SPE ACCE 2009 Show Highlights

The Society’s annual conclave highlights composites use in new hybrids and electrics and its prospects in a “post-depression” auto industry.

The 8th annual Automotive Composites Conference & Exhibition (ACCE), presented jointly by the Automotive and Composites divisions of the Society of Plastics Engineers (SPE) and organized around the theme “Plug in to Composites,” focused the spotlight on hybrid and electric vehicles from startups in a year when the future of legacy auto OEMs is a hot topic.

Held Sept. 15-16 at Michigan State University’s (MSU) Management Education Center (Troy, Mich.), the conference welcomed 348 attendees, representing less than a 10 percent decrease from the 2008 event — a pleasant surprise for conference organizers. The attendance numbers also clearly indicated that the ACCE’s featured technologies, seven keynote addresses, 46 technical papers and a timely and informative panel discussion met with strong interest in an industry among the hardest hit by the ailing economy. Among the exhibits of key automotive composites suppliers were several composites-intensive hybrid and all-electric vehicles from new players in the automotive market (see photos, at right).

“The ‘green’ theme of the conference offered the opportunity to introduce new content,” noted conference chair Cedric Ball of Ashland LLC (Dublin, Ohio.). “Two of our keynote speakers not only presented their novel vehicles, they also came to say they want to use composites and were here looking for suppliers.”

A prime example was keynoter Hadrian Rori, the VP of vehicle engineering at Bright Automotive (Anderson, Ind.), who described the company’s hybrid-drive IDEA cargo van, slated for production in 2012. The powertrain is described as a “parallel road-coupled” design, with a 2.0L Chrysler engine driving the front wheels and a battery electric system for the rear wheels. The vehicle can go 30 miles on the batteries alone, and over a distance of 100 miles achieves as much as 100 miles per gallon. Although most of the bodywork is currently aluminum, Rori expressed a strong desire “to convert components to lightweight composites” and a willingness to pay a premium of $5 per 1 lb of weight saved to accomplish that end.

Two additional keynote speakers described all-electric vehicles already in production. Barry Dickinson, director of body engineering at Tesla Motors (San Carlos, Calif.), gave an overview of the carbon fiber-bodied Tesla Roadster, which — powered by 6,831 Al-Li batteries (weighing 900 lb/408 kg) — traveled 313 miles/504 km on a single charge during the 2009 Global Green Challenge in Australia. The body panels are produced via resin transfer molding (RTM) by SOTIRA (St. Meloir, France) in 20-minute cycle times. The tooling is capable of 1,500 vehicles per year, yet Dickinson says the company’s forthcoming Model S sedan will be aluminum-skinned, because Tesla has not found an economical way to manufacture lightweight carbon/epoxy body panels at the planned production rates of 20,000 per year.

Dana Myers, president of Myers Motors (Tallmadge, Ohio), introduced attendees to Myers’ one- and two-person all-electric commuter vehicles: The single seat NmG (No more Gas), on sale since 2006, and the as-yet-unnamed two-seater, which will go on sale in late 2010. Both vehicles rely on fiberglass composites for the body panels, run on lithium batteries, deliver a 60-mile/97-km range at highway speeds, and cost approximately $0.02 (USD) per mile to operate. Myers continues to look for composite body panel technologies that reduce weight even further and lower costs as volumes increase.

Conference sessions provided a diversity of papers in new thermoset and thermoplastic materials, and a session specific to bio-fiber and natural-fiber composites. Dr. Deborah Mielewski, technical leader, plastics research, at Ford Motor Co. (Dearborn, Mich.), seconded the industry’s increasing interest in natural fiber composites in her keynote speech, noting that Ford is looking for weight savings “everywhere in the vehicle,” including interior components, and areas where natural fiber reinforcement can improve strength and allow for thinner walls in molded parts. With an ever-increasing emphasis on cost reduction, a number of papers were presented on the use of simulation and digital processing to replace expensive prototyping and testing in the design phases of new vehicle development.

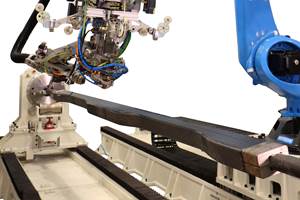

Carbon fiber composites are a perpetual subject at every ACCE, and this year was no exception. In the opening keynote, Kalyan Sehanobish, a senior scientist at Dow Chemical Co. (Midland, Mich.), noted that, while carbon fiber pricing of $4/lb to $5/lb is important, the real barrier to widespread adoption is the lack of high-throughput fabrication technologies. Antony Dodworth, principal research manager of Volkswagen’s Bentley Motors division (Crewe, U.K.), presented a technical paper on a new automated carbon fiber preforming process that aligns fibers in specific directions for structural components. Gary Lownsdale, engineering and R&D manager at Plasan Carbon Composites (Bennington, Vt.), described the strides his company has made in reducing cycle times for prepreg-based components. Plasan is working closely with Oak Ridge National Laboratory (Oak Ridge, Tenn.) on several initiatives aimed at further reducing carbon composite cycle times and costs.

While last year’s conference came on the heels of record U.S. fuel prices, the 2009 event coincided with the one-year anniversary of the global banking crisis, the catalyst for worldwide recession and auto industry restructuring, ownership changes, abandoned nameplates and severe curtailment of production capacity after consumer demand fell more than 40 percent. With the industry showing signs of stabilization (but still far from healthy), an elite group of executives — Tesla’s Dickinson; Jim DeVries, staff technical specialist and manager of the Manufacturing Research Dept. at the Ford Research Laboratory (Detroit, Mich.); Tadge Juechter, chief engineer, Cadillac XLR & Chevrolet Corvette, at General Motors Co. (Detroit, Mich.); Dr. Phil Sklad, field technical manager, Lightweight Materials Program, Office of Vehicle Technologies for the U.S. Department of Energy (DoE).; Mike Jackson, director – North American Vehicle Forecasts at CSM Worldwide (Northville, Mich.); and Dr. David Cole, chair of the Center for Automotive Research (CAR, Ann Arbor, Mich.) — attacked head on the question on every attendee’s mind in a panel discussion entitled “The New Automotive Landscape: What Does it Mean for Composites?”

Cole led off by stating that while the global economy in general was in a recession, there was no mistaking that the automotive industry is experiencing a true depression, unlike anything in history. Both Cole and Jackson supported the U.S. government’s financial intervention at GM and Chrysler, noting that the alternative would have been “much worse,” with ramifications for the entire supply chain, not just OEMs. The positive outcome of all the major changes that have occurred and that are still in progress is that all of the OEMs have been able to reduce their cost structures, and will emerge much healthier than before when demand returns, even to modest levels.

The panelists agreed that smaller cars will gain market share, but noted that solutions that will improve fuel economy in larger vehicles are still of high interest, given that demand for them will continue. Hybrid powertrains will see increased use, especially in sport utility vehicles (SUVs), and there is clearly a niche for all-electric vehicles as the industry moves forward. Dickinson sees near-term potential for significant increases in battery power density, which will be an enabler for disruptive entrants like Tesla.

On the subject of where composites fit in future vehicle portfolios, DeVries, Juechter and Sklad were emphatic that composites no longer compete with steel, but instead must vie with other lightweight materials — aluminum and magnesium. And, although significant fuel-economy advancements will be made via powertrain enhancements, opportunities for composites are definitely available. DeVries summarized it succinctly: “We’re looking for fuel economy improvements anywhere we can find them.”

Related Content

CompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More