JEC World 2023 highlights: Innovative prepregs, bio-resins, automation, business development

CW’s Jeff Sloan checks in with JEC innovations from Solvay, A&P, Nikkiso, Voith, Hexcel, KraussMaffei, FILL, Web Industries, Sicomin, Bakelite Synthetics, Westlake Epoxy and Reliance Industries.

JEC World 2023 in April promised a lot and delivered. Exhibitors from across the globe showcased all they had to offer, from sustainability — a major topic of discussion at most booths, whether it was bio-based resins, hydrogen tank manufacture or decarbonization — attempting to meet the ever-increasing demand for carbon fiber, towpreg manufacture, establishing more automation or announcing new business developments. A recap of some of these conversations are detailed below.

For CW’s other recaps, read about “Recyclable resins, renewable energy solutions, award-winning automotive” and “Recycling, biocomposites, smaller equipment and expanding brands.”

High-rate M&P solution primary and secondary aerostructures

Solvay Composite Materials (Alpharetta, Ga., U.S.), Japanese composites fabricator Nikkiso (Tokyo, Japan) and braiding specialist A&P Technology (Cincinnati, Ohio, U.S.) announced at JEC World 2023 the product of a two-year partnership that produced a new material and process technology to respond to demand in the composites industry for high-rate, sustainable, complex geometry parts, particularly for primary and secondary structures in aerospace and advanced air mobility (AAM) applications.

This innovation uses a prepreg that consists of a thermoplastic resin system provided by Solvay, tape slitting from Web Industries (Atlanta, Ga., U.S.) and a ±45° braided fabric supplied by A&P Technology. The result, designed and developed by Nikkiso, is an integrated stiffening structure fabricated via a one-shot, press-based processing technology, which Nikkiso officials at the show said eliminates multiple fabrication processes. Total process time is reduced from 7 hours using conventional processes to a takt time of just 1 hour.

Nikkiso noted that stiffened thermoplastic components traditionally are fabricated using discontinuous fiber molding compound (for drapeability), or use an stringer/skin design, with the stringer attached via secondary processes.

Nikkiso’s integrated stiffened thermoplastic demonstrator uses continuous fiber for aerospace performance while maintaining its highly drapeable functionality. The “cupcake pan” structure exhibited at JEC was designed to show the depth (20 millimeters) the forming process can achieve, and Nikkiso officials said deeper draws are possible. In addition, Nikkiso noted that the press-forming process requires no preheating.

A key enabler of Nikkiso’s work is the combination of Solvay’s APC polyetherketonketone (PEKK) prepreg and A&P’s ±45° braided fabric, which provides the drapability and conformability that Nikkiso sought for the application. Nikkiso also said that use of polyetheretherketone (PEEK) is viable with this process.

Nikkiso used five plies of the braided slit tape fabric in a one-shot compression molding process. No trimming or other post-processing was required, which the company said helps optimize material use and minimize waste.

Towpreg-based filament wound hydrogen storage

Voith Composites (Garching, Germany) attracted attention at JEC World 2023 with four large hydrogen storage tanks in its stand. Voith, which has a strong history of developing highly automated composites manufacturing systems for automotive applications, is seizing on the growth explosion in the hydrogen storage economy and developing materials and process solutions to optimize filament winding of pressure vessels for on-vehicle hydrogen storage. The tanks on display were designed for large truck use.

Anna Pointner, CEO of Voith Composites (Garching, Germany), said at the show that the company is focusing on the use of towpreg technology to manufacture its tanks. This is a deviation from the norm in the hydrogen pressure vessel manufacturing community, which has relied primarily on less expensive wet winding. Pointner said, however, that Voith has optimized its tank design and manufacturing process to make highly efficient use of towpreg, thereby negating any cost penalty that comes with the material. Pointner said Voith is committed to hydrogen pressure vessel design and development and will be introducing a full line of storage solutions.

Hexcel celebrates 75 years

Composites materials specialist Hexcel (Stamford, Conn., U.S.) is celebrating its 75th anniversary in 2023, and this was a major focus of the company’s JEC exhibition. CW spoke with Thierry Merlot, president Europe/Asia-Pacific/MEA, who has 40 years experience in the composites industry, about where the company is now and where it will be in the next 10 years.

At the moment, the company is as healthy as its been in several years. It’s Q1 2023 financials, which were reported just before JEC, showed across-the-board improvement, with all income categories up more than 100% over Q1 2022 totals. More than 60% of Hexcel’s sales now come from commercial aerospace, with the balance in space and defense (28%) and industrial (10%).

