Episode 21: Mike Del Pero

Mike Del Pero, managing director at FocalPoint Partners, a middle-market investment banking advisory firm, discusses the business side of the composites industry including growth strategies, mergers and acquisitions and intellectual property protections.

Editor’s note: The highly dynamic nature of the composites industry makes it a strong target for mergers and acquisitions (M&A) activity on the part of a variety of companies and investors eager to be a part of this industry’s growth. Further, the past few years have seen several very significant acquisitions by larger industry players looking to shore up material and technical capacity (e.g., Tokyo, Japan-based Toray Industries’ acquisition of TenCate Advanced Composites, Nijverdal, The Netherlands). Michael Del Pero, managing partner at investment banking advisory firm FocalPoint Partners (Los Angeles, CA, US), has worked for several years in the composites industry M&A space and recently shared with CW Talks: The Composites Podcast his assessment of the composites investment market. CW’s conversation with Del Pero is excerpted below.

Mike Del Pero, managing director at FocalPoint Partners

CW: The composites industry is relatively young and growing quickly, but it’s also highly technical. As someone who bridges the gap between those inside and outside the industry, what are your observations of the composites industry?

MDP: The composites industry has been around for 50 years — and I am sure there are people who would argue it’s been longer or shorter than that — but it’s really been more in the last 5 to 15 years that a lot of the materials and a lot of the technologies and a lot of the landscape has really developed and evolved. So it’s been a little bit of a shorter period of time. .… and a lot of the problems [companies] are trying to solve for are fairly bespoke, or there’s a lot of “secret sauce” that goes into competitively differentiating one business from the next. That secrecy or that protection of what’s going on behind the curtain has been very beneficial to a lot of players … but I think a lot of the “bespokeness” of the industry has translated into a little bit of an insular attitude in some regards. And that’s made it tough for some of the more institutional coverage efforts [to get involved]. … I don’t mean that to sound derogatory. Like I said, the industry’s greatest benefit is perhaps one of its areas for development and further growth. Ultimately what you have is a lot of very smart technical people in this industry, running businesses and owning businesses, but kind of figuring out the business of business on their own as they go, and they don’t have some of the same tools and resources that might be available to other peers in other industries.

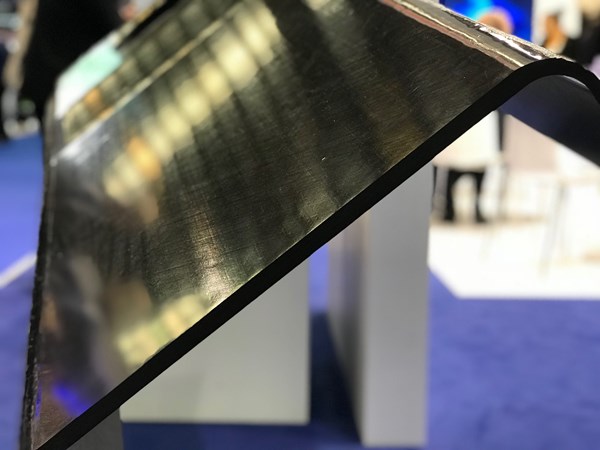

A thermoplastic composite spar on display in the TenCate Advanced Composites booth at JEC 2018. Soon after JEC, TenCate was acquired by Toray. Photo | Jeff Sloan

CW: How does this play out in the composites industry?

MDP: To give an example … if you have, call him Joe Composite, and he’s built a great technology and he’s built it up to a fairly sizable scale and it’s now starting to attract some interest from potential partners, would-be investors, potential acquirers, and he’s typically got that insular mentality because where he’s gotten with his business and his lifecycle has focused on protecting that intellectual property or whatever that secret sauce is. … He may be thinking that the time is right to consider some sort of alternative, whether that’s selling the business, taking on capital or a growth partner that will help him get to that next level … there’s less of a tendency to engage outside help to go make that happen. So then what happens is you’ve got the guy down the street or maybe it’s one of the big guys that they’ve been able to shoot breeze with at events over the year, and there’s a level of familiarity there to work together and a deal ends up happening. … But if you compare the average deal, in any industry, without some sort of advisor or some sort of third-party input, versus one that gets done with that advisory assistance, there’s a pretty notable difference in terms of valuation, terms of the deal, outputs and capability of the individuals moving forward.

