Current state of the M&A and capital markets – sell, sell, SELL!!

Current market conditions suggest that 2017 should see sustained M&A activity, despite the 2016 reduction.

Share

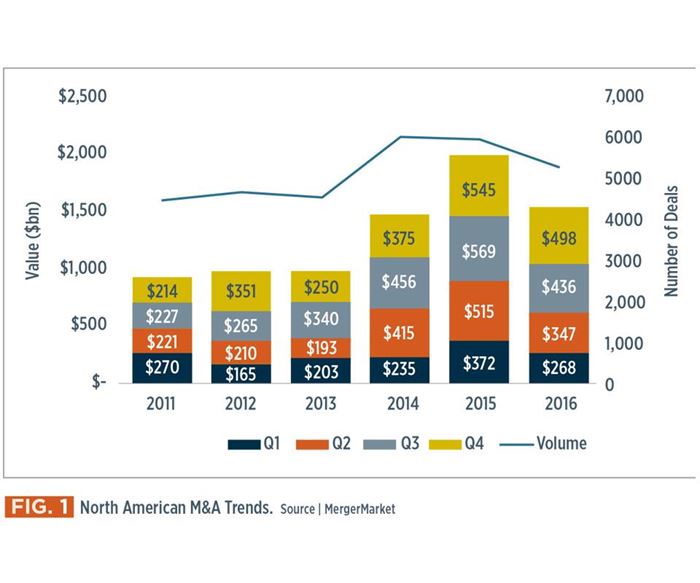

As we turn the page from 2016 to 2017, there is much to reflect on — the US presidential election (in case anyone has been living in a hole for the past 18 months), international conflict, Brexit, Russia ... just to name the big ones. In the capital markets and in the world of mergers and acquisitions (M&A), there is similarly much to reflect on. After a record year in 2015 in terms of M&A activity, 2016 actually saw a notable slowdown (see Fig. 1). In fact, after a somewhat frenetic buildup to a US presidential election that dramatically belied most expectations, North American M&A activity dwindled by December 2016 to its lowest level in five years.

There were a handful of megadeals that buoyed total M&A-related spending — AT&T’s announced US$105 billion takeover of Time Warner and Bayer’s US$63 billion bid to acquire Monsanto are two notable examples. And although time, obviously, will tell, current market conditions suggest that 2017 should see sustained M&A activity, despite the reduction in 2016. It will be driven by historically cheap acquisition financing, record levels of cash on corporate balance sheets and the abundance of private equity capital that still needs to be deployed via buyouts before it expires and, disappointingly, must be returned to investors.

Further, M&A will be key to boosting the growth of strategic acquirers, who are currently projecting high single-digit growth, at best, for 2017, as well as attracting new investment dollars for private equity buyers looking to raise new funds. Regardless of how you personally view Donald Trump’s platform of policies (or, in some cases, the seeming lack thereof), it is widely believed that the new president’s administration will be good for M&A, based on the anticipated loosening of regulatory oversight and a more pro-business merger review policy.

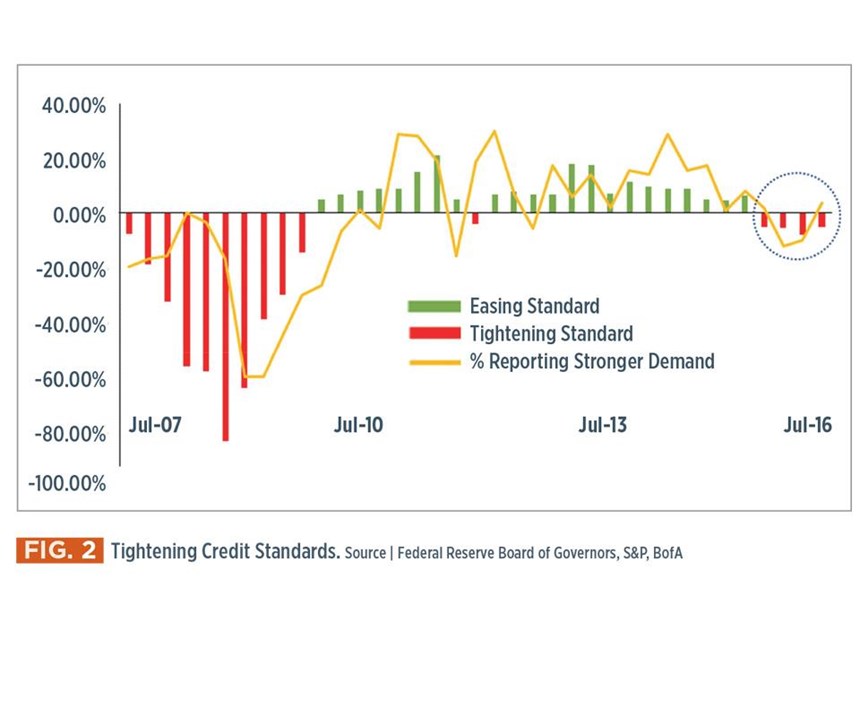

Having said all that, we believe that the M&A market has identifiably peaked after a nearly seven-year bull run that has seen some of the highest transaction valuations in history. Given the number of deals and assets we are seeing come to market here in the first part of 2017, our forecast is that we will see a bit of a crescendo in dealmaking this year before the market levels off and likely starts to trade downward. We have already seen a tightening of credit conditions among the major banks over the past year (Fig. 2). Interestingly, this has not been driven by concerns over the inevitability of rising interest rates, as those concerns have largely already been priced into the market. Instead, major banks are clearly preparing themselves for a cyclical correction, which should be a leading indicator to anyone keeping an eye on the macroeconomic picture.

