Adapting proven solutions for new markets

Hexagon Purus Maritime will adapt its well-proven H2 storage solutions for markets like distribution and heavy truck to meet the needs of a wide range of ship sizes and architectures. Photo Credit: Hexagon Purus

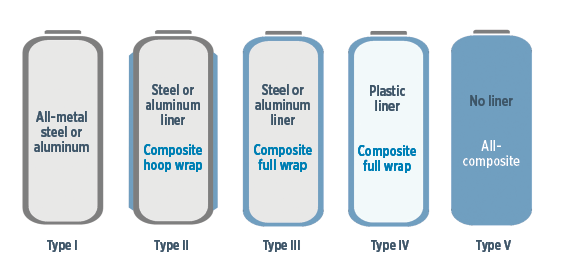

For years, carbon fiber-reinforced polymer (CFRP) composites have offered lightweight storage of compressed hydrogen (H2) gas for zero-emission, fuel cell-powered vehicles via Type IV tanks comprising plastic liners wrapped with carbon fiber and epoxy resin. Though H2 has long promised a sustainable source of clean energy, until recently, progress was slow. Even in CW’s Oct 2020 feature, “Carbon fiber in pressure vessels for hydrogen,” there was still serious doubt as to whether the long-awaited H2 economy would actually materialize.

One year later, that doubt is fading fast. For example, Universal Hydrogen (Los Angeles, Calif., U.S.), highlighted in the 2020 article, has signed letters of intent with three regional airlines to retrofit existing turboprop aircraft with H2-powered propulsion systems. Also highlighted, Cimarron Composites (Huntsvillle, Ala., U.S.) has now been acquired by Hanwha Solutions (Seoul, South Korea) and announced a $130 million new production facility in Opelika, Ala. Another composite tank manufacturer, NPROXX (Heerlen, Netherlands), is now a 50/50 joint venture with Cummins (Columbus, Ind., U.S.), a company that produces 130 million internal combustion engines per year and which has now invested in H2-producing electrolyzers, H2 engines, fuel cells and storage tanks.

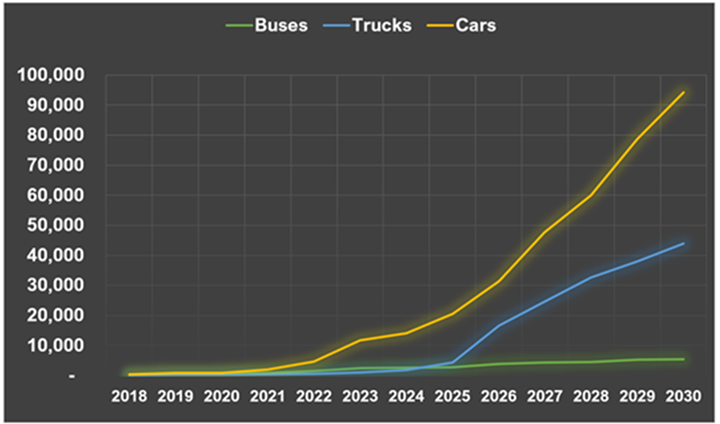

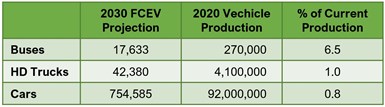

Growth projections for Type IV tanks are tremendous. For example, Hexagon Composites (Alesund, Norway), a leader in Type IV tank production, spun off Hexagon Purus in January to focus on zero-emission H2 and battery electric systems and storage. It estimates a 630% increase in tank revenues from 2025 to 2030.

However, Type IV tanks also face serious issues. Most notably, the cost of carbon fiber makes these tanks very expensive. Another key issue is storage density. Although compressed H2 gas offers three times the energy per mass of gasoline, its energy per volume is quite low, requiring large cylinders to contain the high pressures needed to store enough fuel. For mobile applications, the light weight that CFRP Type IV tanks offer has driven their use versus metal alternatives. But in stationary applications, including hydrogen refueling stations, weight is not the primary driver.

Hydrogen actually offers higher density as a cryogenic liquid, stored at -253°C, and the highest density — reportedly 50% more H2 versus 700 bar Type IV tanks — when stored in cryo-compressed (CCH2) tanks at -230°C and 300 bar. Cryotanks have typically been metal, and versions using significant amounts of composites have yet to be demonstrated with the same performance and fatigue life proven in Type IV compressed gas tanks, which have more than 25 years of performance data behind them. Cryomotive (Grasbrunn, Germany), founded in 2020 by Dr. Tobias Brunner, is developing metal CCH2 tanks based on his previous work at BMW (Munich, Germany).

