Plastic Omnium aims for world leadership in hydrogen mobility

Aiming for revenue of around €300 million in the hydrogen mobility market by 2025 and €3 billion by 2030, Plastic Ominum will invest around €100 million a year to achieve these targets.

Photo Credit: Plastic Omnium

Convinced that hydrogen will play a key role in future clean mobility, Plastic Omnium (Île-de-France, France) presented its strategic vision for hydrogen mobility at an online conference on Nov. 25. During this conference, the company touched on its industrialized and competitive offer across the entire value chain, its plans to implement cost-cutting measures, how it has addressed its situation in the current market environment, and more.

The company points out that it has already invested €200 million in hydrogen technologies since 2015. Over the past five years, the Group has also reportedly built up research and development resources in Europe and China, acquired Optimum CPV (hydrogen vessels) and Swiss Hydrogen (integrated hydrogen system), and created an open innovation ecosystem (venture capital with AP Ventures, Hydrogen Council membership, etc.) to extend its expertise in each segment of the hydrogen industry.

More recently, the Group announced the creation, with the German supplier ElringKlinger ( Dettingen an der Erms) of a joint venture called EKPO Fuel Cell Technologies which specializes in fuel cell stacks, and the acquisition of ElringKlinger’s subsidiary in Austria specializing in integrated hydrogen system. These two transactions, for a total investment of €115 million, are said to complement Plastic Omnium’s offer. According to the company, these investments have brought Plastic Omnium well ahead technologically and industrially, since it claims it is currently the only company able to deliver the complete hydrogen value chain with its production capacity already in place. Further, a hydrogen vessel production line recently came on stream in Belgium to supply the first bus and truck contracts starting in 2021, and the EKPO joint venture is able to produce 10,000 fuel cell stacks annually at its German facility.

Significant cost reductions will be achieved by automating the industrial processes, leveraging the volume effect and improving on both design and materials.

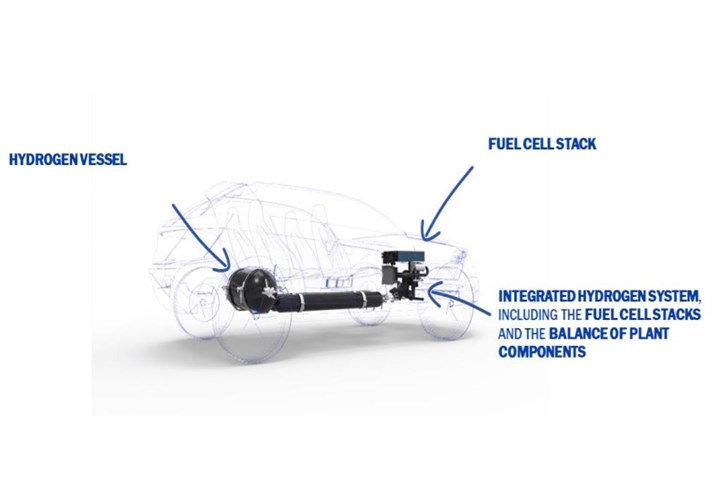

Plastic Omnium says its complete value chain comprises of three segments: hydrogen vessels, fuel cell stack and integrated hydrogen system. Plastic Omnium will be in a position to sell each segment individually or as an ensemble depending on customers’ preferences.

Plastic Omnium aims to be the leader in each of these segments by developing an offer that is technologically and commercially competitive. For 2030, the Group is targeting 25% of the hydrogen vessel market, between 10% and 15% of the fuel cell stack business and 10% of the integrated hydrogen system segment.

The competitiveness of Plastic Omnium’s offer will depend on reducing the technology costs in each of the three segments:

- The Group aims to cut hydrogen vessel costs by 30% by 2030; and

- To divide by five the cost for fuel cell stack and integrated hydrogen system within the same timeframe.

According to Plastic Omnium, these significant cost reductions will be achieved by automating the industrial processes, leveraging the volume effect and improving on both design and materials, including lowering the carbon fiber and precious metal content.

By 2030, the company suggests the total cost of the hydrogen system for a passenger car will be around €6,000 to €8,000, bringing the technology within reach of the mass market.

Further, Plastic Omnium is aiming for revenue of around €300 million in this market by 2025 and €3 billion by 2030.

To achieve these targets, the Group says it will be investing around €100 million a year over the coming years, directly or through its EKPO Fuel Cell Technologies joint venture, to build industrial capacity in all regions with around 15 production lines installed by 2030 at existing or new plants.

“We are firmly confident and are looking toward the future and the transformation of our businesses in favor of clean and connected mobility.”

The Group also intends to create a major Hydrogen Hub at the α-Alphatech R&D center in Compiègne, France. Around 100 engineers will bolster the existing teams of 500 people, and close to €30 million will be invested in laboratory and research equipment over the coming two to three years.

During the conference, Plastic Omnium also addressed its situation in the current market environment.

The Group says it rapidly rolled out all the necessary measures to adapt its cost structure and protect its cash position: these measures put Plastic Omnium in a position to deal with the 33% drop in automobile production in the first half of 2020 and to benefit from the faster-than-expected recovery in global automobile production, down just an estimated 3% compared with the 10%-15% initially expected.

In this more favorable context, while not overlooking the uncertainties surrounding automobile production in Europe as the year draws to a close, Plastic Omnium revised its second-half 2020 targets:

- Operating margin above 5% (compared with the previous 4%);

- Free cash flow above €400 million (compared with the previous €250 million).

At the end of October 2020, the Group liquidity stood at €2.2 billion, similar to the 2019 year-end figure and higher than the €1.9 billion on June 30, 2020.

The programs to rationalize costs and transform the organization are ongoing. For Plastic Omnium, 2021 looks like seeing a sharp upturn in business, and profitability and free cash flow generation climbing back to 2019 levels.

“Despite the uncertainties surrounding short-term prospects for the automotive market, we are firmly confident and are looking toward the future and the transformation of our businesses in favor of clean and connected mobility,” says Laurent Favre, CEO. “As a responsible and innovative industrial company, we are playing our part in the energy transition and already offer advanced technology and production capacity in every segment of the hydrogen value chain. Longer term, we see a very bright future for our hydrogen business and the human and technological resources we are deploying reflect that.”

Related Content

Bio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreRecycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MorePlant tour: Arris Composites, Berkeley, Calif., U.S.

The creator of Additive Molding is leveraging automation and thermoplastics to provide high-volume, high-quality, sustainable composites manufacturing services.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreRead Next

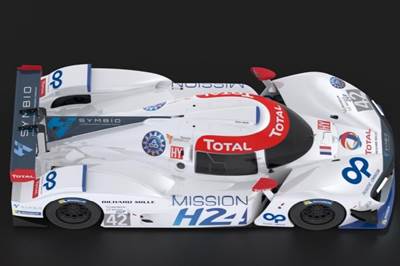

Plastic Omnium supplies composite hydrogen storage tanks for MissionH24 cars

Plastic Omnium’s Type IV overwrapped carbon fiber tanks will be subjected to highly demanding operating conditions in terms of speed, refueling frequency and temperature.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More