The outlook for composite pressure vessels

Environmental and economic pressures continue to drive growth in the market for composite pressure vessels used in personal and public transportation applications.

The natural gas vehicle (NGV) industry has been growing at double-digit rates, and with it, the demand for pressure vessels capable of safely containing and storing natural gas fuels has grown as well. NGVs have a considerable history, stretching back at least to the 1930s and World War II. Despite more than 75 years of operational experience, however, less than 2 million NGVs traveled the world’s roadways in 2000 — only about 0.2 percent of all automobiles in service. But an unprecedented combination of economic and environmental factors have changed the auto production landscape.

Drivers for double-digit growth

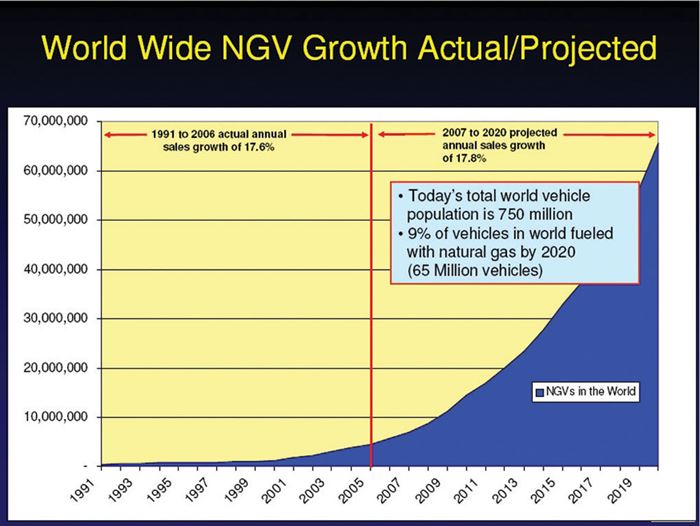

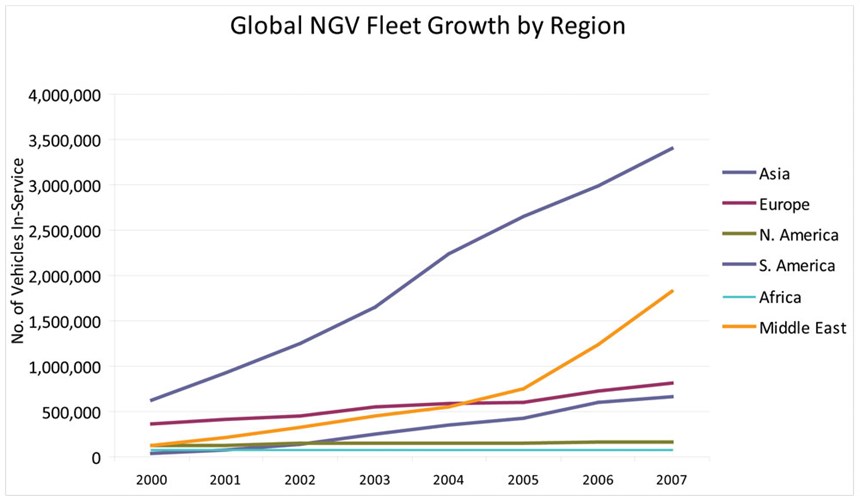

In the economic realm, the factor is oil. As the average prices of fuels have risen over the past eight years, low-cost natural gas gained favor in Asia, South America and throughout the Middle East. Even countries that are net exporters of their oil production are directing much of domestic automobile production toward the use of natural gas. Statistics provided by the International Association of Natural Gas Vehicles (IANGV, Auckland, New Zealand) indicate that over the past six years, the number of NGVs has grown more than 25 percent annually. When 2008 figures are in, the worldwide NGV fleet is expected to stand at more than 9 million vehicles. By vehicle type, automobiles account for almost 93 percent, buses almost 2.5 percent, and medium- to heavy-duty trucks just under 2 percent of the total NGV market.

Chief among the environmental factors is the specter of global warming. The National Climatic Data Center, a division of the U.S. National Oceanic and Atmospheric Admin. (Washington, D.C.), recently concluded that 2008 was the eighth warmest year on record, with land and ocean surface temperatures that averaged nearly 58°F, about 0.88°F above the 20th Century average. NASA scientists, using a different measuring process, disagree. They say that 2008 was the ninth hottest year ever recorded. Regardless of who is correct, the 10 hottest years since such records have been kept have all occurred since 1997. Although many other factors have an impact on global climate change, the human need for energy is a key contributor.

