Source | McLaren Racing

Formula 1 (F1) is widely regarded as the pinnacle of auto racing, where the best drivers in the world race the most advanced single-seat, open-cockpit cars ever built. But in recent years, this ultimate merging of human and machine has not offered a parallel ultimate racing spectacle. If anything, F1 has become a two-tier competition, with just six cars built by Red Bull, Ferrari and Mercedes – known as The Big Three – battling at the front, their huge performance advantages leaving the remaining seven teams with little hope of winning a race, let alone the World Championship.

This dominance is leaving the chasing pack scratching their heads. Is it The Big Three’s management? Recruitment? Drivers? Their design philosophies? Though all of these factors undoubtedly contribute, what sets Mercedes, Ferrari and Red Bull apart is their ability to constantly enhance and upgrade the aerodynamics of their cars — faster than anyone else — throughout the season.

An F1 car’s performance is dictated by grip, mass, power/energy and aerodynamics. Of these, aerodynamic improvements offer the smallest performance gains: a 10% improvement in aerodynamics equates to just a 0.9-second gain in lap time on average, whereas the equivalent improvement in grip, for example, offers a 3-second lap time advantage. Yet ever since Lotus introduced the first primitive rear wing in 1968, aerodynamics has consistently been the difference between winning or losing. To put it bluntly, the faster a team can iterate its aerodynamic package, the faster its car will go. And given that 80% of an F1 car by volume is made from composite materials, rapid iteration rests on extremely short composite manufacture lead times.

Concept to car

The processes involved in taking a composite component from concept to fitting it on a car have been optimized throughout the F1 paddock to maximize just one parameter: performance. Serviceability, cost and durability are secondary considerations. “A lot of our designs are driven by a relentless quest for increased aerodynamic performance,” explains a member of the U.K.-based McLaren Racing team. “We have to work very closely with the aerodynamicists at the concept stage to ensure that we can give them as much design freedom as possible whilst satisfying weight budgets, reliability targets and very tight manufacturing lead times.”

A suite of advanced software assists aerodynamicists in stress analysis (including linear and non-linear finite element analysis), structural optimization and crash analysis, as well as full 3D CAD software to model aerodynamic surfaces and component modeling.

After this, and if time and regulations allow, 60% scale parts are manufactured for wind tunnel testing. High-volume manufacturing techniques, such as resin transfer molding (RTM), are simply not viable in terms of cost and lead times, so the vast majority of F1 composite components are made using the latest technology available in prepreg carbon fiber materials.

McLaren stocks a variety of prepregs — made with different fibers, fabric styles and resins —that it keeps in frozen storage for 12 months or more. “We generally make molds from carbon fiber tooling prepreg cured onto tooling block patterns, rapid prototype materials or machined and polished aluminum,” notes the McLaren team. “The choice depends on the size of component, whether it is open- or close-molded, the accuracy required and how much time we have available.” Part layup is still done by hand, assisted by ply nesting and templating software that guides a laser ply placement system. The parts are then cured in one of several autoclaves within the McLaren Technology Centre in Woking, U.K. Should the 60% scale parts perform as expected, full-size parts are made using identical processes for on-track testing on the real car.

A 3D printing revolution?

Mark Preston, formerly with Arrows F1, McLaren Racing and Super Aguri F1, and current team principal of the championship-winning Techeetah Formula E racing team reveals that manufacturing processes have not changed markedly since he first entered F1, though some have become more efficient. “Over the years, the processes have got quicker, and cycles have got a lot shorter, mostly because of improved capacity and better software.”

One element that has changed is the use of 3D printing. In 2017, McLaren introduced trackside 3D printing to F1 with the uPrint SE Plus 3D Printer from Stratasys (Eden Prairie, Minn., U.S.), which the team used to make small, last-minute modifications to the front or rear wings and areas of bodywork.

