Industrial corrosion control: Huge opportunities

Fiber-reinforced plastic is the ideal but still widely ignored option in environments that eat away at most metal alloys. Opportunities abound, but the key is still education.

According to the World Corrosion Organization (New York, N.Y.), the annual cost of corrosion worldwide is estimated at $2.2 trillion (USD) — more than 3 percent of the world’s gross domestic product (GDP). Corrosion-control products are required in practically every area of industry and daily life — from the power plants that produce our energy and the wastewater treatment plants that clean our water to the bridges that connect our highways and railways. Fiber-reinforced plastic (FRP) has been used in many industrial corrosion-control applications, notably as pipes and vessels in the chemical processing industry, for more than 30 years. The industrial corrosion market is, in fact, one of the faster growing segments of the composite industry, according to Matthew Lieser, global specification leader for Owens Corning Composite Solutions Business (Toledo, Ohio). It has recently experienced phenomenal growth in areas such as power and water management. Yet for all these successes, Thom Johnson, corrosion industry manager at Ashland, LLC (Dublin, Ohio), says his company estimates that FRP “commands less than five percent of the corrosion-control market for industrial processes. The vast majority of this market,” he says, “is composed of metals and lined materials — metal and concrete.”

That fact notwithstanding, FRP is the demonstrably superior choice in acidic environments and in contact with dissolved aqueous salts. “These environments actively pit and corrode most metals and thus become a serious challenge for corrosion design engineers,” explains Johnson. “These same environments are much less aggressive towards FRP and, thus, the reason behind its extended durability relative to metals.” When properly designed, FRP systems also have very good abrasion resistance relative to metals, which is important when handling the slurry materials found in air-pollution control systems and metallurgical processes, he adds.

Education, education, education

So, what’s holding composites back? First and foremost, despite three decades of FRP availability, is lack of awareness. “Composites are one of the best-kept secrets of the corrosion-resistant materials market,” says Johnson. “Those that have discovered FRP are wed to it. They know the value that it brings and the downtime that it saves. Those that have no experience are reluctant to dip their toe in the FRP pond,” he explains, noting that this lack of experience can be laid at the door of engineering departments of higher-education institutions. “Our universities,” he laments, “spend precious little time teaching young engineers about thermoset plastics.”

In fact, Owens Corning’s corrosion team conducted a survey during a webinar it hosted on how to reduce corrosion costs using FRP and asked attendees what was preventing them from using more composites. “The number one response was that they weren’t sure what resin and glass to use,” says Lieser. “The number two response was that they weren’t familiar with FRP strength characteristics.”

Further, FRP is not without its challenges, Johnson admits. One is thermal performance. “It can only withstand so much heat before it starts to decompose,” he explains. “Even the best high-temperature corrosion resins can’t go much above 400°F [203°C] for continuous service.” The other? “FRP is also challenged by strong oxidizing agents and certain strong solvents,” he says. In these environments, metals are typically the preferred material of construction.

“Compounding the issue is that, unlike with metals, there are fewer accepted standards for FRP design,” adds Johnson. “It’s a custom-manufactured product, and it’s not easy for the uninitiated to separate the well-fabricated equipment from the lesser materials and the good fabricators from the less skilled.” He notes that standards-setting body ASME’s (New York, N.Y.) effort to change that has been a slow trek on a long road.

For now, the task of educating those in need of corrosion-control products about the virtues of composites falls to those who market them. Those who make the products, and their resin and fiber suppliers, have been and will continue to be on the front lines, explaining how and when to effectively employ FRP solutions and what materials are appropriate for the various corrosive environments.

Those efforts, however, are showing increased sophistication. This past May, for example, Ashland teamed up with the American Composites Manufacturers Assn. (ACMA, Arlington, Va.) and the corrosion-control engineering society NACE International (Houston, Texas) to sponsor the Chemical Processing Symposium: Managing Corrosion with Non-Metallics in Houston, Texas. Ashland and others, including Owens Corning, and resin suppliers AOC Resins (Collierville, Tenn.) and Reichhold LLC2 (Durham, N.C.), also published comprehensive corrosion guides (see article endnote).