Not surprisingly, the first topic Merlot addressed is sustainability. He noted that for composites manufacturers, lightweighting solutions are no longer enough to meet the decarbonization challenges the industry faces. Hexcel, he said, as the world’s second largest manufacturer of carbon fiber, has a responsibility to reduce the energy required to produce carbon fiber. He also pointed to the need for bio-based resin systems as a tool for decarbonization.

Sustainability colored Merlot’s comments on other materials and markets as well. Regarding the marine market, and pointing to a massive carbon fiber mast structure for which Hexcel won a JEC Innovation Award, Merlot said Hexcel is looking to reduce carbonization in this market by 30% by 2030. For commercial aerospace, he pointed to Hexcel’s long history developing fiber and resin system for infusion processes, with special attention given to noncrimp fabrics (NCF) and Hexcel’s RTM 6 resin system for resin transfer molding. Hexcel’s presence in thermoplastic composites comes through its joint venture with thermoplastics specialist Arkema (Colombes, France and King of Prussia, Pa., U.S.). Merlot noted that the two companies have enjoyed their cooperation, expect it to continue, and that they jointly operate a thermoplastics laboratory in France.

In the hydrogen pressure vessel market, Merlot said, “Hexcel is leveraging existing carbon fiber technologies to develop a fiber for this application, with a strong focus on translation properties.” He said the company is evaluating 24K tow solutions for hydrogen tanks and the possibility of using towpreg (slit prepregs) — most current hydrogen pressure vessels use wet winding — to optimize fiber use. The challenge of towpreg is cost, but Merlot said a towpreg tank can be cost-competitive with wet winding if the tank is designed to use the material.

Asked to look a decade down the road, Merlot spoke somewhat wistfully, implying that his career might not extend that far. Still, he expressed optimism about Hexcel’s and the industry’s prospects. He pointed to mobility applications that need the kind of lightweighting that composites can provide. He said, “I think a new single-aisle aircraft, when it’s announced, will have 50-70% composites.” And he returned to sustainability, noting that Hexcel had recently worked with Fairmat (Paris, France) to develop a wind blade spar cap with recycled carbon fiber content, and that the industry still has work to do to reduce manufacturing scrap rates: “We as an industry need to have a solution to our scrap problem. This is huge challenge for all of us, Hexcel included. We have so much to do — we’re not bored at Hexcel!”

KraussMaffei, FILL collaborate

Composites machinery specialists KraussMaffei (Florence, Ky., U.S.) and FILL Gesellschaft (Gurten, Austria) revealed at JEC that they have launched a collaboration designed to leverage the complementary strengths of each company. KraussMaffei, which has established technologies for resin transfer molding (RTM), injection molding, overmolding, pultrusion, extrusion and more, is looking to take advantage of FILL’s automation and preforming expertise for aerospace manufacturing. FILL, for its part, has a strong market position in Europe, but wants to establish a presence in the U.S., which KraussMaffei can help facilitate.

At JEC, Nolan Strall, president of KraussMaffei in the U.S., and Wilhelm Rupertsberger, general manager at FILL, noted that the two companies have a history of working together, and are eager to restart that effort. As part of this cooperation, called the 4X4 strategy, it’s expected the two companies will provide expertise in RTM automation this way: automated pre-forming (FILL), automated forming/molding (KraussMaffei), automated machining (FILL) and automated nondestructive testing (FILL).

FILL will establish employees in the U.S. and then work with KraussMaffei on systems development on a project-by-project basis. Either KraussMaffei or FILL will be prime on such projects. Initial technologies to be focused on include thermoplastic compression molding, KraussMaffei’s FiberForm system, KraussMaffei’s direct injection process and injection molding (including overmolding). Rupertsberger also hopes to establish a FILL preforming system somewhere in the U.S. as a demonstrator of the company’s capabilities. Where that might be remains to be seen.

New leadership for Web Industries

Tape slitting and cutting/kitting specialist Web Industries (Marlborough, Mass., U.S.) introduced its new CEO, John Madej, at JEC. Madej comes to Web with a long history in the plastics industry, including with GE Plastics (what is now SABIC) and Hollingsworth & Vose. Madej said Web is still recovering from COVID-19, which obviously struck its aerospace business significantly. Aerospace, he said, is now a third of the company’s overall business, which also includes products for the medical and consumer products markets, also representing a third each.