With good reason, much of the con-cern about controlling greenhouse-gas emissions is focused on the transportation sector. Globally, about 86 percent of all energy is derived from burning fossil fuels. Oil accounts for about 37 percent of the global energy mix and is used almost entirely for transportation fuels. The rub here is that, despite 1.1 percent growth in global demand in 2007 (during which time the price of oil doubled to almost $100 per barrel), oil-producing regions, on average, saw production drop by 0.2 percent. Although year-end 2008 statistics have not been finalized, it appears that the global oil consumption was on par with 2007 figures. Yet, even as the price of oil reached historic highs in the third quarter of last year, figures for oil production were essentially flat or falling. Although there is little fear that the world’s supply of oil will run out in the near future, the prospect of increasing available supplies appears to be limited.

Events in the past several years also have highlighted the need to adjust energy policies around the world to address supply security and the political and military entanglements that often result. Trillions of dollars are spent each year by nonproducers and producers to import oil annually (estimates for 2008 U.S. oil imports alone total between $450 billion and $700 billion). There is growing consensus that something must be done soon. Although concrete plans to change energy policies of individual countries are often nebulous targets, subject to the influence of economic conditions, there is widespread agreement that change will come, whether we like it or not. Change is often uncomfortable, but in this case it will provide a boon to the alternative energy and composites industries.

Trending toward alternative energy

When one considers the price and supply volatility of petroleum-based fuels, the “green” mandate, the political skirmishes over a tightening oil supply and many other factors, it should come as no surprise that alternative energy is gaining traction. The increasing number of alternative-fuel concept cars and production vehicles shows that petroleum-based fuels are under challenge. Yet, although the future limelight shines brightly on hybrid electric, plug-in electric and hydrogen fuel-cell cars, the natural gas-powered vehicles are proven, practical, economical and available.

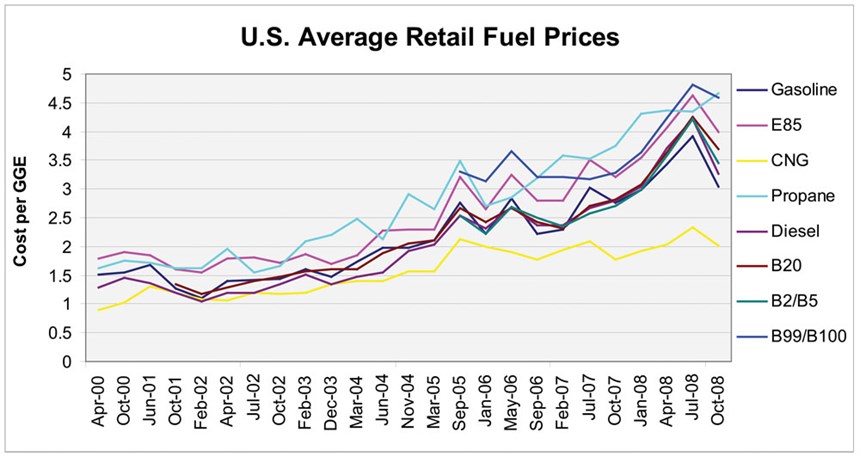

Despite the fact that oil prices have recently dropped back to 2003-2004 levels, there is little confidence that they will stay down and not return to the $65- to $100-per-barrel range over the next few years. And because the prices of gasoline and diesel consistently range about 30 percent per gallon of gasoline-equivalent higher than natural gas, it should come as little surprise that the number of NGVs produced around the world is growing rapidly.

Trying to err on the conservative side, the IANGV projects an average growth rate of 18 percent per year through the end of the next decade. At this rate, by the end of 2020, there are expected to be about 65 million NGVs on the road. Although the existing supplies of natural gas (composed today of about 90 percent methane gas) are varied, and some are even renewable, for the automotive industry natural gas comes in only two forms: liquefied natural gas (LNG) and compressed natural gas (CNG). The LNG systems are a component of many medium- and heavyweight vehicles in North America and Europe, but the process of generating and storing LNG at cryogenic temperatures adds considerably to their cost. Accordingly, the lower-cost CNG systems are the most popular. CNG-based fueling systems are found in nearly all passenger vehicle applications and in more than 80 percent of all medium- and heavy-duty trucks and transit buses. Clearly, there is already an annual market for millions of CNG containment vessels, a significant portion of which utilize composite reinforcements.