Part 1 of this two-part series will explore the development of Type IV tanks for heavy trucks and cars, including Asia as the leading regional market, and the possibility that growth in CFRP tanks may actually be held back by a lack of carbon fiber production. Rapidly developing markets for tanks in rail and maritime applications will also be discussed.

Hydrogen for heavy-duty transport

Cummins is working on a fuel cell-powered Class 8 truck with longtime customer and truck manufacturer Navistar (Lisle, Ill., U.S.). The truck will be integrated into Werner Enterprises’ (Omaha, Neb., U.S.) 7,700-unit fleet for a year-long trial in local and regional service out of Fontana, Calif. Cummins has also begun testing a hydrogen-powered combustion engine (i.e., H2 is burned directly), which it will evaluate in various on- and off-highway applications. In a June 2021 interview, Cummins vice president for New Power Engineering, Jonathan Wood, said that by the end of this decade, such offerings will approach the total cost of ownership (TCO) of a diesel engine. As countries seek to meet zero-emission targets, he notes that future heavy-duty transport will be powered by hydrogen, fuel cell or battery electric — not diesel.

“In Europe, we have legislation that mandates truck OEMs, by 2030, must achieve 30% reduction in CO2 for their produced fleet, on average, compared with 2019 levels,” says Michael Himmen, managing director and head of sales for tank manufacturer NPROXX. “So, some portion of truck production in Europe will be hydrogen powered, perhaps as much as 5%, which could be as much as 15,000-20,000 trucks/year. It will start in 2026-27 at perhaps 2,000 trucks/year and increase steadily.” With five to seven Type IV tanks per vehicle, heavy-duty trucks could, within a decade, require 100,000 tanks annually, requiring 6,000 metric tons of carbon fiber. This would be 25% of Toray’s (Tokyo, Japan) current total carbon fiber production from its Japan, South Korea, France and U.S. plants, and 25% of Hyosung’s (Seoul, South Korea) planned capacity from 10 production lines in 2028 (see sidebar “FCVs and carbon fiber demand”).

“The heavy-duty transport sector is especially picking up speed,” says Jørn Helge Dahl, sales and marketing director at Hexagon Purus. He explains that H2 is more practical than batteries for larger vehicles because the increased size, weight and recharging time of batteries sufficient to meet the payload and range requirements becomes uneconomical. Hexagon Purus estimates revenues from Type IV hydrogen storage tanks of $1.1 billion and $7 billion in 2025 and 2030, respectively, with heavy-duty vehicles expected to make up the largest part (≈30%).

Light transport, cars and Asia

French automotive Tier 1 suppliers Faurecia (Nanterre) and Plastic Omnium (Lavallois) are new entrants to the Type IV tank market, both aiming for a 25-30% market share. They forecast production of 2 million hydrogen-powered vehicles/year by 2030, of which 1.5 million are light-duty and passenger vehicles (LDV and PV). Plastic Omnium says H2 car sales will start to pick up in 2027-2028, but Faurecia claims its activity with five LDV/PV OEMs in Europe and North America has already generated sales for 2022 and initial production of 80,000 hydrogen vehicle systems/year. Faurecia, Hexagon Purus, NPROXX and Plastic Omnium all offer complete hydrogen/fuel cell systems that comprise fuel cell stacks, storage tanks and auxiliaries. Faurecia claims that 40% of the value of fuel cell systems is in the H2 storage tanks, and 70% of that value is the tanks versus valves and other components (called the balance of plant, BOP).

Plastic Omnium points out that Asia is expected to lead in hydrogen fuel cell vehicle (FCV) sales, with 75% of the market, followed by 20% in Europe and 5% in North America. Indeed, China and Japan have announced targets of 1 million and 800,000 FCV in operation, respectively, by 2030, while Korea says it will convert all commercial vehicles to hydrogen by 2025 and targets 6.2 million FCV produced by 2040. Notably, these are all countries with significant carbon fiber production.

Accordingly, when Plastic Omnium set up its Δ-Deltatech (Brussels, Belgium) R&D center for fuel cells and H2 storage in 2019, it simultaneously established its ω-Omegatech (Wuhan, China) R&D center complete with pilot CFRP filament winding line and fuel systems test lab. Wuhan has been designated as China’s first “hydrogen city,” with 30-100 hydrogen fueling stations, three to five world-leading hydrogen enterprises and a hydrogen industrial park with more than 100 fuel cell automakers and related companies.

Meanwhile, Hexagon Purus announced a joint venture with CIMC Enric (Shenzhen, China) in March 2021, which will initially expand existing Type III pressure vessel production and, in parallel, install Type IV cylinder production. Ramped Type III production and construction of the new Type IV facility will begin in 2021, with a capacity of 100,000 tanks/year by 2025.

