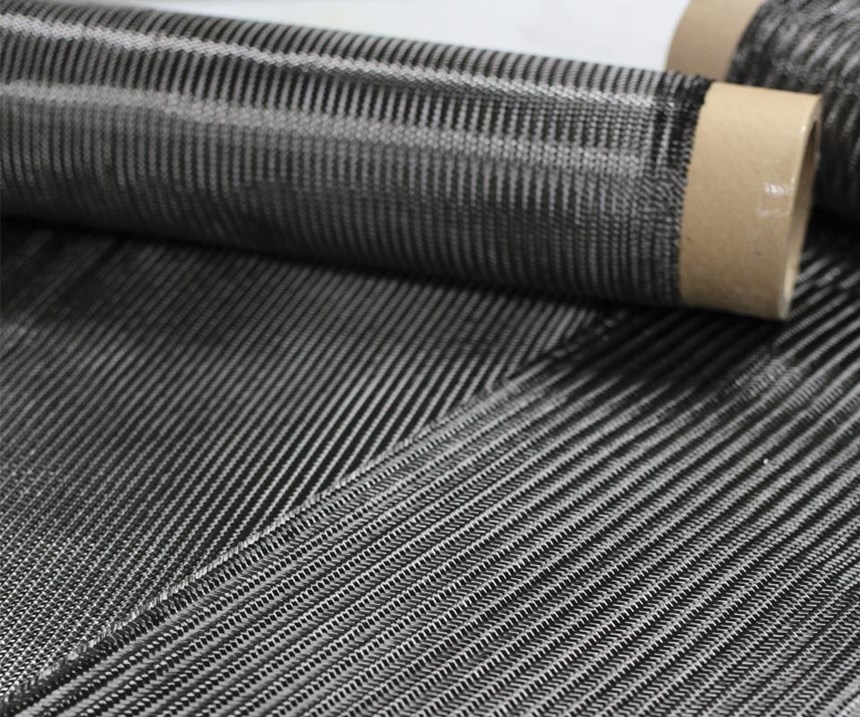

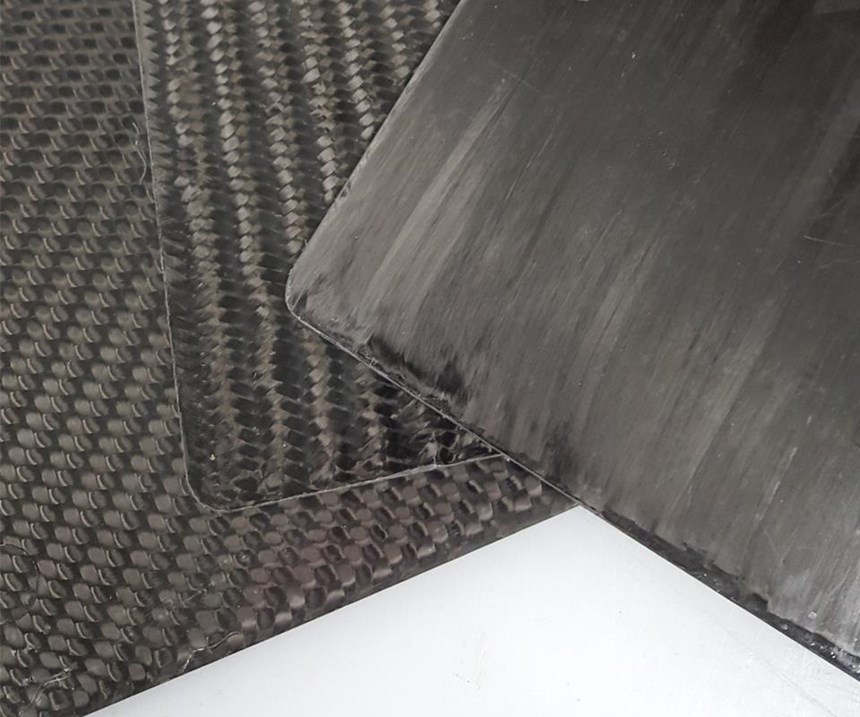

An important change to the conventional SMC recipe is that it is no longer defined by chopped glass fiber. Compounders and molders are exploring carbon fiber and even basalt fibers and are moving from chopped-fiber formulations into those that selectively use continuous-fiber reinforcements. The latter include not only unidirectional (UD) rovings, but also biaxial and triaxial weaves and non-crimp fabrics (NCF) to produce greater stiffness, strength and impact properties in parts that must nevertheless weigh less than standard SMC. As a side benefit, in many cases part walls also can be made thinner.