Pressure vessels today are classed in four categories, based on their type of construction:

• CNG Type I: All-metal construction, generally steel.

• CNG Type II: Mostly metal with some fiber overwrap in the hoop direction, mostly steel or aluminum with a glass fiber composite; the metal vessel and composite materials share about equalstructural loading.

• CNG Type III: Metal liner with full composite overwrap, generally aluminum, with a carbon fiber composite; the composite materials carry the structural loads.

• CNG Type IV: An all-composite construction, polymer (typically high-density polyethylene or HDPE) liner with carbon fiber or hybrid carbon/glass fiber composite; the composite materials carry all the structural loads.

Each type of pressure vessel has its benefits and liabilities. Type I vessels are the least expensive, with estimated production costs of roughly $5 per liter of volume. The metalworking skills and equipment needed to produce them are widely available internationally. To their detriment, Type I vessels also are the heaviest, weighing approximately 3.0 lb/l (1.4 kg/l). By comparison, Type II vessels cost about 50 percent more to manufacture but can reduce the weight of the storage containers by 30 to 40 percent. Type III and Type IV vessels take the weight savings even further, weighing between 0.75 and 1.0 lb/l (0.3 to 0.45 kg/l). The cost of Type III and Type IV vessels, however, is roughly 2 times greater than Type II vessels and 3.5 times greater than the all-metal Type I tanks.

Market molded by price pressure

The plus/minus factors have a predictable impact on current usage figures. Looking at the global marketplace, it’s readily apparent that the largest regional markets for NGVs are in South America (49 percent) and the Middle East (26 percent). If we sort the data differently, accounting for the number of vehicles in service in each of 85 countries, we gain a better perspective on the subject. Argentina, Brazil, Pakistan, Italy and Iran currently rank as the five countries with the most NGVs in service. Together, they host about 75 percent of the world’s total NGV fleet. Supporting the growth of domestic industries is a major objective of these countries. In these national markets, the upfront cost is probably the most significant factor in NGV purchasing decisions and, with the exception of Italy, each has a developing industrial base that has limited access to composites processing capabilities. It makes perfect sense, then, that CNG Type I pressure vessels — all-metal construction — are the most common. Because developing economies will continue to make up the majority of the forecasted market for CNG-powered vehicles, the Type I pressure vessels are expected to maintain a market share of about 93 percent (by unit volume) over the next few years.

The composite vessel value proposition

On the surface, this may not sound encouraging to current or prospective manufacturers of composite pressure vessels. Given the overall growth rate projected for future NGV sales, however, the 7 percent attributed to Type II, III and IV pressure vessels represents a rapidly expanding market for composite materials, manufacturing equipment and processing technologies.

Several factors indicate that this will be so. First, constructing pressure vessels, in whole or in part, from composites reduces fuel system and vehicle weight. On a typical transit bus or commercial truck, for example, the use of Type III and Type IV vessels easily could reduce the weight of the gas containment system by more than 1,000 lb (454 kg). This weight reduction would not only improve fuel economy but increase load-carrying capacity and introduce other operational benefits as well, making it possible for the more expensive tanks to buy their way onto vehicles.

Second, composite vessels extend the practical limit for gas containment pressures and provide better energy storage density. For many high-pressure applications — requiring cylinders rated at 5,000 psi (344.7 bar) or greater — Type III and Type IV vessels represent the most practical solution.

Third, composite materials signifi-cantly improve the pressure vessel’s corrosion resistance and overall safety. Finally, for those composite vessels that incorporate carbon fiber tow as reinforcement, the excellent fatigue resistance of these fibers also extends the vessel’s service life. Carbon fiber-reinforced Type III and Type IV pressure vessels can remain in use up to 30 years before they require replacement — twice the interval allowed for Type I and Type II vessels.

These benefits, combined with higher petroleum fuel costs, underlie a growing interest outside of Europe and North America in developing more sophisticated composites manufacturing capabilities. For companies in India, China, Argentina and Iran, the development of products beyond current Type I storage systems also represents an opportunity to compete in the market for high-value products, which has been dominated, thus far, by a small number of North American and European manufacturers. Although technology controls restrict the export of certain carbon composite materials and related manufacturing equipment and technologies to some countries, it is nevertheless clear that pressure vessel manufacturers in China, India, Argentina and several other countries are moving in this direction.

