For an industry accustomed to years-long (if not decades-long) development cycles for new components, composites fabricators may find the timeline for a bicycle frame at Arevo (Milpitas, Calif., U.S.) quite remarkable. Wiener Mondesir, Arevo chief technical officer, reports that the company rolled out a demonstrator frame made from continuous carbon fiber/polyetheretherketone (PEEK) in May 2018; was approached by every major U.S. bicycle OEM shortly after; and launched into bike frame production in its new 20,000-square-foot facility in February 2019 — a span of just nine months. The bicycle industry is perhaps even more astounded: an Arevo frame for a battery-assisted “ebike” advanced from design to prototype in just 18 days, compared to 18 months for traditional composite bike frames.

The key to this short development cycle? Continuous fiber-reinforced 3D printing.

Though Arevo’s experience is unlikely to become the new normal for development cycles of all composite components, it augurs well both for the composites industry and for innovators like Arevo that are advancing this new technology. CW has been following these developments since 2014, yet news from stakeholders suggests that the next one to two years may see accelerated growth in R&D, prototyping, small-batch and — yes — commercial production applications. CW gathered the latest updates from continuous fiber-reinforced 3D printers around the world, including contributors from university research facilities, entrepreneurs and small start-ups, and established composites companies.

Interestingly, efforts in continuous fiber-reinforced 3D printing seem to be diverging in two primary directions: those pursuing high-volume applications, and those servicing prototype and small-batch parts with especially challenging features such as highly complex geometries or critical performance characteristics that require extremely accurate manufacture. Whether these two market paths are accompanied by two distinct technology paths is a point of debate, as revealed in some of the opinions expressed here.

Volume production

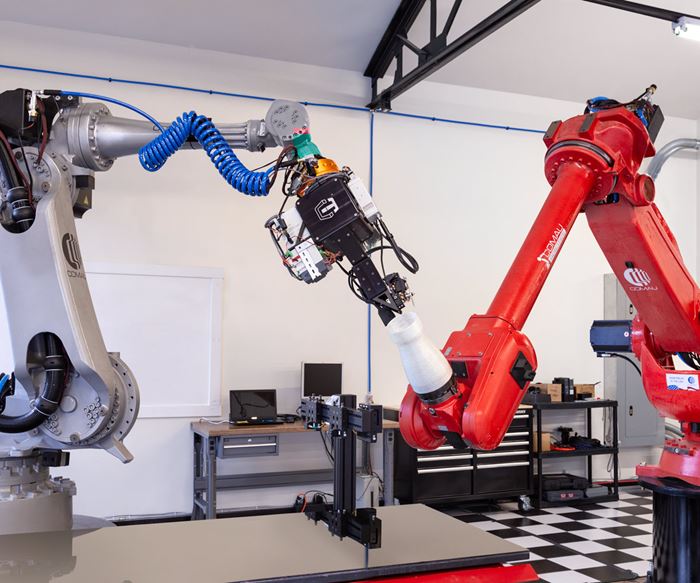

Arevo’s swift move into commercial production volumes is powered by the company’s direct energy deposition (DED) process, which prints components from thermoplastic towpreg. Comprising an industrial robot, a printhead with laser heating and a rotating build platform, the Arevo DED work cell is reportedly capable of accelerating production speed 100-fold compared to previous continuous fiber-reinforced 3D printing.

Arevo’s current focus is on both consumer products, evidenced by the most recently introduced bike frame for a new line of electric bikes; and on aerospace applications, toward which Airbus Ventures has recently invested in Arevo’s efforts.

The eight robotic work cells that have begun producing bike frames in Arevo’s new facility are each able to produce one frame per day, including the printing itself as well as post-processing (for example, drilling holes) and pre-sanding for painting. Mondesir predicts a speedy ramp-up, with three times faster cycle time within the first year of production. To accomplish this, Arevo is working to implement “parallelizing,” that is, running multiple printheads per robot and/or multiple robots per work cell. The company is also investigating larger feedstock (large tow). As with other manufacturing technologies, a balance will have to be struck between the slower cycle times but feature-rich, complex geometries possible with small tow, and the higher production speeds but steerage limitations of large tow.

