Thermoplastic composites technology: A view from Europe

For this Dutch consortium, bringing the manufacturability of thermoplastic materials to maturity is the goal in concert with OEMs, materials and equipment supplier members.

Thermoplastics remain perpetually five years from maturity.

This quote from an industry insider, recorded in a 1994 update on thermoplastic matrices in composites applications published in CW’s predecessor, High-Performance Composites magazine, still rings true more than 20 years later.

There is progress, however. Thermoplastic composites are earning a growing share of structural applications, and their many benefits are a lot closer to maturity today in Europe than anywhere else. One reason is the Thermoplastic Composites Research Center (TPRC, Enschede, The Netherlands), a well-known thermoplastics consortium backed by The Boeing Co. (Chicago, IL, US) and an impressive array of industrial suppliers, together with the University of Twente, Saxion University and The Delft University of Technology, all based in The Netherlands. “There is enormous demand for strong, durable, yet lightweight materials to decrease energy consumption,” says TPRC’s general manager Harald Heerink. But he points out, “In the past, there have been some huge expectations concerning thermoplastic composites, which were never fully met. One of the root causes for this was a general lack of in-depth knowledge of these materials.”

CW had the chance to visit TPRC and several nearby TPRC members’ facilities, and learned that the Centre, its partner firms and key thermoplastics-focused groups in other parts of Europe (see “European consortia, galore!” at the end of this article or click on its title under "Editor's Picks" at top right) aim to change that paradigm. Consortium members are conducting an array of research projects intended, ultimately, to improve the entire thermoplastics value chain, including processing methods, for composite parts.

A knowledge institute

Why is Europe such a hotbed for thermoplastics development? One very strong motivation is that European countries have adopted stringent vehicle end-of-life goals (see “Learn More”), and, therefore, favor thermoplastics for their recyclability. Another, says Arnt Offringa, director of R&D at Fokker Aerostructures (Hoogeveen, The Netherlands), is that his company and others in Europe, including TenCate Advanced Composites (Nijverdal, The Netherlands) and DSM (Heerlen, The Netherlands), invested in thermoplastics technology consistently for 25 years and now are reaping the benefits. “This investment was kept up,” Offringa points out, “even during the major aerospace downturn of the mid-1990s.”

Dutch thermoplastic R&D programs attracted the attention of Boeing in 2007, says Heerink, which led to initial collaboration related to thermoplastic structure among Boeing, TenCate, Fokker Aerostructures and the University of Twente. In 2008, the group undertook two joint research projects on materials, joining and bonding, with assistance on best practices from The University of Sheffield’s Advanced Manufacturing Research Centre (AMRC, Sheffield, UK). “The effort found numerous themes that required a decent amount of fundamental research,” says Heerink. That led to an agreement to form the TPRC in 2009, which, in essence, created a new member of Boeing’s GlobalNet network of research centers, which exists to provide innovation and development of materials and technologies for the aircraft manufacturer.

Three years later, TPRC’s facility became operational, adjacent to the University of Twente’s campus, says Remko Akkerman, a professor at the University of Twente and the TPRC’s technical director: “We were able to create a base, with the right equipment, to conduct research. It’s a ‘knowledge institute,’ based on Boeing’s consortium model, where members all along the value chain help shape our roadmap for research activities.”

Membership in the consortium can be “full” Tier 1, or Tier 2, which involves a lesser monetary commitment. Tier 1 members are Boeing, Fokker Aerostructures, TenCate, Alcoa Fastening Systems and Rings (Torrance, CA, US), the University of Twente and Saxion University of Applied Sciences, with multiple campuses in The Netherlands, including Enschede. Currently, Tier 2 members are Coriolis Composites (Queven, France), DAHER (Nantes, France), Pinette Emidecau Industries(Chalon Sur Saone, France), Instron (Norwood, MA, US), KVE Composites Group (The Hague, The Netherlands), Aniform (Enschede, The Netherlands), Dutch Thermoplastic Components BV (DTC, Almere, The Netherlands), and the Delft University of Technology (TU Delft). In addition, Heerink explains, there are a dozen “bi-lateral” project members that conduct projects to become familiar with thermoplastic materials for a fee but are not consortium members. Most of the current bi-lateral participants are auto industry OEMs and their Tier suppliers.

