Wind blades: Progress and challenges

Despite double-digit wind energy industry growth, turbine blade manufacturers and materials suppliers acknowledge a pressing need to reduce costs and innovate.

The past year was exceptional for the world wind energy market, as wind-generated electricity continued to increase its share of the overall electric power supply base. The global wind power industry grew about 16 percent in 2012, adding 45 GW of new capacity. This increased total capacity to 285 GW, or about 2.62 percent of the world’s electricity, according to statistics published by online energy market news aggregator TheEnergyCollective.com. In the U.S., 6 GW of new capacity was installed in 2012, 19 percent more than in 2011. Wind turbines now account for roughly 3.4 percent of all electricity generated in the U.S. With the Jan. 1, 2013, extension of the federal Production Tax Credit, the U.S. is expected to add 5 GW of wind-generated electricity this year.

Despite the ongoing expansion of wind power, the wind energy industry’s mandate to innovate has never been greater. Its ability to compete with other renewable and nonrenewable sources of energy and the continued growth and profitability of turbine manufacturers and suppliers depend on it. Areas of concern include better ways to enhance not only the mechanical and aerodynamic performance of turbine blades but also their weatherability and resistance to environmental elements. It is also incumbent on the industry to explore ways to reduce the radar signature of wind farms — an issue that has resulted in delays or cancellations of some farm installations. Last, there is a sense of urgency about mitigating the cost of manufacturing, installing and metering wind turbines in anticipation of what many experts predict will inevitably be a subsidy-free, level energy playing field.

Pushing past the efficiency plateau

If the rotors of a wind turbine are not turning, the turbine is not producing electricity and its owners are not making money. That fact feeds the perception among critics that wind cannot compete with on-demand power sources, such as fossil fuels, nuclear and hydro. Thus, one rationale for longer rotor blades is that the longer the blade, the greater the amount of time a turbine will spend in service under variable wind conditions, a metric known as capacity factor.

Keith Longtin, general manager, wind product line, for GE’s renewable energy business, says the company has increased the capacity factor of its current turbines to more than 50 percent, up from roughly 35 percent 10 years ago. Longtin reports that GE sold more than 1,000 of its 100m/328-ft diameter 1.6-MW 1.6-100 wind turbines in 2012 — all installed in the U.S. This turbine has a capacity factor of roughly 53 percent. The turbine’s 48.7m/159.8-ft blades are E-glass/epoxy sandwich constructions with a hybrid core that comprises balsa wood and PVC and SAN foams. Each blade weighs approximately 10 metric tonnes (22,000 lb), has a root diameter of 2.5m/8.2 ft and a chord width of 3.5m/11.5 ft.

More recently, Invenergy (Chicago, Ill.) became the first company to purchase GE’s new 2.5-120 series turbine. The turbine is equipped with 60m/197-ft long blades and has a capacity factor of more than 50 percent in low-wind conditions. Invenergy purchased three of the 2.5-MW turbines, which will be installed as part of Goldthwaite Energy Center, an 86-turbine facility under construction in Mills County, Texas. GE says the turbine is the first to integrate short-term battery storage and software that enables power producers to store short-term surges in power during peak wind conditions. This onboard system eliminates the need for more costly offline, farm-level battery storage systems.

Longtin reports that one of the company’s strategies for reducing variability and costs in the ramp up to bigger blades is a standardized design and manufacturing process, which facilitates scalability of composite layups. The company also collaborates with its suppliers to find ways to enhance automation. For example, one of the company’s suppliers, TPI Composites Inc., which manufactures rotor blades for GE’s turbines at its plant in Newton, Iowa, reports using hydraulic power hinges to assemble blade halves. The hinges have eliminated the need for flip fixtures for skin demolding, resulting in significant reductions in assembly time. TPI manufactures blades using the Seamann Composites (Gulfport, Miss.) Resin Infusion Molding Process (SCRIMP), in which feed lines, vacuum lines and embossed distribution channels are integrated into a reusable vacuum bag to reduce setup time and improve process repeatability.

Better design and design for manufacture

Building ever-larger rotor blades using the same or similar production methods and materials is a strategy now subject to the law of diminishing returns: The increase in the weight of, and loads borne by, longer turbine blades outpaces the increases in power capacity. Turbine manufacturers, therefore, are vigorously investigating optimized designs, lighter materials and more efficient manufacturing processes to reduce blade weight and cost.

