Aviation Outlook: Composites in General Aviation 2011-2020

As the general aviation (GA) segment emerges from the recessionary storm clouds, GA manufacturers and the composites supply chain that supports them should see sunny days … with some clouds and a chance of rain.

Market forecasting is comparable in some ways to your TV weather forecast. In both cases, forecasters have plenty of knowledge, collect both current and historical data and use mathematical tools and models to help their audiences make informed decisions about future plans. Weathercasters are commonly respected and thought of as well-intentioned … if sometimes prone to err. Market forecasters, however, are often held in slightly less esteem. This is because the tools and models used to make their forecasts treat the markets like closed systems, where all known factors are quantifiable and their interactions within the system are clearly defined. As we all know, the world in which we live is often upset by the chaos inherent in open systems, where outside forces can steer our reality in unexpected ways. The future, when it comes, is always more colorful and interesting than we can possibly imagine.

So it was when, almost four years ago, HPC published my 10-year forecast (then 2008-2017) of the demand for composite materials and manufacturing services for the global general aviation (GA) industry. I predicted relatively steady growth in the number of aircraft deliveries. This was coupled with increasing adoption of composites on new programs as they entered the market. Although I tried to account for a number of economic and technical factors in my predictions, the collapse of the global economy was not among those factors.

The events of the past four years have required massive reactions by all aircraft manufacturers in order for them to survive. The ramifications of these changes are becoming clear. So this seems to be an appropriate time to rechart the GA industry’s likely demand for composite goods and services. Economic conditions are slowly improving, and the industry is starting to recover (that’s the sunny news). But, as GA history shows, the number of elegant but ultimately ill-fated programs will continue to mount (these are the clouds on the horizon). And, as always, there is the very real but not so predictable impact of business cycles, natural disasters and international policymaking and conflict that can destabilize markets (a chance of rain).

GA market defined

The General Aviation Manufacturers Assn. (GAMA, Washington, D.C.) loosely defines GA as all aircraft production that is not directly associated with the military or commercial airline services. Under this definition, helicopters and other rotary-wing aircraft could be included within GA. Although there is some overlap between rotorcraft and other GA vehicles, this definition ignores the significant differences in technologies, design and regulatory governance, as well as the extremely small cross-section of OEMs and suppliers in the rotorcraft segment. For this article, then, GA is defined as fixed-wing aircraft operated by businesses or private individuals. Within this narrower focus, there are hundreds of aircraft models in production or development that fall into five categories:

• Private jets

• Turboprop passenger aircraft

• Piston-engine airplanes

• Light sport aircraft (LSA)

• Experimental and home-built

aircraft

Today’s weather

For this forecast, more than 80 major factory-certified aircraft programs were investigated; about three-quarters of these models were also represented in the 2008-2017 forecast. Sales and manufacturer delivery figures were quantified for the period from 2008 to the present and were used to create a new 10-year outlook. As intimated above, the overall forecast is sunny.

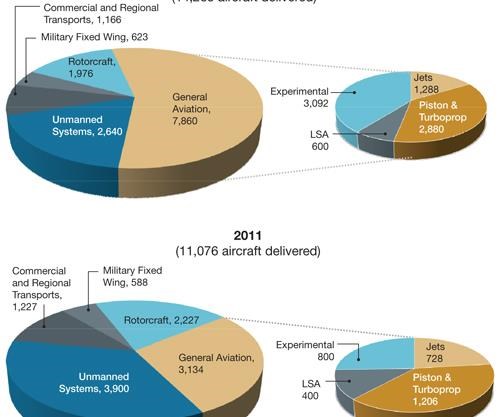

Globally, more than 320,000 GA aircraft are reportedly in operation, two-thirds of which are based in the U.S. According to records kept by the Federal Aviation Admin. (FAA), the average age of these aircraft is approximately 40 years. This fleet age would be older were it not for the business-jet subsegment, which has an average age of about 17 years. GAMA statistics show that during 2011 its members delivered about 2,000 GA aircraft, representing approximately $18 billion (USD) in sales. Comparing 2011 to 2010, the GA market suffered another double-digit decline. From the peak in 2008, annual GA aircraft deliveries declined by nearly 2,200 units (55 percent), with sales values dropping by $7 billion (28 percent). And although the market signs are improving, these figures underscore the desperate challenge of the past few years.

