Composite vs. corrosion: Battling for marketshare

Market trends and tighter budgets are helping to expand the use of composites to repair and replace corrosion-damaged infrastructure — aboveground and underground.

Corrosion of metals, by some estimates, costs the U.S. economy $300 billion per year in maintenance, repair and replacement costs. Always an Achilles’ heel for manufacturers who work with metals, this massive problem plays to one of the composites industry’s greatest strengths. Corrosion prevention was one of the earliest applications for glass-reinforced plastics, championed by developers of highly corrosion-resistant isopolyester resin systems. Although that role has since been supplanted — especially in saltwater environments — by epoxy vinyl ester resins, manufacturers schooled in the use of composites continue to make inroads in several markets that have massive long-term potential.

Rehabilitating corroded steel

One of the more lucrative strategies is refurbishing degraded municipal and industrial piping as aging infrastructure and postrecession budgets force maintenance decision makers in municipalities and industrial environments to look for options that are less drastic, disruptive and financially disabling than wholesale replacement.

Composites Advantage LLC (Laguna Hills, Calif.) offers a composite solution called Pipe Wrap Composite Strengthening. In the case of exposed or aboveground piping, sheet composite is wrapped around the pipe, acting as reinforcement for pipe walls that have been thinned by corrosive attack. Sheets of carbon fiber fabric are fed through rollers that apply a two-part proprietary epoxy to the material. The fabric is then directly wound spirally or in bands around the pipe. The epoxy, which has about a two-hour pot life, saturates the fabric and adheres to the metal substrate, bonding the carbon fiber to the pipe. The fabric is supplied by Edge Structural Composites LLC (Sonoma, Calif.). Steve Behrens, president of Composites Advantage, says higher-strength carbon fiber is better suited than glass fiber as a reinforcement for corroded pipe because glass not only has less strength, but, he claims, it also tends to elongate over time. Edge’s carbon fiber is certified to International Code Council (ICC) standards. The standard is mandated by most municipalities in California and requires, among other things, that the material pass a 20,000-hour durability test. Behrens says the company uses various sizes of carbon fiber fabric, but the most common is 18-oz unidirectional fabric, supplied in 25-inch/635-mm width.

