Composites recycling: Gaining traction

Recycling of carbon fiber, glass fiber and — at last — resins, is growing as new players enter the space.

A key question — What happens to manufacturing waste and end-of-life parts? — was silently swept under the rug in the composites industry for years as companies resigned themselves to paying for land ll disposal while metals suppliers touted recyclability to industry. But at least three marketplace realities have converged to drive the growth of composites material recycling, particularly the reclamation of carbon fiber:

- First, the European Union’s end-of-life-vehicle (ELV) directive requires that 85%, by weight, of the materials used in a car or light truck must be reusable or recyclable.

- Second, carbon fiber’s high manufacturing cost and high performance, even in chopped form, make it an attractive recycling target, which is creating market pull for recycled fiber products, most notably, from automotive.

- Finally, the newest generations of consumers were raised on environmental awareness, actively support recycling activities and closed-loop manufacturing, and seek out goods with recycled content.

Although CW’s coverage of composites recycling (see Carbon fiber: Life Beyond the Landfill) dates back over a decade, informal statistics still show that only ~2% of composites-related companies are active recyclers. That said, three years since our most recent feature on the subject, there is demonstrably greater interest and activity, and commercial applications of recycled ber are growing.

The technologies: Different approaches

One reason aluminum and steel remain formidable competitors to composites is their suppliers’ long track records in recycling, which has helped reduce their overall material production costs, says Ed Pilpel, senior technical advisor at PolyOne Corp. (Englewood, CO, US) and the current recycling committee chairman at the American Composites Manufacturers Assn. (ACMA, Arlington, VA, US). “But it took those industries

30-50 years to achieve their current success rate at recycling, which for aluminum is upward of 80%. The composites industry is much younger, and we have years to go,” he admits, “but we’ve got to jump into the deep end of the pool and get going.

Those who have jumped in are employing several recycling strategies, separately or in combination. Most initial efforts have focused on reclamation and reuse of high-quality carbon fiber material waste streams, typically from aerospace manufacturing, because they are relatively easy to work with and yield high-quality carbon fibers with performance properties virtually undiminished, albeit in chopped form (continuous fiber can also be recovered, discussed below). Waste sources include off-spec material, cutting/trimming/kitting scraps (dry and prepreg) and bobbin ends, including thermoset and thermoplastic materials.

Current commercial methods for eliminating the resin from the carbon fibers are pyrolysis (thermal treatment) and solvolysis (chemical treatment). Although pyrolysis requires thermal energy to burn off the resin, and can cause fibers to char, the energy of pyrolysis represents only a fraction of the embodied energy of virgin carbon fiber. Some sources say solvolysis requires even more energy than thermal treatment, but it enables recovery of fiber and resin. In both processes, the recovered fibers transfer well to nonwoven mats or thermoplastic pellets for injection molding, and are a natural fit for automotive part applications.

More difficult is recycling of end-of-life (EOL) cured parts to complete a true “closed-loop” situation, where materials are recovered from scrapped products and reused in new iterations of those products. Pyrolysis and solvolysis can be applied to cured parts, as can mechanical crushing, typically used for fiberglass parts; the resulting crushed glass/resin material is either reused as a resin filler, burned for energy (waste to energy plants) or co-processed in cement kilns.

Alternatively, two companies offer recyclable resin products that can be un-crosslinked in a chemical solution that leaves the original fiber reinforcements intact (more on that below) for closed loop recycling in some sporting goods applications. And, a number of materials suppliers are investigating in-house, closed-loop recycling of scrap and parts, avoiding a recycling middleman.

But, says Frazer Barnes, managing director at ELG Carbon Fibre Ltd. (ELG CF, Coseley, West Midlands, UK), a subsidiary of German metals recycler ELG Haniel (Duisburg, Germany), “So far, closed loop arrangements are scarce: We’re working with one closed-loop customer on a development project, where their recovered carbon fiber will go back to them for reuse.”

Thermal treatment leads

“Three years ago, it was a real push to get these materials out into the market. Now, there’s more ‘pull’ and we’re getting more inquiries on how to use recycled carbon. We are now designing products and developing them to meet specific customer requirements,” says Barnes. ELG CF processes more than 2,000 MT of waste material per year in its patented pyrolysis process, including manufacturing waste and cured parts.

