Carbon Fiber 2017 final highlights

Applications and enabling technologies for carbon fiber promise new market penetration – challenges notwithstanding.

The final day of Carbon Fiber 2017 focused on enabling technologies for the expanded application of carbon fiber, as well as market forecasts about this potential growth. (See “Live from 2017 Carbon Fiber conference” for Day 1 recap.) The tenor of the day’s sessions was tempered yet optimistic. The conference ended on a positive note as several technological advancements were presented.

CFRP Growth and Challenges

The challenges of expanding carbon fiber into new automotive applications was the focus of Carbon Fiber 2017’s keynote address, given by Mark Voss, General Motors engineering group manager, body structures advanced composites. From his own experience implementing carbon fiber panels for several vehicles in the Corvette series, Voss’ primary admonition was to “limit the ‘news’” in new applications; that is, restrict the number of technologies and processes that are new to the automotive industry. Material and process variables abound in carbon composites, he noted, and scaling further complicates implementation outcomes. “And the variables are amplified by 100 when you’re working on Class A surfaces,” he added. Critical to the success of a new carbon fiber component, he believes, is choosing familiar material forms and processing techniques where possible.

Voss also emphasized how crucial joining technologies are to the introduction of carbon components, which must be integrated with dissimilar materials in automotive structures. Finally, to make carbon composites cost-competitive despite their higher material cost, Voss suggested that scrap costs be considered early in the development cycle. With the intellectual resources represented at Carbon Fiber 2017, Voss concluded, “I’m really excited to see what this room brings to us in the next 20 years.”

Anthony Vicari of Lux Research (Boston, MA, US) followed the keynote with a study of future growth opportunities and challenges for carbon fiber composites. He began with a forecast for carbon fiber (CF) nameplate capacity (total announced by the manufacturer) of 151,000 metric tonnes (MT)/yr by 2020. Actual yield is forecast to be roughly 10-20% less. Demand for CF is estimated to reach 228,000 MT/yr by 2025, with the most growth in wind and aerospace. Vicari believes that CF penetration into automotive will not move beyond luxury models in higher-volume mainstream vehicles before 2025 if indeed this happens at all.

Vicari expects CFRP will continue to grow through large opportunities in rail, construction repair and large marine vessels. In rail, CFRP bogies replacing steel can reduce the weight of a rail car by almost 1 MT and also provide corrosion resistance for improved maintenance and service life. Vicari also sees a large market in bridge repair, which is a very mature technology using CFRP, but the infrastructure marketplace has not yet been “sold” on this approach. Expansion depends on the promise of near-term low-cost carbon fiber, being developed by LeMond Composites (Oak Ridge, TN, US) and Oak Ridge National Lab (ORNL, Oak Ridge, TN, US), among others; OEM pull; and improved repair techniques, under development by innovators like FARO Technologies and Oxford Performance Materials.

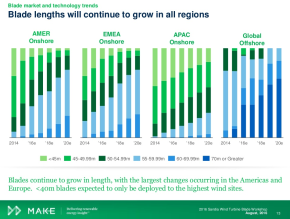

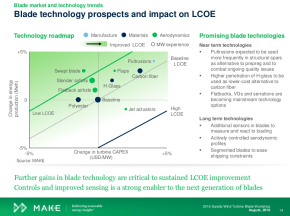

News on the wind energy front was somewhat muted, as more than one speaker noted that wind turbine manufacturers are looking toward high-modulus glass fiber rather than carbon fiber. Price and supply chain concerns as well as manufacturing sensitivities are steering wind turbine manufacturers away from carbon, reported Brandon Ennis, rotor aeroelastic lead at U.S. Department of Energy’s Sandia National Laboratories (Albuquerque, NM, US). Ennis included market information from MAKE consulting (Aarhus, Denmark and Boston, MA, US

Part of Sandia’s presentation at CF2017 included market information from MAKE Consulting, similar to the slides shown above from a 2014 presentation on blade technology by MAKE analyst Aaron Barr. SOURCE: SlideShare (click on each to enlarge).