Fig. 3. Pressure vessel types

Pressure vessel types and construction as classified by the American Society of Mechanical Engineers (ASME) and the International Organization for Standardization (ISO). Photo Credit: CW

Iljin Composites — renamed Iljin Hysolus (Bongdong-eup, South Korea) for its Sep. 3, 2021 public offering on the Korea Stock Exchange KOSPI Index — is described as Korea’s only producer of composite tanks and sole supplier for Hyundai’s Nexo cars. Iljin also reportedly supplies tanks for Korea’s police and regional and transit bus systems and has two production sites, one in Jeonbuk province and one in Wanju.

In other activity of note, Toyoda Gosei (Inabi, Japan) produces the third tank for the 2021 Toyota Mirai and has a capacity of 30,000 tanks/year (Toyota produces the first two tanks for the Mirai in-house). In France in 2021, Faurecia closed its acquisition of leading Chinese tank manufacturer CLD (Shenyang) with two plants in Liaoning capable of producing 30,000 tanks/year.

According to a Dec 2020 “Overview of Hydrogen Storage Technology in China” by analyst firm Integral Co., China has preferred Type I and Type III tanks with very few companies manufacturing Type III. However, demand is increasing. Report author Stephanie Ao notes that Type IV tanks were actually prohibited in China until recently. Understandably, Type III tanks still dominate the Chinese market for H2 vehicles, especially for applications that require 35 MPa/350 bar. However, she points out that 70 MPa/700 bar Type III tanks are in the final process of testing validation. Top suppliers of Type III tanks include CLD — now owned by Faurecia — as well as Beijin Chinatank Industry, Furuise and Tianhai Industry.

Rail and bus: Easy infrastructure

Fig. 2. Hydrail picking up speed

Top to bottom: Alstom has sold 41 Coradia iLint H2 trains to Germany and is testing others in Austria and the Netherlands; French rail SNCF has ordered 12 of Alstom’s Coradia Polyvalent dual-mode overhead electric and H2 regional trains; Alstom is working with Eversholt Rail in the U.K. to convert electric trains to H2 Breeze trains; Siemens is developing the Mireo Plus H train for testing in 2023-24. Photo Credit: Alstom and Siemens.

Before Cummins formed its 50/50 joint venture with NPROXX in 2020, it acquired, in 2019, fuel-cell developer Hydrogenics (Mississauga, Ont., Canada), reportedly a first mover in locomotive-scale fuel cells. Cummins then announced in 2020 a new factory in Herten, Germany, to make fuel cell systems for Alstom’s (Paris, France) H2-powered Coradia iLint train, which is already in service in Germany (14 units to Lower Saxony began operating this year and 27 units to the Rhine-Main region will be in service by 2022). The iLint is also being tested in Austria and the Netherlands.

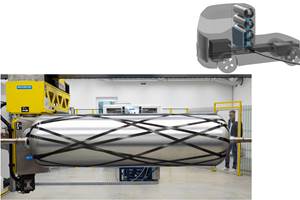

With a 1,000-kilometer range and a top speed of 140 kilometers/hour, the iLint matches current regional train performance. Its two-car units use 24 Type IV tanks housed in a rooftop compartment atop each car, which also contains the fuel cells. Hexagon Composites supplied H2 tanks for the prototype trains based on its 416-millimeter-diameter, 3,128-millimeter-long heavy-duty tanks, which hold 300 liters/9 kilograms of hydrogen at 350 bar. The iLint is now being supplied with 350-bar, 500-millimeter-diameter, 2,200-millimeter-long tanks from NPROXX.

Cummins is also working with Siemens (Munich, Germany), which is testing its two- and three-car Mireo Plus H trains on several regional lines in Germany during 2023-2024. Hexagon Purus, meanwhile, is supplying Type IV H2 tanks for Talgo’s (Madrid, Spain) Vittal-One train, slated to begin testing in 2023. Hexagon Purus will also supply tanks to Stadler Rail (Bussnang, Switzerland) for its first FLIRT train to be built and tested in Switzerland and then transferred to San Bernadino, Calif., for service in 2024.

In Japan, Toyota has partnered with Hitachi (Tokyo) and East Japan Railway Co. (Tokyo) to develop a two-car train with a 140-kilometer range, top speed of 100 kilometers/hour and H2 storage capacity of five 700-bar, 51-liter/2-kilogram tanks in each of four storage compartments for a total 40 kilograms of H2. It will be tested in 2022 in Tokyo suburban service. China is also testing fuel cell-powered trams for short urban service. Developed by China South Rail Corp. subsidiary Sifang (Qingdao, Shandong) in collaboration with fuel cell supplier Ballard Power Systems (Burnaby, Canada), this demonstration line in Foshan, Guangdong province uses five trams, each comprising three coaches with a 125-kilometer range and top speed of 70 kilometers/hour. Each tram uses six 350-bar tanks to store 104 liters/4 kilograms of compressed H2 gas.