Continuous-fiber SMC often is combined with conventional discontinuous/chopped-fiber SMC, a technique that researchers at the Fraunhofer Institute for Manufacturing Technology (F-ICT, Pfinnztal, Germany) call “tailored SMC.” The advantage here is that the short-fiber SMC can fill ribs and other complex design features that continuous-fiber reinforcement tends to bridge, but the presence of continuous fiber enables mechanical performance approaching that of true prepreg, and do so at a lower cost and without investing in specialized processing equipment. Furthermore, this can be done without sacrificing SMC’s parts consolidation benefit or its capacity to form complex 2.5D geometries — more complex than can typically be molded in prepreg. An example of a continuous-fiber SMC part is the Chevrolet Spark electric vehicle (EV) battery box (see Onboard protection: Tough battery enclosure) from General Motors Co. (GM, Detroit, MI, US). An SMC part that combines both continuous and discontinuous reinforcements is the structural underbody from the U.S. Council for Automotive Research (USCAR, Southfield, MI, US) (see Automotive composites: Structural underbody).

As carbon fiber prices come down and more suppliers offer heavy tows (50K and 25K, used primarily in automotive and industrial applications), interest in “Carbon SMC” has definitely ramped up. Carbon fiber-reinforced SMC has been commercial, if not in widespread use, in automotive since it formed structural fender supports launched on the 2003 Dodge Viper from then DaimlerChrysler (now FCA US LLC, Auburn Hills, MI, US).

Molded by now-defunct Meridian Automotive Systems Inc. (Allen Park, MI, US), a pair of supports in 50% chopped carbon fiber with a VE matrix consolidated 15-20 previously metal brackets and saved 40 lb/18 kg vs. stamped steel. And carbon fiber fabric-reinforced SMC reportedly was used in Europe on locomotive covers in the early 1990s.

Today, many compounders and molders are offering SMC-type materials reinforced with various carbon fiber forms, but there are several challenges to marrying these materials. The first is finding carbon fiber sized for VE and VE-hybrid matrices, rather than typical epoxy or urethane, to ensure good bonding between matrix and reinforcement. The dearth of such offerings has led to a new project of the Institute for Advanced Composites Manufacturing Innovation (IACMI, Knoxville, TN, US) involving Zoltek Corporation: A Toray Group Co. (St. Louis, MO, US), Michelman (Cincinnati, OH, US) and Ashland.

“We think the chemistries are different enough, and the challenges significant enough, that we need the industry to come together,” notes Ashland’s Seats. “How hard is it to change sizings? Manufacturing changes are a big deal.”