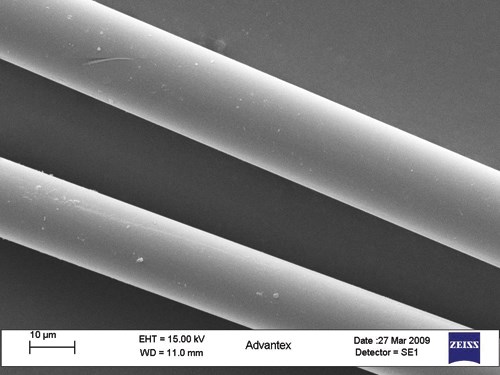

“We’ve been able to provide engineers a method with which they can easily see [what to do: If] they have, for example, sulfuric acid at 26 percent, then here’s what resin to use, what glass to use, what corrosion barrier and what method of fabrication,” explains Lieser (see the sidebar at end of article, titled “Building a better corrosion-control laminate”).

Another factor in the education campaign is the shifting economic paradigm. “Growth in the corrosion market is driven by the GDP and global growth in industrial production,” says Lieser. “Since our target is really to replace traditional materials, the price of those materials is a key component to how successful we are at substituting for steel and other materials,” he adds. Therefore, the increase in the cost of alloyed steel over the past five to seven years has allowed composites to compete head to head against stainless steel and other alloys. Lieser stresses that it’s important to make the most of what a composite has to offer. “If something is corrosion resistant, that’s good compared to stainless steel, but if that same solution can be corrosion resistant, lightweight and high strength, while still being cost-effective, then it’s a sure bet.”

New gas revival

Paradigm shifts also are occurring in corrosion control markets. The biggest is in electric power. For the past five years, there has been huge growth in pollution control for coal furnaces. In 2005, when the U.S. Environmental Protection Agency (EPA) implemented the Clean Air Interstate Rule (CAIR), intending to reduce sulfur dioxide (SO2) emissions by 70 percent and nitrogen oxide (NOx) emissions by 60 percent across 28 eastern states by 2015, use of corrosion-resistant FRP surged in the air pollution market. Although highly corrosive to stainless steel and nickel alloys, the environment inside these air-pollution control systems proved to have little effect on FRP composites produced from epoxy vinyl ester resins. In short order, explains Johnson, “Millions of pounds of fiberglass were employed to build scrubbers, piping, ducting and chimney liners in power plant air-pollution control systems in the U.S.” However, with the advent of cheap natural gas and more restrictive EPA regulations, this market has all but dried up in the U.S., he contends, as a “dash to gas replaces coal-fired power generation.”

Globally, however, the largely coal-fired electric power industries in China and emerging industrial nations, such as India and South Africa, have begun to invest in flue gas desulfurization systems. “In China, where they’re using 5 billion tons of coal a year — five times that of the U.S. — there is a lot of opportunity as they adopt pollution control systems,” says Lieser.

One area in the power plant where FRP still could see growth — in the U.S. and globally — is cooling towers. All conventional thermoelectric power plants (coal, nuclear, natural gas and oil) require cooling, and according to the U.S. Department of Energy’s National Energy Technology Laboratory (Jefferson Hills, Pa.), more than half of U.S. power plants use a wet-recirculating or closed-loop cooling system that requires cooling towers.

“Not so long ago, most cooling towers were made from wood,” says Johnson. “Today, cooling tower structural elements are mostly pultruded fiberglass,” he points out. “The piping, fans, stacks, weirs and panels are also largely composed of fiberglass.”

The reason for the switch is simple: FRP offers a projected service life twice as long as wood (50 years vs. 25 years).

The downside’s upside

Although the natural gas boom has deflated composites adoption in coal-fired power plants, in North America it could drive increased FRP applications in a variety of other corrosion-control applications, not the least of which is in the gas industry itself.

“The recent focus on shale gas in the U.S. and oil sands in Canada have caused an explosion in the use of hydrochloric acid for fracking, which needs hundreds of thousands of pounds of composite materials,” says Guyle McCuaig, VP of sales, ZCL Dualam (Montreal, Quebec, Canada), which manufactures FRP and dual-laminate piping, vessels and other corrosion-control equipment.

The switch from coal to cheaper natural gas is enabling utilities to reduce power bills, passing the savings along to customers in other industries. And according to analysts at Citigroup (New York, N.Y.), shale gas production could lead to a “re-industrialization of America” based on the availability of feedstock that is dramatically lower in cost than anywhere else in the world. In fact, Citi declares that the surging supply growth in North America, which has been the fastest-growing oil and natural gas producing area of the world for the past half-decade, could transform the region into “the new Middle East” by 2020 (see article endnote).