In the wake of a survey of selected clients (owners of privately held businesses and institutional private equity investors), it is clear to us that those who are contemplating potential sales of their businesses in the coming 3-5 years are leaning toward testing the market sooner rather than later ... and they can hardly be blamed for their proactivity. Although I’ve covered both the composites industry and the broader industrial sector for the better part of 15 years, I can’t say whether the market will turn tomorrow or two years from now. What I can say with certainty is that we are now entering year eight of an upcycle, and anyone who has studied economic cycles can tell you that the average cycle lasts 6-8 years, so trying to perfectly time the market at this point is, at best, a gamble.

Business owners are reminded of 2007, right before the market had its most recent major correction, and many simply don’t have the stomach or energy to try and weather another one. On the other end of the spectrum, private equity owners of cyclical businesses (arguably, the “smart money”) are actively in the process of trying to sell anything they can. At the very least, they are looking to refinance current loans and obligations in their portfolio companies now while conditions are still favorable, rather than waiting a couple of years until those obligations mature in the event that we do, in fact, find ourselves in the middle of a down cycle, which would make refinancing quite a bit more difficult — even if it means incurring some prepayment penalties.

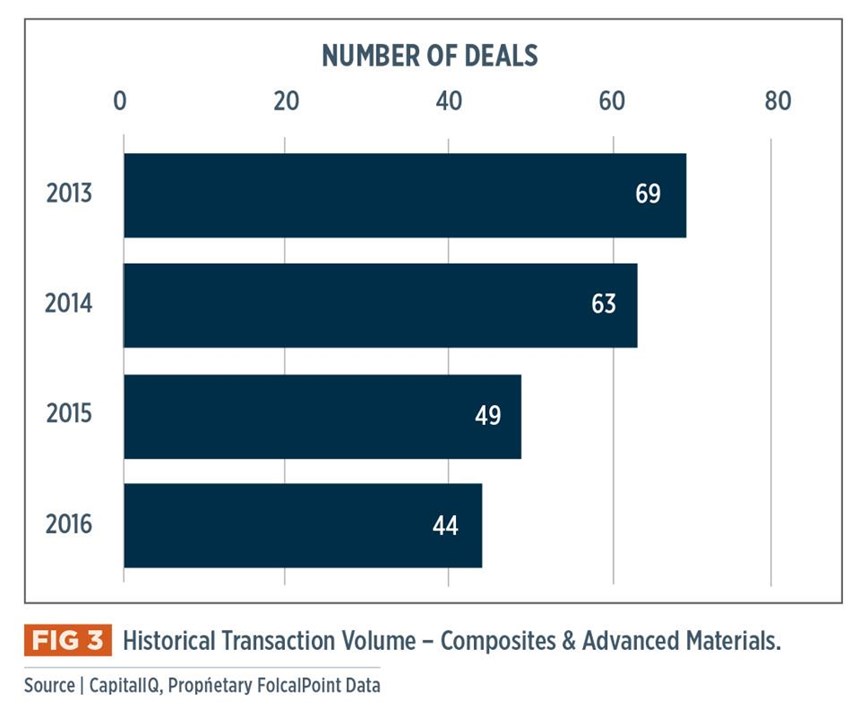

In the composites and advanced materials sector, we see similar trends and market signals. Deal activity in this space was marked by some very high-profile transactions in 2016 — Teijin acquiring Continental Structural Plastics, LANXESS buying Chemtura, and PolyOne Corp. making several notable acquisitions to expand its advanced materials capabilities and diversify away from more commodity offerings were all well-publicized M&A transactions.

That said, deal activity in the space generally has steadily declined during the past couple of years (see Fig. 3). As we talk to companies throughout the industry, it has become clear that, right now, there are more interested buyers than sellers. This, combined with some of the previously discussed macroeconomic trends, suggests that 2017 is an ideal time to start thinking about exploring exit or liquidity options.

This doesn’t mean, however, that the sole option is entertaining an outright sale of one’s business (although there is sure to be a long line of suitors for high-quality companies with truly differentiated products or material technologies). There are in fact a variety of other alternatives to consider. These can include anything from dividend recapitalizations to create shareholder liquidity, raising capital to fund future growth initiatives or make acquisitions, and strategic joint ventures or partnerships with an industry-focused institutional investor to help the current management team take a business to the next level.

Whatever the desired outcome may be, we firmly believe that maintaining the status quo will become increasingly difficult, given mounting competition and consolidation throughout the industry. And because deals don’t happen overnight, the important thing is to start exploring those options soon, before the market turns again.

Related Content

How AI is improving composites operations and factory sustainability

Workforce pain points and various logistical challenges are putting operations resilience and flexibility to the test, but Industry 4.0 advancements could be the key to composites manufacturers’ transformation.

Read MoreThe evolution, transformation of DEA from lab measurements to industrial optimization

Over the years, dielectric analysis (DEA) has evolved from a lab measurement technique to a technology that improves efficiency and quality in composites production on the shop floor.

Read MoreThe next-generation single-aisle: Implications for the composites industry

While the world continues to wait for new single-aisle program announcements from Airbus and Boeing, it’s clear composites will play a role in their fabrication. But in what ways, and what capacity?

Read MoreReducing accidental separator inclusion in prepreg layup

ST Engineering MRAS discusses the importance of addressing human factors to reduce separator inclusion in bonded structures.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More