Thermoplastic composites: Inside story

Reinforced thermoplastics buy their way into structural aircraft interior components.

Once a rarity in aircraft, reinforced thermoplastic composites (RTCs) today are fast finding applications in aircraft interiors as interior manufacturers discover the toughness, fast cycle times and other RTC benefits that are familiar to composites fabricators in other markets. This dramatic shift owes much to the development of high-performance engineered thermoplastics, including polyetherimide (PEI), polyphenylene sulfide (PPS), polyetheretherketone (PEEK) and polyetherketoneketone (PEKK). Inherently fire resistant, these advanced materials are enabling manufacturers of aircraft interiors to meet more stringent flame, smoke and toxicity (FST) standards. Moreover, automated processes and labor-saving joining technologies are making RTCs cost-effective for production of safety- and weight-critical components, including large structures and parts with complex geometries. As the following case studies illustrate, carbon and carbon/glass RTCs are successfully hitting strength, stiffness, toughness, weight and cycle time targets, displacing not only legacy metallic designs but thermoset composite options as well.

RTC floors cut weight and increase durability

Stork Fokker AESP (Hoogeveen, The Netherlands) has supplied carbon/PEI floor panels for Gulfstream 550 (G550) executive jets since 1995 (see “Learn More,” at right) and is gearing up to produce them for the new Gulfstream 650 (G650). According to Arnt Offringa, Stork Fokker’s R&D director, “We are the sole source for the full floor of the G550 and G650, and we also supply the G450 cockpit floor, which changed to thermoplastic composites as a postproduction modification.” For the G650, Stork Fokker will produce two flooring types: nonpressure floors, which carry moderate shear loads and traffic loads from passengers/crew in the cockpit, cargo hold and part of the aircraft cabin; and pressure floors, which double as the primary structure pressure bulkhead above the wheel bay (temperatures down to -55°C/-67°F and design pressure differential of 27.6 psi/1.9 bar). The floors offer structural performance and damage resistance (toughness) yet meet cost targets due to low-cost processing, like thermofolding of edges and welding of inserts. Offringa claims that weld time is less than one second per insert, with many hundreds of inserts per aircraft flooring set.

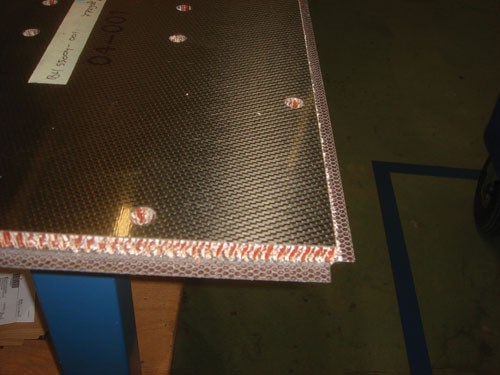

Nonpressure floors begin as 4-ft by 12-ft (1.2m by 3.7m) sandwich panel stock, featuring carbon fabric/PEI CETEX laminate skins (TenCate Advanced Composites, Nijverdal, The Netherlands) and honeycomb core, from Euro-Composites (Echternach, Luxembourg), made from Nomex paper supplied by DuPont Advanced Fiber Systems (Richmond, Va.). Skins and core are joined with AF163 modified epoxy film adhesive (3M, St. Paul, Minn.). The core is machined away from the bottom skin along the panel edges, and the skin is then thermofolded upward to seal the edges. Next, thermoplastic inserts are welded in place and the edges are sealed automatically with a thermoplastic material that has a lower melt temperature than PEI.

Because the nonpressure floor design required skins that were both lightweight and highly resistant to damage from spike-heeled shoes, Stork Fokker tested them by pulling a weighted roller fitted with spiked heels over test panels 20,000 times, after which the panels underwent four-point bending tests. “The strength retention of the thermoplastic panels far exceeded that of previous metal and thermoset composite options and was the reason Gulfstream chose thermoplastics for these nonpressure panels,” says Offringa.