Whether or not that prediction comes to fruition, the gas revival is already impacting growth in the chemical processing industry. “The resin chemistry used today for corrosion-resistant FRP was born in the chemical industry and it has remained a vibrant market for FRP ever since,” says Johnson. The epoxy vinyl ester chemistry found in Ashland’s trademarked Derakane resins was actually invented by Dow Chemical Co. (Midland, Mich.), and Shell Chemical LP (Houston, Texas) formulated what are now Ashland’s trademarked Hetron resins. “Both firms found the epoxy vinyl ester resins to be more corrosion resistant than their epoxy precursors, and, in the case of Dow Chemical, began to actively use the products in their own facilities to extend the life of piping, tanks, ducting and other chemical-process equipment,” says Johnson.

“With the emergence of $2/MM BTU natural gas, the U.S. chemical industry has seen a resurgence in capital investment. Energy is cheap and so are ethane/propane feedstocks,” he adds.

One result is the announcement of new chemical plants and expansions of existing facilities. Outside Pittsburgh, Pa., Shell Oil Co. (Houston, Texas) is investing in a multibillion-dollar ethane cracking plant that will convert Marcellus Shale natural gas liquids into chemicals such as ethylene. Also, Dow Chemical plans to build a similarly ambitious cracking plant in Texas by 2017. A host of other companies are reportedly following suit with either new plants or expansions near shale gas sources. Like Ashland’s and Dow’s plants before them, these new cracking facilities are fertile fields for the growth of composite corrosion-resistant equipment.

Movement in mineral processing

Elsewhere, another shift could lead to significant future growth. “Mineral processing has largely filled the gap left by the disappearance of the air-pollution control market in North America,” says Johnson. Many minerals, such as copper, nickel and rare-earth elements, are extracted from their ores using strong acids that leach the active metal from the ore in a process known as hydrometallurgy. Those same acids are extremely corrosive to metal surfaces but are handled fairly easily by epoxy vinyl ester resins.

Several large mineral extraction plants are under construction in North America, including the Long Harbour project in Newfoundland, Canada; the El Boleo project in Mexico; and the Mountain Pass project in California, reports Johnson. These projects are expected to employ hundreds of FRP process vessels and miles of FRP piping. And mining growth isn’t limited to North America. The world’s largest nickel mine, the $4.76 billion Ambatovy mine in the African island nation of Madagascar, should reach full production capacity in 2013. This one site, which includes a sulfuric acid plant, consumes miles of FRP piping and houses hundreds of storage tanks and processing vessels.

According to Lieser, the outlook for mining this year grew 11 percent compared to last year in terms of project spending. “We definitely see mining as a key area of opportunity for FRP,” he says.

Thermosets and thermoplastics

In some hydrometallurgy fields, chemicals are so aggressively corrosive that fiber-reinforced thermosets are unsuitable and metal alternatives (titanium, zirconium and high-nickel alloys) are cost-prohibitive. In these cases, a dual-laminate system like the one developed by ZCL Dualam, which combines the superior corrosion resistance of a thermoplastic liner with a thermoset FRP structure, is viable. Today, many projects require single-laminate and dual-laminate FRP pipe, and dual-laminate vessels are also in demand.

“The FRP and dual-lam vessel market is evolving organically at 15 to 20 percent per year in traditional markets, such as chemical processing, hydrometallurgical mining, pulp and paper and power,” says ZCL Dualam’s McCuaig. “We are set for growth with large-scale investments in both dual-lam pipe and vessels, as well as regional representation in FRP facilities.”

The company fabricates FRP or dual-laminate corrosion-resistant solutions ranging from piping, vessels and scrubbers to custom products equipment. Dual-laminate structures require careful design to account for and accommodate the differential expansion rates of the thermoplastic liner and the supporting thermoset structural laminates. The company employs several types of thermoplastic, depending on the specifications of the application, including chlorinated polyvinyl chloride, polypropylene and a variety of high-performance fluoropolymers, including DuPont Protection Solutions’ (Wilmington, Del.) Tefzel-brand ethylene/tetrafluoroethylene (ETFE) and Teflon-brand fluorinated ethylene propylene (FEP) resins. A layer of electrically conductive material is laminated behind the thermoplastic to enable spark testing or installation of a liner leak-detection system, such as the patented DuraShield system developed by Corrosion Cos. (Washougal, Wash., see “Tough resins for aggressive environments,” under "Editor's Picks" at uppor right).