Siemens AG (Erlangen, Germany) is building what is purported to be the world’s largest wind turbine, the SWT-6.0-154. Each of its three B75 blades measures about 75m/246 ft in length. Fabricated as a single cast part, comprising glass, epoxy and balsa wood, the blade is molded via the company’s patented and trademarked IntegralBlade process. The seamless blade has no bonded joints — weak points that could crack or separate, exposing the joint to water ingress and accelerated weathering. Additionally, a weight savings of about 20 percent, compared to conventionally produced blades, is achieved by incorporating a specially designed blade profile, shaped to maximize the rotor capacity factor at a variety of wind speeds. The turbine has a cut-in wind speed of 3 to 5 m/sec, produces nominal power at 12 to 24 m/sec and has a cut-out wind speed of 25 m/sec. It is part of the company’s D6 platform, which replaces the gearbox, coupling and generator with direct-drive technology that eliminates about 50 percent of wear-prone and geared parts. The reduction in associated maintenance costs is especially advantageous for offshore applications. Siemens is testing the B75 blades on a prototype 6-MW turbine at Denmark’s Osterlid test station. After testing is complete, power supplier Dong Energy (Fredericia, Denmark) plans to purchase and install about 300 SWT-6.0-154 turbines off the British coast, according to a recent press release from Siemens.

Meanwhile, Kolding, Denmark-based LM Wind Power’s 73.5m/240-ft blades were installed on Alstom’s (Levallois-Perret, France) Haliade 150-6MW wind turbine in Carnet, France, this past year, and the company has plans to open a blade manufacturing plant in Cherbourg, France, and begin production of the blades there by 2016 (see “Fair winds for offshore wind farms,” under "Editor's Picks," at top right). The glass/polyester blades feature the company’s SuperRoot design, which supports blades that are up to 20 percent longer without an increase in root diameter. Additionally, in 2012, LM Wind Power extended its GloBlade line of ultraslim wind turbine blades to 3-MW turbines. Originally introduced for the 1.5-MW segment, the GloBlade replacement blades are designed with “plug-and-play” features that make them compatible with a variety of turbine platforms and aerodynamic configurations. The new 3-MW line includes 58.7m and 61.2m (192.6-ft and 200.8-ft) blades, which the company says can improve annual energy production by as much as 14 percent, compared to the standard blades they replace.

Molded Fiber Glass Companies (MFG, Ashtabula, Ohio) custom molds blades and a variety of parts for wind turbines. For example, the company manufactures a spinner nose cone, which fits over the windward side of the rotor hub, from E-glass fabric and polyester for a major wind turbine manufacturer. Carl LaFrance, MFG’s VP of renewable energy products, cites the need to reduce wind energy’s cost per kW-hr and to make investments in material and process R&D. “We don’t have a full understanding of how blade design, materials and manufacturing processes affect system costs,” says LaFrance, “so we don’t have any idea about how much cost we could potentially take out.” He believes that will require more upfront collaboration between custom molders and turbine manufacturers, but adds, “it’s a conversation not all customers are willing to have because of the competitive nature of this business.”

LaFrance specifically earmarks the need for tougher matrices, and he notes that early testing and prototype work with polyurethanes appears promising. “Polyurethanes have much better fatigue properties than either polyester or epoxy,” he contends. LaFrance also reports that some materials suppliers are researching methods to make vinyl ester a tougher material.

Erosion control and de-icing capability

As blades get longer and blade tips reach greater speeds, resistance to wind-driven rain, ice, sand and salt is a key performance criterion, especially along the blade’s leading edge. When wind-driven particulate strikes a blade spinning as fast as 60 m/sec, there is the potential for damaging shear forces in the first laminate layer of the edge. Leading-edge erosion reduces power output, which results in significant revenue loss for wind farm operators.

To counteract erosion, LM Wind Power recently introduced a new protective coating technology, LM ProBlade Collision Barrier. The company claims the coating can improve erosion resistance along the leading edge by up to 20 times, compared to standard barrier coatings already in use. The coating system comprises a primer and an aliphatic-based, solvent-free, two-component, highly elastic polyurethane topcoat. LM says results of independent testing on prototype blades shows the coating lasts about twice as long as leading-edge thermoplastic polyurethane tape. Tape produces aerodynamic drag, and LM estimates that eliminating it can enhance the average annual energy production of a turbine by 2 percent. The company began serial production of the coating in the second quarter of 2013. Lene Ri Ran Kristiansen, manager of global communications at LM, says the barrier technology will be available, initially, only on blades produced by LM Wind Power.

Another option, Arkema Inc.’s (King of Prussia, Pa.) KYNAR PVDF-acrylic hybrid emulsion coating, has been used for more than 30 years as an architectural weather coating on exposed metal in large commercial buildings and public structures. The original solvent-borne emulsion requires baking at temperatures up to 200°C/392°F to cure. However, the company introduced a water-based version of KYNAR, in both thermoplastic and thermoset formulations, which is curable at room temperature and can be applied to a variety of composites.

Kurt Wood, group leader of KYNAR PVDF coatings R&D, reports that the company has been working with researchers at North Dakota State University (NDSU) to evaluate the performance of paints formulated with the water-based thermoset and a hybrid resin when they are applied on typical glass/epoxy laminates as a possible all-purpose leading-edge and weather-resistant coating. In the thermoset formulation, hydroxy-functional monomers are incorporated in the acrylic portion; the hybrid resin is combined with commercially available water-dispersible polyisocyanate crosslinkers to produce a two-part urethane. The resulting crosslinked polymer in the applied coating is structured as a bi-continuous network of fluoropolymer and acrylic urethane.