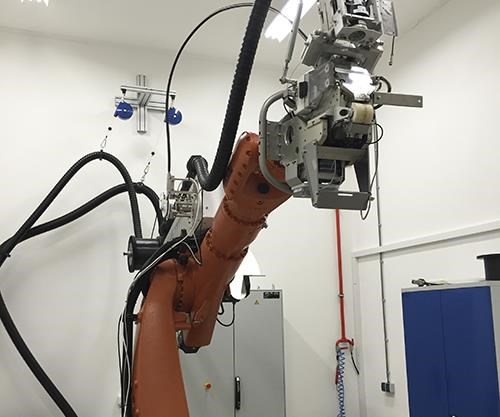

TPRC’s building houses layup tables, a lab-scale autoclave manufactured by Italmatic Presse e Stampi Srl (Cassina de’ Pecchi, Italy), an automated, high-speed compression molding work cell from Pinette Emidecau and a robotic, automated tape placement (ATP) system with a single-tow head, supplied by Coriolis. A material testing laboratory, offices, conference rooms and material storage finish out the roughly 1,000m2 floor space within the building. Heerink explains that the consortium receives European-level and regional funding, in addition to fees paid by members, to finance the equipment and research work. Specific projects are selected and guided by the TPRC’s consortium board and technical advisory board. New technology developed at the facility is the property of TPRC, through a subsidiary entity. “We own the intellectual property,” says Heerink, but emphasizes that “Tier 1 members have automatic usage rights to that IP.” Like Tier 1s, Tier 2 members also may participate in all projects, but Tier 2 usage of IP, he says, “must be approved by the Tier 1 members.”

“A big focus here is development of more — and better — engineering design tools, both software and material property databases, for thermoplastics, to aid engineers in part designs,” adds Akkerman, who was instrumental in starting AniForm, which offers a solver for simulating how composites behave during molding. Other ongoing TPRC research includes investigation into the following:

- Overmolding (where a structural fiber-reinforced composite element becomes part of an injection molded component; see “CAMISMA’s car seat back: Hybrid composite for high volume” under "Editor's Picks").

- Stamp-forming.

- Laser-assisted thermoplastic tape placement.

- Recycling methods.

Heerink adds that the consortium members are also investigating additive manufacturing methods and materials.

Member company advantages

Firms affiliated with TPRC receive the benefits of innovative research, which they can apply to their own operations. CW has reported previously on the adoption of a high-rate thermoplastic part production process for the Airbus (Toulouse, France) A350 XWB at Daher-Socata (see “Inside a thermoplastics hotbed," under "Editor's Picks”), and will publish a Plant Tour later this year to highlight Fokker Aerostructures’ successful thermoplastic aerospace part manufacturing.

Tier 1 TPRC member TenCate Advanced Composites, a textile producer since 1704, is a key manufacturer of thermoplastic composite materials for aerospace. Several metric tonnes of TenCate CETEX thermoplastics are used annually on more than 1,500 applications for engines, interiors and primary aerostructure across the Airbus and Boeing fleet families. Its parent company, TenCate, also is a manufacturer of synthetic grass, geosynthetic fabrics and personal protective fabrics, says Rob Boogert, director of operations for TenCate Advanced Composites EMEA: “Our strength is in our diversity and our ability to meet customer demand.” While thermoplastics is a major focus, Boogert points out that TenCate’s recent acquisition of Amber Composites (Langley Mill, UK) has broadened its thermoset expertise in Europe, and complements TenCate’s US prepreg operations as well. The company is involved in supplying composite materials for virtually all the major aerospace programs.

Boogert, along with manager of engineering Winand Kok and sector sales manager Aerospace EMEA Marlie Koekenberg, demonstrated during CW’s recent visit the evolutionary changes that have occurred in TenCate’s business, starting with its legacy weaving rooms that feature English-style sawtooth glazed roofs that kept the fabrics from direct sun while allowing shadow-free light — the best light for evaluation of textile quality. Many automated looms, until recently, produced commodity fiberglass and aramid fabrics. These are now made under contract by Hexcel (Stamford, CT, US, and Les Aveniers, France), explains Kok. Five-harness, satin-weave carbon fabrics, typically 125-cm wide, will continue to be made in-house on high-speed, automated Lindauer DORNIER GmbH (Lindau, Germany) rapier looms, using 3K carbon fiber tow supplied by Toray Carbon Fibers Europe(Paris, France).

To convert its technical carbon textiles to thermoplastic composites, TenCate uses several processes and works with several polymer suppliers, including Victrex USA Inc.(Cleveleys, Lancashire, UK), Arkema (Colombes, France) and Celanese Corporation (Irving, TX, US, and Oberhausen, Germany).

