Basalt in sporting goods. Kayak paddles are one among many sporting goods applications that benefit from basalt fiber’s combination of “give” and strength. Source | Nimbus Paddles

If you quarry rock originally formed from the rapid cooling of magnesium- and iron-rich lava, and find a way to produce fibers from this rock, it should come as no surprise that the fiber would exhibit excellent thermal insulation and fire resistance properties, as well as very high service temperatures. These key properties have made basalt fiber a standard material for insulation products in high-temperature applications, such as industrial furnace lining and fireproof rope. Basalt fiber producer Kamenny Vek (Dubna, Russia), for example, is supplying a large amount of its product to the U.S. automotive industry for exhaust system insulation, and also to producers of heat-resistant materials for industrial applications.

In addition to its thermal properties, basalt fiber’s combination of strength, impact resistance and chemical inertness also have made it an attractive candidate for composites applications. So the question remains: When will basalt fiber-reinforced polymer composites (BFRP) enjoy significant market penetration?

The inside joke, reports James Streetman, manager at Advanced Filament Technologies (Houston, Texas, U.S.), is that BFRP applications “have been five years away from a major breakthrough for the past 15 years.” Advanced Filament Technologies offers the trademarked Sudaglass basalt fiber, originally made in Sudogda, Russia, and now produced by GBF Basalt Fiber Co. (Zhejiang, China). All kidding aside, cautious optimism may best describe Streetman’s mood — and more generally, the mood of many BFRP stakeholders. For example, Nick Gencarelle, principal at Smarter Building Systems (Newport, R.I., U.S.), describes the BFRP market as “very slow, flat — but in the last two years, things have started to open up a bit. Structural engineers are beginning to more fully understand the need for BFRP.”

One clear sign that BFRP may be poised for growth is the recent investment of $20 million to build the first basalt fiber production facility in the United States. Relative newcomer Mafic (Kells, County Meath, Ireland) is building the facility in Shelby, North Carolina, and expects to “go hot” in the third quarter of 2019, reports Jeffrey Thompson, Mafic marketing manager.

It would seem that the appeal of basalt fiber’s performance characteristics and the potential for considerable BFRP market penetration are strong. As a result, basalt fiber manufacturers continue to pursue this market resolutely and are ironing out the technical and market issues that so far have kept the breakthrough from occurring.

The appeal of basalt

Basalt fiber source material. Rapidly cooled lava forms basalt rock, which helps explain basalt fiber’s excellent thermal properties. Basalt fiber producers seek out basalt sources with consistent composition and properties. Source | Mafic

The notion of creating fiber from basalt is not new; the first patent for basalt fiber manufacture was issued in 1923, and application to military hardware was researched extensively in the 1950s and 1960s. Even major producers of glass fiber explored basalt’s potential, though they abandoned this focus in the 1970s to concentrate R&D efforts on better-performing glass fiber, including S-2 glass. While interest in developing basalt fiber-reinforced composites has waxed and waned over these decades, it has persisted and grown in recent years.

A June 2015 MarketsandMarkets Research (Pune, India) report estimated near-term overall growth in the basalt fiber market, including composite and non-composite applications, to be substantial. According to the report, the basalt fiber global market in 2020 will reach $200 million, with a compound annual growth rate (CAGR) of 13.1 percent between 2015 and 2020. “We are in the process of updating our existing study on the basalt fiber market,” says Pankaj Kumar Tiwari, MarketsandMarkets associate manager, “as we have witnessed significant changes in this market in 2018.” As contributors to the market change, he cites growing use of basalt fiber in hybrid composites, an increasing demand from the automotive market and the appeal of basalt’s recyclability combined with its strength (said to be greater than that of E-glass). Tiwari mentions two specific events, as well. In 2018, Owens Corning (Toledo, Ohio, U.S.) acquired Paroc Group (Helsinki, Finland), maker of basalt insulation fibers; also, Mafic and fiber sizing manufacturer Michelman (Cincinnati, Ohio, U.S.) announced a partnership focused on basalt fiber composites.

Basalt fiber’s thermal properties are of interest beyond non-composite insulation applications. BFRP opportunities are opening up in applications demanding high and/or wide-ranging service temperatures. Another property, impact resistance, differentiates basalt fiber significantly from glass and carbon. A preliminary study by the Aachen Center for Integrative Lightweight Construction and the Institut für Textiltechnik der RWTH (Aachen, Germany), for example, demonstrated approximately a 35 percent higher specific energy absorption capacity of a basalt hybrid yard woven fabric (HYWF) with polyamide 6 resin compared to glass HYWF/polyamide 6, and 17 percent higher compared to carbon HYWF/polyamide 6.