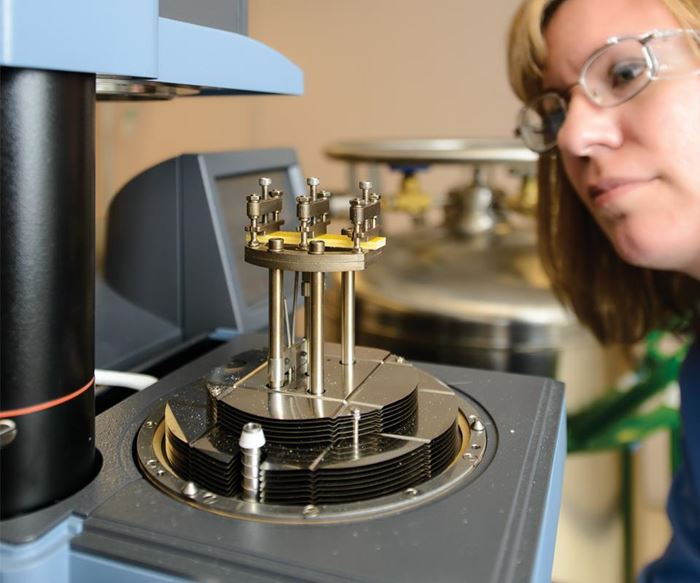

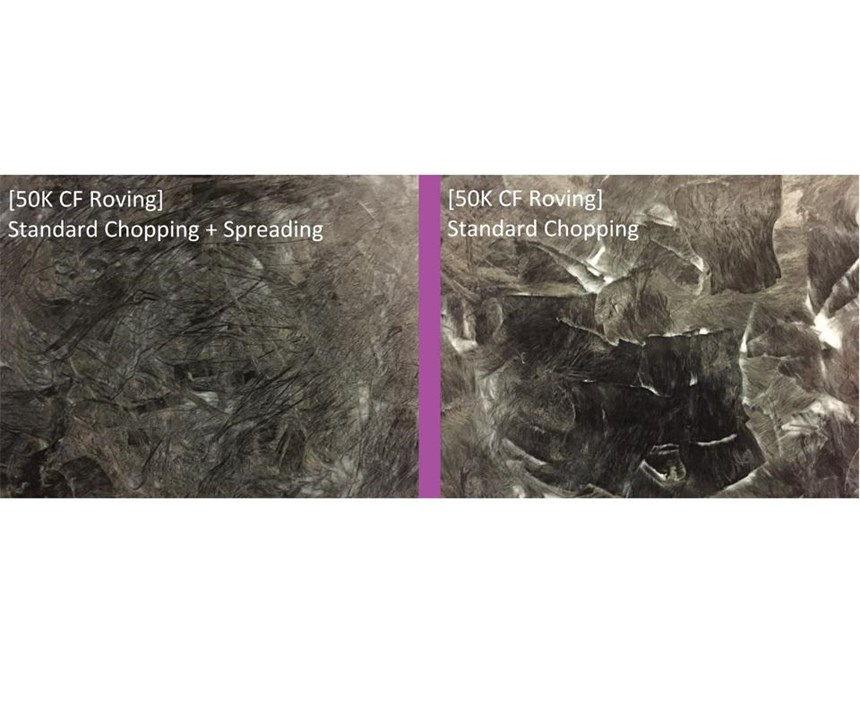

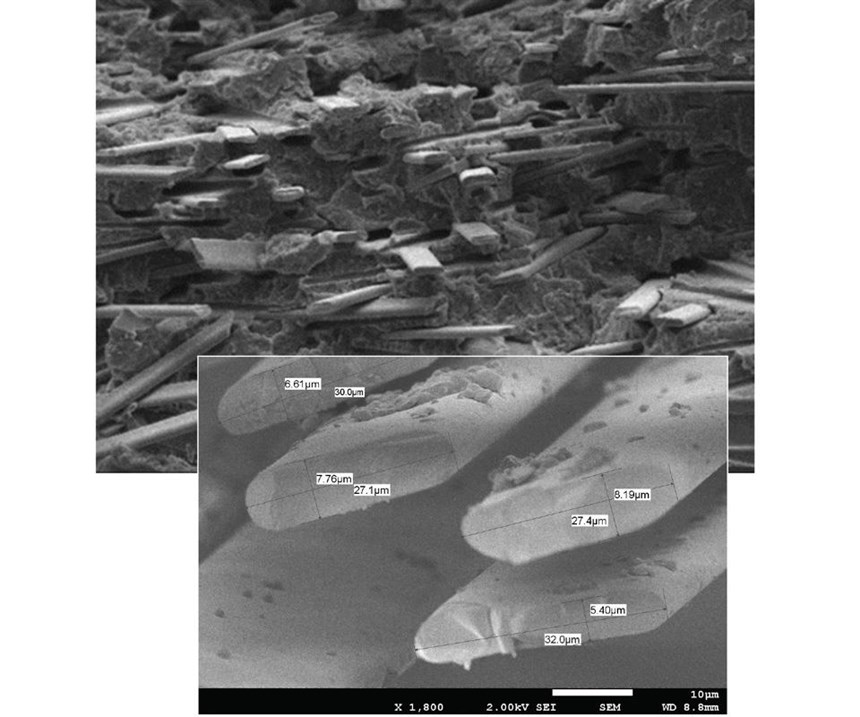

The second, and somewhat related, challenge is achieving good fiber wetout in the thick paste systems typical of SMC. “Carbon fiber wetout in the SMC process is notoriously difficult, especially with large-tow fibers,” explains Daniel Park, research engineer, Fraunhofer Project Centre for Composites Research (FPC, London, ON, Canada). “As a result, people are finding ways to split fiber bundles to aid wetout and improve mechanical properties. With large-tow carbon SMC, you typically get half the strength of a similar glass fiber SMC, although you do get a boost in stiffness. It’s hard to cost-justify carbon [fiber], when your tensile strength values are only 100-150 MPa vs. upwards of 300 MPa with glass. We’ve addressed this in our direct-SMC process [D-SMC] by adding a fiber spreading system to lamentize the fiber bundles from 50K down to 3K tows. It gives us fiber bundles that are easier to wet, a more uniform material, and an exponential increase in strength. That’s the reason multi-end glass rovings” — twisted rovings made from much thinner glass yarns that exhibit faster, more thorough wetout — “are used in SMC, but those products aren’t available yet in carbon.”

The wetout issue requires processors of heavy-tow carbon fiber SMC to create workarounds. “Carbon SMC is our material of choice for structural and semi-structural applications where previously we might have used prepreg,” reports Andrew Swikoski, global product line director – lightweight composites, Magna Exteriors (Troy, MI, US), who explains the company currently has two carbon fiber-based products, both in modified-VE matrices: a chopped-fiber grade called EPICBLEND CFS-Z, and a 0°/90° NCF grade called EPICBLEND CFS-Z Continuous, which is used with the chopped grade as a reinforcing patch for areas of parts that require higher mechanicals.