To put things into better perspective, production estimates for the LSA, experimental and home-built aircraft subsectors drive the total GA deliveries up to 3,134 units. At this level, GA aircraft represented 44 percent of all manned aircraft delivered last year (28 percent of unit production, if unmanned aircraft systems are figured in). Obviously, not all of these aircraft carry significant percentages of composite structures. This forecast focuses on programs that are notable consumers of composite goods and services. The 80 aircraft models tracked for this outlook represent deliveries of 2,100 aircraft, or about 68 percent, of the total estimated GA unit deliveries. It is interesting to note that during 2007-2008, the number of GA aircraft deliveries with significant composites applications represented only about 50 percent of the market. Clearly, there is a very strong correlation between advanced composites and successful GA programs!

Driving the weather change

Composites applications have expanded rapidly in GA design, from small secondary structures to more demanding flight-control surfaces, empennage assemblies, fuselages and wings. Examples of this growth are frequently found in the pages of this magazine. This trend can be attributed to the material’s ability to enable the following improvements:

Greater impact resistance in airframe, wing and empennage: Carbon-fiber-reinforced polymer (CFRP) structures, in particular, are significantly stiffer than similar aluminum structures of the same strength. This provides more passive safety and greater resistance to erosion or impact damage.

Reduced unit costs: Parts integration and cocuring strategies enable manufacturers to reduce manufacturing and assembly time, as well as labor costs, and they eliminate a significant number of heavy, drag-inducing fasteners.

Reduced maintenance: Metal structures are subject to long-term fatigue and corrosion; by contrast, composite structures better retain their strength over time and won’t corrode. This reduces the airframe inspection, maintenance and repair component of ongoing operating costs.

Enhanced aerodynamics: Composite structures are shaped without the production constraints of metal, so ideal aerodynamic lines can be achieved.

Improved power-to-mass ratio: Composite airframes have lower mass but are stronger than conventional airframes, resulting in improved operating efficiency and aircraft performance.

Yesterday’s stormy weather

In the months following my 2008 forecast, financial markets withered, credit dried up and the record-breaking order backlogs held by established GA manufacturers and a whole host of new market entrants withered away. As demand for new aircraft plummeted, sales evaporated and a surplus of used aircraft for sale further depressed the market. Most GA manufacturers and suppliers saw their private aircraft businesses decline by 50 percent or more.

One of the most promising emerging applications for composites in the 2008 outlook, the very light jet (VLJ) segment, was rocked by sudden failure after its production volumes rapidly expanded in 2006 and 2007. Among the casualties were Eclipse Aviation, Adam Aircraft and Epic Aircraft. Several other VLJ programs — Diamond Aircraft Industries’ (Wiener Neustadt, Austria) D-Jet, Cirrus Aircraft Corp.’s (Duluth, Minn.) SF50 and Piper Aircraft’s (Vero Beach, Fla.) PiperJet (now being developed as the Altair) — have seen significant delays and could face additional challenges before serial production can begin.

Further up market, Carlsbad, Calif.-based Spectrum Aeronautical’s bid to sell jets with an innovative filament-wound fuselage in the light aircraft segment stalled after a fatal crash. Grob Aerospace’s all-composite airframe SPn Utility Jet similarly ground to a halt. Shortly thereafter, Grob’s operations were shuttered but subsequently purchased by H3 Aerospace and renamed Grob Aircraft AG (Tussenhausen, Germany). Today, only a few examples of this once-vibrant product line are produced, mainly for military training operations.

The collapse of production and deliveries from these programs has made a rather dramatic impact on the demand for composite aerostructures from GA programs. It also has depressed the potential purchase prices of these companies and their assets. It appears now that the improving business environment is bringing with it a resurgence of interest in GA and a resurrection of some of these promising but stalled programs.

Cloudy skies part

At the October 2011 National Business Aviation Assn. (NBAA) Meeting and Convention in Las Vegas, Nev., Sikorsky Aircraft (Stratford, Conn.) announced that it had made a substantial investment in Eclipse Aerospace (Albuquerque, N.M.) and would restart production of the Eclipse 500 (redubbed the model 550) in 2013.