Growth markets by the numbers

As previously indicated, the strongest growth markets for CNG pressure vessels are to be found in the developing economies of the world. Of the more than 2 million CNG-powered vehicles delivered globally during 2008, about 90 percent of them — representing about 4.5 million Type I, primarily, and some Type II pressure vessels — were delivered to customers outside of Europe and North America.

By way of comparison, the European and North American demand for these systems is expected to total about 2 million pressure vessels between 2009 and 2013, while the rest of the world will likely demand 32 million. It is not rocket science to predict that, in this age of globalization, high-value, high-tech vessel manufacturers will find their best expansion opportunities outside their borders. They will establish pro-ducts and manufacturing capacity in international growth regions, either as wholly-owned assets or, perhaps more likely, as joint-venture partnerships with well-established, local manufacturing firms. Given the current slowdown in CNG bus sales in Europe and the U.S., international expansion may be the best route to take for Type III and Type IV vessel manufacturers that hope to sustain and grow their businesses over the next couple of years.

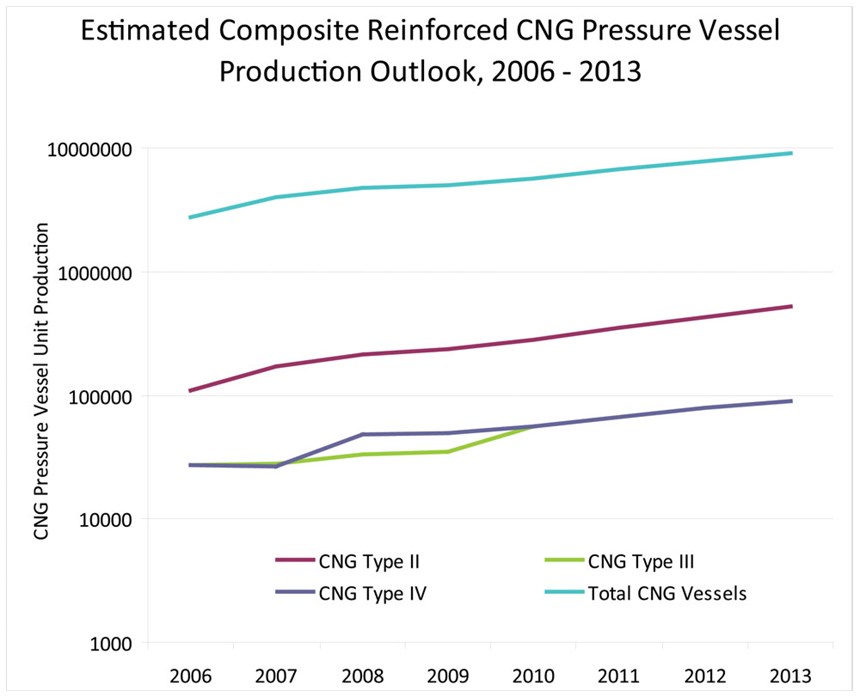

Of the 36.5 million pressure vessels that we expect to be produced between now and 2013, nearly 2.5 million are should be of CNG Types II, III and IV. Annual production of these three vessel types stands, today, at roughly 295,000 units. Together, these vessels represent approximately 6.8 million lb (3.1 million kg) of finished composite product, conservatively valued at $105 million. This figure is expected to grow at an average annual rate of 19 percent over the next five years, although 2009 unit volumes are expected to be only about 5 to 8 percent higher than the past year (largely because of demand for Type II cylinders). Despite this, sales of composite pressure vessels are expected to grow to $250 million, worldwide, by 2013. Moreover, this market has the potential for much greater expansion, and could total as much as $560 million and more than 20 million lb (9,072 metric tonnes) of glass fiber and carbon fiber composites annually by the end of the next decade!

Production of composite pressure vessels at these volumes will require a significant expansion of manufacturing capacity and will provide opportunities to new suppliers. Despite a temporary slowdown in sales of Type III and IV pressure vessels, suppliers of these products are expanding their facilities. Inflex-Argentoil S.A. (Buenos Aires, Argentina), one of the world’s leading suppliers of Type I and II pressure vessels, has been regularly expanding its in-house and joint-venture production throughout South America and the Middle East, and is growing its product line with Type III vessels. Hypercomp Engineering (Brigham City, Utah) is expecting to receive certification for its first commercial Type IV CNG pressure vessels for vehicle applications in mid-February, with production slated to start soon thereafter.