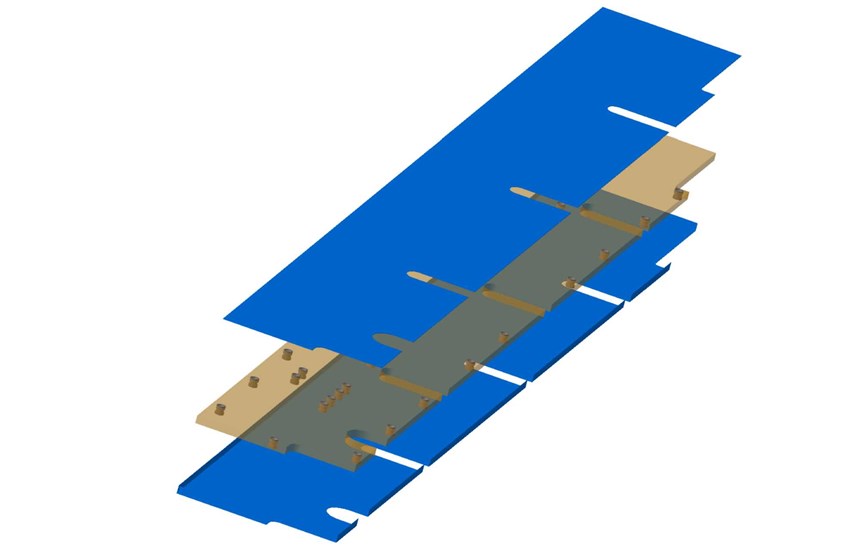

The pressure floors each feature a “picture frame” made from press-formed uni carbon/PEI profiles (C-sections), with carbon/PEI CETEX skins of the same type used on nonpressure floors bonded on either side, using AF 163 adhesive. As primary structure, they required much more extensive development. Stork Fokker manufactured more than 600 certification test specimens for this panel type. “We use a special technique to guarantee the bondline quality between the skins and C-sections, which increases the shear strength of the bonded-in aluminum inserts by a factor of two,” says Offringa.

This panel design provides high shear load capability and was developed using knowledge-based engineering (KBE) tools to reduce nonrecurring costs and lead time (see sidebar at end of this article). The first shipset of G650 floor panels is scheduled for delivery this month in preparation for the aircraft’s expected entry into service early in 2012.

In 2002, Tods Aerospace Ltd. (Crewkerne, Somerset, U.K.) developed a thermoplastic structural sandwich floor section to support fully reclining aircraft seats (see “Learn More,”). This structure, also known as a plinth, consists of Tods’ modified version of TenCate’s CETEX System 3 panels, with a molded-in carbon (or glass) epoxy composite structural beam to provide load transfer from the seating module to the aluminum seat track and handle 16G crash loads. The System 3 panels are made using skins of woven glass fiber impregnated with Ultem PEI supplied by SABIC Innovative Plastics (Pittsfield, Mass.). The skins are attached to PEI tubular core (Tubus Bauer, Bad Säckingen, Germany) using Sharnet SN4275 copolyester thermoplastic adhesive (Bostik, Middleton, Mass.). The adhesive reportedly produces an excellent bond when heated to 150°C/302°F, a temperature that does not alter the PEI skins.

Plinths of this design have been incorporated into premium-class seating modules manufactured by Contour Premium Aircraft Seating (Cwmbran, Wales), which are now flying on Virgin Atlantic Airways, Air New Zealand, Cathay Pacific, Delta Air Lines, Air Canada and Jet Airways aircraft. According to Tom Hitchings, Tods Aerospace business director, “This solution reduces the amount of aluminum required to meet structural requirements, reduces weight and is impervious to moisture uptake vs. traditional honeycomb-cored flooring.”

