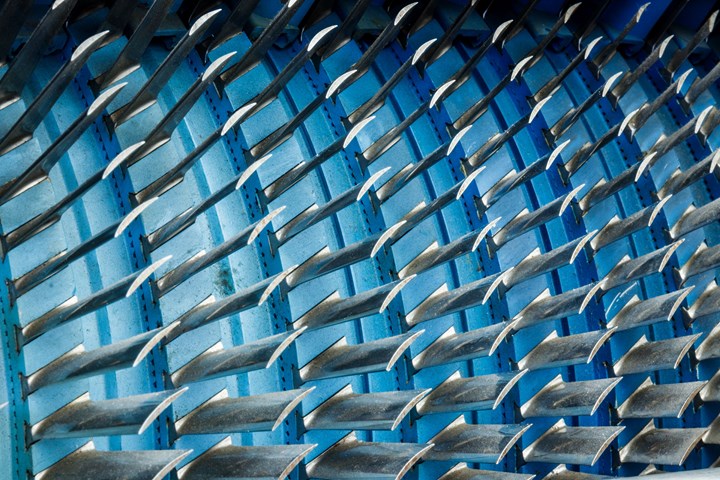

Air compressor turbine blades of an aircraft jet engine. Photo Credit: Getty Images

Aeroengine manufacturer Pratt & Whitney (East Hartford, Conn., U.S), announced on Oct. 22, 2020, that it will invest $650 million through 2027 in a new 1 million-square-foot facility for world-class production of turbine airfoils in Asheville, N.C., U.S. According to a press release issued by Pratt & Whitney about the expansion, the new facility will house an advanced casting foundry and also complete airfoil machining, coating and finishing operations. Of more interest to the composites industry, local sources have noted that this facility will also manufacture airfoils made from ceramic matrix composites (CMCs). This represents a major shift in materials and process application for Pratt & Whitney and is part of the company’s larger effort to position its engines for next-generation aircraft.

“Asheville is already home to a GE Aviation plant that manufactures high-tech ceramic fan blades for jet engines,” noted John Boyle in his Oct. 31, 2020, article for the Asheville Citizen Times. “The company competes with Pratt & Whitney, which will also manufacture high-tech ceramic jet engine parts — in Asheville's case, blades for the turbines inside jet engines.”

In the past, Pratt has downplayed the need for CMCs, choosing instead to highlight its innovations in metals technologies. That position started to pivot several years ago. As explained in a 2017 IndustryWeek article by Steve Minter, even as Pratt worked to introduce its PurePower geared turbofan (GTF) engine, which started production in 2016, it was already talking about upgrades that would use CMCs. “Innovation is the price of admission to be in this industry,” said previous Pratt president Bob Leduc. The article explains how the GTF currently uses double-wall metal turbine airfoil technology, but for “the next generation engine, Leduc said the company will turn to using ceramic matrix composites. ‘We think that ends up with a product in the next five to 10 years,’ he predicted.”

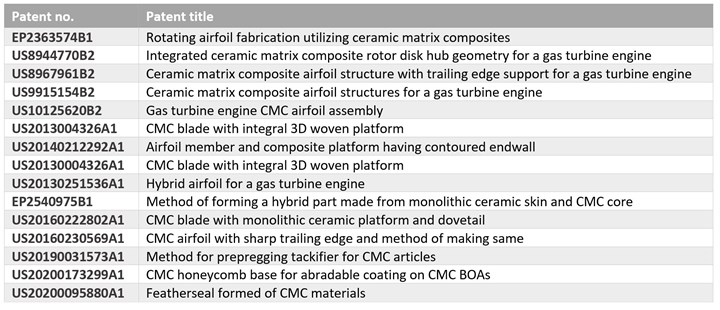

The case for CMC airfoil gets stronger when one looks at the long list of CMC patents awarded to Pratt & Whitney employees. Pratt & Whitney has actually been working on CMCs since the early 2000s. Many of these patents are for airfoils, but also for vanes, disks, hubs, rails, blade outer air seals (BOAS) and other turbine components as well as coatings. Note that these patents are assigned to United Technologies (UTC, Waltham, Mass., U.S.), which owned Pratt & Whitney as a subsidiary until April 2020, when UTC merged with Raytheon. These UTC patents proliferate from 2008 until 2020, numbering in the dozens.