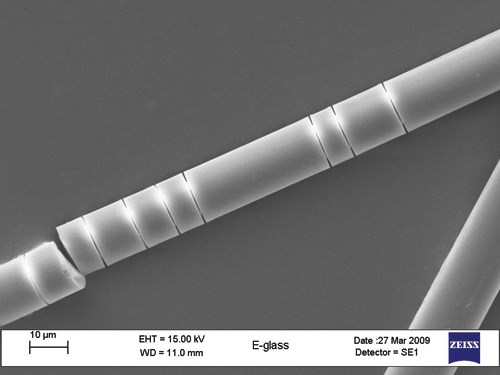

To protect the thermoset composite structure against leakage resulting from thermoplastic liner damage, a secondary resin-rich corrosion barrier is then laminated over the liner, using vinyl ester resin, surfacing veils and chopped strand glass mat. The structural layer is applied last — either a hand layup with alternating layers of chopped strand mat and woven roving wet out with vinyl ester resin, or via filament winding (or ortho-winding).

An exterior coating provides UV resistance, flame retardance and external corrosion resistance.

McCuaig warns against complacency in the more mature corrosion-control markets, such as chemical processing. “I believe viewing certain product segments, such as FRP vessels, as a mature industry is a threat to our future in terms of technological advancement and growth,” he says. “Staying ahead of the curve in composite technology has always been one of our goals,” he adds.

Water treatment stays strong

Another growth area is water treatment, says Scott Lane, product leader for corrosion- and fire-retardant resins at AOC. He notes that there is growth for both wastewater (odor control and ductwork), a historically high-volume market for composites, and freshwater (water treatment and water sanitization). FRP is a natural fit for wastewater treatment systems because it is much more durable in contact with dissolved solids environments than most metals. This is especially true when applications involve either bleach (sodium hypochlorite) storage or odor-control systems.

“On the water sanitization side, we see an increased emphasis on approvals and certifications and listings,” says Lane. AOC recently introduced to its corrosion-resistant Vipel resins, a bisphenol A epoxy vinyl ester resin (Vipel F010-H20-00) certified to standards set by NSF International (Ann Arbor, Mich.), a not-for-profit public health and environmental standards organization. The resin reportedly is suitable for potable water and sodium hypochlorite containment. “Water purity standards have become even more stringent, and bleach is being used more frequently as a sanitizer, which is opening more opportunities for composites, not only in storage tanks, but also in transport tankers,” says Lane.

Breaking paradigms

In short, the corrosion-control market is thriving. Given the composites industry’s single-digit penetration into this sector, so far, it’s well worth the effort to grow its market share. Potential applications abound. Realizing the potential will hinge on whether today’s paradigms continue to shift in favor of FRP. If they do, suppliers of composite corrosion-control materials say they’re ready to help composites manufacturers educate their customers and they have the product to support resulting sales. “What we have on the shelf is ready to go into a huge number of existing applications,” stresses Johnson. “New chemistry is great,” he adds, and it is welcome, but he emphasizes that a lack of the material “is not what is holding FRP back from becoming a household name in this industry.”

Endnotes

Read more about shale gas market predictions in “Energy 2020: North America, the New Middle East?,” Citi GPS: Global Perspectives & Solutions, March 20, 2012.

Ashland Performance Materials (Dublin, Ohio) has a corrosion resistance guide on its Web site at http://www.ashland.com/strategic-applications/corrosion-resistant-frp

Owens Corning Materials LLC (Toledo, Ohio). Glass Fiber Reinforcement Chemical Resistance Guide; http://ww1.owenscorning.com/composites/leads/request-guide.asp.

Reichhold (Durham, N.C.). Dion Corrosion Guide; www.reichhold.com/brochures/composites/Corrosion%20guide.pdf.

Related Content

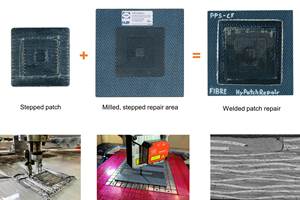

Developing repairs for thermoplastic composite aerostructures

HyPatchRepair project proves feasibility of automated process chain for welded thermoplastic composite patch repairs.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreRead Next

Tough resins for aggressive environments

New thermoset systems drive composites deeper into markets where fire, corrosion, stress and fatigue are ever-present threats.

Read MoreComposite vs. corrosion: Battling for marketshare

Market trends and tighter budgets are helping to expand the use of composites to repair and replace corrosion-damaged infrastructure — aboveground and underground.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More