RTCs take seats in commercial aircraft

Cutting Dynamics Inc. (CDI, Avon, Ohio) annually delivers more than 100,000 aluminum seat backs and also supplies thermoset composite seat components to the major aircraft seat manufacturers. In 2007, however, the company established a thermoplastic composite seat production center and became the exclusive North American licensee of the patented Relay Station automated tape laying cell, developed by Fiberforge (Glenwood Springs, Colo.) specifically for production of aircraft seat structures. The move was prompted by the fact that hand-layed and autoclaved thermoset composite seat components cannot meet airline cost targets unless they are made offshore, says CDI’s CEO, Bill Carson. “Thermoplastics make sense because they are made using an automated process which offers the best chance of being able to manufacture the parts here in the U.S.,” he points out. “They also meet all of the FST requirements, excelling in the heat release tests where thermosets struggle, and they offer recyclability at the end of the product’s life cycle.”

“Thermoplastics meet FST without any additional process steps or coverings, saving both weight and cost,” notes Fiberforge CEO John Fox-Rubin, adding that the tape-laying cell’s speed makes the product cost-competitive and ensures that CDI can meet customer schedules (the typical coach-class seat-back program averages 8,000 to 10,000 units per annum).

For the first prototype, tested and patented by CDI, an existing 18-inch by 30-inch (457-mm by 762-mm) aluminum seat back design was re-engineered, with the help of Fiberforge, to use PPS from Ticona (Florence, Ky.) reinforced with commercial-grade carbon fiber from Hexcel (Dublin, Calif.). According to Fox-Rubin, this early, conservative design reduced part weight by 1 lb/0.45 kg or between 20 and 30 percent. Subsequent iterations used carbon/PPS unitape from TenCate. However, Fox-Rubin and Carson agree that carbon RTCs can cut weight by 40 to 50 percent vs. aluminum if the design is optimized to take advantage of the material and process. CDI has already cut material cost by using finite element analysis to determine that a standard 4-inch/100-mm width for the 0.008-inch/0.2-mm thick tape minimizes waste while meeting production and structural requirements.

Carson says production carbon/PPS seat backs have been installed already on in-service aircraft, and CDI’s newest, yet-to-be-released model will appear at the Aircraft Interiors Expo in Hamburg, Germany (March 31 to April 2, 2009).

CDI is working on new applications, including nominal 12-inch by 18-inch (305-mm by 457-mm) seat pans, which support the seat cushion. Carson notes that all three of the major aircraft seat suppliers are interested in thermoplastic composite seats.

Meanwhile, Dutch Thermoplastic Components (DTC, Lelystad, The Netherlands) reports that it has commercialized a glass-and-carbon/PPS replacement for an aircraft seat pan previously made from aluminum. The redesigned, FST-compliant, 1-ft by 1.5-ft (0.3m by 0.6m) structure is made using thermoplastic prepreg materials, mostly from TenCate but also from Porcher Industries (Badiniéres, France). It is press-formed at ~330°C/625°F and pressures of 20 to 50 bar (290 to 725 psi) with an cycle time of only two to five minutes. The seat pan thickness varies from 1 mm to 3 mm (0.04 inch to 0.12 inch) to optimize its ratio of structural efficiency to weight. “They have already squeezed a lot of weight out of the aluminum seat pan designs,” says DTC’s CEO, David Manten, “so you must be able to optimize the thermoplastic composite design in order to save any further weight.”

To offset some of the high cost of carbon fiber, says Manten, “we added fiberglass, which also is structurally favorable because it is more flexible than carbon.” Manten says the business-class seat pan is undergoing in-flight evaluation on Boeing 737 and 757 aircraft but will be adopted in economy-class seats when its in-service performance is proven — a move that will result in production of tens of thousands of pans annually.