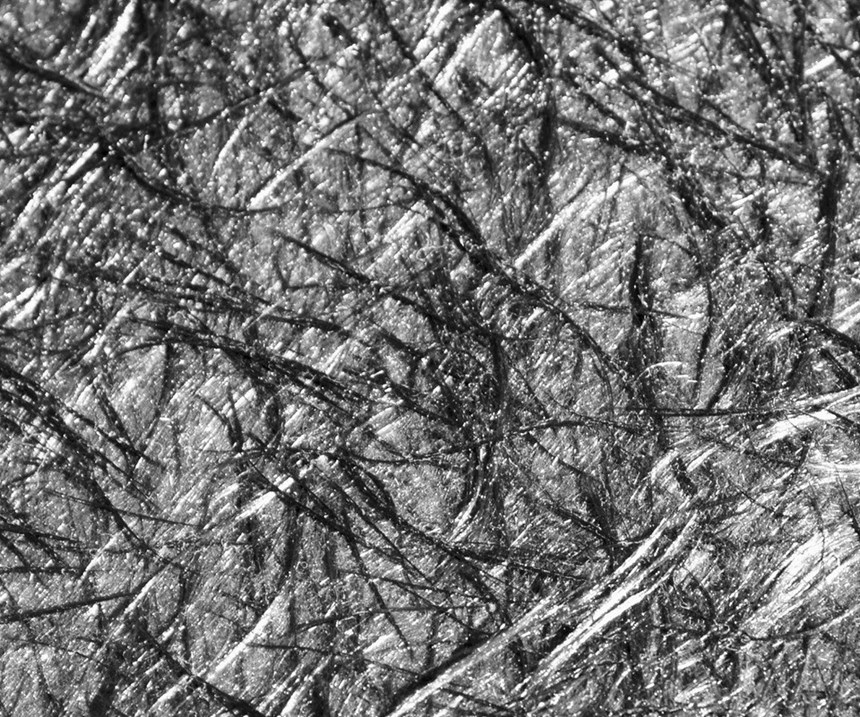

All incoming waste is sorted, cataloged and classified, based on fiber type and source, and the ber provenance data stays with the recovered ber during processing and recovery. Mechanical testing data on recycled carbon products is freely available, notes Barnes, to encourage greater adoption of recycled fiber, which it offers at a cost about 40% less than virgin fiber: “In an equivalent product form, there is no performance difference between recycled vs. virgin fiber.” In addition to its chopped and milled products for thermoplastic compounding, ELG CF offers nonwoven mats, ranging from 100 to 500 g/m2, as well as hybrid commingled mats that combine chopped carbon fibers and thermoplastic fibers (polypropylene, polyamide, polyphenylsulfone, and polyetherterephthalate).

The company is currently involved in providing recycled carbon fiber in thermoplastic pellet form for a production automotive semi-structural part being produced by Tier 1 supplier Sanko Gosei (Skelmersdale, UK), with compounds provided by Albis (Knutsford, UK). The project’s objective is to demonstrate the feasibility of using recycled fibers in production automotive applications, which could eventually lead to production of nearly a million parts per year. More automotive projects for ELG CF are in early phases, including a sports car chassis.

The company also was recently awarded a grant from the UK’s Rail Safety and Standards Board (RSSB) to explore the use of recycled carbon for future rail-car primary structure. ELG CF also is working with the University of Nottingham and University of Bristol on “realignment” techniques that will eventually align short chopped fibers to give better material properties. Barnes says ELG CF might also begin using other recycling processes going forward: “We are not tied to any one technology. Pyrolysis is certainly effective, but 20% of our staff is involved in research and development. We are open to new ways to process, including solvolysis, and it may depend on different incoming materials in future.”

In the US, Carbon Conversions Inc. (Lake City, SC, US) employs pyrolysis and can process “the entire composites waste stream,” claims Keith Graham, Carbon Conversions’ VP of business development. at includes continuous tow from various markets; intermediates, such as dry fiber waste (from fabrics, trimming, braiding), and “wet” uncured prepreg and pultrusion waste; and end-of-life parts from commercial aerospace, recreational and industrial sources. “We’ve built a robust business to take any industry’s waste stream and convert it into any one of our many products,” adds Graham. Hexcel (Stamford, CT, US) recently purchased a minority stake in the company.