Elsewhere, Ruag Aerospace Services GmbH (Wessling, Germany) has restarted production of “new generation” Dornier Do 228 aircraft, which previously competed in the 19- to 30-passenger regional aircraft market. The first new airframes were delivered in late 2010, and planes are coming off the assembly line at a rate of four per year.

Meanwhile, Bombardier Aerospace (Dorval, Quebec, Canada) continues to make progress with its all-composite-airframed Learjet 85, which is expected to enter service next year. The company also has released additional details for its new Global 7000 and 8000 long-range business jets, which will serve the large transcontinental segment. Aircraft from these two programs are scheduled to enter service in 2016. Although Bassam Sabbagh, Bombardier VP and general manager of the Global program, said the decision had been made to use metal construction as opposed to composites for the 7000/8000’s transonic wing, other company executives said a decision on the new wing’s exact metallurgical content had yet to be made.

The new models’ industrial plans are still under development, so little is known about their potential for composites use, but if these aircraft resemble the construction of the Global 5000, each could incorporate, elsewhere on the airframe, approximately 3,000 lb/1,361 kg of composite structures per copy.

Wichita, Kan.-based Cessna Aircraft’s new CEO, Scott Ernest, also made a number of important announcements at the NBAA show. He has taken the helm of the company at a time when its operations have shrunk by half in both its prop-driven and jet-powered product offerings. To meet the challenges posed by the market and direct competitors, such as Embraer (São José dos Campos, Brazil), Cessna has announced a revitalized version of its Citation Jet 1, known as the M2. Perhaps more significantly for the composites industry, Cessna took the wraps off a long-overdue enlargement of its midsized jet line, unveiling the Citation 680A Latitude. Its first flight is targeted for mid-2014, FAA certification is expected in mid-2015 and entry into service is scheduled for the second half of 2015.

Clearer skies ahead

Barring renewed economic turmoil, recent GA sales and production increases foreshadow 12 percent more aircraft this year than in 2011. Many key OEMs and GA suppliers indicate that over the next several years, European and North American markets for their aircraft will slowly improve. Most of the forecasted growth, however, will come from the emerging markets in China, Brazil and India — where small planes will provide transportation to and from small, distributed communities with limited road infrastructures.

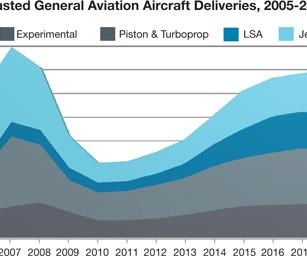

In all, this outlook forecasts that approximately 56,000 GA aircraft will be built between 2011 and 2020, an increase in unit production of 115 percent (averaging 9 percent per year). This certainly is good news, but it is important to note that when the GA market reaches its anticipated peak (circa. 2017-2018), the unit volume will be about the same as that during the 2006-2007 time period. Further, the 10-year outlook presented here differs significantly, in several major aspects, from the one I presented in 2008:

• Slower overall market growth due to moderated economic forecasts.

• Decimation of the VLJ and air taxi marketplaces.

• Reduced demand for one- to four-seat piston aircraft.

• Increased preference for smaller LSAs by many piston-aircraft owners.

• A dramatic decline in experimental aircraft production due to LSA popularity.

• Smaller small- and medium-sized private/business jet markets.

In terms of numbers, this current market forecast has shed approximately 6,000 LSA aircraft; 8,000 piston-powered and small turboprop aircraft; and 17,000 experimental or home-built planes compared to the 2008-2017 forecast. This adjustment had a huge impact on the resulting calculations for the manufacture of composite aerostructures, as illustrated in the figure titled “Forecasted General Aviation Aircraft Deliveries, 2005-2020.".