Ennis emphasized that wind energy applications require carbon technologists to transition from the performance-based designs of aerospace to cost-driven designs. Yet while no 4-8 MW turbine blades used carbon in 2015, Ennis anticipates some carbon use in turbines under 5 MW and over 10 MW. He described a two-year joint study by Sandia, ORNL and Montana State University currently underway, which is assessing the commercial viability of cost-competitive tailored carbon fiber composites in wind turbine blades.

Rail bogie frame using recycled carbon fiber.

SOURCE University of Huddersfield.

Composites Recycling

The urgent need to grow composites recycling capabilities and capacity made for a significant and lively discussion during CF17’s recycling panel, which included brief presentations by each panel member followed by a 40-minute question-and-answer session.

The panel was moderated by Geoffrey Wood, Composite Recycling Technology Center, who emphasized that composite scrap streams can enable virgin fiber sales by opening entirely new markets thanks to lower CFRP product costs — not just fiber cost. All panel members agreed that future scrap production will be reduced due to increased automation and part process efficiency. Wood also pointed out that the aluminum industry recycled 5 billion kg of material annually. The composites industry has some work to do in order to compete.

The panel included CF17 keynote speaker Mark Voss from General Motors, along with previous speaker Anthony Vicari of Lux Research Inc. Both reiterated the dependency of growing CFRP use on effective recycling technologies. In particular, while most recycling today focuses on scrap from CFRP fabrication processes, the speakers noted the increasing need to recycle end-of-life composite components, which are expected to represent a significant proportion of recycling waste by the late 2020s. Other panelists and some of their noteworthy points were:

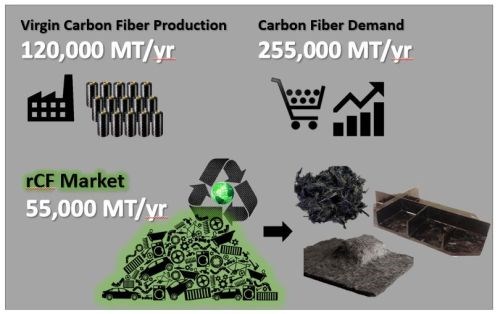

Frazier Barnes, ELG Carbon Fibre Ltd. -- The market addressable by recycled carbon fiber (rCF) is 55,000 MT/yr with 50,000 MT/yr of CF scrap available to fill this. Barnes also pointed out the gap between Lux Research’s forecast CF capacity of 120,000 MT/yr in actual yield vs. projected demand of 225,000 MT/yr, emphasizing there is plenty of room for rCF to help meet this shortfall while also making CFRP more competitive compared to recyclable metals and plastics. Barnes notes that ELG rCF materials have been in road testing for 6 months on 19 vehicles in the US. If adopted, this 6 kg/vehicle opportunity will ramp to 200,000 vehicles/yr. Other projects close to commercial production include a CFRP rail bogie frame made using 80% rCF/20% virgin CF (vCF) made using compression molded prepreg and cutting weight 75% vs. steel, as well as reducing wheel-to-rail loads by 40%. An automotive oil pan uses an rCF nonwoven mat blank overmolded with CF-filled thermoplastic to achieve a net-shape part in one shot, achieving 30% weight savings vs. glass fiber reinforced plastic (GFRP). Many seat projects are in process, offering, for example, parts weighing only 2.5 kg vs. original metal components at 13 kg. According to Barnes, the biggest challenges for recycled carbon fiber are qualification and showing consistency in fiber and parts.

|

|

| Episode 7: Frazer Barnes, ELG Carbon Fibre

Frazer Barnes, managing director at ELG Carbon Fibre, discusses the carbon fiber waste stream and the market for recycled materials. |

Episode 12: Geoff Wood, Composites Recycling Technology Center Geoff Wood, VP of innovation at the CRTC discusses the center’s programs, the composites recycling market and more. |

Tia Benson Tolle, The Boeing Company -- Zero waste manufacturing is Boeing’s goal. This includes zero solid waste to landfill, hazardous waste, water intake and greenhouse gas (GHG) emissions. Benson Tolle explained that a key means toward this end is increasingly more efficient manufacturing of composite components to minimize scrap “from ply to fly.”

