AWEA market report indicates record third quarter

The U.S. wind industry installed nearly 2,000 MW of new wind power capacity in Q3 2020, bringing U.S. wind capacity to 112,000 MW. Development and construction activity remains strong despite the pandemic.

Photo Credit: AWEA

Photo Credit: AWEAOn Oct. 29, the American Wind Energy Association (AWEA) released its 2020 third-quarter report and addendum to its 2019 annual report. According to the market report, the U.S. wind industry installed nearly 2,000 megawatts (MW) of new wind power capacity in the third quarter of 2020, setting a record for third-quarter additions and bringing total American capacity to nearly 112,000 MW. The report revealed that U.S. wind is on pace for a record year, with installations through the third quarter up 72% over the first nine months of 2019.

“This progress during the third quarter is a tremendous testament to the more than 120,000 wind workers in the U.S. who are on the ground every day striving to bring more clean, affordable electricity to communities across America, even in the midst of a global pandemic. Challenges still remain, but the American wind industry will continue pushing to add jobs and investments to the U.S. economy as we look toward a cleaner, more reliable and more prosperous energy future for our country,” states Tom Kiernan, AWEA CEO.

Ten new wind projects totaling 1,934 MW started operations across nine states during the third quarter, enough to power more than 600,000 American homes. Texas led the country with 687 MW of new wind projects installed, followed by Colorado (496 MW), Illinois (200 MW), Iowa (168 MW) and Indiana (147 MW). Of particular note, the two largest single-phase wind projects in U.S. history came online during the third quarter: the 525 MW Aviator Wind project in Texas and the 496 MW Cheyenne Ridge project in Colorado.

The report indicates that there are now 111,808 MW of operating wind power capacity in the United States, enough for over 34 million American homes. Twenty states have more than 1,000 MW of installed capacity.

Wind power development and construction activity remained strong during the third quarter. Despite disruptions from COVID-19, project developers announced 2,420 MW in combination with new development activity, with projects totaling 972 MW starting construction and an additional 1,448 MW entering advanced development. At the end of September, there were 43,575 MW of wind power capacity in the near-term pipeline, including 24,355 MW under construction and 19,220 MW in advanced development. Construction activity ticked down 3% from the previous quarter, primarily due to a large volume of projects reaching commercial operation during the third quarter, but remains up 4% from the same period in 2019.

The offshore wind market continued to advance in the third quarter. Coastal Virginia Offshore Wind, slated to be the second offshore wind project in the country and the first in Federal waters, completed reliability testing in September and is expected online before the end of the year. Offshore wind makes up 47% of projects in advanced development, with developers planning to bring 9,100 MW online by 2026.

A number of factors contributed to American wind power’s record-setting progress during the third quarter. Market fundamentals and consumer demand continue to be the main drivers of U.S. wind development, with wind presenting the most affordable source of new electricity in many parts of the country and residents, cities and states increasingly seeking affordable, clean electricity to power their communities. Targeted additional flexibility regarding tax credit qualification from the U.S. Treasury and Internal Revenue Service (IRS) this year has also been crucial as the American wind industry works to address the significant short-term challenges posed by the COVID-19 pandemic.

Despite this progress, significant hurdles remain as the American wind industry continues working every day to add jobs and investments to U.S. communities during this challenging time. Wind developers continue to report difficulty raising tax equity for their projects, as economic uncertainty is restricting the supply of tax equity in the U.S. financial markets. AWEA and the wind industry are working with Congress and other renewable energy leaders to address these and other impacts of the pandemic and to keep contributing strongly to the U.S. economy at this moment when those jobs and investments are needed most.

Leadership at the local, state and federal level, including forward-thinking policies to increase our country’s use of clean electricity, will be vital as American wind power works to expand its support for local communities and to deliver clean, reliable and affordable power to U.S communities today and in the years to come. This policy leadership is especially important for the offshore wind industry, America’s newest major energy source, which is poised to deliver up to 83,000 jobs and $25 billion in annual economic investments within the next decade.

Market forecast, cost and price

AWEA today also released an important addendum to its Wind Powers America Annual Report 2019, including an updated market outlook and new data on wind power’s price and financing. These trends underline the market fundamentals supporting American wind power’s growth during the third quarter.

As detailed in the updated report, American wind power is set to continue strong growth over the next decade, with forecasters estimating nearly 60 gigiwatts (GW) of new wind power installations over the next five years and 94 GW over the next ten years. Offshore wind is expected to set sail in the coming years, with forecasters anticipating at least 20 GW of operational offshore wind power by 2029.

Wind energy costs continue to fall, with project costs declining 16% over just the past five years. The average installed cost of a wind project in 2019 was $1,436 per kilowatt (kW) and wind turbines last year priced from $700-$900 per kilowatt, a 50% decline from 2008. These falling costs have contributed to wind power purchase agreements pricing at roughly $20 per megawatt-hour (MWh), the lowest cost of power generation in many parts of the country.

Related Content

Recycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MorePolar Technology develops innovative solutions for hydrogen storage

Conformable “Hydrogen in a Box” prototype for compressed gas storage has been tested to 350 and 700 bar, liquid hydrogen storage is being evaluated.

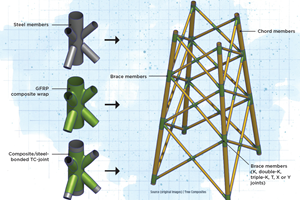

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More