Gurit reports net sales impacted by challenging wind turbine blade market

Unaudited sales results for the first half of 2022 are marked by a decline of -7.0% at constant exchange rates impacted by the wind market, though high growth is reported in marine and other industrial markets.

On Aug. 17 Gurit (Zurich, Switzerland) reported unaudited sales results for the first half of 2022. Net sales for this period were CHF 234.8 million ($246.8 million) which is a decline of -7.0% at constant exchange rates or -9.2% in reported CHF versus the prior year. For Continued Operations, the decline was -5.7% at constant exchange rates.

Net sales in the first half of the year continued to be impacted by a challenging market for wind turbine blades, the company notes. Specifically, its largest Western wind customers produced less blades year-over-year. In China, Gurit observed market growth, but at aggressive price levels. Alternately, the marine and other industrial markets saw growth well above pre-pandemic levels. As reported in April, Gurit acquired a majority stake in the wind industry supplier Fiberline Composites (Middelfart, Denmark) to strengthen its product offering for the wind energy market and divested its Aerospace business.

Materials achieved net sales of CHF 141.4 million ($148.9 million) for the first half of 2022, which includes CHF 27.4 million ($28.8 million) of the newly acquired Structural Profiles business (operating under the brand Fiberline). This represents an increase of 22% at constant exchange rates compared to the first half of 2021. The demand for wind core materials achieved lower levels compared to last year, while the sales for Marine and other industrial segments grew year-over-year.

Kitting recorded net sales of CHF 71.6 million ($75.3 million) for the first half of 2022. This is a decrease of -20.9% at constant exchange rates compared to the first half of the prior year. In response to the continued challenging environment, the kitting production for Europe will be consolidated at the Gurit sites in Spain and Turkey. These sites will be strengthened and accommodate the volumes from Ringkøbing, Denmark, which is being converted into an innovation hub for the wind industry and now hosts a wind innovation center.

Manufacturing Solutions (Tooling) saw a decrease in its first half of 2022 net sales by -43.7% at constant exchange rates compared to a very strong first half of 2021, down to CHF 32.4 million ($34.1 million). The market for wind blade molds remains challenging as Western wind turbine manufacturers are delaying investments into new production equipment and the Chinese market saw increased price pressure.

Gurit reports that it reached an Operating Profit of CHF 19.8 million ($20.8 million) with an operating profit margin of 8.4% of net sales. Excluding divestment effects, restructuring and impairment charges, the adjusted operating profit is at CHF 4.6 million ($4.8 million) with an adjusted operating profit margin of 2.0% of net sales. The lower profit is mainly due to reduced sales in Wind, particularly in Manufacturing Solutions and impacted by increased raw material, energy and freight costs. In the first half year 2022, the operating profit is temporarily impacted by CHF 5.6 million ($5.9 million) (H1 2021: CHF 4.7 million/$4.9 million)) ramp-up cost in its new and major production sites in Mexico and India. Earnings per share are CHF 3.61 in H1 2022 (H1 2021: CHF 2.56).

Gurit achieved a net cash flow from operating activities of CHF -13.1 million ($-13.8 million) compared to CHF 19.3 million ($20.3 million) in the first half of the previous year. The reduction is due to a lower operating profit in 2022 and higher working capital levels caused by the timing of received trade payments. Capital expenditures amounted to CHF 6.7 million ($7 million) during H1 2022 compared to CHF 13.8 million ($14.5 million) for the first half of the previous year. Major growth capacity investments were made at the now operating site in Chennai, India.

The company expects a stronger second half of 2022, driven by the initiated cost-out programs and new plants going operational. For the full year net sales are expected around CHF 500-530 million ($526-557 million) with an adjusted operating profit margin between 2.0% and 4.0%. Adjusted operating profit does not include further restructuring and impairment charges in the second half of this year, which might become necessary if market conditions worsen further. Gurit believes that the longer term market outlook for wind energy remains strong, driven by an increasing demand for renewable energy and recently announced international support policies.

|

Net sales (in MCHF) by markets:

|

First half year

|

|||

|

H1 2022 |

H1 2021 |

Change in reported CHF |

Change at constant HY 2021 rates |

|

|

Composite Materials* |

141.4 |

118.2 |

19.7% |

22% |

|

Kitting |

71.6 |

95.2 |

-24.7% |

-20.9% |

|

Manufacturing Solutions |

32.4 |

55.4 |

-41.6% |

-43.7 |

|

Eliminations |

-20.2 |

-24.3 |

||

|

Total Continued Operations |

9.6 |

14.2 |

-32.6% |

-29.4% |

|

Aerospace |

9.6 |

14.2 |

-32.6% |

-29.4% |

|

Total Group |

234.8 |

258.6 |

-9.2% |

-7% |

|

Operating Profit |

19.8 |

18.6 |

||

|

Operating Profit Margin |

8.4% |

7.2% |

||

|

Adjusted Operating Profit |

4.6 |

26.0 |

||

|

Profit for the Period |

16.6 |

10.3 |

||

|

Operating Cashflow |

-13.1 |

19.3 |

||

|

Capital Expenditures |

6.7 |

13.8 |

||

|

Equity in % of Total Assets |

34% |

47.4% |

||

*Note: Composite Materials contains Structure profile sales of CHF 27.4 million ($28.8 million) for a period of two months since the acquisition end of April 2022.

Related Content

Drag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreAchieving composites innovation through collaboration

Stephen Heinz, vice president of R&I for Syensqo delivered an inspirational keynote at SAMPE 2024, highlighting the significant role of composite materials in emerging technologies and encouraging broader collaboration within the manufacturing community.

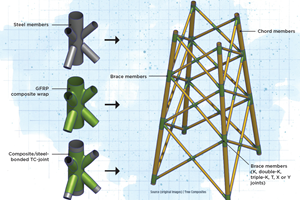

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Gazelle Wind Power teams up with Ferrofab for hybrid floating wind platform

Center for Manufacturing Excellence to be established in UAE to accelerate manufacture and deployment of next-generation offshore wind platforms.

Read MoreEvident wind blade inspection system automates nondestructive ultrasonic testing

An autonomous, cobot-mounted inspection system combines Industry 4.0 with established ultrasonic technology to rapidly provide repeatable, accurate data and improve overall efficiency.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More