AWEA reports record U.S. wind farm activity in Q2 2019

The U.S. wind project pipeline grew 7% in the second quarter, with 7,290 megawatts in new construction and advanced development activity announced.

Source | AWEA

U.S. wind farm development activity rose to a new high point in the second quarter of 2019, according to new data released by the American Wind Energy Association (AWEA; Washington, D.C., U.S.).

The record 41,801 megawatts of U.S. wind capacity currently under construction or in advanced stages of development represents a 10% increase over the level of activity this time last year, AWEA says. The wind project pipeline grew 7% in the second quarter, with 7,290 megawatts in new construction and advanced development activity announced.

According to the report, strong consumer demand from Fortune 500 businesses and utilities as well as calls from multiple states for offshore projects added to wind power’s growing development pipeline. At the same time, wind turbine manufacturers saw an increasing number of factory orders for more powerful wind turbines capable of powering almost twice the number of homes as an average wind turbine installed in the past few years.

“We’re seeing a growing number of wind farms select turbines capable of powering nearly twice as many homes as the average U.S. wind turbine,” says Tom Kiernan, AWEA CEO.

Wind power is expanding rapidly in many regions of the U.S. Over 200 wind projects are underway across 33 states, and 15 of those states have over 1,000 megawatts of wind capacity that will come online in the near term. Texas currently hosts the most activity (9,015 megawatts), followed by Wyoming (4,831 megawatts), New Mexico (2,774 megawatts), Iowa (2,623 megawatts) and South Dakota (2,183 megawatts). Half of all U.S. states have enough projects underway to grow their installed wind capacity by 25% or more, AWEA says.

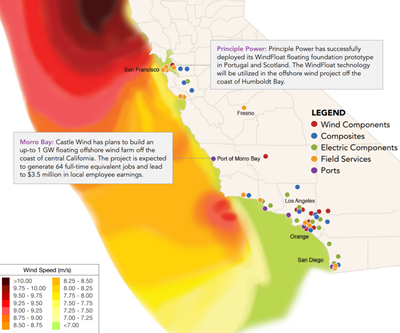

Offshore wind is also said to have seen significant activity in the second quarter, with new offshore wind targets legislated in Maryland (1,200 megawatts), Connecticut (2,000 megawatts) and New York (9,000 megawatts). New Jersey granted its first offshore renewable energy certificate (OREC) award to Ørsted’s 1,100-megawatt Ocean Wind project — the largest offshore project planned in the U.S. so far. In addition, early in the third quarter, New York announced Empire Wind and Sunrise Wind as winners of the state’s first call for offshore wind project proposals.

According to the report, the U.S. grid now includes an additional 736 megawatts of wind power as developers commissioned four new wind farms in the second quarter. This brings total U.S. wind capacity to 97,960 megawatts, with more than 57,000 wind turbines operating in 41 states and two U.S. territories. In addition, wind power customers announced new long-term contracts, called Power Purchase Agreements (PPAs), totaling 1,962 megawatts in the second quarter. Non-utility corporate customers signed up for 52% of second quarter PPA capacity. Hormel Foods, Smithfield Foods, Crown Holdings and Ernst & Young were first-time customers of wind energy in the second quarter, along with repeat customers like General Mills, Walmart and Target. Strong demand from utilities reportedly account for the remaining 48% (949 megawatts) of second quarter PPAs. So far this year, 35 customers have announced wind power purchases totaling 4,799 megawatts.

AWEA also reports that new developments in wind tubine design, resulting in lower costs and higher performance, have resulted in an increase in the number of projects selecting wind turbines with a capacity of 3.5 megawatts or more. In the second quarter, wind turbine manufacturers publicly reported nine orders totaling 2,049 megawatts for turbines ranging in capacity from 4.2 to 4.5 megawatts.

“Wind technology innovation is keeping pace with demand, but we can’t afford to neglect the power grid infrastructure that delivers electricity from where it’s made to consumers,” Kiernan says. “We continue to urge the Administration, Congress, FERC and grid operators to ensure well-designed transmission lines can be planned, permitted, and built in a timely fashion.”

These findings can be found in AWEA’s U.S. Wind Industry Second Quarter 2019 Market Report.

AWEA also reported U.S. wind growth by 6,146 megawatts in the first quarter of 2019, and overall U.S. wind energy growth of 8% for 2018.

Related Content

Recycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreRead Next

U.S. states set gigawatt goals for offshore wind

Three different states plan for gigawatt grids, powered by wind turbines with >90-meter-long composite blades, to help combat climate change.

Read MoreDecommissioned wind turbine blades used for cement co-processing

An initiative to recycle wind turbine blades includes the use of recycled glass fiber composites for cement manufacturing, replacing raw material and saving energy.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;width=70;height=70;mode=crop)