Composites automation: Trending smaller and robotic

Although AFP and automated tape laying (ATL) lamination technologies are widely used in the aircraft industry, market conditions in the past few years are driving some changes in composites equipment supplier product lines. Consultant Carroll Grant explains why.

Share

When I started my composites career in 1984, I was working for Hercules Aerospace (Magna, Utah), the company that did much of the early development work on the automated fiber placement (AFP) process. My composites career started with automation, and I’ve been involved with automated processes for my entire time in this industry.

By the early 1990s, Cincinnati Milacron (now MAG IAS, Hebron, Ky.) and Ingersoll Machine Tools (Rockford, Ill.) had commercially available AFP machines. Today, AFP machines also are supplied by two other major machine tool companies — MTorres (Torres de Elorz, Navarra, Spain) and Electroimpact (Mukilteo, Wash.) — and a few smaller machine companies: Automated Dynamics (Schenectady, N.Y.), Accudyne Systems (Newark, Del.), Coriolis Composites (Quéven, France) and Mikrosam (Prilep, Macedonia).

Although AFP and automated tape laying (ATL) lamination technologies are widely used in the aircraft industry, market conditions in the past few years are driving some changes in composites equipment supplier product lines. Since AFP and ATL first became viable production processes, equipment suppliers typically have designed and built very large and expensive machines, intended for the largest companies in the aerospace industry. But this longstanding way of doing business seems to have changed in the past few years. Composites equipment suppliers are beginning to develop smaller and more affordable composites lamination machinery for a market segment that, historically, has not been able to afford — and does not need — very large machines.

The use of commercially available robots as a platform for smaller-sized composites layup equipment is getting to be quite popular across the equipment supplier base. MTorres, MAG IAS, and Electroimpact offer smaller-sized lamination equipment based on robots. MTorres and MAG IAS also offer gantry-configuration ATL systems that are scaled down in size.

MTorres has been very active in developing smaller composites lamination systems. The company has a new, small ATL that is based on a robot. It has a scaled-down tape head that lays 3-inch/76.2-mm wide tape. MTorres has installed one of these machines in a new R&D building at the company’s main plant in Pamplona, Spain. Prospective customers can use this machine to run process trials. MTorres also has sold one of the robot-based ATL’s to an aerospace company in Europe.

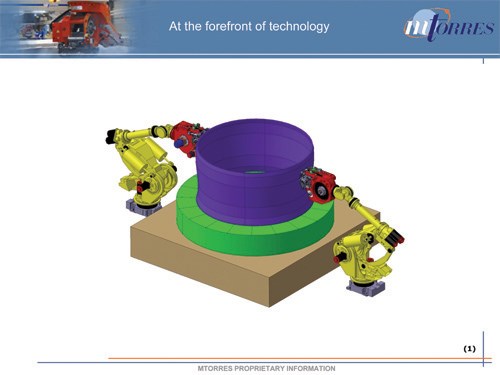

The robotic ATL has a central tool rotator and two robots that lay tape on a rotating tool (see Fig. 1). This machine was developed for components such as turbofan engine cases.

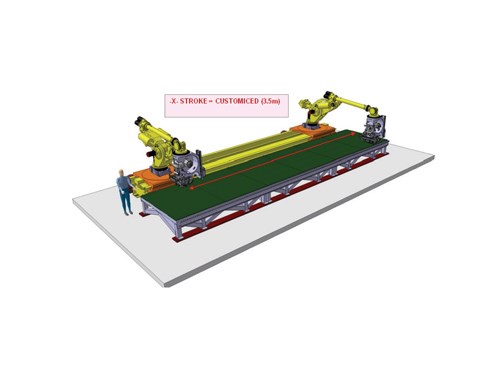

Another of MTorres’ robotic ATLs was developed for layup of flat laminates (Fig 2). The robot moves parallel to the layup surface on floor-level x-axis drives. This machine can be configured in a wide range of x-axis travel lengths, depending on the customer’s application requirements.

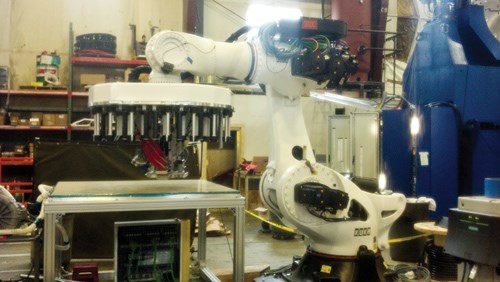

MTorres also has a small cantilever gantry machine that uses an AFP head to lay up flat laminates (Fig 3). It was developed specifically for laying up stringer laminates for the Airbus A350 program. Using AFP to lay complex flat laminates greatly reduces the in-process material scrap.

MAG IAS has a new small Robot Viper AFP system that was developed for small parts that are normally fabricated with hand layup processes (Fig. 4). MAG offers the Robot Viper with delivery head capacities that range from 4 to 16 tows,with tow (slit tape) widths of 0.125 or 0.250 inch (3.18 or 6.34 mm).

Electroimpact also is known to be expanding its composite laminating machine product line into smaller-sized equipment. The company already has sold a small AFP machine that is based on a commercially available robot (Fig. 6). This robotic system has a 16-tow AFP head that has the material spools incorporated with the delivery head.

Ingersoll Machine works with prospective customers to design and build equipment for their specific needs, including smaller lamination equipment. However, no specific information on Ingersoll’s smaller machine products was available for this article.

Smaller machine companies — Automated Dynamics, Accudyne Systems and Coriolis Composites — have been supplying smaller, lower-cost composites lamination equipment for several years, and many of their machine products are based on robots.

Automated Dynamics has supplied smaller layup equipment since 1990, and the company has a lot of experience with robot-based equipment. During the past few years, its machine product line has been primarily robot-based. Automated Dynamics believes the market for smaller, robot-based lamination systems will grow significantly in the next few years and plans to add more machines of this type to its product line.

Coriolis Composites was a pioneer in developing AFP machines based on commercially available robots. Its robot-based composites lamination equipment (Fig. 5) was selected to build composite parts on the new Bombardier C-Series regional jet aircraft.

We can expect the variety in AFP and ATL machine configurations and sizes to continue expanding in the next few years, and robot platforms will be used for more composites layup systems. Robot platforms combined with composites material layup technology has proven to be a very good combination. The expanding variety in composites layup equipment means the smaller composites shops around the world will have access to automated lamination equipment that is sized and priced for their specific needs.

It is inevitable that, eventually, composites automation will become a common in the composites industry, as 5-axis CNC machining centers have in the metalworking industry.

Related Content

How AI is improving composites operations and factory sustainability

Workforce pain points and various logistical challenges are putting operations resilience and flexibility to the test, but Industry 4.0 advancements could be the key to composites manufacturers’ transformation.

Read MoreST Engineering MRAS presents initiatives to drive autoclave efficiency, automation

During a JEC World 2024 panel discussion, the company revealed ways in which it is maximizing throughput and efficiency of its autoclaves and enhancing composites production processes.

Read MoreSAM XL demonstrates closed-loop digital methodologies via full-size aerocomposite parts development

PeneloPe Project’s modular, zero-defect manufacturing deliverables are being highlighted in an upcoming video that demonstrates the resulting aerospace pilot line’s feasibility.

Read MoreCom&Sens presents workshop on fiber optic sensing for COPVs

Three-day hands-on workshop from June 11-13 in Leuven, Belgium, will equip participants with a better understanding of fiber optic sensing technology for digital manufacturing of composite tanks.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More