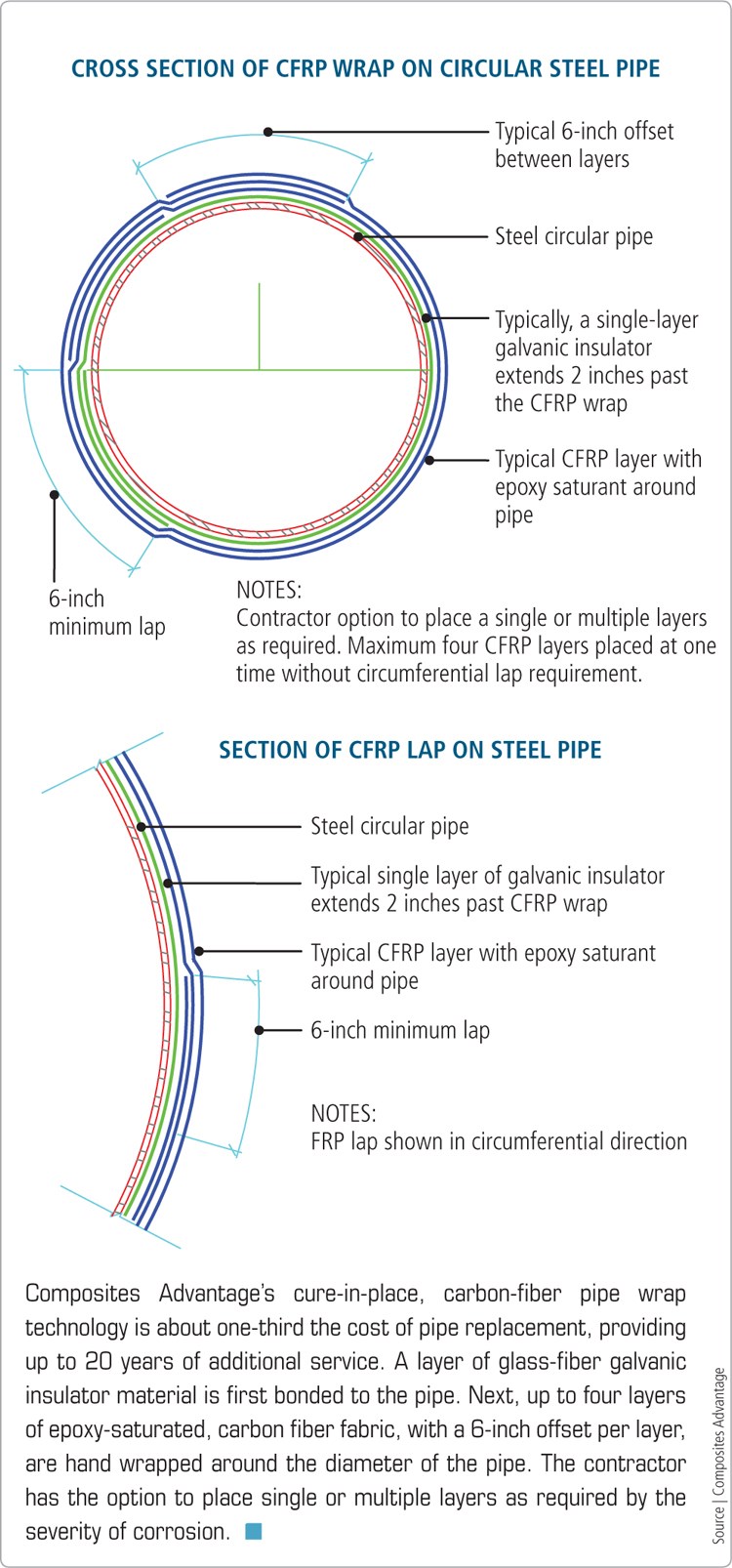

Composites Advantage is currently supplying a contractor that is refurbishing a 10-inch/254-mm diameter chiller pipe at a customer’s data center in Northern California. The chiller pipe, which has thin, leaking walls as a result of corrosion, supplies water to the building’s air conditioning and sprinkler systems. All holes and leaks in the pipe are first repaired with 18-gauge (1.02-mm) steel plate that is bonded to the pipe with epoxy adhesive. The circumference of the pipe is wrapped with a glass fiber fabric to insulate the carbon fabric from contact with the metal, which prevents a galvanic interaction, then it is overlaid with a maximum of four layers of epoxy-saturated carbon fiber fabric at a thickness of about 1 mm/0.04 inch per layer (see diagram on facing page). The contractor determines the number of carbon fiber layers for each section of pipe, and each layer overlaps the layer beneath it by a minimum of 6 inches/152.4 mm.

“To tear all the piping out and replace it would have cost well in excess of $1 million,” reports Behrens. “Our carbon fiber composite overwrap will cost $300,000, tops, and provide another 15 to 20 years of service.”

Relining for longer life

CT has chronicled the development of cured-in-place pipe (CIPP) and slip-in pipe sleeving systems that reline rather than replace existing underground pipe that is long past its prime. These systems are revolutionizing and, more to the point, reducing the cost of rehabilitating buried wastewater pipe and, more recently, potable-water pipe (see the articles listed under "Editor's Picks," at top right). CIPP, especially, has quickly gained favor not only for its relative speed and significant cost savings but also, because much of the old pipe lies beneath city streets, eliminates lengthy disruptions of vehicle traffic during excavation and replacement. One disadvantage of CIPP sleeving operations, however, is that its utility is restricted to the physical limits of the equipment that forms the sleeves — typically a minimum diameter of 6 inches/152 mm to a maximum of about 8 ft/2.4m.

Composites Advantage has developed a technique for wrapping the inner walls of much larger underground pipe. Behrens expects the method to eventually find widespread application in the retrofitting of municipal water mains, which can be as large as 12 ft/3.66m in diameter. With this method, the pipe is drained one section at a time, power washed to remove sediment and corrosion and dried. The epoxy-impregnated carbon fiber fabric can be applied manually “like wallpaper” to the inside of any pipe with a diameter of 30 inches/762 mm or greater. The company is experimenting with several new technologies for making the process more efficient, including a machine that will automatically infuse the fabric and apply it to the inner pipe walls, as well as a laminate sheet that employs an air bladder under pressure to compact the fabric and ensure adhesion to the inner diameter of the pipe. The market for large-diameter pipe relining extends to most cities. “In Los Angeles,” Behrens notes,“there are sections of underground steel water pipe over 100 years old.”