To maintain quality and repeatability throughout the ramp-up, Arevo has implemented in-situ inspection and machine learning to control process parameters in real time. The printer is fitted with numerous sensors — measuring height, pressure, distortion, etc. — and the system’s software uses data from these sensors to adjust process parameters as needed. “As we run the robot faster, we make sure that deposition rate, heating, consolidation and other parameters match baseline,” Mondesir explains. “In-situ inspection is the way to go. We build a digital model of the process, then iterate and improve. Allowables and data for a host of thermoplastics are now known.”

Another company working toward mass production with a continuous fiber-reinforced 3D printing process is Orbital Composites (Silicon Valley, Calif., U.S.) — though CEO Cole Nielsen is pushing away from the “3D printing” moniker, noting that there has been “too much hype for ‘3D printing’; the fact is, you can’t print just anything.” He prefers to focus on the next generation of customers’ products rather than the additive manufacturing technology itself. Built for the demands of the end product, Orbital’s modular robot printers can vary greatly.

The trajectory for this technology? “We want to be able to print a million of one object,” Nielsen says. With this goal, Orbital is focused not just on the flexibility of 3D printing but also on its reliability, repeatability and layman usability.

Like Arevo’s technology, Orbital’s modular, coaxial extrusion end effectors, parallel robotics and out-of-autoclave processes boast production speeds up to 100 times faster than what was possible with previous continuous fiber-reinforced additive manufacturing. The extrusion nozzle feeds fiber through its central bore and the matrix material through the surrounding annular nozzle. Parallel robotics accelerate production velocity through teamwork.

Orbital’s technology development philosophy is “material agnosticism.” Ideally, the company wants to design the specific end effectors and print cells around the material a customer has already selected, Nielsen says, noting that aerospace material developments may have been specified five or 10 years before deployment. Orbital’s technology is designed to adapt to nearly any composite material: plastic, ceramic or metal matrix, including thermosets, thermoplastics and silicon carbide; dry, bindered fiber ranging from 3K to 48K tow; and with the capacity to incorporate copper or aluminum wire, nanomaterials, conductive inks or other options that help to achieve a multifunctional structure.

Importantly, Orbital’s system works effectively with commodity materials — a necessary capability to be cost-competitive in high-volume applications. “We want changes happening on the tool side, not the material side,” says Amolak Badesha, Orbital COO. “We would rather have a very complex tool and low-cost materials than the other way around.” Unlike companies that are producing specialty — and more costly — materials optimized for their print technology, Orbital is devoting its R&D efforts to optimizing the print technology for standard, lower cost materials. As the company nears public disclosure of some major projects, the Orbital team is optimistic about this potential for large-scale applications.

Across the Atlantic, 9T Labs (Zurich, Switzerland) in February began beta testing of its CarbonKit, which is designed to make existing 3D printers capable of continuous fiber printing. An undisclosed serial production application, also in the works, is expected to make around 30,000 parts per year. A spinoff from the Swiss Federal Institute of Technology Zurich (ETH Zurich), 9T Labs has a goal of using 3D printing to make carbon fiber-reinforced composites more accessible for industrial serial production, says co-founder Martin Eichenhofer. “We provide the CarbonKit so engineers at R&D departments, students at universities or makers at home can experience the new possibilities and advantages of 3D printing with continuous fibers at competitive entry-level pricing. This is because we see the mass adoption as crucial to finding real industrial-use cases.”

The CarbonKit employs knowledge gained from the continuous lattice fabrication (CLF) process that Eichenhofer developed as a Ph.D. student at ETH Zurich. Intended for use with industry-grade, inexpensive material as feedstock, the system pultrudes composite rods, which then travel through a pulling unit and into a thermally regulated extrusion head. The system, he says, can work with a range of thermoplastic matrix systems and produces fiber volume content upwards of 50 percent. Another important feature is the ability to scale the extrusion cross-sectional area, so that the system can accommodate high-resolution applications with small tow, as well as big area additive manufacturing with large tow.