That said, Madej noted that Web used the pandemic to invest in new slitting and kitting technologies to enable the company to meet demand during recovery of aerospace manufacturing. Significant effort has been spent on Web’s “pre-formatting” services — cutting and kitting of fiber reinforcements and other flat goods — which are designed to absorb customer need for material preparation. This effort includes digitization — integration of Web’s manufacturing and operations data with its customers’ manufacturing and operations data, to streamline manufacturing and improve responsiveness.

Looking ahead, Madej said, “Web is scaling and specializing to cover customers needs.” Such “coverage” includes a 50-inch-wide bias ply carbon fiber product that Web introduced in 2022, 1-millimeter slit tape for 3D printing of composite materials, and ongoing research into optimizing slitting of thermoplastic prepreg tapes, particularly for aerospace manufacturing.

Asked about Web’s position as a sole-source supplier in the composites industry — no other company has the slitting capabilities that Web does — Madej was practical: “It’s a tremendous source of pride for us, but it’s also a lot of responsibility. But we have established a global footprint with a lot of redundancies to make sure we meet our obligations to our customers.”

Carbon fiber manufacturing in India

Indian manufacturing giant Reliance Industries Ltd. (Mumbai) exhibited at JEC World 2023 on the heels of its announcement in August 2022 that it intends, in 2025, to stand up a 20,000-metric-tonne (MT) carbon fiber manufacturing facility in India.

Reliance officials at the trade show would not comment on the company’s carbon fiber strategy except to confirm the announcement from Reliance’s Chairman’s Statement, given at the company’s 45th annual general meeting in 2022.

The document, titled, “Setting the Stage for the Next Wave of Growth and Value Creation,” states, on p. 10: “Third, consistent with our vision for New Materials, we will build in phases India’s first and one of the world’s largest carbon fiber plants at Hazira, with a capacity of 20,000 MTPA, based on acrylonitrile feedstock. We will commence acrylonitrile production next year [2023] and aim to complete the first phase of the carbon fiber plant in 2025. We will further integrate our composites business with carbon fiber to produce carbon fiber composites. Besides other applications, carbon fiber composites are also used to meet the rapidly growing lightweight requirements of mobility and renewable energy. Thus, carbon fiber promises to be a multi-decade growth engine for CO2.”

High-modulus bio-based epoxy systems

Epoxy specialist Sicomin Epoxy Systems (Châteauneuf les Martigues, France) has been at the forefront of bio-based epoxy development for several years, but the increased focus on sustainability and decarbonization in the composites industry is causing Sicomin customers to demand more from the resin manufacturer.

At JEC, Marc Denjean, export manager at Sicomin, said 50% of the company’s revenue now comes from bio-based material sales, and its newest product is an example of the demand it’s seeing. The new product is a high-modulus, bio-based epoxy that offers 3,700-4,000 MPa tensile modulus, elongation of 4-5% and improved health and safety performance. Targeted toward the marine market, Denjean says the new resin’s modulus is down slightly compared to its predecessor, but its health and safety performance is what makes it stand out — particularly the elimination of potentially harmful chemicals.

Similarly, Sicomin is now working on epoxy hardeners that offer up to 45% bio-based content, but at prices competitive with petroleum-based hardeners. Also on the horizon, said Denjean, is a 100% bio-based epoxy, “which could come on market as soon as 2025, if all goes well.” This resin, he said, would be developed for hand layup applications first, and then infusion applications. And, finally, Sicomin is working on resin recyclability and bisphenol A replacement.

Denjean said he’s seeing a shift, for the better, in how Sicomin’s customers assess products. “The person responsible for sustainability now, more often, has a higher position than the person in charge of purchasing,” he said.

Products featured in the Sicomin stand at the show included a Salomon snowboard made with bio-epoxy — “a big change for a company that is reluctant to switch resin systems” — and composite roof panels developed for the retractable roof on Real Madrid’s football (soccer) stadium.

Bakelite, Georgia-Pacific phenolic businesses come together

When Hexion was divided and sold off during the pandemic, the epoxy business was sold to Westlake and became Westlake Epoxy (Stafford, Texas, U.S. and Rotterdam, Netherlands). Hexion’s phenolics business became Bakelite Synthetics (Atlanta, Ga., U.S.). Then, in 2022, Bakelite acquired Georgia-Pacific’s (G-P) phenolics business from Koch Industries — G-P used to compete with Hexion in the phenolics market. The result, today, is a phenolics powerhouse in Bakelite Synthetics, which now has a 65%/35% U.S./Europe revenue split.