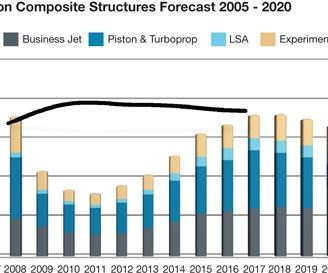

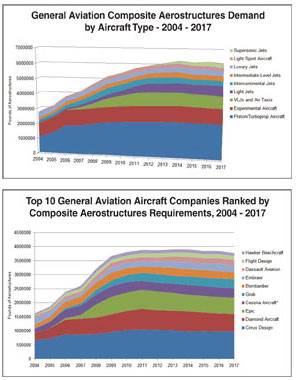

Based on deliveries reported between 2008 and the end of 2011, and forecasted production through 2017, the loss of nearly 50,000 aircraft units results in a 17 percent reduction in forecasted composites demand. From 2011 through 2020, aircraft OEMs and their suppliers are expected to produce more than 28 million lb (12,700 metric tonnes) of composite primary and secondary structures for the GA market. Significantly, as the GA market reaches its peak in 2017, composite structures manufacturing will represent roughly the same amount of business reported in 2008, despite an anticipated 30 percent reduction in the total number of aircraft deliveries. We can conclude from this observation that the adoption of composite materials systems on aircraft that are now in the design and development phase is expanding faster than anticipated in 2008.

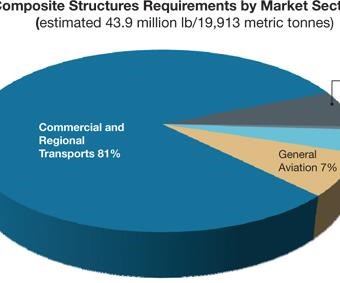

Assuming the actual GA production rates conform to the adjusted forecast, the composite aerostructures market represents an estimated $503 million in composites manufacturing business during 2011. This figure is expected to grow 16 percent to $580 million this year, and it represents about 11 percent of the total market for composite structures on all aircraft types (commercial, military, rotorcraft, etc.). At the peak in 2017, the calculations indicate that the GA composites market will be valued at more than $1 billion. During the remainder of this decade, approximately $8 billion in composites structures will be delivered to GA programs. This will be the result of production volumes that are expected to more than double during this decade. Yet in the bigger picture, the GA market will represent only about 7 percent of the total aircraft structures market.

Material opportunities

A large portion of this business will be increasingly outsourced to Tier 1 and Tier 2 manufacturing partners that have specialized skills to produce these structures cost-effectively. Some companies, such as Bombardier; Wichita, Kan.-based Hawker Beechcraft; and Tarbes, France-based Daher Socata (formerly EADS Socata), are able to leverage internal expertise in producing large composite assemblies and in-place advanced manufacturing processes, such as fiber placement, tape laying and infusion molding. Those who can are likely to keep much of the composites manufacturing in-house. However, for the HondaJet, Embraer’s Phenom 100 and 300, Gulftream Aerospace Corp.’s (Savannah, Ga.) Gulfstream G650, GECI Aviation’s (Onville, France) Skylander SK-105 and other platforms, their respective OEMs will partner with composites manufacturers to design and construct major aircraft sections. Throughout much of the industry, production of secondary structures and flight-control surfaces is frequently outsourced. Secondary structures present some of the most numerous — and safest — opportunities for part manufacturers.

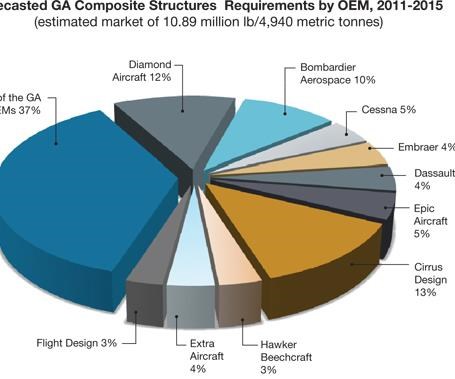

Worldwide, there are roughly 100 companies that produce GA aircraft. The top 10 GA manufacturers, however, represent about 63 percent of the market for composite aircraft structures. Chief among them are Cirrus Aircraft, Diamond Aircraft, Cessna and Bombardier. For the rest of this decade, growth in the LSA segment is expected to continue at the expense of more traditional one- or two-passenger aircraft designs. The high end of the GA market, particularly the large luxury and intercontinental business jets, escaped the past four years of turmoil relatively unscathed. These subsectors of the business jet market are expected grow an average of 7 percent annually throughout the forecast period, including about a dozen transcontinental supersonic business jets and prototypes.