Encapsulating damaged concrete

Fiber-reinforced plastic (FRP) rehabilitation has become an attractive alternative to replacement in another water-related application: concrete pilings and piers in waterfront settings. Structural (Hanover, Md.), a specialty-contracting firm with a focus on using proprietary technology to repair and strengthen assorted industrial and public infrastructure components, says it has logged more than 10,000 installations of its trademarked LifeJacket Galvanic Protection system, which is designed to encase steel-reinforced concrete in marine environments. The product, on the market since 1995, comprises a 0.0375-inch/1-mm thick FRP jacket with an inner zinc-mesh liner that acts to protect pilings that have suffered chlorine-induced corrosion, says Doug Leng, VP business development, ElectroTech CP LLC, a wholly-owned subsidiary of STRUCTURAL.

When aging pilings develop cracks and saltwater intrudes into the concrete, the steel rebar is at risk. Saltwater contains enough ions to conduct electricity. In contact with steel rebar, it completes an electrical circuit much like that in a common battery. A low current flows from areas of the steel that are rich in oxygen or chloride (the battery’s cathode) to areas where oxygen or chloride are less abundant (the anode). Like the anode in a battery, the steel that is less rich in oxygen or chloride corrodes and expands, eventually causing the concrete to fail structurally.

When LifeJacket is wrapped around the piling, the zinc mesh (which is more electrochemically active than iron but corrodes much more slowly) becomes a sacrificial anode, that is, it becomes the locus for corrosion and, being less prone to corrosion than steel, enables the jacket system to provide corrosion protection for an extended period before the zinc must be replaced.

The FRP jacket also can function as a stay-in-place concrete form to rehabilitate pilings that have suffered cross-sectional loss as a result of saltwater intrusion and corrosion. The FRP jacket is made of woven glass mat and vinyl ester, then it is gel coated. Each jacket system is custom made for a specific application. Leng says that jackets are typically specified to extend several feet below low tide and extend upward to an elevation that covers all afflicted areas — usually about 8 to 10 ft (2.4 to 3m). Jackets for mildly deteriorated pilings are specified with 2 inches/50.8 mm of annular space; thus a 20-inch diameter pile requires a 24-inch jacket. Jackets for pilings that are more heavily damaged may be specified with up to 6 inches of annular space. Concrete can be poured into the space to repair and seal off the existing damage. Leng holds a joint patent for LifeJacket with the Florida Department of Transportation, the agency with which he codeveloped the technology.

The use of carbon or glass fiber-reinforced overwrap for aging structural beams is becoming more widespread outside the marine context. The Bay Area Rapid Transit (BART, San Francisco, Calif.) system is currently taking bids for a project to refurbish and strengthen aerial beams and columns that support six commuter stations on an elevated section of its transit line. Composites Advantage’s Behrens, one of the bidders, says the project will require up to 250,000 ft2/23,226m2 of carbon-reinforced fabric to wrap dozens of support columns at an estimated total cost of roughly $30 million (USD). Behrens reports that despite rising carbon fiber prices (due to high demand from aircraft manufacturers and supply outages in Japan, as a result of the recent earthquake and tsunami), carbon fiber overwrap is still a more economical solution than wrapping columns in steel clamshells. “We can wrap a column in one to two days vs. a week or more for a steel clamshell, a process which requires excavation and welding,” Behrens reports.

Replacing stainless steel

Matthew Lieser, specifications leader at Owens Corning Composite Solutions Business (Toledo, Ohio), says the rise in the price of stainless steel over the past seven years has opened up new opportunities for FRP to compete for business in the chemical-storage and fluid-handling markets. “The trend upward in alloyed steel prices over this period has made FRP a better choice in many cases because not only will it outperform steel, it has had a better price point.”