Stratasys 3D printers at the McLaren Technology Centre. Source | McLaren Racing

The team has since used 3D printing extensively both trackside and in the factory for manufacturing, prototyping and composite tooling. The McLaren Technology Centre houses a suite dedicated to Stratasys 3D printing solutions with filament deposition modeling (FDM) and PolyJet capabilities, including a fleet of 3D printers from Stratasys’ Production Series and others from their Design Series.

It is unsurprising that all competitors have since followed suit. “3D printing has greatly reduced the lead times to manufacture components and sped up the development loop — it’s much quicker than producing all the associated machined tooling to arrive at the same point,” says a McLaren engineer. “In one example, we were able to produce a full-size, FDM-printed rear wing flap mold in record time to form a test rear wing flap. This was done to find the right direction to balance aero load and reduce drag.”

It would seem that 3D printing offers the ideal solution for Formula 1, producing parts on demand in a fraction of the time it takes to manufacture a composite equivalent. Unfortunately, materials are limited to laser-sintered nylons and high-performance polymers such as polyetheretherketone (PEEK) and polyetherketoneketone (PEKK), which are not appropriate for components that have to withstand significant loads. And not all tools for composite components can be rapidly 3D-printed either, because the finished parts can often vary when it comes to final material and dimensional properties.

As a result, the majority of F1 components still follow the same largely manual manufacturing process. “Most of the F1 parts are still handmade,” Preston confirms. “There are only a few things that I can think of that are done in an automated way.” Yet new Industry 4.0 composite manufacturing automation technologies not only have the potential to speed up F1 part production, but also level the playing field on track.

Robotic fiber patch placement

Cevotec GmbH (Munich, Germany), for example, has developed a fiber patch placement (FPP) solution for automated production of complex composite parts. The additive technology won the 2019 “Processes of the Future” award at the Industry of the Future Challenge, as well as the JEC Innovation Award in 2018.

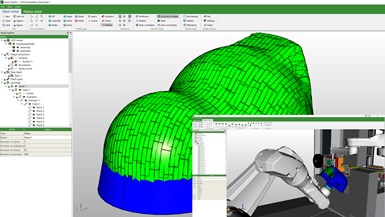

Laminate designed with Patch Artist, robot programming on Motion Artist, complete virtual product development with Artist Studio CAD/CAM suite. Source | Cevotec

FPP technology uses software called ARTIST Studio that goes from the laminated design phase all the way to simulating and programming the automated production process. Within ARTIST Studio, a module called Patch Artist allows engineers to define exactly where composite patches are going to be laid, so that they can tailor patch orientation according to the requirements of each part. Internal algorithms then optimize the patch positions to maximize the mechanical properties of the part. Next, a second module called Motion Artist simulates the manufacturing process and creates the machine program, optimizing both the patch sequence and movements of the robot that will be putting the patches into place.

Patching is done by one of Cevotec’s SAMBA Series production systems. Fed with composite tape, SAMBA automatically cuts the tape into patches and inspects patch quality. Its pick-and-place robot — up to six-axis using a form-flexible patch gripper to avoid draping effects — then picks up the patch, checks its position and finally positions the patch on a 3D preforming tool.

Final cured part using a fiber patch placement system. Source | Cevotec

Currently, the company mainly services the aerospace sector. However, Cevotec business development manager Christian Fleischfresser says that there is a range of potential applications in motorsport, including the manufacture of carbon fiber hoods, roofs, spoilers, front wings, back and rear wings, air intakes and tailored reinforcements.

Fleischfresser outlines why he feels FPP could become a democratizing technology in motorsport, and F1 in particular. “The status quo is the artisanal hand layup of small product volumes involving high skilled labor,” he says. “These high skilled workers migrate between teams and go to where the money is, and this is a problem for a lot of the teams.” Removing this manual process for many types of parts would go a long way to leveling the playing field in F1. “Let’s see if this technology could work in the motorsport industry.”

