Boeing releases annual long-term forecast

The 2021 Boeing Market Outlook states that commercial airplanes and services are showing signs of recovery, while the global defense, space and government services markets have remained stable.

Share

Boeing (Chicago, Ill., U.S.) has released its annual forecast for the commercial, defense and aerospace market, reflecting signs of the industry’s recovery following the impacts of COVID-19. The 2021 Boeing Market Outlook (BMO) — Boeing’s analysis of long-term market dynamics — states that commercial airplanes and services are showing signs of recovery, while the global defense, space and government services markets have remained stable.

The BMO projects a $9 trillion market over the next decade for aerospace products and services that Boeing addresses. The forecast is up from $8.5 trillion a year ago, and up from $8.7 trillion in the pre-pandemic 2019 forecast.

Commercial market outlook

According to Boeing, demand for domestic air travel is leading the recovery of the commercial market, with intra-regional markets expected to follow as health and travel restrictions ease, followed by long-haul travel’s return to pre-pandemic levels by 2023 to 2024. Boeing’s commercial market outlook (CMO) projects 10-year global demand for 19,000 commercial airplanes valued at $3.2 trillion.

In addition, projected demand for dedicated freighters has increased, including for new and converted models. With sustained demand for air cargo tied to expanding e-commerce and air freight’s speed and reliability, the CMO projects the global freighter fleet in 2040 will be 70% larger than the pre-pandemic fleet.

“The aerospace industry has made important progress in the recovery, and Boeing's 2021 forecast reflects our confidence in the resilience of the market,” says Stan Deal, president and CEO, Boeing Commercial Airplanes. “While we remain realistic about ongoing challenges, the past year has shown that passenger traffic rebounds swiftly when the flying public and governments have confidence in health and safety during air travel. Our industry continues to serve an essential role of bringing people together and transporting critical supplies.”

Highlights of the new 20-year CMO forecast include:

- The availability and distribution of COVID-19 vaccines will continue to be critical factors in the near-term recovery of passenger air travel. Countries with more widespread vaccination distribution have shown rapid air travel recovery, as governments ease domestic restrictions and open borders to international travel.

- Passenger traffic growth is projected to increase by an average of 4% per year, unchanged from last year’s forecast.

- The global commercial fleet will surpass 49,000 airplanes by 2040, with China, Europe, North America and the Asia-Pacific countries each accounting for about 20% of new airplane deliveries, and the remaining 20% going to other emerging markets.

- Demand for more than 32,500 new single-aisle planes is about equal to the pre-pandemic outlook. These models continue to command 75% of deliveries in the 20-year forecast.

- Carriers will need more than 7,500 new widebody airplanes by 2040 to support fleet renewal and long-term passenger and air cargo demand growth in longer-haul markets. These projections are up slightly compared to 2020 but remain down 8% from 2019.

|

Airplane Demand (2021-2040) |

||

|

Airplane type |

Seats |

Total deliveries |

|

Regional jets |

90 and below |

2,390 |

|

Single-aisle |

90 and above |

32,660 |

|

Widebody |

7,670 |

|

|

Freighter widebody |

-- |

890 |

|

Total |

43,610 |

|

Services market outlook

Boeing forecasts a $3.2 trillion market opportunity for its services market, with commercial, business and general aviation services representing $1.7 trillion and government services representing $1.5 trillion through 2030.

Digital solutions, including analytics offerings, interiors modifications and freighter conversions, have proven to be bright spots in the long-term services landscape as customers adjust to leaner operations for future growth and meet strong cargo demand.

Boeing claims training services will see a near-term increase in demand as personnel transition to new aircraft types, maintain certifications and return from pandemic-related pauses in active service. Demand for services dependent on aircraft utilization, such as maintenance, parts and supply chain is projected to follow the market recovery.

Defense and space market outlook

The BMO also projects the defense and space market opportunity will remain consistent with last year's forecast at $2.6 trillion during the next decade. According to Boeing, this spending projection continues to reflect the ongoing importance of military aircraft, autonomous systems, satellites, spacecraft and other products for national and international defense, with 40% of expenditures expected to originate outside of the U.S.

Pilot and technician outlook

Boeing says long-term demand for newly qualified aviation personnel remains strong, with projected demand for more than 2.1 million personnel needed to fly and maintain the global commercial fleet over the next 20 years, including 612,000 pilots, 626,000 maintenance technicians and 886,000 cabin crew members.

Related Content

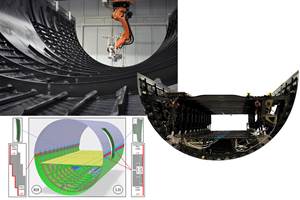

Manufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

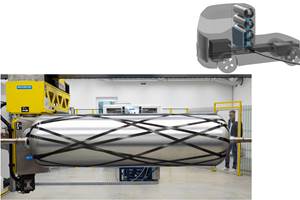

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More