Bakelite was represented at JEC by Michael Stahl, ex-Hexion and now Bakelite’s global director marketing and communication (based in Europe), and by Frank Ludvik, ex-G-P and now Bakelite’s senior sales representative (based in the U.S.). They said Bakelite’s product efforts are focused on a low-formaldahyde phenolic that G-P developed right before the acquisition by Bakelite.

Stahl said this resin is being qualified in aerospace and automotive applications and offers strong mechanical performance and relatively easy processing, thanks to use of innovative solvent systems (phenolics are notoriously hygroscopic and difficult to process). Stahl added that new phenolic products coming from Bakelite will revolve around this low-formaldahyde technology.

Westlake Epoxy targets automotive, hydrogen, wind, sustainability

Westlake Epoxy, like a lot of major composites industry suppliers, is still assessing how end markets are evolving post-COVID. On top of that, they are coping with new demands from fast-growing markets that were nascent just a few years ago.

Historically, Westlake Epoxy has had strong positions in the wind energy market (wind blade manufacturing and repair), automotive and some aerospace. Those markets remain, but are joined by hydrogen storage and sustainability.

In automotive, Francis Defoor, global market segment leader transportation, said there has been a significant shift away from carbon fiber and toward glass fiber as a reinforcement. This is most evident in fabrication via RTM of leaf springs for suspension systems spanning the entire spectrum of vehicle types, including fleet vehicles. A newer product, Defoor noted, is a phenolic sheet molding compound (SMC) (not part of the Bakelite portfolio — see above) being developed for suspension applications.

Defoor added that carbon fiber used in automotive applications is applied mostly in aesthetic, exterior and some structural applications, and almost exclusively in premium vehicles.

Sigrid ter Heide, global market development manager transportation, discussed work Westlake is doing with resin development for use in filament winding of pressure vessels for hydrogen storage. She noted, as several JEC exhibitors did, that “Westlake favors the consistency, speed and quality of towpreg in this market and is working with customers to better understand how they impact tank performance.”

For the wind energy industry, Westlake emphasized its kits, developed with DD Compound (Ibbenbüren, Germany), for repair of up to 45 meters of a wind blade leading edge — the portion of the blade most susceptible to erosion from wind, sand, ice, rain and snow. The kits a supplied with resins in fixed ratios with easy-to-use applicators designed to speed the repair process and minimize waste.

Finally, in sustainability, Westlake is working on compliance with Scope 1 and 2 emission targets, with an eye also on Scope 3. These will mandate significant carbonization reduction, which has Westlake evaluating a mass-balance approach for a bio-based epoxy and recycling of epoxy.

Related Content

SMC composites progress BinC solar electric vehicles

In an interview with one of Aptera’s co-founders, CW sheds light on the inspiration behind the crowd-funded solar electric vehicle, its body in carbon (BinC) and how composite materials are playing a role in its design.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreCo-molding SMC with braided glass fiber demonstrates truck bed potential

Prepreg co-molding compound by IDI Composites International and A&P Technology enables new geometries and levels of strength and resiliency for automotive, mobility.

Read MoreGuidance for the thermoforming process

A briefing on some of the common foam core material types, forming methods and tooling requirements.

Read MoreRead Next

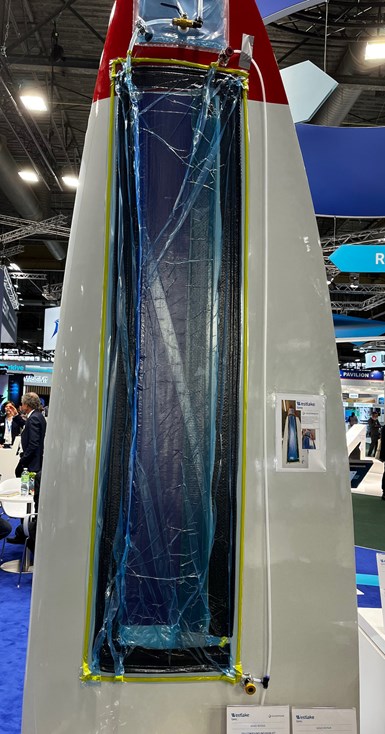

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More