As a naturally occurring material, basalt fiber is inherently more recyclable than other reinforcing fibers, a factor that automotive and other industries take into consideration.

Basalt rock’s iron and aluminum oxides create other favorable characteristics. For example, basalt fiber provides better corrosion and fire resistance than that provided by E-glass. Additionally, a recent study by Mafic in collaboration with the Fraunhofer Project Center (London, Ontario, Canada) confirmed a higher tensile modulus, tensile strength and interlaminar shear strength, a 40 percent higher specific strength and a 20 percent higher specific stiffness for basalt fiber/epoxy test panels compared to E-glass/epoxy panels made with the same resin and fabrication process. Kamenny Vek reports similar results.

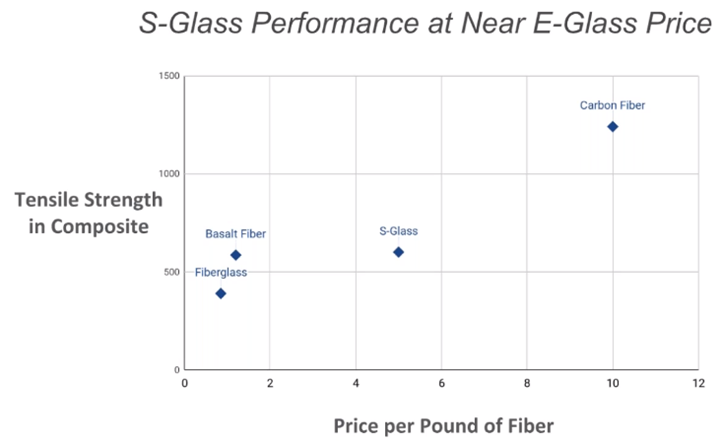

Basalt fiber features low water absorption, important in construction and pipe applications. Basalt fiber is electrically non-conductive. As a naturally occurring material, it is also inherently more recyclable than other reinforcing fibers, a factor that automotive and other industries take into consideration. In sum, Gencarelle refers to basalt fiber as “leaner, greener and meaner” and more impact-resistant than other reinforcement choices. These characteristics point to a sweet spot for BFRPs in the performance window between E-glass and carbon fiber composites. As Thompson expresses it, “We find ourselves to be filling the cost and performance gap between carbon and glass fiber. That market segment has been hungry for a product to fill that space.”

Price-performance sweet spot. Recognizable because of its unique color, basalt fiber more importantly provides a unique combination of performance characteristics that place it within the price-performance gap between E-glass and carbon fibers. Source | Kamenny Vek

A move from carbon fiber to basalt is reportedly an easier business case to make than a move from E-glass to basalt, but both cases can be made. Regarding carbon fiber, cost savings are typically the primary justification for a switch to BFRP; applications for which carbon fiber overshoots performance requirements can be served at the cost-performance point offered by basalt. Also important in some applications are the differing failure modes of carbon and basalt. While carbon fiber, when damaged, tends to “shatter” catastrophically and sometimes in more than one place, basalt fiber experiences what could be characterized as a gentler failure mode. Streetman illustrates: “When a carbon composite prosthetic leg fails, the user falls down; with a basalt composite prosthetic, the user would sit down.”

While basalt fiber’s relative cost has decreased as production methods have become more efficient, it is still more expensive than E-glass — as much as double the price in large-volume applications — so for an application to absorb this cost increase, it must be adequately counterbalanced by improvements in performance characteristics critical to the application. Characteristics that may come into play include added mechanical performance such as stiffness and strength, resistance to impact, chemicals, corrosion and water as well as a difference in failure mode compared to glass, which tends to splinter more than basalt.

The hurdles for basalt

The basic manufacturing method for basalt fiber is straightforward enough: Much like glass fiber production, basalt fiber is extruded into filaments from the melted raw material, in this case mined basalt rocks. Material efficiency for basalt fiber is enhanced by the fact that no secondary materials are needed to create the fiber, or as Gencarelle puts it, “One pound of rock becomes one pound of fiber.” The melt point for basalt of 1,500°C is also comparable to glass, for which the melt point ranges from 1,400 to 1,600°C. Because basalt is opaque, it is more difficult to uniformly heat than glass is, and this has created a need for production enhancements such as keeping the molten product in a reservoir for an extended period, the immersion of electrodes in the bath, or a two-stage heating scheme. These advancements have been made and are well-established technology in basalt fiber plants.

