Market Trends: Carbon fiber demand, supply and the commodity threshold

CompositesWorld conferences director Scott Stephenson notes the increasing evidence at Carbon Fiber 2007 that the carbon fiber market is maturing.

This year’s COMPOSITESWORLD conferences — Carbon Fiber 2007 and High Performance Fibers 2007 — are now over. I was gratified to see the large number of attendees at both conferences, and I hope that they learned as much as I did from the wide range of excellent presentations, panel discussions and seminars.

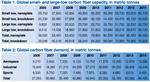

It was clear from our Carbon Fiber conference that this market is being shaped by a number of forces. First is the unprecedented number of fiber capacity expansions that are underway. Every established supplier is building new lines and equipment to substantially increase supply. One of the conference cochairs and a seminar instructor, industry consultant Tony Roberts, presented an overview of carbon fiber capacity and demand based on what he believes is a “realistic forecasting” approach. Roberts noted that “knockdown” factors for small-tow fiber, in particular, range from 25 to 50 percent of published nameplate capacity. He estimated that, with an average 35 percent knockdown factor, small-tow fiber capacity is 24,500 metric tonnes (54 million lb) today, and it should increase to nearly 40,000 metric tonnes (88 million lb) in 2014. One of Roberts’ key points was that as new fiber lines start producing, they will be more efficient than existing lines, and each probably will be dedicated to a single product. As a result, knockdown rates will gradually decrease, pushing that 40,000-metric-ton figure closer to 45,500. Roberts also reported large-tow capacity of 14,500 metric tonnes (32 million lb) today, and it should increase to 30,000 metric tonnes (66 million lb) by 2014, with an estimated 8 percent knockdown. His figure for total combined small- and large-tow nameplate capacity by 2014 is 93,450 metric tonnes (205.6 million lb). That’s a seven-fold increase over 1998, when I organized the first Carbon Fiber Conference in San Antonio, Texas. And while those figures include output from new startups in China (Xingke Carbon Fiber Co., Sinosteel Jilin Shezhou Carbon Fiber, and a potential third) as well as new players in Canada, India and Saudi Arabia, Roberts said those entities might increase their production more than anticipated, and other suppliers are likely to surface as well.

During the panel discussion on the second day, the panelists and audience were asked to consider what this increasing capacity means to the overall industry. Is demand still too tenuous to justify the new fiber volume? Are we going to embark on a new roller-coaster ride of fiber glut, falling prices and fear of future investment, followed by a market collapse, especially in view of high oil prices? Not surprisingly, fiber users, like Brian Spencer of Spencer Composites (Sacramento, Calif.), including Bill Dick of Lincoln Composites (Lincoln, Neb.), noted instances where a customer didn’t choose carbon fiber composites because adequate fiber supply couldn’t be ensured. Fiber manufacturer representative and conference cochair Peter Oswald of Toho Tenax America Inc. (Rockwood, Tenn.) countered that manufacturers have to invest at least $100 million (USD) in a new carbon fiber production line and said it’s “hard to convince a businessman to bet on something that might come.” Oswald also said he would like to see “take or pay” contracts, which would minimize the investment risk for carbon fiber manufacturers, whose risks are only going to continue to increase over time.

Steve Lemery, a Boeing materials engineer based in Seattle, noted that his company, which is comfortable with its fiber supply at the moment because of long-term supply contracts, has “opened up our intelligence to our suppliers.” He thinks that Boeing, by being more open about future designs, future trends and manufacturing shifts, has helped ease the uncertainty of what might come and is encouraging other companies to do the same with their suppliers.

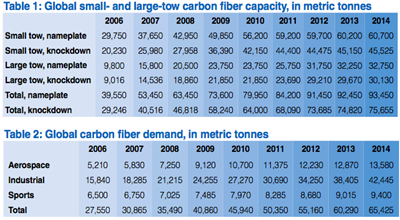

Every panel member noted that the “slugs” of capacity that occur when capacity expands need to be balanced against market demands. One paper that struck many of the participants was given by Dr. Gary Savage of Honda’s Formula One racing team, which invests nearly $500 million each racing season, much of it in carbon fiber bodies and other race car components. Add to that all other racing teams and thousands of Tier 3 aerospace firms, sporting goods makers and industrial parts producers that use carbon fiber and it’s clear that we’ve crossed a threshold and now are becoming a commodity industry.

It was the general consensus of the panel, and I agree, that market diversity today is much greater than in the 1990s when demand last tanked. That diversity is expected to ensure plenty of fiber demand for the next decade — a sure sign that the advanced composites market is maturing.

Links to HPC’s coverage of the CF and HPF Conferences are provided under “Related Content,” at left.

Related Content

Plant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MorePlant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreRead Next

Carbon Fiber 2007 looks forward with optimism

As high demand confronts a still limited supply, industry insiders and analysts meet to assess carbon fiber’s future and review emerging applications.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More