The rapid market expansion outlined here will likely rely on a combination of improved manufacturing processes. For many of the smaller pressure vessels used in automobiles and smaller bus and van applications, the need to accommodate large production volumes will likely spur manufacturers to capitalize automated production equipment. Filament winding systems that produce multiple pressures vessels simultaneously will dramatically reduce the factory overhead and labor costs included in the price of each cylinder produced. Restrictions on the transfer of carbon fiber manufacturing technology to security-sensitive regions around the world are likely to continue. That will ensure that high-strength glass fibers designed to improve performance over that of today’s E-glass products, such as AGY’s (Aiken, S.C.) new S-1 products, will find significant avenues for growth within the pressure-vessel market.

Beyond the NGV market, continuing developments in nascent applications, notably hydrogen-gas storage tanks for fuel-cell power systems and large-scale tanks for bulk gas storage and transport, are likely to increase the value of the composite pressure vessel market.

Bulk transport systems string together a series of much larger Type III and Type IV cylinders (with future potential to use some Type II vessels as well). These are fitted to truck trailers to deliver natural gas to markets that are without a pipeline infrastructure, and to reach and retrieve stranded gas reserves. By way of comparison, a typical CNG cylinder for an automobile or bus measures between 15 and 150 liters of volume, and bulk hauling tank designs are two or more times larger. The largest design offered to date is the 40-ft/12.2m long, 4,600 lb (2,087 kg) all-composite Titan manufactured by Lincoln Composites (Lincoln, Neb.), a sister company to Raufoss Fuel Systems (Raufoss, Norway) and a subsidiary of Hexagon Composites (Ålesund, Norway). During the first half of last year, Dynetek Industries (Calgary, Alberta, Canada) received U.S. Department of Transportation approval for two Type III products rated at 3,000 psi and 6,500 psi (206 bar and 450 bar), which are arranged into modules of 39 vessels each on truck trailers that carry either three or six modules. These bulk-transport applications are still seeking commercial and/or regulatory acceptance, but they have the potential to contribute an additional 1.6 million to 1.8 million lb (726 to 816 metric tonnes) of composite pressure vessels annually, worth about $50 million, by 2013.

Hydrogen gas storage is another extension of CNG pressure vessel tech-nology, but taken to extreme performance levels. Honda Motor Co. (Tokyo, Japan) began production of its FCX Clarity fuel-cell vehicle in limited numbers in June of last year with the intention of raising production to as many as 200 vehicles per year by 2010. Limited numbers of hydrogen-powered buses and a growing number of demonstration vehicles guarantee that at least a few hundred of the 5,000 to 15,000 psi (345 to 1,034 bar) Type III and Type IV carbon fiber-reinforced pressure vessels will be produced each year. Although fuel-cell technology is constantly advancing, it is unlikely that the issues involved in fuel-cell-system and gas-storage costs will be adequately addressed soon enough to enable more widespread production over the next five years. Much like the bulk gas transport vessels, hydrogen storage technology offers a vast market expansion opportunity in the long-term. However, the numbers for near-term hydrogen potential will be, optimistically, a little smaller than the figures for bulk gas transport.

Related Content

Watch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

Aviation Outlook: Composites in rotorcraft reaching new altitudes

One of the earliest markets for advanced composites, helicopter manufacture is and will continue to be a stronghold for industry growth.

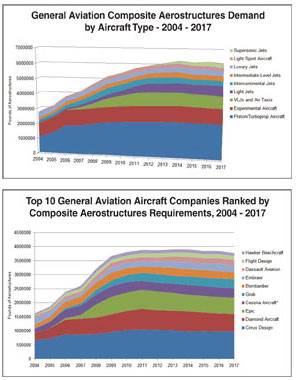

Read MoreAviation Outlook: Composite aerostructures in General Aviation

Although the math is fuzzy and once helpful category distinctions are blurring, the forecast for this sector’s use of fiber-reinforced polymer remains strong.

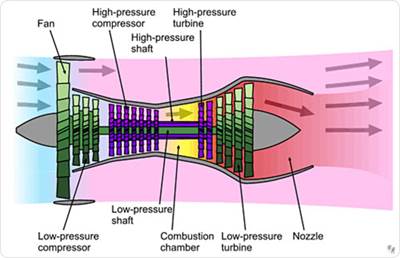

Read MoreAviation Outlook: Composites in commercial aircraft jet engines

Airlines' need for fuel-efficient flight provides the thrust behind composite lightweighting strategies in jet engine manufacturing.

Read More