Carbon Conversions’ products include two distinct families. The first comprises chopped-seeded recycled carbon fibers (that is, fibers that have been treated with a proprietary sizing to increase their bulk density for better handling and processing), primarily used in injection molding applications. Fiber lengths offered range from 6.5-25 mm, all with known pedigrees as to fiber source and type, either high-strength or intermediate-modulus. Carbon Conversions uses a proprietary sizing for compatibility with many common thermoplastic resin systems. “We can provide a recycled milled fiber upon request,” he adds. The second product family is nonwoven mat, made from recycled carbon fibers. The mats are offered as recycled carbon fiber only (for RTM, VARTM and prepreg processes) and hybrid, commingled constructions that incorporate thermoplastic fibers for compression molding processes. Nonwoven weights range from 100-500 g/m2. Carbon Conversions also has patented and trademarked 3-DEP materials made in the Co-DEP wet-laid slurry process, for custom recycled chopped carbon ber preforms, in weights up to 1,400 g/m2 (see Recycled carbon fiber update: Closing the CFRP lifecycle loop). The company has successfully demonstrated automotive parts, including a floorboard part for an automotive OEM. Graham says the company also is working with customers on closed-loop programs: “We worked with Oracle Team USA to recycle their racing yachts and recover the carbon fiber for use in tooling for their newest vessel. We have other customers interested in closed-loop arrangements, and it will give them a distinct advantage in the market as we continue to collaborate on recycling and product development together.” Graham notes that Carbon Conversions will push the envelope to advance composites recycling: “We’re all in this together, and we need to produce repeatable, consistent quality materials to grow this industry.”

CFK Valley Stade Recycling GmbH & Co. KG (Wischhafen, Germany), part of the Karl Meyer Group, is Europe’s largest composites recycler that uses pyrolysis, and takes in waste streams from automotive, aerospace and end-of-life sporting goods, says Tim Rademacker, a managing director at the company: “Due to the increasing use of wind turbine blades made with carbon fiber, the quantity of waste from the wind industry has risen significantly.”

With a 1,000-MT per annum yield of recycled fibers, CFK Valley Recycling’s partner company within Karl Mayer AG, CarboNXT (Wischhafen, Germany), distributes the recovered fiber as chopped and milled products as well as wet-laid veils and air-laid nonwoven mats. Says Rademacker, “We identify incoming waste streams, and depending on customer demand, CarboNXT can produce customized recycled semi-finished products, with three different proprietary techniques for resizing the fibers.” Although CarboNXT’s customer list is proprietary, Rademacker reports that milled recycled carbon fiber is used as a filler in polyurethane (PU) rear and front bumpers on the new Mercedes AMG GTC roadster. “The ever-growing consumption of carbon fibers and the resulting greater quantity of composites waste will inevitably lead to a higher demand for recycling technology, and innovative applications for the recovered fiber materials,” he adds.

Pilpel describes the ACMA’s ongoing collaboration with Institute for Advanced Composites Manufacturing Innovation (IACMI, Knoxville, TN, US) to bring a new thermal recycling solution to market: the trademarked Thermolyzer technology, from CHZ Technologies (a subsidiary of Aliquippa Holdings LLC, Austintown, OH, US), is a waste-to-energy reactor system, developed and originally envisioned in Germany to recycle discarded nylon carpeting. Thermolyzer processes shredded cured-part waste — end-of-life wind turbine blades, for example — and recovers all by-products by means of multiple reactors.

For example, says Pilpel, if copper-clad printed circuit boards were processed, the copper could be recovered, as well as the fibers: “This technology creates a clean-fuel gas product from the resin residue that meets natural gas specifications, and it generates no harmful emissions, thanks to inline scrubbers.” With a long list of composites industry and wind energy partners, including Owens Corning Composite Solutions Business (OC, Toledo, OH, US), ACMA and IACMI are evaluating a pilot process in Germany as a first phase, to prove the system and determine scalability, says OC’s Dave Hartman.

“More work remains to be done, but it’s a very promising technology,” adds Pilpel.

Wet chemistry methods growing

Adherent Technologies Inc. (ATI, Albuquerque, NM, US) started its recycling business at least 20 years ago (see Carbon fiber: Life Beyond the Landfill). Company president Dr. Ron Allred and Dr. Jan-Michael Gosau, engineering and environmental project manager, chose a wet chemistry process they call chemolysis, also referred to as tertiary treatment, that uses a liquid transfer fluid and catalyst combined with low heat and pressure to recycle end-of-life parts and recover both carbon fibers as well as resin, without generating airborne emissions. The recovered resin can be reused as fuel or as process chemicals in other industries. Allred adds, “We are recycling discarded commercial pressure tanks, for example, on our pilot line that yield 50-mm-long fibers with greater than 90% of virgin properties.” Allred and Gosau point to the company’s proprietary sizing technology, a key component of the recycling process, that makes the fibers usable again in composites processes. ATI has developed sizings not only for epoxy and thermoplastics (for injection molding pellets) but also for vinyl ester and bismaleimide (BMI) resins: “Our sizings provide superior mechanical properties,” says Allred. He says that ATI is working with the University of New Mexico and European groups to develop a method to align recovered fibers and create nonwoven fabrics for the market: “It’s a longer-term goal.”