United Technologies patents related to CMCs in aeroengines

Add to this Pratt & Whitney’s announcement in late 2019 that it would open a 60,000-squre-foot CMC research and development facility in Carlsbad, Calif., U.S. “Pratt & Whitney views CMCs as an enabling technology,” said Meggan Harris, Pratt & Whitney senior director for CMCs, in that announcement. Andrew Lazur, the director for the new CMC R&D facility, presented a paper titled, “Application of Ceramic Matrix Composites to Deliver Value” at the HT-CMC10 conference (Sept. 22-26, 2019, Bordeaux, France). As explained in the abstract below, CMCs are one means for Pratt & Whitney to meet its engine improvement targets (emphasis added):

“The Pratt & Whitney PurePower geared turbofan engine introduced dramatic improvements in propulsive efficiency and noise reduction. To continue improving the overall efficiency of our engines, further improvements to thermal efficiency are targeted. Ceramic matrix composites (CMCs) are one technology that offers significant promise in this area. The higher operating temperature of CMCs compared to current state-of-the-art single crystal castings will enable the reduction or elimination of component cooling air and may also enable higher combustion temperatures thereby increasing thermal efficiency. While CMCs offer tremendous promise, the cost of CMCs is a significant challenge. Multiple facets of cost must be addressed to deliver value to our customers and enable broad implementation of CMC technology. P&W will leverage broad expertise in the field of CMCs to optimize material systems for cost and performance.”

CMCs offer improvement vs. single-crystal alloys

Various sources report that Pratt & Whitney already manufactures CMC exhaust nozzles for the F135 engine used to power the F-35 Joint Strike Fighter. As explained in a 2009 article by Heyward Burnette at the Air Force Research Lab (AFRL, Wright-Patterson AFB, Ohio, U.S.):

“CMC components increase gas turbine engine fuel efficiency. Their accelerated machining can save hundreds of hours and tens of thousands of dollars. Applying this technology to a single set of F-35 aircraft engine parts would reduce related machining time by more than 100 hours and cut associated tooling costs in half. Potential applications include nozzles, blades, vanes, flame holders, and brakes.”

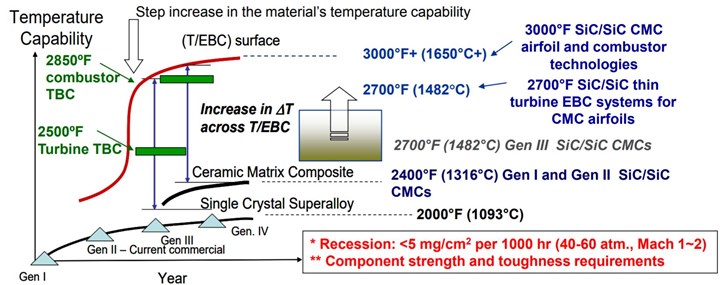

Notably, Pratt & Whitney introduced the PW1000G geared turbofan engine family without CMCs, using instead single-crystal nickel alloys and advanced thermal barrier coatings (TBC). However, this single crystal alloy technology can only take Pratt & Whitney so far. CMCs with advanced TBC (also called environmental barrier coatings, or EBC) offer a significant improvement as shown below from a 2017 NASA presentation. Note that Pratt & Whitney has been researching TBC/EBC technology not just for metals but also for CMCs and has participated in various NASA R&D programs.

Photo Credit: “Advanced Thermal Barrier and Environmental Barrier Coating Development at NASA GRC” by Dongming Zhu And Craig Robinson, NASA Glenn Research Center, presented April 6, 2017 at the Army Research Laboratory, Aberdeen Proving Ground, Maryland.

CMC airfoils for the A321 XLR?

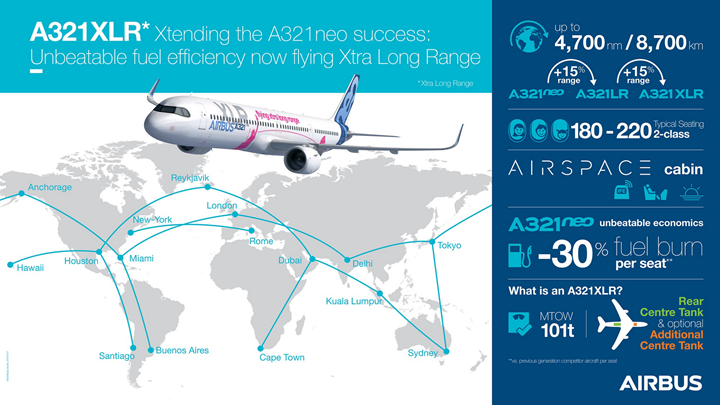

The PW1000G is currently the exclusive engine for the Airbus A220, Mitsubishi SpaceJet and Embraer's second generation E-Jets, and an option for the Irkut MC-21 and Airbus A320neo. Could the CMC airfoils to be produced in Pratt & Whitney’s new Asheville plant debut on a PW1000G upgrade in development for the Airbus A321 XLR? Announced in June 2019, the XLR stretched version of the A321, which was already the longest variant in the A320 family, offers 15% more range than the previous stretch model and 30% lower fuel burn per seat.