The fact that the raw material for basalt fiber is naturally occurring leads to one major technical hurdle: inconsistent raw material properties. That is, rock mined from different locations varies in the specific quantities of iron, magnesium and other constituents. Key parameters have varied by as much as 10 percent. Pointing out that fiberglass has faced the same challenge regarding raw material variation, Streetman reports, “We have been making headway in providing a standardized product.”

Filling the gap. Data indicates that basalt fiber offers tensile strength comparable to that of S-Glass at a cost closer to that of E-glass. Source | Mafic

In years past, the variation in basalt fiber properties served as a setback to potential applications. “When basalt has been shown to be the best fiber for the application,” Thompson explains, “the inability of the customer to rely on material availability, quality and consistency meant that the application would not be commercialized at that time.” In overcoming this variation, “the raw material is simultaneously the most important and the least important aspect of our process,” Thompson declares. “Once you’ve identified a consistent source, it’s no longer a problem.” Mafic uses a European source for its Irish facility. It will use this same source when it begins U.S. production, but the company is also targeting an undisclosed U.S. source for future supply to the U.S. plant. All fiber makers carefully select the source ore and prequalify it, and this along with production process improvements has resulted in greater consistency.

Historically, basalt fiber manufacture has been manually controlled, but fiber makers are advancing their product’s quality and consistency with the addition of automated controls. Gencarelle reports that the basalt fiber factory he represents is ISO 9000 certified. “They emphasize quality control from the raw materials all the way through the process,” he notes. He believes that the lower limit for variation is around 3 percent which, admittedly, may be too high for aerospace structural applications. But other market opportunities abound, including applications in the sporting goods, prosthetics, cryogenics and energy industries.

In terms of the market, basalt fiber manufacturers report that the biggest hurdle today is regulatory. “Many areas in the construction industry,” Streetman explains, “can only use materials that have been accepted into the code.” He mentions the Florida Department of Transportation as one body that has been “more forward-thinking” and is closing in on standards for acceptance of basalt composites. Gencarelle also points out that the American Concrete Institute has recognized that basalt rebar meets the institute’s requirements for rebar applications. Still, work lies ahead before construction and other industries achieve widespread code acceptance for basalt composites.

Finally, and perhaps most significantly, basalt fiber producers find themselves in a market “Catch-22,” especially with respect to current E-glass applications. The large volume of many such applications means that current fiber use is greater than the current capacity that basalt fiber manufacturing facilities could begin to meet. Even if basalt fiber is technically the best fit for an application, composites manufacturers don’t want to commit to a BFRP design unless they know they can get enough product. Conversely, since it takes two to four years to commission a large basalt fiber plant, basalt investors want assurances that market demand will be there when the plant comes online.

BFRP activity

Basalt textiles. Basalt fiber producers have developed sizing and fiber handling technologies sufficient for the creation of a fully spectrum of fabrics for composites applications. Source | Mafic

If basalt fiber providers can point to one application that portends particularly well for BFRP growth, it would be rebar. Like fiberglass rebar, basalt rebar is considerably lighter than conventional steel rebar, “over 70 percent lighter, in fact,” Gencarelle says. “One person can easily lift a 100-meter coil of 10-millimeter basalt rebar.” Advantages over glass rebar include basalt’s natural resistance to rust and corrosive liquids and chemicals, he continues. This makes it well-suited to marine applications, chemical plants and other potentially corrosive environments. “Also, moisture penetration from concrete does not spall, so it needs no special coating like fiberglass rods,” he adds. Gencarelle also highlights the match between basalt rebar’s and concrete’s coefficient of thermal expansion. The fact that it is nonconducting makes basalt rebar a good option for buildings that house MRIs or data-intensive operations.

Gencarelle reports some work being done to bring basalt rebar pultrusion factories to the United States, noting that such a move would help grow basalt’s market share both by avoiding tariffs and by allowing these factories to compete for projects that specify U.S.-made rebar.

Another growing application area for basalt fiber is in composite pipes.

Work on the regulatory front continues. Basalt rebar is included in the national construction codes and is widely used in the construction industry of countries like Russia, Ukraine and China. “In some other countries, like the United States, Canada, the United Kingdom, Italy and Poland, basalt rebar is widely used in applications where certification is not required, such as swimming pools and garden paths,” says Oleg Kuzyakin, commercial director for Kamenny Vek. Major basalt rebar certification efforts are underway in these countries. “In some European countries like Germany and France, this process is more expensive, long and complicated than in others,” Kuzyakin adds, “but we see rising interest in basalt rebar in these countries, too.”

