In the recent article, “What to Expect in Commercial Aviation During the Next 10 Years,” Aviation Week editors discuss how current megatrends — including dynamics in the Boeing-Airbus duopoly and the drive for reduced CO2 emissions — may impact new aircraft design and production over the next decade, including in the advanced air mobility (AAM), regional and single-aisle sectors. Even though Airbus commands 60% of the narrowbody market — where the European OEM needs to avoid arrogance and missteps — market share in widebody aircraft is exactly opposite — and here, Boeing must overcome production challenges to convert orders into deliveries.

New aircraft at Boeing?

Artist’s concept of Boeing’s Transonic Truss-Braced Wing (TTBW) aircraft. Photo Credit: “NASA plans for subsonic flight demonstrator”

If Boeing does pursue an all-new aircraft design, possibilities listed include a reworking of its new midmarket airplane (NMA) development. Essentially shelved during the 737 MAX crisis, years of previous work could be reformulated into a single-aisle sized between the 737-9 and 757, with entry into service (EIS) by the early 2030s. This could then pave the way for a smaller, 100-180 seat single-aisle to follow in 2035-40. The latter could possibly use Boeing’s Transonic Truss-Braced Wing (TTBW), which it has been researching since the 2010s. Aviation Week reported in March that Boeing is preparing to submit its TTBW in response to NASA’s June request for proposals to its Sustainable Flight Demonstrator program. The goal is a partner to build a full-scale technology demonstrator X-plane that could fly by 2026 to test new green technologies.

Photo Credit: Boeing, Aviation Week “Boeing’s Digital-Design New Airliner Plan Faces Long Road Ahead”

Aviation Week editors posit that both of these potential aircraft at Boeing would be all composite with an engine likely derived from CFM’s RISE program, which aims to demonstrate advanced technologies for a 20% reduction in both fuel and CO2 emissions. Although RISE initially targeted an open fan design (no nacelle), it will pursue a range of technologies, including a geared fan, advanced materials and more electric features.

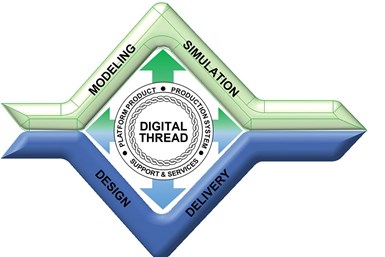

However, Boeing CEO David Calhoun says there will be no all-new aircraft until the company can meet key milestones in its digital transformation to model-based system engineering (MBSE), scaling from military aircraft (e.g., T-7A advanced trainer) to commercial aircraft (see “Boeing’s Digital-Design New Airliner Plan Faces Long Road Ahead”). Aviation Week reports that target is at least two years away and noted that for the T-7A program, “MBSE resulted in a 75% increase in the number of parts that passed quality inspections the first time, a reduction in development cycle time to just 36 months and an 80% reduction in assembly time due to the use of full-size determinate assembly techniques.”

“They probably have to build an NMA and a MAX replacement eventually,” says Adam Pilarski, senior VP at aviation industry consulting firm Avitas (Chantilly, Va., U.S.). The Aviation Week article continues, “Boeing’s NMA studies, slowed down over the past few years but silently continuing, were targeting the 757 replacement market, which is now rapidly becoming the Airbus A321XLR market. Given all the problems Boeing has to solve right now— 787 production, 777X certification, 737 MAX ramp-up, supplier challenges — Pilarski does not expect the OEM to move fast. “They will launch something in three years,” predicts Pilarski, which would likely lead to EIS by 2032. Another industry executive said Boeing doesn’t have three years, but must launch a competitor to the A321XLR in 12-18 months.

Another one of Boeing’s core requirements as part of a potential new aircraft program development is a new, more efficient engine — one that, according to Aviation Week, reduces fuel burn by 20-25%. Without such fuel cost savings, the value proposition of a new aircraft would be substantially eroded.

New aircraft at Airbus?

Aviation Week surmises that Airbus is trying to avoid launching a new airliner, at least not before its ZEROe hydrogen aircraft, which is slated for EIS in 2035. However, if Boeing should launch a new aircraft, then Airbus will probably have to react, because the first ZEROe aircraft will most likely sit at the bottom end of the narrowbody market.

The market expects Airbus to instead move ahead with new derivatives of existing aircraft. AvWeek reports the OEM has a strategic option for an “A322,” a further stretched A321neo with new engines and a new composite wing, for which the technology development work is essentially complete.

GKN Aerospace, along with Airbus, easyJet, Bristol Airport and others, launch Hydrogen South West consortium to develop net-zero infrastructure in U.K. Photo Credit: GKN Aerospace

The reference here is the Wing of Tomorrow (WOT) program, which CW has reported on extensively, including:

- OOA rear spar, thermoplastic ribs target Wing of Tomorrow

- Airbus assembles first WOT prototype

- Update: Lower wing skin, WOT

- WOT ribs: One-shot, thermoplastic, OOA consolidation

- FACC novel flap system for WOT

- GKN Aerospace delivers RTM demonstrator tool for WOT

Watch for a future article in CW on this last item and the 18-meter spar that GKN Aerospace has now manufactured and delivered to Airbus.