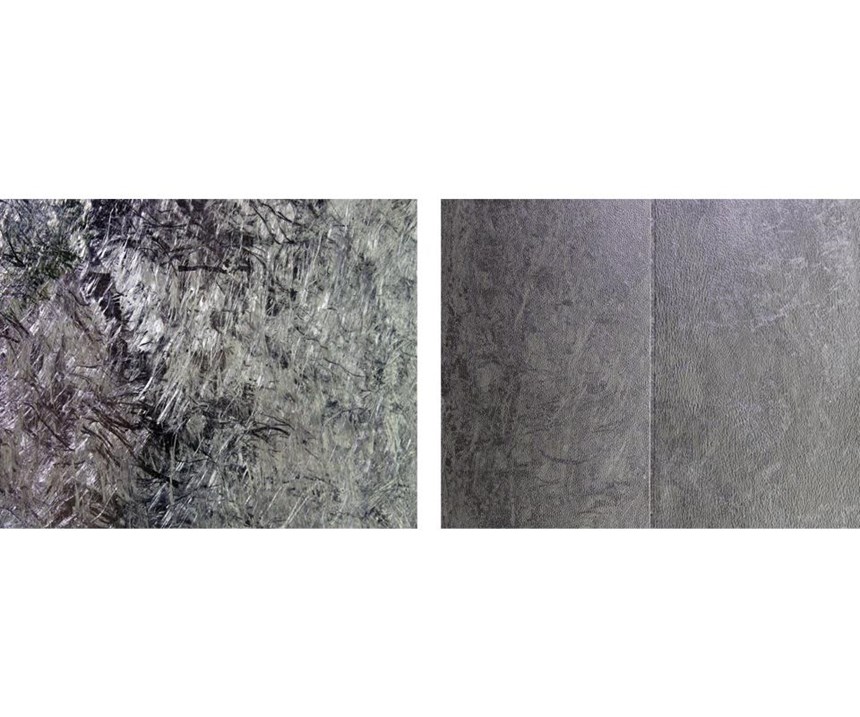

“The way we manufacture our chopped carbon ‘prepreg-esque’ material means we get better fiber wetout, compaction, and consolidation,” says Swikoski. “The way we chop, spread and loft the fiber is a little different than anyone else, allowing us to present finer fiber to the cutter, and to vary fiber length and fiber distribution on the SMC line, which helps with orientation and flow.” Fiber bundles contain fewer laments. More smaller-diameter bundles tend to wet out, separate and flow more readily in the matrix. “Our fiber is very random, not the ‘ribbons’ that others have. That gives us a significant cost advantage, and also allows us to reduce [part] wallstock and flow longer with greater consistency.”

Swikoski notes that the chopped fiber SMC does not produce a Class A surface. “It’s always used as an inner panel. It can be grained, but already has a very ‘technical’ look to it, making it ideal for a B surface like the inner panel of a hood, door or liftgate.” He also says that Magna can change back and forth between all-carbon and a mix of glass and carbon. “We’re looking for the lowest mass and the thinnest wall. We currently can get down to 1.2 to 1.0 mm, which is in steel’s territory. However, we offer a flowable material that’s capable of parts consolidation — some- thing stamped metal can’t offer.”

Compounder A. Schulman Inc. (now LyondellBasell, Fairlawn, OH, US) has several new takes on carbon fiber SMC. Its subsidiary, Quantum Composites Inc. (Bay City, MI, US), has developed and commercialized chopped carbon fiber SMC since 1987 — initially in epoxy matrices and later, VE. Starting in 2006, Quantum worked closely with Callaway Golf Co. (Carlsbad, CA, US) and shortly thereafter, Automobili Lamborghini SpA (Sant’Agata Bolognese, Italy), to develop a chopped-carbon fiber material in a modified-VE matrix that came to be called Forged Composites. Calloway subsequently used Forged Composites for its Diablo Octane drivers and Lamborghini used it on various components for several concepts as well as Sesto Elemento, Aventador J, Veneno and Huracan supercars. “More recently, Callaway asked for a similar product that was even thinner and stronger for its Big Bertha Fusion drivers,” recalls Douglas Gries, A. Schulman’s director – market development (composites). “The only way we could do that was with a continuous fiber system. Fortunately, we’d already done some work with woven carbon [fiber] fabric, so we developed a new material to meet Callaway’s structural and visual requirements. Now we’re showing it to automakers and they’re very interested, too.”

The product, which A. Schulman calls Forged Preg, was introduced at CAMX 2016 and has expanded to three grades, each in proprietary hybrid-VE resin systems: 8575 uses a 3K tow triaxial braid, 8585 uses a 12K tow biaxial fabric, and 8595 features 60K unidirectional tow.

Glass fiber technology is advancing as well. Chongqing Polycomp International Corp. (CPIC, Chongqing, China), which bills itself as the world’s third-largest glass supplier based on capacity, reports having several grades specifically sized for SMC. Perhaps the most interesting and unique offering is a flat fiber said to offer more isotropic dispersion and significantly reduced warpage in thin-walled parts. In all other properties, the flat strand is said to be equivalent to conventional round E-glass fiber. The company also offers conductive sizing systems and an HL grade with a lower dielectric constant than conventional E-glass. Also, CPIC recently commercialized its HT and TM grades, which have been designed to provide higher modulus. The TM grade is reportedly the highest tensile modulus E-glass fiber available on the market, at 88-92 GPa for impregnated strands (1,700m, 2400 tex roving, per ASTM D 2343). The HT grade is said to have even higher tensile modulus (92-96 GPa), with values roughly halfway between E- and S-glass, but at lower cost than S-glass.