For the fiberglass/polyphenylene sulfide (PPS) material used by Fokker Aerostructures to form the J-nose fixed leading edge on the Airbus A380 aircraft wings, a PPS film is applied to both sides of an eight-harness, satin-weave (re-sized) fiberglass fabric in a heated laminating process, to form what Kok calls a semi-preg product. For semi-preg materials typically used in aircraft flooring and interiors, woven carbon, glass or aramid fibers are dip-coated with polyetherimide (PEI) in a solvent-coating process. But semi-preg also can be made in a powder-coating process that, Kok explains, eliminates the cost of forming thermoplastic laminating films. The process uses machinery designed by TenCate in-house.

“We’ve been perfecting this process for several years, and are currently involved in qualifying it for Airbus,” he says, to show equivalency with filmed and solvent-based prepregs. The powder-coater can rapidly dispense any thermoplastic resin onto a fabric, which then passes through heated rollers and an oven to melt and crystallize the polymer as required. “We can achieve very tight thickness tolerances,” adds Kok, and explains that if thicker products are required, the material can be sent through the machine twice for two coats of resin.

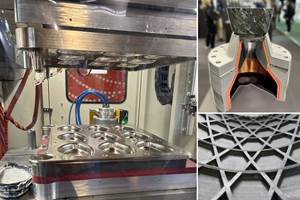

TenCate’s well-known CETEX thermoplastic sheet is made in three, large, heated compression presses that operate around the clock. Workers lay up thermoplastic prepreg material to form the 3.6m by 1.2m sheets, in any fiber architecture from 1 to 24 plies thick, to customer specs. PPS is the most common matrix, says Kok, who explains that the layups are moved to the press, heated and consolidated in a heating, compression and cooling process that depends on sheet thickness and resin type, and desired resin crystallinity. The pre-consolidated, stiff sheet product is virtually void-free — all CETEX sheets undergo a C-scan inspection to verify quality and thickness before customer shipment.

“We’re continuously working to develop new products, with higher performance. For example, PEI has good fire/smoke/toxicity properties, but it doesn’t stand up well to hydraulic fluid, so PPS or PEEK is a better choice for wet applications,” concludes Kok. “An example of a recent product development is carbon fabric/PEI prepreg used as an air inlet liner in the engines on several Airbus aircraft.” He adds, “Our participation in the TPRC allows us to stay abreast of advances in thermoplastics, and to conduct our own product research projects there — while allowing other partners to familiarize themselves with our products.”

Robots + thermoplastics = new markets

Processing thermoplastics rapidly is another key component of TPRC’s mission. Automated work cells, such as those produced by Tier 2 member Pinette Emidecau, speed the thermoforming of blanks for relatively simple part shapes. For more complex shapes, fiber placement and automated tape placement technology holds promise. TPRC member and robotic fiber placement specialist Coriolis Composites has its eye on bringing greater automation to the composites industry. “TPRC provides an opportunity for open discussion with key players, and trials of new materials and equipment in a confidential environment, that is a real benefit for us,” says chief technical officer and company co-founder Alexandre Hamlyn. “We appreciate the focus only on thermoplastics, which keeps the research focused.”

Coriolis uses readily available, off-the-shelf robotic elements and integrates them with company-designed heads and software to form a customer-specific, turnkey workcell. Robotic arms are typically supplied by Kuka Robotics Corp. (Augsburg, Germany), with up to eight axes of movement. “Medium” floor-mounted, robotic arms have a payload capacity of 250 kg, while the “large” option allows a 500 kg payload, and can support a correspondingly larger head. Optional are rotating “positioners,” or headstock and tailstock parts, supplied by Güdel SAS (Mulhouse, France). Robotic motion is controlled by Siemens 840D CONTROLLER software from Siemens PLM Software Inc. (Munich, Germany).

Heads, built and assembled by Coriolis, can be configured to lay thermoset towpreg, thermoplastic tape or dry tape, with appropriate heating strategies for the selected material, in widths from 6.4 mm up to 12.7 mm. Customers can specify single or multiple (4, 8, 16 or even 32 simultaneous) tows in the larger heads, explains Hamlyn. Minimum fiber laydown length is 90 mm, and speeds up to 1m per second are possible, for laydown rates up to 40 kg of material per hour. A key feature of the company’s head design is that tows or tapes move from the creel and Multiwinch tension controller within individual, shaped plastic conduits to the head, at very low tension. “We have found that the tubes, together with lower tension on each tow, is better, as it allows faster placement speeds and reduces the chance for bridging or fiber deformation, as well as breakage,” he points out.

