Global car user survey identifies automotive trends, variations for future mobility

Conducted by Asahi Kasei and Skopos, the November 2022 survey found differing opinions regarding purchasing behavior, automotive sustainability and autonomous vehicles from the top automotive markets in Germany, China, Japan and the U.S.

In November 2022, Asahi Kasei (Tokyo, Japan) and market research institute Skopos (Cologne, Germany) conducted its fourth global “Automotive Interior Survey” in the four most important automotive markets: Germany, China, the U.S. and Japan. Up to 1,000 vehicle users with different income levels in each market answered questions about their purchasing behavior (brand loyalty), understanding of automotive sustainability, as well as acceptance and use scenarios for autonomous vehicles. The survey, now available, reveals major differences among these markets, and paints a picture of the mobility of the future.

Brand loyalty globally continues to decrease

The results of the new survey show respondents in all four regions prefer to own a car also in the future. One in two respondents in Germany and the U.S. can imagine purchasing a new car; this proportion is significantly higher in China (79%) and Japan (62%). In contrast, not owning a car or using car-sharing services only is not yet an option for respondents in Germany (11%), the U.S. (3%) and Japan (4%).

In Germany, the U.S. and Japan, as in recent years, one in two vehicle users would choose a model from another brand when buying their next car. In China, 82% of the respondents would choose a car from another manufacturer. By comparison, in 2020 only 41% could imagine switching brands. The rapidly growing range of domestic brands in the car market will further intensify the competition for customers’ favor in the coming years. In addition, the differentiation via price, drivetrain technology, as well as interior equipment and functions is becoming increasingly important.

“To address this challenge, OEMs need to partner with suppliers, who have expertise across interior, exterior and electrification, which will allow them to shorten development times and bring new features and functions to market quicker,” notes Michael Franchy, director of North American mobility for Asahi Kasei America.

Range and charging times are key when buying electric cars

Fifty-eight percent of the respondents in China would consider buying a purely battery-powered electric car. In Germany, only 29% choose this option, in the U.S. (21%) and Japan (18%). Among potential electric vehicle (EV) buyers in all regions, range and charging time are important factors in the purchase decision. Thirty-nine percent of the potential EV buyers in Germany also look at the CO2 emissions during vehicle production. This shows the issue of sustainability is becoming more important and more complex in the purchasing decision process.

The understanding of sustainability is changing

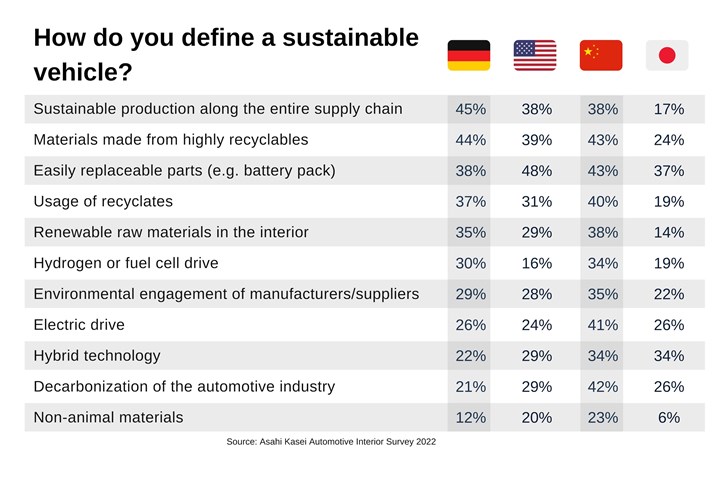

Even with the transformation to a zero-emission vehicle the mission of achieving “sustainable mobility” is far from complete. The survey results show a “sustainable vehicle” is no longer just defined by the drivetrain technology, but also by the CO2 footprint in production, easily recyclable materials or even the decarbonization of vehicle manufacturers and their suppliers. In short, sustainability and transparency along the entire value chain are also playing an increasingly prominent role from the customer’s perspective.