CW: How do you compare the M&A strategies of composites material suppliers vs. fabricators and parts manufacturers?

MDP: If you look at, call it the fabricators, the people making stuff. When a business like that gets acquired, it’s usually being done for reasons of scalability or it adds a capability or is accretive in some sort of financial way. So you usually find businesses on the fabrication side that are acquired tend to be a little more established, mature — have been around for some period of time. And then you look at the material supplier and the materials technology side of the equation and the people acquiring those businesses are typically more interested in gaining technological differentiation through acquisition. That allows them to look at a slightly different universe of potential targets. Ultimately their goal is to be in a position to offer more of the value chain to their end customer. So they can take an earlier stage or smaller business that’s got a great technology, or some established differentiation through IP.

CW: What is your assessment of current M&A activity in the composites industry? How has the last year looked? How does the future look?

MDP: Some of the same themes from an end-market standpoint continue to be there. There’s an ever-increasing need for light weight and fuel efficiency, which drives a lot of the production efforts in strategic initiatives at some of the big OEMs, whether that’s automotive or aerospace or something else. .… As it relates to what we’re seeing from an activity standpoint, this market is as hot as people in my industry have ever seen, and that’s specific within composites and advanced materials, but it’s specific to the broader market. I think that us, on the advisory side, look at it and say, “Gosh, we have been in an up-cycled market going on nine years. It’s been wonderful and we’re working our tails off. But at some point it’s going to have to cool off, or start going in the other direction.” I don’t think any of us has that crystal ball to say when … but, what we can see if that the valuations have climbed and climbed and climbed to a bit of a plateau over the last 18 months. It does feel like we’re at the top. …. I think the takeaway is that if you’re thinking of doing anything in the next few years, it’s probably not going to get much better than it is right now.

CW: You see a lot composites industry businesses, good and bad. What kinds of things do investors look for when they evaluate a target?

MDP: No one strategy is absolutely right for everybody. It’s a mix of personality, culture, market position, capability, technology, and based on any one of those variables, the ultimate recipe about creating what we call enterprise value can be a bit different. But my message to folks is you should always be thinking about how am I creating enterprise value for my business. … Never lose sight of building the business from the inside out. That incorporates practices that are universal, not limited to composites. … Don’t forget that a good financial person or a good CFO can make all the different in the world when you’re trying to create value for yourself as an owner as an investor in a business. What I tell people is to have a plan in mind for where you ultimately want to be. For some people that’s time-based, for some people that’s monetarily based, but if and when you decide you want to do something … the more chance we have to help make sure the house is in order before going to market — there’s a direct correlation between those upfront efforts and the success of the outcome.

Related Content

CCG FRP panels rehabilitate historic Northamption Street Bridge

High-strength, composite molded, prefabricated panels solve weight problems for the heavily-trafficked bridge, providing cantilever sidewalks for wider shared use paths.

Read MoreCCG meets customer demand with StormStrong utility pole lineup

Additional diameters build on the portfolio of resilient FRP pole structures for distribution and light pole customers.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreSwedish parking garage to incorporate decommissioned wind blades

Architect Jonas Lloyd is working with Vattenfall to design the multistory building with a wind blade façade, targeting eco-friendly buildings and creative ways to remove blades from landfills.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreModeling and characterization of crushable composite structures

How the predictive tool “CZone” is applied to simulate the axial crushing response of composites, providing valuable insights into their use for motorsport applications.

Read MoreVIDEO: High-rate composites production for aerospace

Westlake Epoxy’s process on display at CAMX 2024 reduces cycle time from hours to just 15 minutes.

Read More

.jpg;maxWidth=300;quality=90)