An R&D/prototyping focus

On the other end of the market spectrum, researchers at the University of South Carolina’s Ronald E. McNair Center for Aerospace Innovation and Research (Columbia, S.C., U.S.) have collaborated with TIGHITCO (Atlanta, Ga., U.S.) and Ingersoll Machine Tools (IMT, Rockford, Ill., U.S.) to develop continuous fiber-reinforced 3D printing for highly specialized and demanding applications. The technology is a fused filament fabrication (FFF) approach for which the team has developed a thermoplastic composite filament and a robotic 3D print system (patents pending). The system, which will be produced by IMT, provides seven degrees of freedom using a Siemens controlled industrial robotic platform equipped with a continuous fiber deposition end effector. “One of the biggest things we want is to remain leaders in part accuracy,” says Arturs Bergs, TIGHITCO project engineer (who works onsite at the McNair Center). “Rather than large beads and large patterns with significant post-processing, we want to print with minimal post-processing.”

The McNair team believes that the technology is well-suited for three application trajectories. First is low-volume manufacturing in aerospace or automotive applications; for example, this includes applications where only one of a particular high-strength component is needed per vehicle, making a mold or mandrel difficult to cost-justify. Second is highly complex structures, such as stiffened grids, for which other manufacturing methods are unable to produce the required strength- and stiffness-to-weight ratios. Third is overprinting, a technique in which a component is inserted during the print cycle and is thus fully embedded within the printed part. Examples include printing around a threaded insert instead of adding it through a post-print process; or embedding RFID chips or electronic sensors within a printed part. Overprinting may thus enable part consolidation. Michel van Tooren, McNair Center professor and senior member, explains: “An automated fiber placement [AFP] fuselage has a minimal level of integration, with many smaller parts bolted on. The brilliance of this technology is that if you make a composite component with thermoplastics, you remelt each time to add new parts through overprinting.” Eliminating rivets, fasteners and bonding adhesives could advance these structures significantly.

A pioneer of continuous fiber-reinforced 3D printing, holding the earliest patents on the process worldwide (2012), is Continuous Composites (Coeur d’Alene, Idaho, U.S.). CEO Tyler Alvarado holds an optimistic view of long-term market penetration for the company’s trademarked CF3D technology and foresees a day when it will be used to print entire aircraft or automotive structures on demand – whether 10 or 10,000 parts. “The economics of CF3D will democratize composites into a variety of new industries and applications,” Alvarado believes.