Turboprops, sustainability and UAM

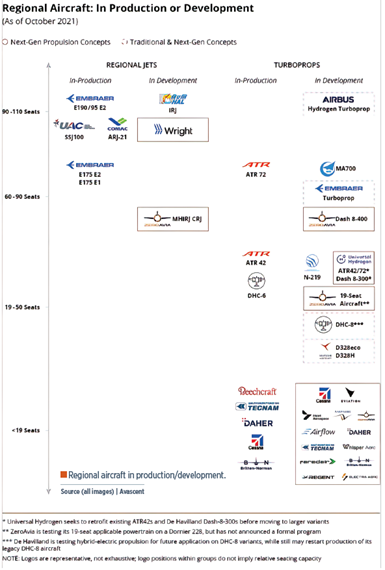

Aviation Week reports that in order to meet 2050 zero emission goals, the aviation industry must make significant progress across multiple fronts in the next 10 years. Watch for increasing use of sustainable aviation fuel (SAF) in medium- and long-haul aircraft as well as new zero-emission electric and hydrogen-powered regional aircraft. Numerous startups in Europe and the U.S. are pursuing the latter:

- Connect Airlines orders Universal Hydrogen conversion of 75 ATR regional aircraft

- New agreement with MHIRJ helps ZeroAvia hydrogen electric regional jet plans

- ATI releases final FlyZero aircraft concepts, technology roadmaps

- Deutsche Aircraft and H2FLY join forces to explore hydrogen-powered flight

Flights of retrofit nine- and 19-seat regional aircraft are slated to begin in 2025-26, with plans to bring new 40-80-seat electric, hybrid and hydrogen aircraft to the regional market by 2030. Their success, says the Aviation Week article, depends on those startups surviving through certification and delivering on the promise of lower operating costs that would make regional routes once again economical.

This issue of restoring regional routes is key as major airlines in the U.S. abandon smaller airports, citing their inability to make money. AAM could provide a very necessary solution to the hole that is widening in the market as major carriers abandon regional routes. As explained in CW’s March 2022 column on Regional Air Mobility:

Photo Credit: Avascent

“… fuel price increases have made regional operations increasingly unprofitable for smaller aircraft with limited capacity, forcing airlines to shift to larger aircraft or to just cancel service. For instance, the number of unique routes flown in North America by commercial aircraft with less than 50 seats dropped 40% between 2005 and 20182.

Scott Kirby, CEO of United Airlines, said in July 2021, ‘We’re struggling with [how to serve small cities]; we feel some obligation to keep the communities connected, but the economics ultimately aren’t going to work…’”

The article goes on to discuss the economics of regional aircraft with +70 and <50 seats, concluding that, “… the successful implementation of new propulsion technologies, supported by novel composite design and manufacturing, has the potential to revitalize regional route networks and position suppliers for longer term upmarket opportunities.”

Lighter weight and more fuel- and cost-efficient than jet engines, turboprops for future zero-emissions aircraft concepts being developed by (top left, clockwise) Embraer, FlyZero, Airbus and Electric Aviation Group (EAG). Photo Credit: Embraer, FlyZero, Airbus and EAG.

This looming revitalization is also pushing a renaissance in turboprops. Embraer is looking at a new but conventional turboprop in two versions — 70 and 90 seats — targeting a firm decision in 2023 and EIS by 2027-28. ATR is reportedly developing a revamped ATR 42/72 EVO family with a low-emissions megawatt-scale hybrid-electric propulsion system.

Other projects include the D328eco, a modernized 40-seat version of the Dornier 328, being developed by Deutsche Aircraft and the Swedish startup, Heart Aerospace, which plans to deliver the first ES-19 (19-passenger) electric airliner certified for commercial use by 2026. This resurgence in turboprops could bring a boon to composite propeller blade manufacturers. See CW’s August 2022 tour of Dowty Propellers (Gloucester, U.K.).

Composites, then, are a key enabler for the envisioned future of commercial aviation, necessary to lightweight the airframes and electric powertrains to meet required range and passenger/cargo capacities, but also to provide safe storage of hydrogen fuel and safety regulation mandated containment of batteries in the case of thermal runaway. The latter is well known for automotive electric vehicles (EVs) but becomes even more demanding for EVs in flight.

Read the entirety of Aviation Week’s article: “What to Expect in Commercial Aviation During the Next 10 Years”.

Related Content

Recycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreCirculinQ: Glass fiber, recycled plastic turn paving into climate solutions

Durable, modular paving system from recycled composite filters, collects, infiltrates stormwater to reduce flooding and recharge local aquifers.

Read MoreWatch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More