Photo Credit: Airbus

Leeham News and Analysis posted its thoughts based on an interview with Pratt & Whitney senior vice president of sales, marketing and customer support, Rick Deurloo. In the March 30, 2020 posting, author Scott Hamilton explained that Pratt & Whitney is developing “the next generation GTF,” an advancement over the current version, with more thrust and better economics. “We have been discussing with Airbus for some time an improvement to the current configuration or our expected configuration,” Deurloo added. Hamilton continued, “PW has been in conversation with Airbus for the last few years about an engine that will take configuration at the end of this year … PW planned to announce the name of the engine at the now-canceled [2020] Farnborough Air Show.” (Emphasis added.) Hamilton’s summary of this new engine:

- New name, better economics, better durability.

- Designed for the A321XLR, but greater flexibility.

- Fixing current issues.

This “new engine” is not just the set of fixes for the PW1000G’s current issues, as Deurloo explains in the Leeham post: “There’s been a lot of energy and attention on engineering and development right now around fixing the current motor to where we need it to be. We have everything in place to go do that … in the third block quarter this year [2020, emphasis added]. I think it’s important, because then it talks about what’s next. It sets us up for where we’re going.”

“We think to take that engine, and especially when you pair it up with it with the XLR, which is why Airbus pushed us pretty hard on this, it really is a differentiator for that airplane, for that market, for its capability,” said Deurloo in the Leeham post. Hamilton then noted: “Low-rate production is targeted for 4Q-2022. Airbus’ planned EIS [entry into service] for the XLR is 2023. Within 18-24 months, the new engine will be 100% Pratt standard, Deurloo said.”

Note, Pratt & Whitney will need every advantage it can get to compete with the LEAP 1A engine manufactured by CFM (Cincinnati, Ohio, U.S.), a joint venture between GE Aviation (Evendale, Ohio, U.S.) and Safran Aircraft Engines (Courcouronnes, France.). CFM president and CEO Gaël Méheust, in a November 2019 AINonline article by Chris Kjelgaard, said Airbus had indicated the LEAP 1A exactly meets the thrust, fuel-efficiency and dispatch-reliability requirements of the A321 XLR with no further changes. He also said that many LEAP 1A operators with high-hour A320neo family aircraft are seeing fuel efficiencies upward of 20% better than existing fleets. “The longer the LEAP is in the air, the better its fuel efficiency is,” said Méheust. This definitely plays well to this longest-haul narrowbody aircraft.

Investing for the future in Asheville

Why Asheville? Going back to John Boyles’ article in the Asheville Citizen Times, Pratt has seven facilities in the U.S., and according to Raytheon CEO Greg Hayes, the company is focused on moving work to lower-cost areas, citing $175 million in savings that Raytheon will realize by building the Pratt & Whitney facility in North Carolina.

Locating in the same vicinity as GE Aviation’s CMC facility will also help. When CW toured the facility in 2017, GE Aviation had its first line operational, making box shrouds and open shrouds for the LEAP 1A/C and LEAP 1B engines, respectively. “In the future, we will build combustor liners, blades, nozzles and other parts,” said Ryan Huth, GE Aviation’s manager for CMC production. Huth also noted that production technicians are trained locally at Asheville-Buncombe Technical Community College (AB Tech). “We have a close relationship with AB Tech,” said Huth, “which is about 10 minutes away. They built a composites center of excellence for our employee training, complete with autoclave and cleanroom.” Production technicians get 40 hours of training at AB Tech before being certified by GE. This local training and workforce will be extremely helpful if Pratt & Whitney is seeking to start low-rate production in two years.

According to Pratt & Whitney’s press release, its airfoil facility in Asheville will create 800 new jobs through 2027 in Buncombe County. “The new, state-of-the-art facility will implement best-in-class manufacturing technologies and processes exemplifying industry 4.0 manufacturing principles and will complement existing turbine airfoil work that is done across Pratt & Whitney’s facilities. This investment directly supports Pratt & Whitney’s goal to transform its business and strengthen its position by implementing modern solutions to prepare for the future, while reducing structural costs to emerge from the pandemic stronger.”

“This investment will enable Pratt & Whitney to continue to modernize and transform its operations with cutting-edge technologies," said Chris Calio, president, Pratt & Whitney. “Turbine airfoils are a critical component across our engine portfolio and demand will increase significantly as the market recovers over the next several years. We need to invest today to ensure that we have the infrastructure, production capabilities and workforce in place to meet future market demand and provide the best products to our customers worldwide.”

Pratt & Whitney declined to comment on the record for this report.

Related Content

Cryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreBioabsorbable and degradable glass fibers, compostable composite parts

ABM Composite offers sustainable options and up to a 60% reduction in carbon footprint for glass fiber-reinforced composites.

Read MoreSyensqo becomes new Solvay specialty materials company

Syensqo represents what was Solvay Composite Materials, focused on delivering disruptive material technologies and supporting growing customer needs.

Read MoreDaher CARAC TP project advances thermoplastic composites certification approach

New tests, analysis enable databases, models, design guidelines and methodologies, combining materials science with production processes to predict and optimize part performance at temperatures above Tg (≈150-180°C) for wing and engine structures.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More