Mass reduction for mass appeal: FRPs and CMCs in RVs

Composites save weight, speed assembly, improve aesthetics and diminish warranty service and promote sales.

Whether we’re talking about pop-up campers hitched to passenger cars, “fifth wheels” — large trailers towed by pickup trucks — or self-propelled luxury motor homes (affectionately called mobile apartments), those who manufacture them are keen to take weight out of recreational vehicles (RVs). But unlike passenger car and commercial truck OEMs, those who build RVs aren’t motivated so much by pending fuel economy and/or greenhouse-gas emissions mandates — at least, not in North America, where the regulations don’t apply directly to the RVs themselves. Instead, the impetus for lightweighting has two other rationales. First, every pound/kilogram of mass removed is another pound/kilogram of consumer comfort items (e.g., big-screen televisions) that can be added without necessitating that the RV be pulled by a vehicle with greater towing capacity. Second, when the goal is, indeed, an overall lighter RV, the primary aim is to power or pull that RV with a less expensive drive train or tow vehicle that uses less fuel, to minimize the consumer’s cost of ownership.

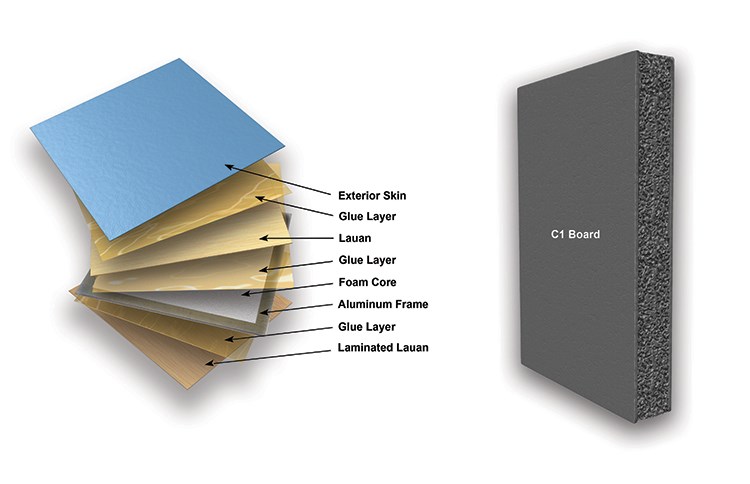

After mass reduction, the hot issue is to reduce RV post-sale maintenance. RVs, especially the larger ones, are rarely garaged. They’re parked outside in all types of weather. The issue then, some industry insiders say, is not if water damage will occur, but when. Some sources report that it can cost an RV manufacturer as much as $10,000 USD to remove and rebuild a wall on a large RV, so as a preventive measure, RV OEMs are eliminating wood products commonly used in sidewalls and floors, which are prone to swelling from moisture intrusion.

Also a hot-button issue is the need to improve curb appeal and weatherability. Although RV industry expectations for exterior aesthetics are not yet as demanding as automotive Class A standards, suppliers report that they’ve been asked over the past decade to upgrade the weather resistance and UV stability of their “fiberglass”-skinned products — today, a too-limited term for what’s available. This applies not only to sandwich-panel sidewall skins but also to roof membranes (see “Commerical trucking: Stremalining the Big Box,” under "Editor's Picks," at top right).

Lastly, innovative and automated production processes are reining in the cost of composite components and delivering parts that can be incorporated more efficiently into the largely hand-built RVs.

Raising the rafters

A good example of assembly-sensitive design is a composite roof support developed by CPI Binani Inc. Formerly known as Composite Products Inc., this Winona, Minn.-based fabricator has replaced aluminum I-beams with hybrid composite C-beams on roof rafters (roof bows) that support plywood and outer roof membranes on a variety of tow-behind trailer RVs produced by Keystone RV Co. (Goshen, Ind.). Surprisingly, composites displaced metal in this application not because they were lighter or stronger, but primarily because they offer significant improvements in assembly efficiency. The product arrives ready for use at Keystone and saves multiple preparation steps previously required with aluminum beams.

Eric Renteria, CPI Binani’s director of business development, product management and marketing, says the company started making the parts after it partnered with a group in the RV industry to ask, What are the customers’ needs? “The overwhelming response we heard was that roof bows were difficult to use and to assemble, and that there had to be a better way to make them,” Renteria notes.