New fillers: Reduced weight, improved functionality

Another important area of work in the SMC field has been the continuous quest to reduce SMC’s specific gravity (SG) and, therefore, final part weight. Historically, SMCs achieved an SG no less than 1.9, but over the last few years suppliers have mounted efforts to bring mid-density grades in the 1.6 to 1.4 SG range. Those materials have subsequently been put on diets, thanks to replacement of traditional CaCO3 fillers with lighter glass microspheres, driving densities down into the 1.2 to 1.1 SG range. AOC, Ashland and A. Schulman all report having 1.2 SG or lighter commercial or developmental grades. Today, some compounders offer grades at 1.0 or even sub-1.0 SG.

The transition from inexpensive but heavy ground minerals to lighter, but more costly and fragile microspheres has not been without its challenges. Earlier generations of microspheres had to be handled very carefully during compounding to avoid breakage.

The development of high-strength microspheres, by 3M Co. (St. Paul, MN, US) and others, is credited as an important breakthrough that made lower density SMCs possible.

In 2015, SMC compounder and molder, CSP made a mid-program running change on painted, Class A, bonded body panels on Chevrolet Corvette sports cars from GM (see Low-density SMC: Better living through chemistry). The company’s 1.2 SG TCA Ultra Lite (in AOC’s UP resin) reportedly cut up to 9.5 kg out of as many as 21 panel assemblies (depending on vehicle model) vs. CSP’s own 1.6 SG mid-density TCA Lite grade, which it replaced. Not only was no change required to tooling, part thickness or process settings, but the results also were achieved without sacrificing mechanicals and at costs less than aluminum.

According to Dr. Mike Siwajek, CSP VP R&D, the company has attacked the lightweighting challenge on multiple fronts to reduce weight without negatively impacting mechanicals, surface appearance or processing. He credits the success to three changes:

- The use of a tougher, higher performance 3M microsphere (new to automotive) with better crush strength.

- A proprietary sizing that CSP developed for the microspheres.

- The use of ME1975, a high-strength, corrosion-resistant multi-end glass roving from Owens Corning (Toledo, OH, US), which is specifically formulated for UP matrices.

Terrence O’Donovan, VP marketing and sales at compounder and molder Core Molding Technologies (Columbus, OH, US), says his company has successfully commercialized materials at 1.2 SG, which he calls the “new standard in density.”

He reports that Core has products for both Class A and structural applications that maintain mechanicals very close to mid-density grades. “Interestingly, surface quality [in terms of waviness] on our Class A MIRILITE SMC is actually a bit better than that on our standard-density SMC, which is a testament to the development efforts of the whole supply chain,” he explains. O’Donovan also says that this past October, Core commercialized its lowest density HYDRILITE SMC at 0.98 SG.

“We continue to work on pushing the envelope for lower density materials because our customers ask for them,” says O’Donovan. However, he does caution that as density goes lower, it’s harder to achieve automotive Class A surfaces, although the majority of Core’s customers are in commercial trucks. He also notes that it is typical to adjust process conditions like pressure and speed of press closing, but that no major changes to hard assets or tooling are needed when processing these very low-density grades.

Given the number of new nanoparticles introduced each year and the plethora of work going on in thermoplastic nanocomposites, has anyone evaluated nanominerals as an alternative to glass microspheres? Nearly all the primary resin suppliers and a few of the compounders and molders say they have assessed nanotechnology, but few reported much success. According to Steven Hardebeck, technology director North America – composites, at Reichhold LLC (Durham, NC, US), “We get approached monthly to try new particles and we do evaluate a lot of them — everything from graphene and nanosilica to nano-zinc and core-shell rubber. Typically, we’re looking to improve toughness without impacting Tg [glass transition temperature] or other properties. Some of them show promise, but others don’t seem to offer the same benefits they do in thermoplastics.” He acknowledges that the key with all nanoparticles is exfoliation and preventing re-agglomeration, and says that’s where they don’t seem to translate well to berglass or carbon fiber- reinforced materials. He also wonders if SMC’s different fracture mechanics vs. epoxies or thermoplastics may be a factor.