Regional differences in acceptance for fully autonomous vehicles

In the new survey, Asahi Kasei placed a special focus on the topic of autonomous driving. The results show that in Germany and the U.S. more than one in two respondents currently rejects the use of fully autonomous cars. In Asia, on the other hand, survey participants are much more open to the new technology: In China, only 10% of all respondents are against its use, in Japan 22%. In both countries, one in two respondents can even imagine buying a fully autonomous vehicle. Chinese manufacturers have caught up rapidly in electromobility in recent years. The customers’ affinity for new technologies favors rapid market penetration of innovations and might contribute to China taking a leading role in the field of “autonomous driving” as well.

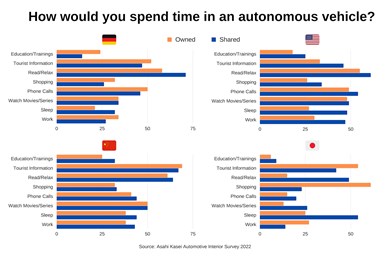

There are also major differences among the markets with regard to the use scenarios of fully autonomous vehicles. Displaying tourist information and reading/relaxing are highly popular among respondents in all regions, regardless of the type of vehicle ownership. About one in two car users in China would watch movies and series, in Japan only one in four. In a shared autonomous vehicle, one in two respondents in Japan would spend time sleeping, while only one in seven would work in the car. These different use scenarios also give rise to new needs in terms of interior design.

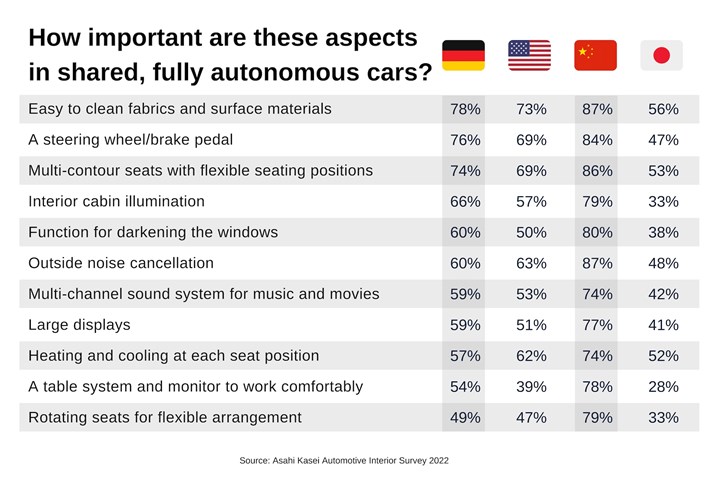

As is already the case with conventional vehicles, easy-to-clean textiles and surfaces as well as easily adjustable seats are very important to respondents in all regions and regardless of the type of ownership of fully autonomous cars. Individualized interior lighting and a function for darkening the windows help with reading and relaxing. Fully rotating seats, on the other hand, play only a minor role, particularly in Germany, the U.S. and Japan.

Even in fully autonomous vehicles, a large proportion of vehicle users in Germany, the U.S. and China prefer to have a steering wheel and brake pedal for optional manual control — in Japan, one in two would. In Germany and the U.S. in particular, this option can help increase acceptance of autonomous vehicles.

“Individual mobility and the car will continue to play a key role in people’s lives worldwide,” says Heiko Rother, general manager business development automotive at Asahi Kasei Europe. “Preferences in terms of usage scenarios and equipment indicate what the interior of increasingly autonomous vehicles may look like. This makes it more crucial than ever to focus on the customer, their wishes and the driving experience when developing new materials and technologies.”

Related Content

Infinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreSMC composites progress BinC solar electric vehicles

In an interview with one of Aptera’s co-founders, CW sheds light on the inspiration behind the crowd-funded solar electric vehicle, its body in carbon (BinC) and how composite materials are playing a role in its design.

Read MoreMcLaren celebrates 10 years of the McLaren P1 hybrid hypercar

Lightweight carbon fiber construction, Formula 1-inspired aerodynamics and high-performance hybrid powertrain technologies hallmark this hybrid vehicle, serve as a springboard for new race cars.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More