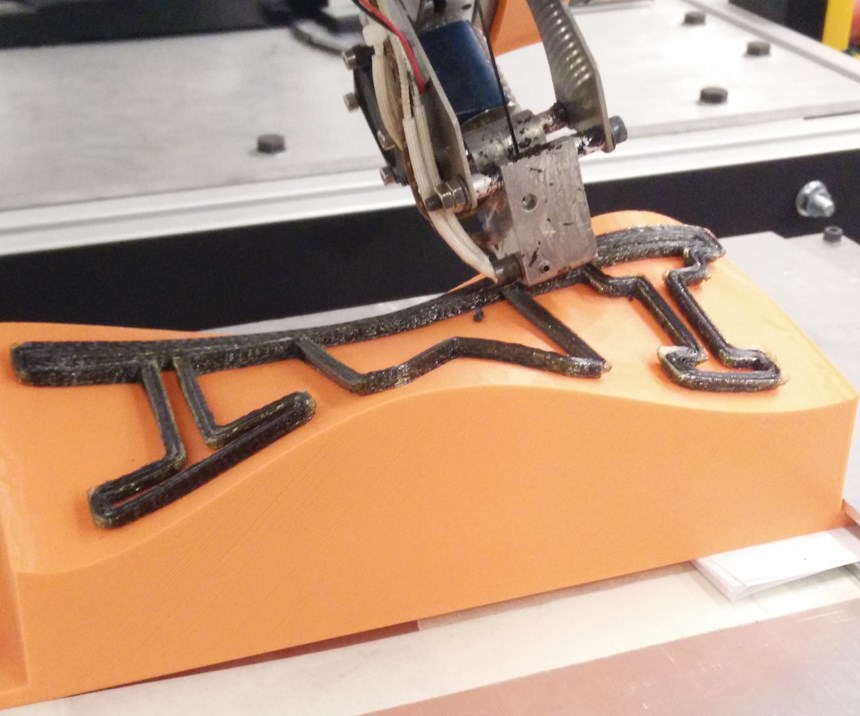

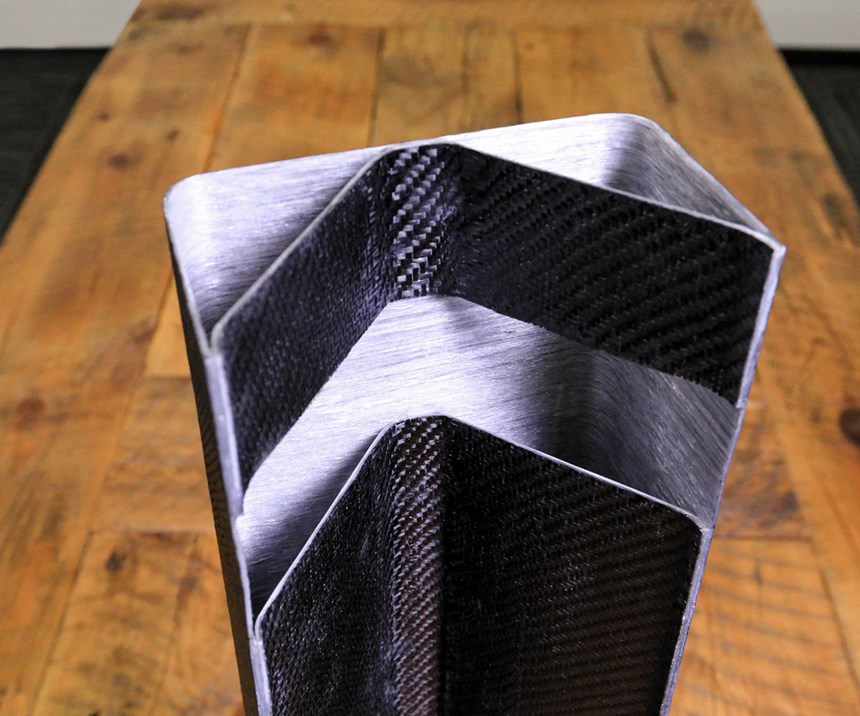

Using snap-cure thermoset resins (though also amenable to thermoplastics), CF3D impregnates the reinforcing fiber within the printhead and cures the composite immediately after material deposition. Thermosets enable the process to perform high-speed printing unsupported in free space. CF3D is achieving 50-60 percent fiber volume, and Continuous Composites is continuing to advance the process in numerous ways. Some of the most significant recent developments include more automated toolpath generation; automated tool changing to enable high-resolution single-channel and high-deposition multi-channel printing on the same part; improved accuracy and precision of robots; and development of materials with greater mechanical properties.

Like Arevo, Continuous Composites is not waiting for the aerospace and automotive markets to materialize. Instead, Alvarado anticipates near-term commercial application in industries that can “self qualify,” such as DOD, experimental aircraft, marine, construction, sporting goods and Formula 1 automotive.

A technology reportedly similar to Continuous Composites’ CF3D, and which has reached the early adoption and development phase (technology readiness level 5), is the continuous fiber manufacturing (CFM) process from moi composites (Milan, Italy). Established in early 2018, the company is another university spinoff, building on work done at +LAB laboratory of the Politecnico di Milano (Milan, Italy).

Moi’s CFM technology was developed to solve the challenge of 3D printing with thermoset resins. The process has successfully printed continuous glass fiber-reinforced composites with epoxy, acrylic and vinyl ester. UV is the predominant cure process used with moi’s print technology, but the process is also amenable to other cure and post-cure mechanisms — necessary for carbon fiber applications because carbon’s opaqueness and black color interfere with UV curing, reports moi co-founder Michelle Tonizzo.