Because many end-users have traditionally specified alloyed steel for corrosive applications, glass suppliers have been playing catch-up, having to educate customers about the nuances of composite structure, performance requirements in highly corrosive environments and the need to specify the right glass. Although the more robust vinyl ester is now the standard resin widely used in FRP tanks, some end-users are still specifying E-glass when the correct choice, says Lieser, is boron-free E-CR glass. When an aging tank develops microcracks in the composite matrix, corrosive chemicals will attack general purpose E-glass and compromise the structural integrity of the tank (see photo, at right).

“Resin suppliers have been doing a better job of educating the end-users on the right materials to use in corrosive applications, whereas glass suppliers have sort of dropped the ball by mainly interacting with only the fabricators,” says Lieser. He says Owens Corning has become more proactive and is striving to make customers aware of standards, such as ASTM D578, which calls for boron-free modified E-glass for “improved corrosion resistance by most acids.” Owens Corning recently published a Glass Fiber Chemical Resistance Guide to help customers select glass reinforcements in corrosive environments. It also recently purchased 85 FRP chemical storage tanks made of vinyl ester and the company’s own Advantex E-CR glass. The FRP tanks are needed to accommodate a process conversion in the binder used to make the company’s fiberglass insulation. Owens Corning estimates that the purchase of FRP tanks saved more than $2 million in comparison to tanks made of stainless steel.

Storing water underground

An unusual new trend is reported by ZCL Dualam Inc. (Edmonton, Alberta, Canada). Seventy percent of its sales revenue comes from double-walled fiberglass underground storage tanks for retail gas stations, with the bulk of the remaining sales revenue generated by aboveground vertical and horizontal tanks used in Canada’s petroleum and gas industry.

Xerxes Corp., a wholly owned subsidiary of ZCL, operates in the U.S. with a core market focus similar to its parent company. ZCL is branching out from this core market with the recent launch of a water products business unit. The decision to enter the water market is based on the view that water is becoming an increasingly scarce, valuable resource, says Ron Bachmeier, the company’s COO. The tanks are manufactured the same way as the FRP tanks used for petroleum storage, that is, mechanically assisted hand layup in large open molds. Typically, ZCL uses E-CR glass and vinyl ester resin. Compared to concrete tanks, drop-in-the-ground FRP tanks are cheaper to install and require less maintenance.

“Water is one of the most corrosive materials known,” says Bachmeier. “Over time, water infiltrates porous concrete and begins to degrade it, as anyone with a concrete-lined swimming pool can tell you.” Bachmeier says the company is primarily marketing the tanks to engineering firms and developers, rather than municipalities, as a decentralized solution to water storage and handling in residential communities. “As housing developments get farther and farther from municipal water sources, it becomes more economical to store drinking water and storm runoff on site.”

Tanks for storage of potable water are certified to public health standards set by NSF International (Ann Arbor, Mich.). Bachmeier says ZCL’s water products line has achieved double-digit growth rates during the past seven years. Sales have reached about $20 million per annum, he notes, but he admits that concrete remains a formidable competitor. “We fought the same battle with our petroleum products line of tanks in which, for years, steel was viewed as the primary solution,” he says. “Water markets are still very entrenched in concrete.”

ZCL also recently purchased CPF Dualam (Montreal, Quebec, Canada). Founded in 1957, Dualam employs a proprietary dual-laminate fabrication process to manufacture custom, highly corrosion-resistant products for the fluids-handling market. Parts made by the dual-laminate process include components for acid strippers, chlorine drying towers, process scrubbers and pressure vessels for the chemical industry. The company has developed proprietary technologies to assure uniform application and bonding of a variety of thermoplastic laminate layers to a substrate backing for enhanced corrosion protection in especially aggressive environments. Today, the backing or structural material is primarily FRP, and liner laminates include polyvinyl chloride (PVC), chlorinated PVC (CPVC), polypropylene (PP) and a variety of fluoropolymers, including ethylene/tetrafluoroethylene copolymer (ETFE) and polytetrafluoroethylene (PTFE, trade named Teflon). “Standard FRP made of E-CR glass provides a good level of corrosion protection,” says Ian Trower, VP of operations for Dualam, “but when you get into extremely acidic or basic environments, even FRP can potentially break down.”

During the fabrication process, PVC and CPVC are both chemically bonded to the FRP substrate. A PVC laminate provides protection in highly alkaline environments, and CPVC exhibits excellent resistance to acids and bases, as well as salts and aliphatic hydrocarbons. However, Dualam uses a mechanical process to bond the fluorocarbons to the FRP substrate. The fluoropolymer is semipregged with glass mat sheet, which is then bonded to the wall of the tank, pipe or duct.