At approximately 50 kg, a small Coriolis head is the most compact and lightest on the market, claims the company — small enough for female tool layup, and light enough to place fiber on honeycomb core without crush. Yet, says Hamlyn, the head can still provide a compaction force of 10 N/mm per band width, an industry standard at Boeing and Airbus. The company has developed a patented method for placing fibers on sharp corners or radii at 45°, an advantage for automating aircraft wing spar layup, for example. “We actually have 20 patents that cover various machine elements,” he adds.

The software that controls head and fiber-placement functions was developed by Coriolis engineers. CADFiber and CATFiber are machine-independent and available for any AFP or ATL machine through Coriolis’ subsidiary software company. CADFiber can be used to design parts for fiber placement, while CATFiber can program automated fiber placement cells. Both software packages directly interface with CATIA/DELMIA from Dassault Systèmes (Velizy-Villacoublay, France) or with SiemensSNX. Customers can try out software and actual machines, and critique the feasibility of projects, at Coriolis’ technical center, where two robots and a team of 12 engineers are available for R&D collaboration.

Many important aerospace programs are reportedly employing Coriolis equipment for automated production. These include several machines at Airbus, with four machines in Stade, Germany, and one at Nantes, France, all working on A350 XWB parts. Two are located at Stelia Aerospace North America (Mérignac, Cedex, France, created by the merger of Aerolia and Sogerma) producing A350 XWB doors. Dassault Aviation (Saint-Cloud Cedex, France) has a machine at its Biarritz, France, facility for Falcon 5X composite parts, while Bombardier Inc. (Montréal, QC, Canada) is using two machines for production of CSeries aft fuselage parts and rear pressure bulkheads. Aeroengine maker Safran SA (Paris, France) is using a Coriolis machine for automated layup of the nacelle inner fixed structure on certain engine models.

In addition to these signs of success, Hamlyn drives home the point of thermoplastic part quality. A recent SAMPE Europe presentation, which Hamlyn co-authored with several Airbus engineers, compared thermoset carbon composite parts, consolidated out of autoclave, with carbon/PEEK parts produced robotically, using laser heating and partially consolidated on-the-fly. The thermoplastic parts were then edge-bagged and oven-cured for an hour to achieve final consolidation. Test results from the thermoset parts and the robotically produced PEEK parts showed no differences in part quality and performance. In addition, the study showed that thermoplastic composites can be readily introduced into the production chain and at the same productivity rate as thermoset prepregs.

“Our goal is to make the automated process of forming composites less and less expensive over time, to bring this technology down to Tier 1 and Tier 2 suppliers, for more and more secondary structures. Our business model is based on taking cost out,” states Hamlyn.

With several potential automotive customers in the wings, a special thermoplastic head for automotive parts may be coming, he adds, one that would reduce scrap rates to the minimum, and use industrial-grade, 50K tows to reduce cost.

On a growth trajectory

Thermoplastic composites are on the upswing, as the composites industry’s reach continues to expand. Fokker’s Offringa points out some of the current, qualified and flying thermoplastic aerospace parts that have already made the cut: the cockpit floor in the Airbus A400M; fixed leading edges for the Airbus A340-500/600 and A380; Apache combat helicopter avionics bay panels; floor panels for the Gulfstream G4, G5 and G6 families; and the rudder and elevators for the Dassault Falcon F5X. “The volume of some of these parts, particularly for Airbus and Boeing commercial aircraft, is going to grow to unprecedented levels as the build rates increase,” he asserts.

Concludes Heerink, “We have the tools and the joint funding with our partners to successfully develop thermoplastics to meet the rate of innovation that’s required by these large OEMs. I foresee continuous growth here at the center,

and collaboration with more industries, including automotive and civil engineering, going forward.”

Related Content

JEC World 2024 highlights: Thermoplastic composites, CMC and novel processes

CW senior technical editor Ginger Gardiner discusses some of the developments and demonstrators shown at the industry’s largest composites exhibition and conference.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

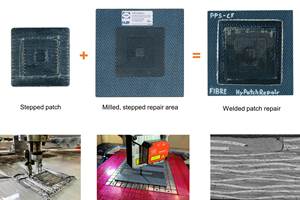

Read MoreDeveloping repairs for thermoplastic composite aerostructures

HyPatchRepair project proves feasibility of automated process chain for welded thermoplastic composite patch repairs.

Read MoreRead Next

CAMISMA’s car seat back: Hybrid composite for high volume

Recycled fibers, in-situ polymerized PA12 and steel inserts combined in one-shot process to cut weight 40 percent at competitive cost, cycle time and safety.

Read MoreThermoplastic composites “clip” time, labor on small but crucial parts

Preconsolidated carbon fiber/PPS and PEEK and automated thermoforming enable six-figure production of connectors for the Airbus A350 XWB.

Read More