Automated mold pricing, ordering and design

Also aiming to level the playing field is Plyable Ltd. (Oxford, U.K.), but from a different angle. Where Cevotec focuses on the composites manufacturing process, Plyable addresses inefficiencies in part procurement and the supply chain.

Top teams have the staff and resources to manufacture almost all of their composite components in-house. McLaren, for example – which placed fourth in the 2019 F1 Constructor’s Championship – outsources very little composites manufacture. “We have around 130 people working on composite parts at any one time, including in the clean room, trim and assembly, pattern shop, and machine shops,” explains a McLaren engineer. “We try to make as much as possible in-house, but at times of high workflow, especially over the autumn and winter periods when we are designing and building the new car as well as running and developing the ‘old’ car, some work is outsourced.”

Laminator technicians utilize tools when working in tight quarters with small aluminum molds. Source | Haas

Further down the field, the picture is very different. Teams cut internal costs by designing components in-house, but outsource as much production to suppliers as possible. The Haas Ferrari F1 team (Kannapolis, N.C., U.S.) – finishing ninth in the 2019 Constructor’s Championship – takes this cost-saving measure to the extreme, outsourcing all production. “We do not actually produce composite parts in-house; most of them are outsourced to Fibreworks Composites [Mooresville, N.C., U.S.] and to Dallara Compositi [Stradella, Italy],” says Guenther Steiner, team principal. “I am sure at peak times we have 200 people around the world working on our components.”

The result of this disparity in resource is that the ‘haves’ can iterate component design as quickly as possible by managing their 24/7 in-house facilities and workforce efficiently to produce parts rapidly, while the ‘have nots’ wade through various layers of communication with multiple suppliers before their mold is designed, made and delivered, and the part finally produced.

Plyable’s solution to this is a mold design automation technology and online mold manufacture marketplace. Essentially, this brings mold design and manufacture under one roof for the first time to allow immediate pricing and ordering, and rapid mold delivery. “The time between the engineer completing the design and the manufactured part landing on the car is the inefficiency Plyable addresses,” explains Plyable COO Adam England, a former composite technician for the F1 Renault Sport Racing team. “If you can optimize this, you can squeeze that time between going from the drawing board to the car — and the time required to make the car go faster.”

Screenshot from Tech - Computer vision combined with stochastic gradient descent to optimize pull direction. Source | Plyable

Customers upload a design to Plyable’s secure online platform, select the preferred material and finish for the mold, and then receive an instant price based on mold complexity and material. Plyable then designs the mold and sends it to one of hundreds of manufacturing suppliers around the world, from which it is sent directly to the customer. This solution sounds simple, but in reality, machine learning algorithms automate a number of time-consuming manual mold design tasks. These include draft analysis, split line creation and determining an undercut-free pull direction for complex components.

By maximizing machine utilization and minimizing needless human-to-human interactions, the resulting Plyable process not only removes up to 20% of upfront costs, but also shrinks the mold design and manufacture process down from weeks to an average of three days. “For a race team, we have delivered tooling in less than 24 hours,” says England. “Twenty hours after they uploaded it, they had the part.”

What Cevotec and Plyable show is that there are more than marginal gains to be found in the way composite components are made if Formula 1 is willing to embrace Industry 4.0 automation technologies. Most importantly though, these technologies do not require huge investments in infrastructure or labor, allowing the less well-funded to iterate designs at the same rate as The Big Three — and potentially restoring Formula 1 to its time-honored status as the ultimate racing spectacle.

About the Author

In a previous life, Ben Skuse was an academic, earning a PhD in Applied Mathematics and MSc in Science Communication. He is now a professional freelance science & technology writer, whose work has appeared in New Scientist, Sky & Telescope, BBC Sky at Night Magazine, Physics World and many more.

Related Content

SMC composites progress BinC solar electric vehicles

In an interview with one of Aptera’s co-founders, CW sheds light on the inspiration behind the crowd-funded solar electric vehicle, its body in carbon (BinC) and how composite materials are playing a role in its design.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreRecycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More