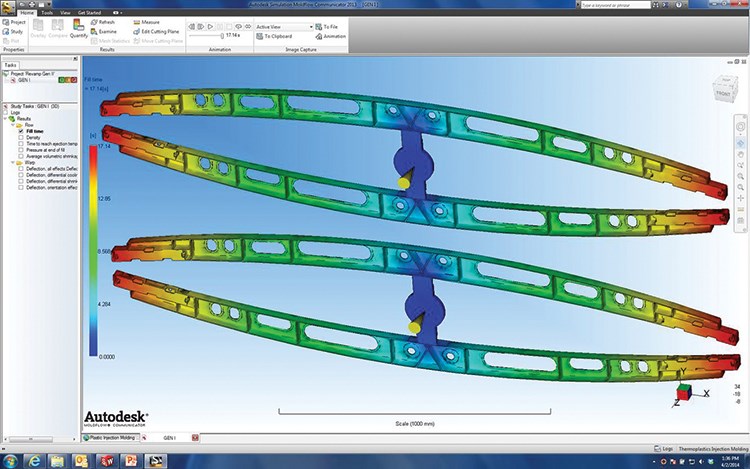

When Keystone showed CPI’s engineers the bows it was then using, made of either aluminum or wood, CPI says it engaged in “lots of mold-filling and structural analysis work” to design the company’s patent-pending double-arched parts, which are supplied in black and are considered to be hybrid composites because they feature a 1-ft /31-cm section of inexpensive #2 pine (wood) inserts on each end. The inserts are more rigid and are convenient: RV manufacturers use the wood inserts to attach roof bows to vehicle sidewalls, using nails or screws. Further, the length of the molded beam can be adjusted simply by trimming the wood inserts on each end with a saw, so a single design serves a wide range of RV models. But because the pine is variable and typically retains 10 percent moisture, the blocks must be dried before molding to minimize dimensional instability. Toward that end, Renteria says CPI first talked to companies that kiln-dry lumber products to very low moisture content, but found the cycle times too long to meet CPI’s production needs. CPI engineers then repurposed a resin desiccant drier unit, and they now dry their own blocks a gaylord at a time.

The beams are a polypropylene copolymer blend of 100 percent recycled resin combined with 100 percent virgin chopped glass that has not been twisted into roving. Glass content is 40 percent by weight and starting fiber length (before processing) is 12.5 mm/0.5 inch. The application was so cost-sensitive that recycled resin was the only way to go, but that brought interesting benefits because the resulting matrix — a resin from an undisclosed source with an additives package supplied by Addcomp BV (Rochester Hills, Mich.), is said to offer the following advantages:

- “Just the right blend” of hardness, for mechanical integrity

- Enough ductility to permit split-free hammering, stapling and/or screwing of hardware into beams

- Bond compatibility with adhesives favored by the RV industry

- A viscosity low enough to minimize glass breakage during molding

- Availability in sufficient quantity to ensure adequate supply

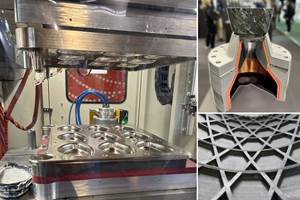

The material is molded in a four-cavity family tool on a 2,000- or 4,000-ton vertical compression press via direct-long-fiber thermoplastic (D-LFT) transfer molding. Cooling the rib bows with the wood inserts in place inside the mold, however, actually takes considerable time because wood, like plastic, is a thermal insulator. As a result, the cycle time is about two minutes, even in a water-chilled tool. Without the wood inserts, cycle time could be significantly reduced, and Renteria says new-generation designs are being validated to find ways to eliminate the need for pine inserts.

Reportedly, current bows demold easily and a quick snip separates parts from runners. The wood blocks are then trimmed to OEM-specified length. Finally, one bow surface is prepped for adhesive bonding, which will be performed at the OEM. After that, parts are packaged and shipped.

Although the bows see no outside exposure, they must withstand concentrated loading during tests in which four assembled beams are subjected to sustained 750-lb/340-kg loads for three days at room temperature and must not deflect more than 0.75 inch/19 mm.