Mark Janney, Carbon Conversions Inc. (Lake City, SC, US) – Carbon Conversions is producing five different families of re-Evo products using recycled carbon fiber. Janney also gave several examples of closed loop composites manufacturing. For example, Oracle Racing Team USA worked with Carbon Conversions to recycle one of their racing yachts. Selected rCF products were then used by Core Builders Composites (New Zealand) to produce CFRP tooling for next-gen boats. In another example, Trek bicycle frames were recycled into rCF products used by Crawford Composites (Denver, NC, US) to build their Formula Lite racecars. Janney also discussed how Hexcel’s investment late in 2016 will enable Carbon Conversions to enhance their R&D activities in reuse applications and full lifecycle collection and processing. Both ELG and Carbon Conversions noted that customers have documented drastic reductions in the need for post-cure finishing due to the flatness and conformability of rCF products.

Akihiko Kitano, Toray Industries -- Toray’s new carbon fiber production facility in Spartanburg, SC will begin operations in 2018. Kitano explained that Toray already has rCF production facilities online in Japan.

Enabling Technologies

Technology developments covered in CF17 sessions spanned the full breadth of carbon fiber technologies, from carbon fiber precursor manufacturing to the recycling efforts just mentioned. Highlights included:

Adaptive mold systems – Christian Raun from ADAPA (Aalborg, Denmark) presented his company’s adaptive mold systems which use digitally-controlled actuated pins to shape plastics, composites, concrete and glass into a wide variety of simple and double-curved shapes using one piece of equipment. Curvatures as low as 200mm radius and panels as large as 6m x 2m have been produced on a single molding system. Processes demonstrated/used in production include resin infusion processing, thermal forming of thermoplastics, shaping of foam cores and molding of UV-cure resin composites. For more details, read “Reconfigurable tooling: Revolutionizing composites manufacturing”.

Novel, Rapid-Cure Prepreg for 1-minute parts – Lewis Williams presented Solvay’s new SolvaLite 730 prepreg. Designed for automated processing and 1-minute takt time parts, it uses high-performance unsaturated vinyl ester chemistry to give properties close to typical epoxies but with lower enthalpy for fast processing and good room-temperature stability with zero tack. Williams discussed process knowledge key to achieving 1-min takt times:

- Blank warm-up time and shuttle time to heated press

- Fast tool closure

- Temperature consistency across the mold surface.

He notes this chemistry platform has a lot of future development left and Solvay will continue to work on increasing performance and lowering cost in the long-term.

Low-Cost Carbon Fiber (LCCF) – The work of Oak Ridge National Laboratory Carbon Fiber Technology Facility (Oak Ridge, TN, US) to pioneer LCCF has prompted the Institute of Advanced Composites Manufacturing Innovation (IACMI, Knoxville, TN, US) to undertake the task of generating LCCF property data as an important aid to commercial application. Uday Vadiya, IACMI chief technology officer, described these efforts. LCCF properties, the study has found so far, are comparable to industrial-grade CF products.

Renewable Acrylonitrile – A critical precursor of carbon fiber, acrylonitrile (ACN) has been produced almost exclusively from petroleum sources, but recent work by Southern Research (SR, Birmingham, AL, US) has progressed to the point of pilot plant construction for non-petroleum-based ACN. Amit Goyal, SR manager, sustainable chemistry and catalysis, described SR’s patented conversion of sugar to ACN, pointing out the advantages of widely sourced biomass over crude and other petroleum sources. The pilot plant is expected to produce 0.5 tonne ACN by 2019. SR’s goal is to see a commercial plant able to produce 5000 tonnes renewable ACN by the end of 2021. Commercial production is expected to make renewable ACN at a cost under $1/tonne. Renewable ACN is thus anticipated to reduce manufacturing costs of 15 to 20 percent, and also to reduce greenhouse gas production by 37 percent.

Related Content

SGL Carbon carbon fiber enables German road bridge milestone

A 64-meter road bridge installed with carbon fiber reinforcement is said to feature a first in modern European bridge construction, in addition to reducing construction costs and CO2 emissions.

Read MoreComposites reinvent infrastructure

Celebrating National Composites Week, CW shares ways in which composites continue to evolve the way we approach infrastructure projects.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More