ATI has recently formed a partnership with investment group DLC Capital (Melbourne, VC, Australia), owned by Damian Cessario, to commercialize the recycling technology. DLC Capital and ATI have collaborated for years and have now formed a composites company, V Carbon (London, UK), which will reclaim carbon fiber and then use the fibers to manufacture parts within the group. V Carbon provides an integrated composites solution, spanning design and modeling, engineering, manufacturing and recycling, with the ATI process providing recycled fibers for customer projects. “This wet-chemistry process is the most elegant solution of any on the market,” contends Cessario, “because the resin is recycled as well as the ber. We’re offering a holistic composite solution.”

Explains Allred, “ATI and V Carbon will be operating under the umbrella of the V Carbon Group, within which ATI will be the R&D entity.” Cessario adds that plans are in the works for recycling plants in the UK, Europe and additional US locations.

A new entrant to the recycling community is Vartega Carbon Fiber Recycling LLC (Golden, CO, US), headed by Andrew Maxey, an engineer whose interest in carbon fiber came from cycling: “We’re the new kids on the block, but things are accelerating and the opportunities for recycling are growing.” Vartega currently has a pilot-scale, proprietary and patent-pending low-energy solvolysis process, which treats uncured prepreg and tow-preg scrap, from sources including Alchemy Bicycle Co. (Denver, CO, US). The company is developing a path whereby Vartega would eventually provide its process technology to licensees, who would lease modular equipment for in-house, closed-loop recycling on a regional basis, because, says Maxey, “It’s expensive to ship waste!”

For now, Vartega is working with Technical Fibre Products Inc. (TFP, Schenectady, NY, US), which converts the recovered fibers (some of them continuous, from towpreg process waste), all with known pedigree and source, into nonwoven mat and veil products. Maxey says Vartega mills and chops fibers internally and works with other partners to compound the material into pellets and 3D printing lament. Vartega is also part of ongoing research on techniques for fiber alignment in, for example, extruded thermoplastic sheet. “We’re now processing enough material to supply developmental programs — for example, automotive programs to validate that the process and the material is viable,” says Maxey. The company has released testing data on its recovered fiber (see Vartega shows positive results of recycled carbon fiber testing), where the tensile strength and modulus of recovered fiber are comparable to virgin fiber controls.

“The fiber retains 100% of its properties with our process,” Maxey contends. “ is type of testing information is vital to help the composites industry get recycled fiber into automotive programs.” Vartega also is working with sizing company Michelman (Cincinnati, OH, US) to develop sizings for recycled fibers to improve adhesion at the fiber/resin interface in thermoplastic composites.

Recyclable resins, reuse of material

“We’re an atypical company,” states CEO Bob Larsen of Composite Recycling Technology Center (CRTC, Port Angeles, WA, US). “We’re a nonprofit, and our mission is to inspire, grow and lead the recycling community.” Located in a region of concentrated composites manufacturing, in proximity to Boeing and many Boeing Tier companies, Larsen says CRTC wants to drive economic redevelopment and help reduce Port Angeles’ unemployment, while modeling wise use of resources. CRTC combines recycled carbon fiber product development with production processes for high-volume, low-cost production. “Lack of consumer demand is often cited as a major factor holding back the development of the recycled composites industry,” observes Larsen. “We are overcoming that barrier by bringing high-performance recycled carbon fiber products to consumer and industrial markets at heretofore unattainable prices.” The company is co-located with Peninsula College and that school’s Composite Work Force Training program, to train future employees for planned growth.

The company purchases “near first-quality” uncured aerospace prepreg scrap at a nominal rate from partner companies, including Toray Composites (America) Inc. (Tacoma, WA, US), and transforms it to make new, nonaerospace products. It has no plans to recycle cured composite parts: “We’re taking advantage of the chemistry that’s already there,” says Larsen. “We’re avoiding the need to add energy and cost to the material — carbon fiber already has more than twice the embodied energy of aluminum!”