A typical 35-ft/11m tow-behind RV typically requires 30 of these beams, which can range from 68 to 96 inches (1,727 to 2,438 mm) in length but with wall sections that are only 3 to 4 mm (0.12 to 0.16 inch) thick. In use, the bow is placed in tension along its bottom edge and compression along its top edge.

“Although acceptance of composite rafters hasn’t spread as fast as we’d hoped,” Renteria notes, “our product has been out in the field for several years now and is doing very well there.”

Building a better mouse trap

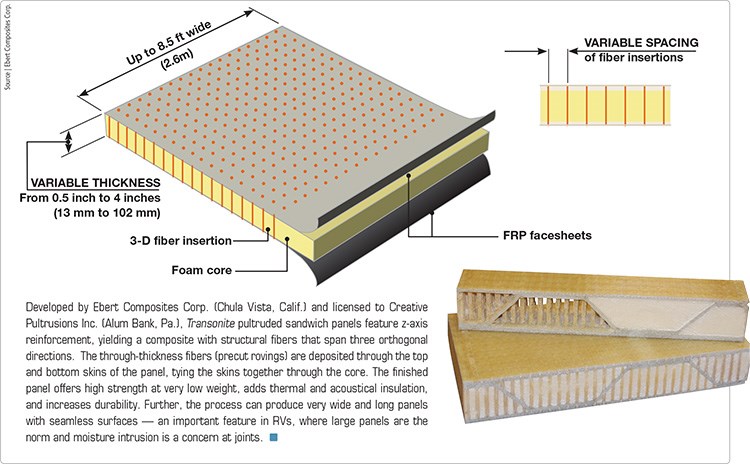

Alum Bank, Pa.-based Creative Pultrusions Inc.. now provides RV OEMs a unique three-dimensional (3-D) pultruded sandwich-panel technology for RV sidewalls and floors, called Transonite. Covered by nine U.S. patents, it was developed by Ebert Composites Corp. (Chula Vista, Calif.) under a grant through the U.S. National Institute for Science & Technology (NIST)’s Advanced Technology Program (ATP). “We originally made a NIST proposal to develop an automated process for making 3-D composites by getting fibers into the z-direction,” recalls David Johnson, Ebert chairman and CEO. “We felt that if we could do this, we’d create a material that would act more like a metal and be machinable, which means originally we were looking at bar stock and billets.” Halfway through the program, the Ebert team substituted foam on the inside and switched to pultrusion, and that evolved into the Transonite product. Next, they developed the equipment and process needed to deposit the rovings through skins without breaking or tearing them. This provided a pathway for fiber placement, allowing rovings to be pulled through without breakage, leaving straight, regular columns of fiber. All of this occurs before resin impregnation, so it necessitated creation of special support tooling to keep the skins and z-axis fibers, in what amounts to a dry preform, from collapsing on themselves.

“This is a very sophisticated piece of equipment,” Johnson sums up. “It … has 17 four-axis robotic modules managed by four robotic servomotors each below and above the package just for the fiber insertion.” The servos control acceleration and deceleration as fiber bundles are put in place, and also control a cam cutting edge that severs all rovings simultaneously. (Rovings are “clinched” or “riveted,” meaning there is no connection between one discrete fiber bundle and another — that is, they are not stitched together). “Essentially, we had developed an 88-axis robotic machine and a 16-step process when we were done,” he adds.

Ebert’s technology is now in its third generation. The fully automated process and equipment are used to pultrude sandwich panels that feature z-axis reinforcement (i.e., structural fibers that span three orthogonal directions). The through-thickness fibers — precut rovings — are deposited through top and bottom skins, tying skins together through the core, which is already in place. Glass roving is most common, but carbon, aramid, basalt and other fibers can be used. This increases panel durability by boosting delamination resistance and peel strength one-to-two orders of magnitude and also improves torsional stiffness compared to a similar sandwich panel without the through-thickness fibers.

Although the most common fiber orientation is perpendicular (90°) to the skin surface, the technology’s latest generation can add to the core another fiber layer (at nearly 45° to the z-axis fiber columns) prior to resin impregnation. The result is an internal “wave” pattern integral to the core that is capable of withstanding deflection and very-high shear forces. Therefore, components can maintain their structural integrity because the fibers hold them together.