DTC also manufactures reinforced thermoplastic monuments, a term for any interior piece that is not a seat or a galley component. One DTC monument program involves a hatch, or table flap, that closes the table-storage space between upper-class seats. This 150-mm by 400-mm (5.9-inch by 15.8-inch) part is made from the same material as the seat pans previously described because the thermoplastic offers weight reduction and, unlike traditional thermoset composites, can be produced cost-effectively in annual volumes of several thousand units. Manten explains, “Our process is very much like sheet metal forming and able to supply a lot of parts very quickly.” DTC buys preconsolidated laminate from Bond-Laminates (Aachen, Germany). The laminates can be provided in sheets of up to 13 plies thick and are specially designed for each application. DTC precuts the laminate using a waterjet or sheet cutter and then stamp forms the hatch shapes on presses capable of 400°C/752°F processing temperatures. Demolded parts are trimmed and drilled using a 5-axis CNC machine made by CMS (Zogno, Italy).

Carbon RTC provides out-of-autoclave cockpit floor

Cytec Engineered Materials’ (West Paterson, N.J.) thermoplastics business manager, Steve Cease, reports that in 2003, Airbus developed a 15-ft by 20-ft (4.6m by 6.1m) cockpit floor for its A400M military transport. “If traditional autoclave methods had been used,” he contends, “the structure would not have been cost-effective.” In place of a thermoset composite, Airbus used Cytec’s APC-2 thermoplastic unitape, a prepreg that combines AS4 carbon fiber from Hexcel and Cytec’s PEEK. The floor’s beam and panel materials were vacuum consolidated in an oven and then sheet formed via a stamping press at the Airbus plant in Saint-Nazaire, France. Processing temperatures ranged from 380°C to 400°C (716°F to 752°C). Beams and panels were joined by fusion bonding and mechanical fasteners, providing an out-of-autoclave option that reduced manufacturing time.Airbus France indicates in three cockpit floor patents received between 2005 and 2008 that “although PEEK resin is preferred due to the high mechanical performances that can be achieved using it, other thermoplastic resin types could be used, such as PEKK or PPS resin.” The patents describe a carbon RTC cockpit floor made using six longitudinal spars, seven crossbeams, two to five stiffeners parallel to and set between each set of crossbeams, and a rigid, constant-thickness skin, which is riveted to the spars, crossbeams and stiffeners. The floor replaces a previous design of aluminum spars and stiffeners that are reinforced by upper and/or lower metallic plates and use honeycomb-cored sandwich panels as a walking surface. According to patent documentation, the carbon RTC floor potentially offers more than 20 percent weight reduction vs. the previous design and drastically reduces the part count.

Weight savings and FST performance were two of the key design drivers. PEEK reportedly meets stringent heat-release test requirements that epoxy resins could not, and Cease believes Airbus saw great benefit in a cockpit floor where each component and the complete assembly delivered the required FST performance. Cease notes that APC-2 was preferred over other thermoplastics because it has the most comprehensive database for aerospace structural applications, dating back 20 years. In addition, the specific grade of PEEK used in APC-2 permits stamp forming of as many as 30 plies in a heated press in as little as 5 to 10 minutes, depending on part complexity and independent of part size, which is limited only by press capacity.

Carbon RTCs see potential boom in brackets

A potentially huge application for RTCs is the hundreds of brackets used to attach interior substructures, such as stow bins, floors, sidewalls as well as cable harnesses and ducting used in aircraft electrical, control and ventilation systems. RTCs are finding favor here, in part, because airframes are transitioning to carbon/epoxy construction. On legacy aluminum airframes, adjacent carbon fiber (CF) composites had to be fabricated with glass fiber isolation plies to prevent galvanic corrosion with aluminum, which added parasitic weight. Cytec’s Cease notes, “With the all-CF composite airframes that are being developed now, this same concept turns the situation upside down in favor of composites.” Traditional stamped aluminum clips and brackets will cause galvanic corrosion when they are placed in contact with CF composite airframes.Because there are thousands of brackets on every aircraft, Cease believes that some airframers can’t afford to make them from vacuum-bagged and oven- or autoclave-cured thermoset composites. Stamp-formed RTCs, however, offer a viable, fast-cycling process for volume production of these and other small parts. This claim is substantiated by several new and ongoing programs conducted by the following manufacturers: Greene, Tweed & Co. (Kulpsville, Pa.), DTC, Tods Aerospace and Advanced Composites and Machines GmbH (ACM, Markdorf, Germany), a business unit of xperion GmbH (Herford, Germany).

