How to win in carbon composites for the automotive market

Of all the material options, only CFRP offers the potential for weight savings greater than 50%.

Carbon fiber has emerged as one of the promising options as automakers work hard to reduce vehicle weight to meet US corporate average fuel economy (CAFE) and European Union (EU) carbon dioxide (CO2) gas emission requirements. As more carbon composites are used for automotive applications, the future of the composites industry looks bright. Most important, the global carbon composites industry is about to enter a period of wide-ranging and transformative change, as demands continue to shift and environmental regulations tighten.

Companies that want to have long-term growth need to develop strategies that respond to this critical trend without delay. This article offers a perspective on what needs to be done to grow the potential of carbon composites in the auto industry. It is based on many discussions and interviews with original equipment manufacturers (OEMs) and composite parts fabricators across various end-use applications in the automotive market.

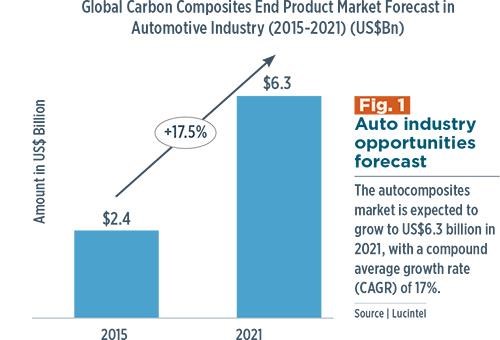

In fiscal year 2015, worldwide demand for carbon composite products in the automotive industry — roof panels, body frame, closure panels and more — reached a value of US$2.4 billion. The market is expected to grow to US$6.3 billion in 2021, with a compound average growth rate (CAGR) of 17% (see Fig. 1, at left). This growth in global carbon composites will be due largely to strong demand for carbon fiber-reinforced plastics (CFRP) in luxury cars, race cars and other high-performance cars.

Government regulation of fuel efficiency and stringent policies concerning CO2 emissions are putting pressure on OEMs to make their vehicles lighter without compromising occupant safety. For example, by 2020 it will be necessary in the EU to restrict vehicle CO2 emissions to 95 g/km. The current regulatory threshold is about 132.2 g/km. Similarly, in the US, CAFE regulation dictates an OEM’s car and light-truck fleet-wide average fuel efficiency be 54.5 miles per gallon or equivalent (mpge), or 23.1 km/L, by 2025. The current average is about 28 mpge (11.6 km/L).

This challenge has opened an opportunity for the development of stronger and lighter automotive equipment and spare parts. When Lucintel spoke to engineers at automotive OEMs about lightweighting requirements, they responded that they are required to develop automotive structural parts with 50% weight-saving potential. Due to this, they are looking into lightweight materials, such as advanced high-strength steel (AHSS, steel with tensile strength that exceeds 780 MPa), aluminum, magnesium and CFRP for their product design. Of all the material options, only CFRP offers the potential for weight savings greater than 50%. For that reason, this advanced material is receiving great attention. Currently, most major automakers, such as BMW, Mercedes, Ford and GM, are focusing on incorporating CFRP in mass-volume cars as a means to meet the stringent government guidelines.

Perhaps the biggest trend in the automotive industry is the development of transformative technologies and material systems to make carbon fiber parts for mass-volume vehicles. The future will not play out the same way for every segment of the automotive industry or type of application or type of material, so suppliers need to develop suitable strategies and a road map to drive success in their business.

There is greater need for innovations to increase the adoption of carbon composites.

The usage of carbon composites is still evolving. Because end-users seek more value for their money, superior quality and increased safety, the composites industry will be forced to deliver the desired output as customers demand shifts. When Lucintel spoke to automotive OEMs about the opportunities related to carbon fiber usage, all responded that they see carbon fiber as one of the most promising weight-saving materials, but they are faced with many challenges in using it. The following are four key challenges that the carbon composites industry need to address to get a bigger piece of future growth and profitability — all of them related to per-part cost.

- Fiber cost reduction: Reduction in the price of raw carbon fiber is critical to making CFRP parts competitive with steel and aluminum parts. The high price of carbon fiber restricts potential leverage in many applications. For example, automotive OEMs demand carbon fiber within the range of US$5-US$7/lb; however, the current price is approximately US$8-US$15/lb for automotive applications.

- Transformative technology: There is a great emphasis on reducing part fabrication cost via automation, simulation and rapid cycle time. There is a greater need for faster, more mature composites technologies, targeting 1-2 minute cycle times for mass-volume markets. Most current carbon composites part manufacturing processes are slow and take several minutes to make the part. Automation and development of suitable material systems and technologies are required to gain wider acceptance of carbon composites in mass markets.

- Recycling: There is a greater need than ever before to address recycling of composite parts if CFRP is to be used in mainstream applications. For example, automakers are reluctant to use composites in a major way until the recycling issue can be addressed, out of concerns driven by government regulations, such as the European Union’s automobile end-of-life directives.

- Repair: Repairing composites is a big challenge. Until repair can be done efficiently, its wider acceptance in mass-vehicle platforms will be stalled. Auto OEMs explain that for steel and aluminum, they have well-developed repair technologies, but these have not been developed for CFRP parts. In conclusion, Lucintel predicts that the next big thing for the composites industry will be the automotive industry. To capture future growth and find profit from these challenges, OEMs, Tier 1 suppliers and material suppliers cannot simply turn to their traditional toolbox. They need to review the opportunity and adjust their priorities, deploy the appropriate investments and resources, and develop new skills and technologies to execute these strategic objectives.

If all major players in the industry work together — OEMs, part fabricators, and material suppliers — the future is bright for CFRP.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreCo-molding SMC with braided glass fiber demonstrates truck bed potential

Prepreg co-molding compound by IDI Composites International and A&P Technology enables new geometries and levels of strength and resiliency for automotive, mobility.

Read MoreThermoplastic composites: Cracking the horizontal body panel nut

Versatile sandwich panel technology solves decades-long exterior automotive challenge.

Read MoreRecycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More