In the freight train market, Sierra Northern Railway (Sacramento, Calif., U.S.) will replace a diesel locomotive with a hydrogen fuel cell locomotive at the Port of West Sacramento, equipped with fuel cells from Ballard Power Systems and 225 kilograms of H2 in storage tanks. The locomotive will start service in 2023 and be refueled at a new hydrogen station to be constructed by Royal Dutch Shell (The Hague, Netherlands).

Ballard is also retrofitting an existing diesel-electric linehaul freight locomotive for Canadian Pacific (Calgary, Alberta), to be operational by 2022, as the first step in its hydrail program. Retrofitting locomotives, which have a 50-year plus life cycle, is seen as a viable and cost-effective alternative to purpose-built hydrail trains.

A significant advantage of hydrogen-powered rail — passenger or freight — is that it requires no modification to the existing track. By comparison, the cost to electrify track (e.g., catenary lines and third rails) for conventional electric trains in the U.K. ranges from $965,000 to $1.3 million per kilometer. A 2017 report for Caltrain (Can Carlos, Calif., U.S.) noted that electrification of the San Francisco-to-San Jose commuter line using 22 fuel-cell trains and including construction of hydrogen filling stations (HRS) would cost $1.3 billion, versus $3.1 billion for 22 conventional trains with overhead contact system (OCS) — a savings of $1.8 billion.

“It may be surprising that rail is a market already moving forward,” says Himmen at NPROXX, “but like buses, I think one of the key factors is infrastructure. For both, you can easily solve the infrastructure because they come back to the same depot every day with filling stations at those depots. For example, Cologne’s regional transit system, RVK, has the largest fuel cell bus fleet in the world — 37 buses in daily operation and 15 more to be added by the end of this year — with just two hydrogen filling stations. They started going zero-emission in 2009 and they are still adding to that fleet. So, the infrastructure is relatively easy and helps to push that market forward.”

Maritime: Rethinking architectures, business models

In June 2021, Hexagon Purus announced it would establish a new subsidiary, Hexagon Purus Maritime. Though Hexagon has been involved in maritime hydrogen programs for some years, “we are now seeing that the maritime requests and activities for hydrogen are rising quickly,” explains Jørn Helge Dahl, sales and marketing director at Hexagon Purus. “Hexagon Purus Maritime will develop onboard storage systems, from the shipside fuel line feeding into the storage and from the storage down to the fuel cell. We think composites are the ideal storage solution for maritime applications, due to the harsh environment, including corrosion.”

But what about large metal tanks to provide longer range? “As companies start to look at hydrogen, we see they would like as large and few tanks as possible,” concedes Dahl, “but there is a huge range in architecture and types of vessels. There is no ‘one size fits all.’ If you have a smaller, fast ferry vessel, the larger tanks might be too large. That is why we will work with companies to adapt our proven tanks along with the vessel architecture to provide the right-sized solution. We will then walk through the approval process with DNV.” Det Norske Veritas (DNV, Oslo, Norway) is one of the leading classification societies for ships and also has a long history in composites.

What about liquid hydrogen? “In the past, there was a lot of focus on liquid hydrogen as the only way to serve the maritime industry,” says Dahl. “But over the last three to four years, we see a trend of companies having looked deep into using liquid hydrogen and coming back to compressed gas again. It’s not only about how to manage hydrogen on the ship itself, but also about the infrastructure, the fueling and the bunkering. And now we are also seeing companies think differently about the ship architecture in order to store more hydrogen onboard.”

Dahl believes the maritime industry will see rapid change in the middle of the decade, with an increased number of projects going live as 2030 approaches. This is driven, he explains, by the targets set by the International Maritime Organization (IMO, London, U.K.) that all new builds and existing ships must cut CO2 emission compared to the 2008 baseline by 40% in 2030 and 70% in 2050. “In addition, we see actions rising from local jurisdictions,” says Dahl. “For example, there are some World Heritage fjords in Norway requiring zero emissions by 2026. This will exclude the big cruise ships; so, they will have to develop smaller vessels to take people into the fjords. We will see more of these kinds of restrictions in dense river transport areas in Europe. Especially with the UN climate report coming out [recently], I think we have just seen the start and much more will come in terms of regulations.”

Part 2 of this series will explore the use of Type IV tanks in H2 refueling stations and tube trailers for distribution, as well as tank cost, storage efficiency and sensors for tank monitoring and recertification.

Related Content

Bio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

STELIA Aerospace Composites advances hydrogen storage

STELIA Aerospace subsidiary converts aero experience into industry-leading storage efficiency for fuel cell applications.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More