In a subsequent step, resin impregnation occurs, then additional skin layers are added (locking rovings into original skins). Finally, the pultruded sandwich is pulled through a heated die, where resin is catalyzed and cured.

Because the cores can be monolithic, foamed resins or balsa wood, and a wide range of z-axis fibers, fabrics and resins can be used, there is great potential for tailoring part properties, weight and cost to the specifics of each application. For example, the current polymer focus at both Creative and Ebert is thermosets, such as unsaturated polyester, vinyl ester and polyurethane. However, Ebert also has tried thermoplastics, with good success. Other variables can be modified, including overall panel thickness (from 0.5 to 4.0 inches/13 to 102 mm), skin thickness (0.05 to 0.40 inches/1.27 to 10.2 mm), the ratio of panel to core, panel width (6 to 102 inches/15 to 259 cm), and the density of the 3-D fibers (0.5/in2 to 16/in2 or 0.08/cm2 to 2.48/cm2)

The benefits of the panel technology include thermal and acoustical insulation, durability (particularly in terms of delamination, which is said to be virtually eliminated) and corrosion resistance.

Given the degree of tailorability, these panels are targeted not only to the RV and other recreational applications, but also to transportation (i.e., truck trailers and rail cars) and marine markets as well as ballistic panels, air cargo containers, furniture and bridge decks. Further, the automated production process is capable of supporting an auto or truck OEM’s higher manufacturing volumes at relatively low cost.

The panels (said to be quasi-isotropic) can be pultruded and cut to nearly any length beyond 1 inch/25 mm, with a maximum width of 102 inches/2,590 mm. “No one else can go that wide,” claims Ted Harris, P.E., who joined Creative Pultrusions as market development engineer after many years in the RV industry at several major OEMs. “The most common size panel … in this industry is 4 by 8 ft (1.2 by 2.4m), which means a lot of seams. Many producers have problems doing length, but since we have a continuous process, we can cut our panels to almost any length as they come off the line, and that gives us another big advantage in this market.” Specifically, large, clean surfaces without edges or seams are important features for the RV industry, where large panels are the norm and moisture intrusion is always a concern at joints. The resulting sandwich panels are said to offer extremely high strength at very low weight.

Harris is excited about Transonite for several reasons. “The fiber inserts are solidly connected to the skins, creating an I-beam effect, so there’s virtually no delamination,” he contends. Because sandwich-panel walls and floors in the RV system typically are bonded together, Harris notes there are many ways problems can be introduced. “You can get miss-outs [breaks in adhesive/sealant beads] or poor cure of your adhesive,” he says, “and eventually that’s going to destroy your laminated sandwich. Now, put that panel out in a harsh environment with hot and cold cycling and you’re going to start seeing blisters and bubbles. Even with good caulking, if you have wood in your product, it’s going to pull in moisture.” Harris says that in addition to water-resistance, Transonite “has greater shear capacity and shear modulus, it’s got localized compression strength and it’s got an R value.” A 3.5-inch/89-mm thick panel’s R-value rating is 11.5. By comparison, the R-value of wood, aluminum and fiberglass panels is almost nil.

Late in April 2014, Creative Pultrusions became Ebert’s sole licensee for the technology. It has three Transonite production machines and is selling panels into the RV industry. Reportedly willing to be a Tier 2, producing “bare” panels that a Tier 1 supplier could finish, Creative Pultrusions also can produce and supply finished panels directly to OEMs. Although current bare panel technology is white, panels reportedly can be produced in almost any color. Further, a variety of surface treatments for interior/exterior walls and flooring are available, including carpet, antiskid aggregate, wallpaper and polyurea finishes. Wall panels also can be supplied with CNC-routered window and doorway openings and/or channels to reduce installation time and labor on OEM assembly lines.