The standard rain erosion test, first developed for helicopter blades, spins blades on a fixture at a high speed through simulated rain. This test is very expensive. Arkema, therefore, is working with NDSU to develop an alternative test method that keeps the part stationary and uses a wind tunnel to accelerate water droplets into the part at high speed. This method will be used to test the rain erosion of blades coated with KYNAR-based paints. The company will be presenting preliminary test results at several wind energy conferences this year. Wood says the company also has done studies that suggest the hybrid resin may have superior long-term erosion-resistance and ice-shedding properties compared to a number of commercial urethane coatings that are currently in use.

To address leading-edge erosion, 3M Advanced Materials Division’s Renewable Energy Div. (St. Paul, Minn.) now offers Wind Blade Protection Coating W4600. The product, which was introduced to the market in May, is a two-component polyurethane coating designed for application via brush or by casting at the OEM facility. 3M also offers Wind Tape 8608 and 8609 for erosion control at the leading edge. The pressure-sensitive tape is UV stable and puncture resistant, and it can be die- or plotter-cut to conform to complex 3-D shapes.

Currently GE Wind Energy employs process controllers on most of its wind turbines to manage ice buildup on the turbines’ rotor blades. When the controller detects imbalances in the rotor as a result of ice buildup, it adjusts the rotor speed to allow continued safe operation, or it shuts down the turbine if ice buildup becomes too extreme. But Longtin reports that GE also has conducted field testing of a “nanoparticle, ice-phobic coating” on its 1.6-MW turbine blades, with encouraging results. “We are going to announce the results later this year but we think the technology has promise,” says Longtin.

Reducing wind turbine radar interference

As wind farms proliferate, a concern about turbine radar interference has, in recent years, prompted aviation, weather, military and marine operations to contest proposed wind turbine installations. The Union of Concerned Scientists (Cambridge, Mass.) estimates the issue has delayed the installation of as much as 6 to 9 GW of potential wind energy production. In a white paper that addresses radar interference from wind farms, the group recommends a number of mitigation measures, including upgrades to the aging, long-range radar infrastructure, modifications to wind farm design to reduce radar cross-section and the use of “gap fillers” in radar coverage.

Turbine manufactures also are investigating technologies to reduce the intrinsic radar signature of wind blades. Vestas Wind Systems A/S (Aarhus, Denmark) is reportedly researching the use of a stealth technology, similar to what is used in military aircraft, to reduce a turbine’s radar signature. The company has built a number of experimental wind blades that comprise two layers of glass fabric printed with a special “ink.” The radar signal passes through the first layer and is effectively trapped between the two layers. According to online reports, the technology works, but the cost could be prohibitive — especially considering the market pressure on turbine manufacturers to reduce, not raise, costs. Further, a turbine completely undetectable to radar would pose a hazard to aircraft flying in the vicinity of a wind farm. The trick, which Vestas is attempting to master, is to “tune” the technology so a spinning turbine doesn’t appear as a threat on the aircraft’s radar, yet doesn’t entirely disappear from the radar screen.

Elsewhere, GE Wind Energy is taking a slightly different approach to reduce a turbine’s radar interference. Longtin reports that GE’s R&D center in Munich, Germany, has investigated applying a number of “commercial radar-absorbing materials” to rotor blades, which have subsequently been tested on turbines and were shown to be capable of reducing radar interference. “We are using materials that you can purchase off-the-shelf and staying away from more exotic materials used in the defense industry,” says Longtin. “If the industry were to move to requiring a blade producing less radar interference, we think we have some technology that we can draw upon that could help.”

As it matures, the wind energy industry faces a number of significant challenges that require collaboration and new, cost-effective technologies. As it stands, even without subsidies, wind energy is competitive, or nearly competitive, with traditional energy sources, including coal and oil. Ongoing materials and manufacturing innovation will help push this important end market to wider, and permanent, acceptance.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreRead Next

Fair winds for offshore wind farms

Innovations in blades, turbines and foundations are helping spur growth in a very big way.

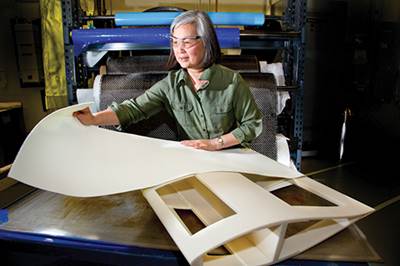

Read MoreA different type of blade?

GE Wind Energy and public/private partners investigate the use of resin-impregnated architectural fabrics as a substitute for conventional composite laminates in the construction of wind blade skins.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More