IDTechEx outlook suggests hydrogen fuel prices, volume are affecting fuel cell vehicle rollout

Report on the current state of FCEV development studies the great lengths made by Toyota, Hyundai and Honda to build industry momentum, and the current state of green hydrogen’s expense and volume production.

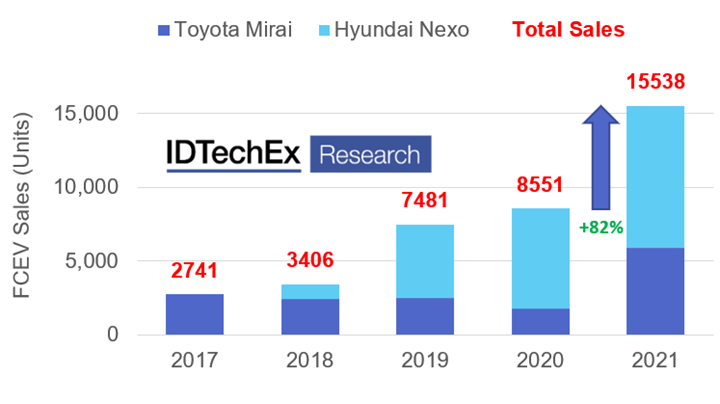

Toyota and Hyundai fuel cell passenger car sales. Photo Credit, all images: IDTechEx

On the face of it, 2021 was a good year for fuel cell electric vehicles (FCEV) in passenger car markets, according to research and consultancy firm IDTechEx (Cambridge, U.K.) in its new report, “Fuel Cell Electric Vehicles 2022-2042.” Toyota (Tokyo, Japan), with its second-generation Mirai FCEV and Hyundai’s (Seoul, South Korea) Nexo FCEV, both had record sales, which largely made up for Honda (Tokyo) announcing in June 2021 that it had decided to pull the plug on production of the Honda Clarity FCV, citing the lack of hydrogen infrastructure and weak demand.

The release of the second-generation Mirai saw Toyota’s global fuel cell car sales more than triple, from 1,770 vehicles in 2020 to 5,918 in 2021, and eclipse the company’s previous best sales year in 2017 when 2,741 vehicles were sold. Similarly, Hyundai built on a strong 2020, where 6,781 fuel cell Nexos were sold, increasing sales by 42% to 9,620 vehicles in 2021.

However, IDTechEx claims this positive outlook only lasts at face value. Rather, to drive this growth, Toyota, Hyundai and the governments supporting the rollout of fuel cell vehicles (FCVs) are having to go great lengths to build the momentum.

For example, in California, the Mirai was reportedly available at a 65% discount from its $50,000 list price. With Toyota offering a $20,000 discount in addition to U.S. federal and state-level tax incentives totaling a further $12,500, the Mirai was available in the U.S. in 2021 for a shade under $18,000. To sweeten the deal further, Toyota also offered a $15,000 fuel credit for the first three years of operation. A $50,000 car for less than $20,000 with 100,000 kilometers of free fuel is undoubtedly an appealing deal.

It is a similar story for Hyundai. Of the 9,620 Hyundai Nexos sold globally in 2021, 88% were in South Korea. South Korean national and state incentives in 2021 meant the sale of each $60,000 Nexo was supported with a subsidy provision of around $30,000, an attractive 50% discount.

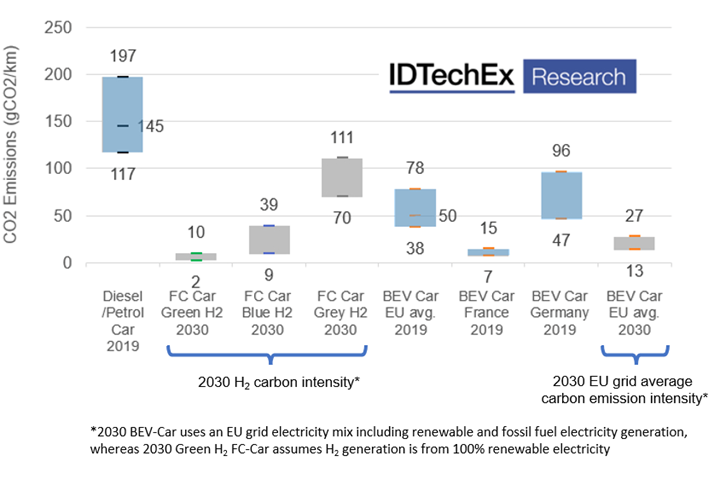

IDTechEx estimate of gram CO2/kilometer emission for passenger car powertrains.