CRTC has found success with its first commercial product, recycled carbon fiber pickleball paddles used in the popular court game. They are made using two plies of T800 carbon/epoxy prepreg, in a 0/90° layup over a balsa wood core, and oven-cured. The paddles have been certified by the USA Pickleball Assn. (Surprise, AZ, US) and are distributed by Pickleball Central.Com (Kent, WA, US). As an IACMI member, CRTC has already set up numerous collaborative research projects with universities and other recycling companies, including ELG CF, with whom it is working on applications of recycled carbon fiber material forms.

To support its manufacturing efforts, CRTC has moved into a purpose-built new facility, equipped with freezers for prepreg storage, presses, ovens, molds and more, says Larsen. “With our ELG partnership, we’re a one-stop solution for scrap carbon fiber,” he contends. “We have three or four new products coming later this year and are preparing for rapid growth.”

Procotex Corp. SA (Dottignies, Belgium, a subsidiary of Dolintex NV) also recycles only unprocessed fiber waste — primarily, weaving and cutting scraps, waste from carbon fiber producers and, for now, only dry fibers. At its inception in 1965, Procotex was a flax fiber processor, but in time began to recycle both natural and synthetic fibers. The company entered the technical ber space in 2011, when it acquired Apply Carbon SA (Lacuidic, France), an established specialist in the milling and precision cutting of not only carbon but also aramid, basalt and glass fibers used in composites.

Procotex sales director Bruno Douchy says the company recycles more than 1,000 MT of carbon fiber waste per annum, to produce milled and chopped carbon. To address the issue of dust emitted from milled carbon, Procotex has developed a new milled carbon fiber in granulate form, which allows better dosing/dispersal into the extruder, without conductive dust, says Douchy. Cut carbon fibers range from 30 μm to 120 mm in length, with fiber quality comparable to virgin fiber. New products include oversized, precision-chopped or random-cut carbon fibers, offered with sizings compatible with a number of matrices, with fibers designed to stay in bundle form for better dosing and dispersal. Says Douchy, “Recycled carbon fibers are attractive to the automotive industry, because good properties can be achieved at a much lower price. A challenge for auto industry projects is maintaining stable supply and quality. For this reason, we keep on hand a large stock of unprocessed material.”

In addition to its technical fibers, says Douchy, Procotex processes 20,000 MT of recycled natural fibers, such as flax, plus synthetic fibers, including aramid and polypropylene — much of the latter from the carpet industry. “We’re involved in the automotive, geotextile and concrete markets, and many more,” states Douchy. “We’re one of the biggest players, with real industrial project experience in fiber recycling.”

Adesso Advanced Materials (Wuhu, China; Cambridge, UK and Princeton, NJ, US) and Connora Technologies (Hayward, CA, US) are approaching recycling from the flip side: Through a strategic partnership, they have developed recyclable thermoset resins that, post cure, can be readily degraded and removed from the reinforcement, leaving fibers intact for reuse. Bo Liang, Adesso’s chairman and CEO, says its trademarked Cleavamine hardener and Recycloset resin enable the crosslinks in the cured part to be “cleaved” by a mild acid solution, such as vinegar. The recovered resin is neutralized and the thermoplastic precipitate can be reused as a toughening agent in adhesives or molding compounds, explains Liang: “This is a programmable, recyclable material by design.” Testing reportedly shows that composite coupons made with this recyclable resin and hardener are comparable in performance to conventional carbon/epoxy.

Adesso is currently involved in several major programs, including recyclable printed circuit boards (PCBs) for Shengyi Technology; a production carbon fiber bicycle by Pardus (a Taishan Sports brand, San Mateo, CA, US); automotive parts for Wuhu-based Chery Automobile Co. Ltd., in partnership with ELG CF; and research on recyclable wind blades, in cooperation with the University of Southern California. Adds Liang, “We’re currently teaming with a large US chemical company with global reach and the manufacturing capacity to make this technology available worldwide.”

In a similar vein, Connora Technologies’ trademarked Recyclamine product is a hardener for epoxy resins that likewise enables polymer crosslinks in cured composites to be broken by an acid, leaving a thermoplastic epoxy residue. The reinforcing fibers originally used in the composite part can be recovered without chopping or shredding, in their original form and architecture, without damage. CW has written about Recyclamine’s use in a high-pressure resin transfer molding (HP-RTM) process in cooperation with Fraunhofer Project Center for Composites Research (FPC, London, ON, Canada) and Fraunhofer ICT (Pfinztal, Germany). The study showed that, after recycling, the properties of recovered reinforcements were the same as virgin carbon fiber.