More sporadic activity characterizes other applications and market segments. Streetman notes, for example, that automotive companies have employed BFRP panels consisting of chopped fiber and thermoplastic matrix to improve impact and corrosion resistance. These programs have come to an end, though, and Streetman is not aware of any current BFRP work in production automotive applications. Kuzyakin confirms, “Customers want to use our fiber for production of different types of panels for trucks, and in car parts made with polypropylene or polyamide resin, but these are not commercial projects yet.”

In India, Russia and Korea, Kamenny Vek chopped basalt fiber is used to make brake pads. The company also reports a significant amount of its fiber being used in compressed natural gas (CNG) cylinders for buses and trucks as well as residential applications.

Another growing application area is in composite pipes. Wavin Ekoplastik (Kostelec nad Labem, Czech Republic) has developed a polypropylene (PP) pipe with a basalt fiber-reinforced layer that exhibits as much as a 50 percent improvement in pressure resistance at high temperatures and 20 percent improvement in flow rate compared to the baseline glass fiber/PP pipe.

Kamenny Vek’s Australian partner Basalt Fiber Tech (Melbourne, Australia) is supplying basalt fabrics for marine applications, and numerous sporting goods applications are also using the company’s fiber, though Kuzyakin notes that these currently are not high-volume markets. “Of greater potential in terms of volume is wind energy applications,” Kuzyakin reports. “Wind is one of the most prominent applications. We consider it strategically important but long-term because of the very long, complicated and costly procedures of certification and qualification.”

A close-up of the Nimbus kayak paddles shows the basalt fibers. Source | Nimbus Paddles

Prosthetics and orthotics, as mentioned earlier, benefit from basalt fiber’s greater “give.” A November 2018 CW story reported one such application by Coyote Designs (Boise, Idaho, U.S.). Some of the company’s customers found carbon fiber polymer composites to be uncomfortably stiff, and the prosthetics suffered from a high rate of cracking failure. Interestingly, another factor that made the switch to basalt attractive was that, unlike manufacturing with basalt fiber, manufacturing with carbon fiber involved masks, protective gear and dust collection systems for health and safety. BFRP improved the prosthetic’s flexural properties and reduced the failure rate significantly.

In sporting goods, often a hybrid carbon-basalt design is used to gain the advantages of each fiber type. The digital magazine Basalt Today is replete with examples, including Wilson (Chicago, Ill., U.S.) badminton rackets, Niche (Holladay, Utah, U.S.) snowboards and Nimbus Paddles (Heriot Bay, B.C., Canada) kayak paddles.

The future seems near

Though a substantial BFRP breakthrough has not yet materialized, progress seems to be occurring on all the necessary fronts: manufacturing efficiency and capacity, global presence, product design and development and regulatory activity. “We think we’re in a fantastic place today,” Thompson declares, “and our customers have been showing us that they believe it too, by their level of investment and their desire to see our U.S. facility come online.”

Anticipating significant developments in the next 12 to 24 months, Thompson concludes, “We’re excited to be an additional composite tool in the toolkit.”

Related Content

RTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

Read MoreEuropean boatbuilders lead quest to build recyclable composite boats

Marine industry constituents are looking to take composite use one step further with the production of tough and recyclable recreational boats. Some are using new infusible thermoplastic resins.

Read MoreMetal AM advances in composite tooling, Part 2

Toolmakers and molders continue to realize the benefits of additive versus conventional/subtractive manufacturing of molds and mold components.

Read MoreSMC composites progress BinC solar electric vehicles

In an interview with one of Aptera’s co-founders, CW sheds light on the inspiration behind the crowd-funded solar electric vehicle, its body in carbon (BinC) and how composite materials are playing a role in its design.

Read MoreRead Next

Lipex Engineering to build basalt fiber production plant in Russia

The plant represents the company’s plan to make basalt fiber one of its key growth areas.

Read MoreAnisoprint launches basalt fiber for continuous-fiber 3D printing

The material is said to be 15 times stronger than plastic, five times lighter than steel and 1.5 times stronger and lighter than aluminum.

Read MoreBasalt fiber composite design wins NASA 3D Printed Habitat Challenge

New York-based AI SpaceFactory’s MARSHA prototype uses automation and composites to create a stronger, more durable space habitat.

Read More