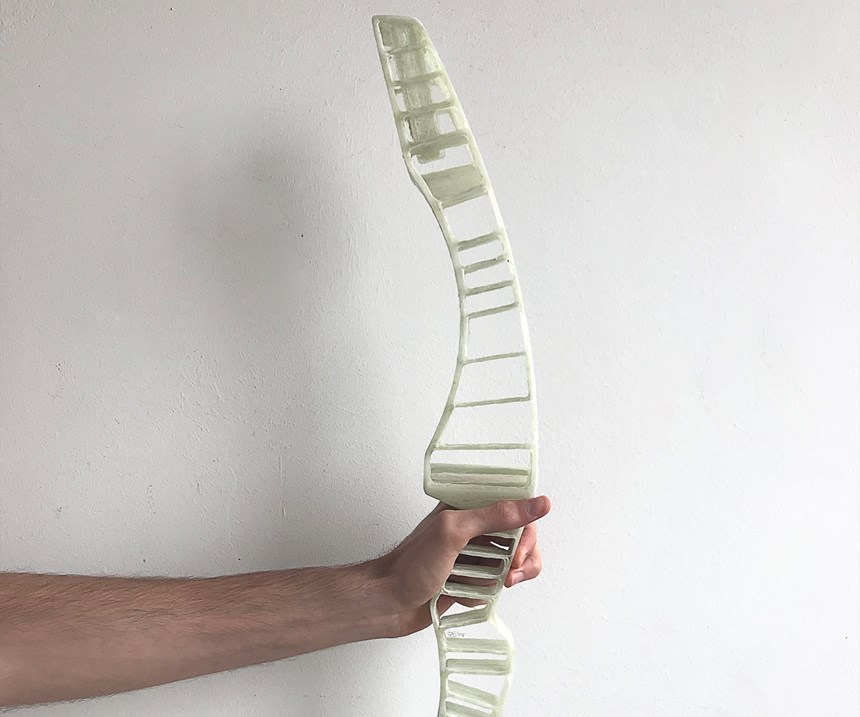

One of the latest projects, produced by Politecnico student Alberto Riganti during his thesis period, is an archery riser (the center part of the bow where the grip is found). “After meeting with the riser’s producer,” Tonizzo recalls, “we decided to focus on optimization and realization of the riser, exploiting the potentialities of CFM technology compared to traditional manufacturing processes.” CFM enabled a unique design, with squared s-shaped infill, denser in the most stressed regions, and enclosed in a double perimeter on the archer’s side and a single perimeter on the opposite side. The riser was printed as a single part exploiting CFM’s ability to deposit fiber in space. To increase stiffness, the printed riser was manually laminated with a carbon fiber twill textile. Final weight of the demonstrator is 550 grams, compared to 1,200-1,400 grams for a traditional metal alloy riser, or 600-700 grams for a manually fabricated carbon fiber-reinforced riser.

Short-run focus

Another European venture expected to launch production applications in the near term, CEAD Group (Delft, Netherlands), introduced its large-scale CFAM (Continuous Fiber Additive Manufacturing) Prime 3D printer in November 2018. While initial CFAM Prime applications will build prototypes, CEAD business development director Charléne van Wingerden believes the system to be especially beneficial for large, complex products in low quantities, where short lead times and the elimination of molds make it a highly efficient manufacturing process.

CFAM Prime is a complete, enclosed printer built on a Siemens CNC system base. With a build volume of 2 by 4 by 1.5 meters, it is reportedly the largest 3D printer available in Europe. The printer has an average output of 15 kilograms/hour and can run for 24 hours without an operator present. It features a smart heating/cooling system that monitors the process with thermal cameras and adjusts as needed in real time. A range of thermoplastics can be used on CFAM Prime. To create continuous fiber-reinforced composites, CEAD first pre-impregnates continuous glass or carbon fiber with the desired thermoplastic. The printhead then combines the continuous fiber with melted thermoplastic granules, which may also include a percentage of chopped fiber.

CFAM Prime’s first two customers are Royal Roos (Rotterdam, Netherlands), a marine engineering company, and Poly Products (Werkendam, Netherlands), which specializes in fiber-reinforced plastics for construction. Royal Roos is considering projects such as gangways, for which unreinforced or chopped fiber 3D printing could not produce the needed strength and light weight. Poly Products expects to make façade cladding pieces, trim lines for cargo ships and various train applications as its initial CFAM Prime projects.

Startup Anisoprint (Moscow, Russia) also has an eye toward short-run production applications. Like CEAD and others, Anisoprint prepregs the reinforcing filament before feeding it into the printer, but this technology has a twist: the filament is prepregged with a specially formulated, proprietary thermoset and is then fully cured, and the matrix resin typically is a thermoplastic. Other composite print experts have expressed some skepticism, given the brittleness of a typical cured thermoset filament. Anisoprint CEO Fedor Antonov says, “The fully cured filament is stiff at room temperature but in a rubbery state when heated.” The thermoset polymer more easily wets out the individual monofilaments than thermoplastics, he continues, and it provides better adhesion.