According to Greene, Tweed’s aerospace project manager, Jennifer Cross, “We are pursuing around 40 different opportunities for brackets.” The company’s trademarked Xycomp composites are carbon-reinforced and can include PEEK, PPS or PEI as a matrix. “For some applications we use continuous fiber-reinforced thermoplastic prepregs,” explains Cross, “but others require discontinuous long-fiber reinforcement because it enables us to make complex shapes that are not possible with continuous reinforcement.” Cross explains that Xycomp can be processed via automated tape laying and compression molding, as well as its patent-pending Techna3 process for net-shape manufacturing of complex tubular shapes. Cycle times for compression molding vary because one mold could produce as many as 12 parts, but generally, a cycle that comprises mold preheating, material placement, forming and cooling will consume a few hours. Although the hardened steel tooling used in the process is more expensive than a composite tool for autoclave processing, the overall part cost is competitive with thermoset composites and metals because the tooling cost can be amortized over thousands of parts. Also, the net-shape processes virtually eliminate scrap.

Aimed primarily at components that can be accommodated within a 2-ft/0.6m processing envelope, Xycomp reportedly can provide a 30 to 60 percent weight savings, depending on what is being replaced: aluminum, titanium or thermoset composites.

For two to three years, DTC has specialized in continuously reinforced thermoplastic clips, cleats and brackets for Airbus and Boeing. The majority are made from carbon/PPS, but some PEKK and PEEK parts are in development. TenCate supplies the preconsolidated carbon/PPS laminates (4 ft by 12 ft/1.2m by 3.7m), and the parts are thermoformed at roughly 330°C/625°F at pressures between 20 and 50 bar (290 and 725 psi) with a cycle time of several minutes. Although many of the parts are small, they are critical structures — clips that connect the structural ring frames to the fuselage, straps that join floor beams to frames and intercostals that reinforce the fuselage door openings. (RTCs are also making inroads in other portions of commercial aircraft. See "RTCs take the heat in wings and nacelles," the second of two sidebars posted below this article.) DTC’s Manten believes that there will be thousands of similar parts aboard the Boeing 787 and Airbus A350 platforms. The company also has roughly 100 different clips and brackets in production. “We are increasing capacity next year to accommodate the new programs coming online,” he says.

RTCs poised for potential growth

The trends previously outlined can be expected to continue. Based solely on the applications discussed in this article (and accounting for brackets in commercial transport aircraft only), the market estimates provided in “Advanced Composites in Commercial Transport Aircraft Interiors,” an upcoming report from Composite Market Reports (Gilbert, Ariz.), are very positive. The market research firm projects an annual volume of between 300,000 and 625,000 lb (134 and 283 metric tonnes) of RTCs by 2017. At that point, RTCs will account for ~6 percent of the overall OEM aircraft interiors market. The report identifies brackets, floors and support beams as strong candidates for RTC growth. RTC-for-metal substitutions represent one of the means by which aircraft OEMs could meet the 25 to 30 percent reductions in fuel burn and operating costs that commercial operators are demanding from next-generation single-aisle passenger aircraft.Related Content

Welding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MoreNext-generation airship design enabled by modern composites

LTA Research’s proof-of-concept Pathfinder 1 modernizes a fully rigid airship design with a largely carbon fiber composite frame. R&D has already begun on higher volume, more automated manufacturing for the future.

Read MoreComposites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRead Next

Thermoplastic composites gain leading edge on the A380

Breakthrough manufacturing process produces lightweight, affordable glass-reinforced PPS J-nose on the worlds largest commercial aircraft wing.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More