Applications are on the way. The company is continuing work on HP-RTM for the automotive industry via a Phase II SBIR project. More recently, Connora Technologies announced partnerships with Shred Optics (a company of Anomaly Action Sports USA, New Boston, NH, US), Future Fins (Huntington Beach, CA, US) and snowboard makers including Burton Snowboards (Burlington, VT, US), Niche Snowboards (Salt Lake City, UT, US) and the CAPiTA Mothership (Gail, Austria) to turn snowboard manufacturing waste into action sports accessories, says Connora CEO Dr. Rey Banatao. “Through our Recyclamine resin technology, we can recover all of the snowboard waste that typically goes to landfiill,” he says. “In addition to reclaiming the plastic and ber reinforcement components, the epoxy resin is transformed into a reusable thermoplastic that is injection moldable, to go back into the sporting goods industry, and reduce waste normally sent to landfill.” To reach industrial scale and cost Connora partnered recently with global epoxy producer and GL-certified wind turbine industry supplier, Aditya Birla Chemicals (Thailand) Ltd. (Lummpini, Bangkok, Thailand), which is now manufacturing Recyclamine at metric-tonne scale.

Many more composites recycling efforts, for lack of space, couldn’t be covered here. The Japan Carbon Fiber Manufacturers Assn. (JCMA) has operated a pilot plant in Ohmuta City, Fukuoka Prefecture, since 2009, and continues R&D efforts on recycling technology. The Korea Institute of Science and Technology’s (KIST, Seoul, South Korea) Carbon Convergence Materials Research Center has reportedly developed a wet-chemistry method for carbon fiber recovery that is 60% less expensive than pyrolysis. And Karborek (Martignano, Italy), which uses a patented combined pyrolysis and oxygen upgrading process, to avoid creating char on the fibers, is still providing Karbo Chopped and Karbo Felt nonwovens.

Recycling efforts have been implemented by individual suppliers as well. Toho Tenax Co. Ltd.’s (Tokyo, Japan) German subsidiary Toho Tenax Europe GmbH (Wuppertal, Germany), for example, recently introduced Tenax-E COMPOUND rPEEK CF30, a reinforced material that combines waste materials generated during processing of its Tenax ThermoPlastics, and recycled semicrystalline PEEK polymer, which contains 30% carbon fiber by weight and offers high performance for injection molding applications. Others, including Continental Structural Plastics (part of Teijin, Auburn Hills, MI, US), have in-house recycling operations at varying scales. And machinery firm Cannon (Peschiera Borromeo, Italy) co-funded a European project called CRESIM (Carbon Recycling by Epoxy Special IMpregnation) and has developed a method for wet compression molding of CFRP parts, using recycled carbon fibers.

Developing a business case

Composites recycling efforts are a puzzle right now, with lots of pieces that include technology, government and industry groups, standards and education,” says Pilpel. “You have to start with a basic business case.” For example, a company’s simplest step is to convert its waste to energy at the plant site, avoiding the cost of landfill disposal and recouping a small portion of the original material cost. Greater return on material cost can be gained if waste can be converted to new, useable forms for sale, or returned internally to a company’s process: “We need to find the hidden applications for recycled material,” he adds, pointing to the success of used auto tire recycling in the US, where uses of shredded tire waste were eventually found, to keep tires out of landfills.

Clearly, if automotive manufacturers do adopt carbon fiber in production vehicles in a big way, supply challenges will follow. High-value recycled carbon fibers can help bridge the supply gap, at a lower price point. ACMA’s Recycling Committee is working with ISRI (Institute of Scrap Recycling Industries, Washington, DC, US) as well as IACMI to develop a recycling infrastructure with reliable logistics, and to develop standards for recycled fibers. The looming question is the far greater quantity of glass fiber parts that could, and should, be recycled — at this point, however, the lower value of glass makes it more difficult to address, says Pilpel.

“There’s no silver bullet, because composites are complicated structures. But we’re on the road to understanding this and getting the industry talking logically. It’s an exciting time, because a recycling infrastructure is growing,” says Vartega’s Maxey. Adds ELG CF’s Barnes, “The situation is getting better — by 2019, I think composites recyclers will start to see real volumes.”

Related Content

Carbon fiber, bionic design achieve peak performance in race-ready production vehicle

Porsche worked with Action Composites to design and manufacture an innovative carbon fiber safety cage option to lightweight one of its series race vehicles, built in a one-shot compression molding process.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRecycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More