Lightening up with CMCs

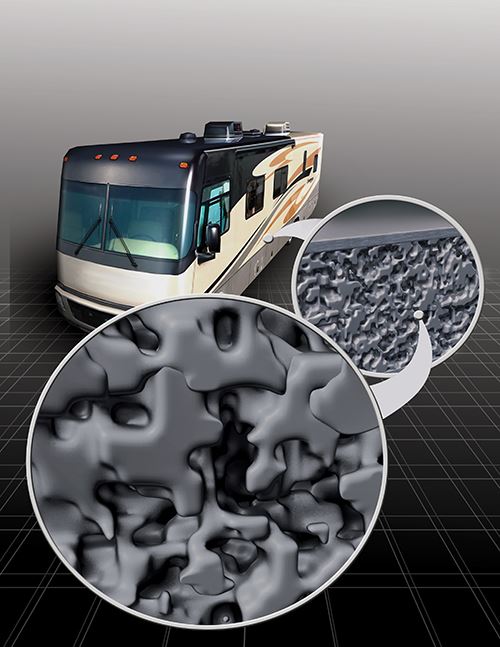

Much more than a lightweighting solution is a new ceramic-matrix composite (CMC) recently rolled out by TekModo LLC (Elkhart, Ind.). Essentially ceramics that can be tailored like other composites, CMCs are known for low density, high hardness, high compressive strength (from 5,000 psi/35 MPa for lower density products to 50,000 psi/345 MPa for fully dense grades) and exceptional thermal and chemical stability. CMCs typically replace metallic superalloys in aerospace parts, such as missile structures, radomes and fighter jet exhaust systems. As one would expect with such high-performance materials, they normally are very expensive, making their use in the RV industry novel. The unnamed producer of Tekmodo’s CMC product, however, has developed a new continuous (rather than batch) production process, which drops cost significantly. These new CMCs are described as a silicon carbide-based matrix with ceramic fiber reinforcement in the form of particles, whiskers, fibers or even nanofibers, which improve the ceramic matrix’s low fracture toughness and help control crack growth. “Green-stage” material can be injection molded, cast, extruded or pultruded like conventional composites. Both fiber orientation and porosity can be controlled to tailor strength and density to the application. The resulting CMC panels, therefore, are said to be 35 percent lighter but only 10 percent more costly than the fiberglass-skinned, aluminum and expanded polystyrene (EPS) foam sidewalls they replace. While the latter exhibit poor insulation and structural values, CMC formulations with reduced densities are said to be similar in consistency to closed-cell foams, yet 100 times stronger and provide good thermal insulation (R-value of 40 in 1.5-inch/38-mm thick wall sections). Notably, fully dense versions are capable of stopping .50-caliber bullets in armor plates.

TekModo is the first commercial integrator for the new CMC technology, called C1 Board. Reportedly, the CMC core can be struck with a hammer without crack propagation, despite the fact that ceramics are considered to be brittle. The product’s density is typically 12 to 36 pcf/192 to 577 kg/m3. In use, cores are surrounded by SpectraLite skins of unidirectional fiber-reinforced thermoplastic tapes in colors of red, green, or blue, with newer Intensity grades coming in the near future in what TekModo CEO Marc LaCounte describes as “very vibrant colors with metallic and pearlescent effects — a vivid departure from the RV industry’s standard white and brown.” Reportedly, coatings are available to produce automotive-quality Class A finishes.

To support the product’s launch into the RV and commercial truck trailer markets, TekModo opened a new composites manufacturing campus in Elkhart under the name TekModo Structures LLC. There, it will manufacture finished sidewalls and floors as well as composite-tape-based roof systems, trailer frame/floor combinations and ramp doors. The facility also houses a research cell dedicated to new product development. LaCounte says that a CMC technology called AirFrame already is in the works for trusses.

The downturn’s upside

As this sampling demonstrates, there’s a lot happening in the RV market, thanks in part to automotive and advanced materials suppliers that, during the 2009-2012 global downturn, diversified their market focus and worked cooperatively to develop new products for the RV industry — many of which are only now being commercialized. As the RV industry confronts the need to lose weight, improve durability and manage costs, CT expects to cover additional innovative technologies in the not-too-distant future.

Related Content

TU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreJEC World 2024 highlights: Thermoplastic composites, CMC and novel processes

CW senior technical editor Ginger Gardiner discusses some of the developments and demonstrators shown at the industry’s largest composites exhibition and conference.

Read MoreRead Next

Commercial trucking: Streamlining the Big Box

Glass fiber-reinforced thermoplastics help commercial trucking industry optimize weight, fuel and cost savings.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;width=70;height=70;mode=crop)