According to IDTechEx, what the deployment of Mirai and Nexo vehicles is doing is demonstrating that the use of proton-exchange membrane (PEM) fuel cells in automotive applications is technologically sound (although Hyundai did recall 15,000 Nexo in August 2021 to fix a rattling problem). PEM fuel cells, using pressurized gaseous hydrogen as fuel, can deliver a greater range and quicker refueling time than equivalent battery electric vehicles (BEVs). However, says, IDTechEx, for FCEVs, it is not the fuel cells, nor the lack of hydrogen refueling infrastructure that is the primary problem in its adoption — it is high emissions and cost of the hydrogen itself.

Within the recent report contains an analysis of the gram CO2/kilometer well-to-wheel emission of FCEV and BEVs, referencing it against the tank-to-wheel emission of current combustion engine cars. Like electricity generation, the production of hydrogen (H2) has a carbon emission footprint. Low carbon green hydrogen is produced by the electrolysis of water. Electrolysis requires around 50 kilowatt-hours of electricity to produce one kilogram of H2, so the carbon footprint of H2 produced via electrolysis is primarily tied to the carbon intensity of the electricity used. Produced using 100% renewable electricity, green H2 can reportedly provide a very low-carbon fuel.

The problem, IDTechEx says, is green H2 is not yet produced in any great volume and when produced, it is comparatively expensive. The vast majority (~95%) of today’s hydrogen is generated by the steam methane reforming of natural gas, a process that is cheaper but results in significant CO2 emissions. This “gray H2” has an emission footprint of around 10.9 kilogram CO2/kilogramH2.

Toyota gives the new Mirai fuel consumption at 0.86 kilogramH2/100 kilometer, so running on gray H2 the Mirai emits around 94 gram CO2/kilometer, while the Nexo (1 kilogramH2/100 kilometer) emits around 109 gram CO2/kilometer. These figures are only a marginal improvement on the CO2 tailpipe emissions of modern combustion engines. For the eco-minded individuals who have purchased FCEV cars, they can relax in the knowledge that their zero-emission on-road (only water and heat) is improving local air quality, but on saving the planet there is still a way to go. The conclusion is that to be truly “green” FCVs need green H2.

A source of cheap green H2 will be critical for the success of FCVs. Green hydrogen production is undoubtedly a huge opportunity for companies willing to invest, IDTechEx notes, though there are substantial production and distribution challenges to overcome to make H2 a cost-effective zero-emission automotive fuel. For the OEMs who have been developing FCVs for the past 30 years, volume production of cheap green hydrogen cannot come soon enough.

IDTechEx’s studies this perspective further in its “Fuel Cell Electric Vehicles 2022-2042” report, which explores the current state of FCV development for passenger cars, light commercial vehicles, trucks and city buses. The report also discusses the technical and economic aspects of fuel cell deployment in these different transport applications and presents IDTechEx’s independent 20-year outlook for the future of FCVs.

Related Content

Hexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreRecycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreUpdate: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreRead Next

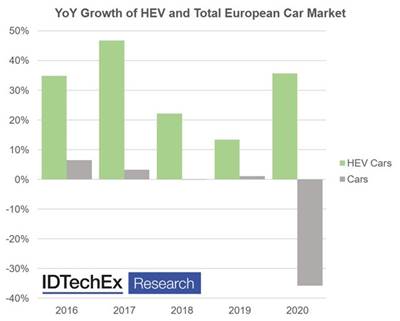

Hybrid electric vehicle market report indicates steady, upward growth

As carbon dioxide emission regulations become stricter across the world, HEV sales show an increasingly upward trend, with expectations to peak at $792 billion by 2027.

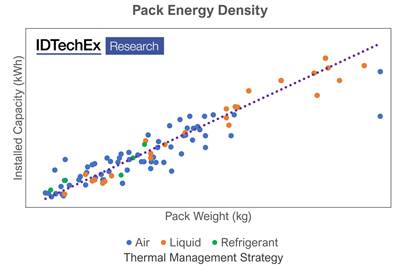

Read MoreIDTechEx presents EV material and component opportunities outside of the battery cell

With the rapid development of the EV market, IDTechEx poses a greater emphasis on cell-to-pack designs and structural batteries, from thermal interface materials (TIMs), composite enclosures and fire safety.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More