These trends signal opportunities both for new, small aircraft companies to enter the business and for manufacturers, whose forte isn’t composites processing, that can cost-effectively produce aerospace-certifiable composites for aircraft OEMs. The current forecast, however, also indicates that active Tier 1 and Tier 2 suppliers have enough combined manufacturing capacity to handle most of the predicted new business.

Beyond the opportunities and challenges for GA OEMs and their suppliers, the 2011-2020 outlook also offers some insight for suppliers of raw materials, equipment, tooling and software, as well as suppliers of testing, engineering and other services.

For the remainder of this decade, this market outlook expects OEMs to build approximately 55,000 jets, turboprops, piston aircraft, LSAs and experimental aircraft. A pantheon of smaller aircraft design prototypes will appear at trade shows. Historically, the chances of successfully pushing a GA design through certification to production is low. Given that fact, only 17 programs (currently in the design, development or certification phases) are included in these projections. In addition, it is assumed that OEMs will continue developing existing platforms to remain competitive in an evolving marketplace and, as a result, there will be additional opportunities for composites manufacturers to provide goods and services to the GA industry.

To support production of these planes, manufacturers will need to produce — in-house, outsourced or both — 400 to 600 complete shipsets of tooling and production jigs for all of the composite components in this forecast. That does not include tooling for the many small-program prototypes that are likely to pass into obscurity. And, of course, the component manufacturers will need to continually invest in increased productivity. This will present myriad opportunities to replace obsolete design-simulation technologies and adopt automated lamination, infusion, cutting, curing, trimming, drilling, testing and other solutions.

Finally, carbon fiber-reinforced composites represent about 62 percent of the total aircraft structures volume predicted in this forecast. From this, we can calculate that this year, carbon fiber suppliers can be expected to deliver about 1.17 million lb (530 metric tonnes) of intermediate- and standard-modulus materials to secondary processors to manufacture prepregs and infusion fabrics for GA applications. That figure represents about 7 percent of all CFRP material shipments to aerospace firms. During the period from 2011-2020 in this forecast, about 15.87 million lb (7,200 metric tonnes) of carbon fiber materials will be consumed. Similarly, glass suppliers are expected to deliver about 727,520 lb (330 metric tonnes) of E- and S-glass reinforcements this year, and a total of about 99.21 million lb (4,500 metric tonnes) of glass product during the forecast period. These reinforcements will be combined with approximately 3 million lb (1,336 metric tonnes) of performance resin systems, primarily epoxies.

The weather forecaster’s disclaimer

As noted earlier, wildly fluctuating conditions created a huge impact on the GA industry and the companies that partner with and supply composite products to GA firms. Although economic conditions are generally improving, there is still much uncertainty about the future across the globe. Accordingly, this forecast assumes that macroeconomic growth will be slow in North America and Europe, and emerging markets in China and Brazil will also be somewhat moderated.

With the imminent withdrawal of fighting forces in Afghanistan, one might assume that there will be a moment of relative peace, which would be good for business aviation. It is unfortunate, however, that new disputes in the Middle East could disrupt oil exports from the region that helps moderate oil prices. The inevitable increases in the price of aircraft fuel could have a dramatic impact on the viability of private aviation, potentially cancelling out the gains I’ve predicted for the next several years. The probability of such a disruptive event during this decade seems fairly high. As many a picnicker can attest, sunny days can turn cloudy and rainy with little warning. Here’s hoping that this composites market forecaster has it right this time.

Related Content

GKN Aerospace, Joby Aviation sign aerostructures agreement

GKN Aerospace will manufacture thermoplastic composite flight control surfaces for Joby’s all-electric, four-passenger, composites-intensive ride-sharing aircraft.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRead Next

Aviation Outlook: Composite aerostructures in General Aviation

Although the math is fuzzy and once helpful category distinctions are blurring, the forecast for this sector’s use of fiber-reinforced polymer remains strong.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read MoreModeling and characterization of crushable composite structures

How the predictive tool “CZone” is applied to simulate the axial crushing response of composites, providing valuable insights into their use for motorsport applications.

Read More