“Nanoclays were originally of interest in SMC lightweighting efforts before it became apparent that glass microspheres were a more effective and economical approach,” adds Core’s O’Donovan. “Our company spent six months looking at carbon-based nanomaterials, but in the end, we didn’t identify any bene t to mechanical performance and we abandoned our efforts.” He does admit to some misgivings on the subject. “I sometimes wonder if it was just that we didn’t figure out how to process them and some beautiful result was waiting for us if we’d stuck with it a bit longer.”

How low can you go?

With SMC density now at or below the 1.0 SG barrier, the question is, How low can it go? The consensus seems to be that from this point, a lower SG triggers several sacrifices or significant changes.

FPC’s Park predicts, “When you get down to SG values of 1.1 and 1.0, you’re really starting to fight against the density of the glass fiber itself and the need to maintain stiffness and strength in your part — even with the switch from minerals to microspheres. From there on, it’s going to take carbon instead of glass fiber to keep pushing density lower,” he argues. “However, in Class A applications, glass fibers are not likely to be replaced anytime soon.”

Laura Gigas, Ashland’s senior product manager – transportation, has a different take: “If we [as an industry] could get higher modulus SMC, the OEMs wouldn’t even look at carbon fiber as the risk is lower if you stay with technology you’re already using rather than investing in new technologies.” She notes that SMC keeps getting tougher and stronger as more people invest in more technologies. “Depending on material, we’ve boosted modulus 20-40% vs. traditional low-density SMC of just five years ago. These products are out for sampling with customers and we’re actively looking for new programs to commercialize them.”

John Young, technology manager, AOC, adds, “We have 1.0 SG systems on the drawing board, but physics does become an issue and you may not be able to overcome stiffness losses in such panels with design alone. You can create such products in the lab, but will anyone be willing to use them on a car? That’s a different story. I think we’re going to see a pause at the 1.2 level for the time being.” He also describes a trend toward the use of low-density SMC for outer panels of bonded assemblies, but use of a higher density grade in thinner walls on inner panels.

Young also argues that what already has been achieved might be sufficient: “If we can finally get to a 1.2-plus-1.2 sandwich while maintaining stiffness on the inner panel, then we’ll really be able to compete with aluminum on a weight, cycle time and tooling cost basis.”

In a similar vein, CSP’s Siwajek explains that the push for ultra low-density panels can be counterproductive. “If someone goes to 1.0 SG but loses stiffness and strength, then they have to add thickness back in,” he says. “Sometimes you get more lightweighting by using a slightly higher density material, with better stiffness and strength in a thinner part.”

“On the other hand, just a year or two ago, we saw 1.0 SG as an unreachable target, yet today we’ve crossed that line,” counters Core’s O’Donovan. “Given the advances in our industry in the last several years, it would be foolish,” he contends, “to bet that someone won’t beat 0.98 SG in the near future.”

Room for SMCs of all densities

Given the pressure transportation OEMs feel to reduce vehicle mass in the face of government mandates to improve energy efficiency and reduce tailpipe emissions, expect a lot more activity in this area.

But those in the know say those heavier conventional grades are unlikely to suffer obsolescence. Most see them finding use in applications where lightweighting is less important than project budgets. “In industries like building and construction and agricultural equipment where mass reduction is less a focus, the older materials work just fine,” observes Ashland’s Seats. “Plus, the older materials are a better fit for cost-sensitive applications in any industry.”

Part 2 of this series explores SMC innovations from the perspectives of the resin matrix and the compounding and molding processes.

Related Content

Composites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreSABIC launches fiber-reinforced, intumescent, fire-retardant resins

SABIC PP compound H1090 and Stamax 30YH611 resins are well suited for extruding and thermoforming large, complex EV battery pack components for automotive.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreAptera reveals first composite production parts for BinC vehicle

Pre-production efforts are underway to begin building production-intent vehicles.

Read MoreRead Next

IDI composite designed for EV battery enclosures

IDI Composites International is introducing a new sheet molding compound (SMC) for the electric vehicle market.

Read MoreSMC: Old dog, more tricks

In the sheet molding compound renaissance, the advent of new resins and compounds are broadening the definition and application of this versatile family of composites.

Read More

.jpg;width=70;height=70;mode=crop)