Once considered a niche technology, thermoplastic-lined FRP applications are entering the mainstream, according to Trower, as the knowledge base of engineering and construction firms grows more sophisticated. “Dual laminates are now viewed as functionally equivalent to what historically would have been used for these types of applications, namely alloyed stainless steel,” he reports.

Plugging oil and gas wells

Bruce Olgivie, applications development leader at structural high-strength glass supplier AGY Holding Corp. (Aiken, S.C.), reports that his company is supplying S-glass used by fabricators to manufacture down-hole plugs for oil and gas wells. The plugs are used to temporarily cap off a well for maintenance or other purposes and must be able to withstand pressures up to 10,000 psi/68.9 MPa. The FRP plugs not only provide corrosion resistance superior to that of conventional steel plugs, but also are easier to drill through when engineers want to reopen the wells.

But Olgivie says the company has become more active within the traditional construction industry. For example, AGY representatives recently attended the annual meeting of the American Concrete Manufacturers Assn. “There’s a lot of development work being done on ways to use FRP to refurbish existing structures that have degraded or corroded, rather than rebuild from scratch,” says Olgivie. The most common targets are structural elements that are compromised by salt and weathering, Olgivie reports, including applications previously mentioned as well as steel rebar used to reinforce concrete.

Eliminating steel in concrete

On that front, Hughes Brothers Inc. (Seward, Neb.), for one, manufactures and sells a line of composite rebar, marketed as Aslan GFRP rebar. The rebar is made of pultruded E-CR glass and vinyl ester resin. After demolding, it receives a surface treatment that enhances bonding to concrete. The company’s core business is FRP components, such as insulator cores, used in the construction of high-voltage transmission towers. Hughes Brothers branched into composite rebar about 18 years ago when an engineer from the Tennessee Valley Authority asked the company if its composite insulator materials could be used as rebar. High-voltage transformers adjacent to concrete structures created strong electric fields, which in turn caused steel rebar to pick up current, heat up and expand, causing cracks or wholesale degradation of the concrete.

Since then, the FRP rebar has been fully certified to all U.S. and Canadian construction codes. GFRP rebar, however, is about three times more expensive than black steel rebar and 1.5 times more costly than epoxy-coated steel rebar. “We market this product to compete with epoxy-coated and galvanized steel rebar used in highly corrosive environments,” says Doug Gremel, director of nonmetallic reinforcement at Hughes Brothers. He says growth in sales of composite rebar had been up steadily until the recession and the decline in the construction market. “First-time cost is a big factor for construction projects, so there’s still a big barrier getting an engineer to specify something that’s more costly, even though it promises better lifetime performance,” Gremel explains, noting that for FRP use to expand in the construction industry, there needs to be more of an apples-to-apples approach to cost evaluation. Civil engineers, for example, will often specify high-performance concrete with additives, extra thickness and waterproof membranes to extend the life of the concrete and prevent exposing the steel rebar to corrosion. Converting to GFRP rebar could possibly allow engineers to switch to a lower-cost concrete system while extending the life for many structural applications, such as beams and columns. Gremel allows that more field data will probably be needed to convince engineers.

Keeping the faith

As the foregoing examples indicate, the message from markets in which corrosion prevention is a prime design driver is mixed. The use of FRP materials and components to impede or repair corrosion in infrastructure applications continues to make impressive gains in some markets long dominated by steel and concrete. Yet composite materials suppliers and fabricators of composite structures also recognize the continuing need to drive the innovation cycle and find ways to reduce FRP costs further if composites are to take significant market share from traditional materials in all the possible corrosion-prone applications. This is no time, it seems, for the composites industry to rest on its laurels.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreRead Next

Composites Technology Digs-In Underground

The Underground Construction Technology Conference welcomes corrosion-resistant composites for underground infrastructure.

Read MoreInside Manufacturing: CIPP Lights Way in Buried Pipe Repair

Spiral-wound, UV-curable fiberglass CIPP bests competitors and bears loads in “trenchless” wastewater pipe rehabilitation project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More