Anisoprint’s first 3D printer is the Composer, a desktop composite fiber co-extrusion (CFC) unit. The dual matrix system is compatible with thermoplastic processing temperatures up to 270˚C. In addition to several customers reviewing prototypes, one current small-batch production customer is Supreme Motors, which is using a Composer to fabricate parts and fixtures for its “UNA wheel” wheelchair electric drive unit. Once it ramps up production, the company expects to print a few thousand parts per year. Anisoprint also plans to bring an industrial model, a robotic cell-based machine, to the market within the next two years.

Volume and small-run production?

Known as a pioneer in continuous fiber-reinforced 3D printing, Markforged (Watertown, Mass., U.S.) has established a solid customer base for its X7 printer, which is currently applied primarily to small-run production; but Jon Reilly, MarkForged VP of products, anticipates technological development to converge for small-run and volume production. Noting that the current market for continuous fiber 3D printing is in high-value, low-volume parts, Reilly expects the target market to grow toward relatively high-volume, low-value parts as printer manufacturers reduce printing costs and material costs. “3D print companies that don’t invest for scale will lose out,” he believes. Yet with few exceptions for ultra-specialized parts, he predicts that print technology made for volume will still possess the capabilities needed for highly detailed, complex components, because complexity is generally addressed in the software.

MarkForged’s continuous fiber system uses proprietary towpreg made with a specially developed thermoplastic resin, and it uses two printheads, one for the matrix resin and the other for the towpreg. Technology improvement efforts are focused on reliability and repeatability, Reilly says. The company also is working toward an entirely closed-loop process and developing additional features such as fully integrated material tracing and comprehensive automatic reporting.

A key market for Markforged is the printing of fixtures and components for traditional production-line tooling. Compared to machined aluminum components, Reilly reports, “Ours are just as strong but lighter. They don’t mar the part like a metal component can. And they are ready the same day.” Customers in this market have reported an impressive return on investment of one to three months.

Software standardization needed

Nearly every team reported that they were developing proprietary software, primarily because the needed software does not exist commercially. “We wrote our own software for tool path planning because we couldn’t find one with continuous tool paths,” McNair Center’s De Backer affirms. Alvarado notes that Continuous Composites wanted to generate tool paths in a more automated fashion than traditional slicing software would provide. As with most software development, though, it seems likely that a standard for tool path generation software will emerge.

In the meantime, activity on the software, hardware and material fronts will likely continue at a brisk pace for the foreseeable future. Innovators and entrepreneurs continue to dominate the continuous fiber-reinforced 3D printing market, and it should be some time before a shakeout and industry consolidation occurs.

Related Content

Hitachi Rail chooses Roboze printers, materials including carbon fiber/PEEK for railway spare parts

The Roboze ARGO 500 will be used at Hitachi Rail factories in Naples, Italy and Maryland, U.S. to reduce cost and delivery times for prototypes and spare parts.

Read MoreHybrid process marries continuous, discontinuous composites design

9T Labs and Purdue applied Additive Fusion Technology to engineer a performance- and cost-competitive aircraft bin pin bracket made from compression-molded continuous and discontinuous CFRTP.

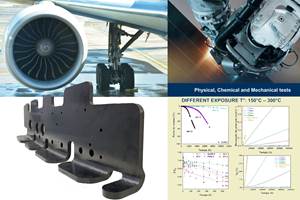

Read MoreClean Sky 2 OUTCOME project demonstrates PEEK thermoplastic composite wingbox cover

Airbus Defense and Space, FIDAMC and Aernnova demonstrate out-of-autoclave, one-shot process for wingbox cover with integrated stringers for regional aircraft.

Read MoreDaher CARAC TP project advances thermoplastic composites certification approach

New tests, analysis enable databases, models, design guidelines and methodologies, combining materials science with production processes to predict and optimize part performance at temperatures above Tg (≈150-180°C) for wing and engine structures.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More