The key to CNTs: Functionalization

An emerging supply base is integrating carbon nanotubes into commercial products that enable composites manufacturers to optimize part performance.

There's a lot to like about carbon nanotubes. On paper, under the microscope and in the lab, carbon nanotubes (CNTs) impart undeniably appealing physical properties: tensile strength and elastic modulus without equal; low density; high specific strength; massive surface area; high conductivity and tremendous length-to-diameter ratio. No material yet discovered has provided a more appealing strength-to-weight ratio. But the promise of CNTs for composite parts and structures has been very long in coming. Proponents touted CNTs as the “next big thing” for more than a decade — always a very hot topic at industry conferences, yet never quite ready for “prime time” application.

Through it all, CNTs have lost little of their luster as a kind of “super fiber” that can do all that carbon fiber can do, but more and better. On the strength of this enduring allure, CNTs have in the last few years finally begun the migration from the lab into commercial resin and fiber systems. Early results are very promising, but it’s clear that the industry is only just beginning to understand what CNTs can do and how they can (and can’t) be integrated into composite parts. Here, HPC looks at the current state of CNT manufacture, how CNTs are being integrated into fiber/resin systems and where the next few years might take CNT-enhanced composite products.

CNT basics

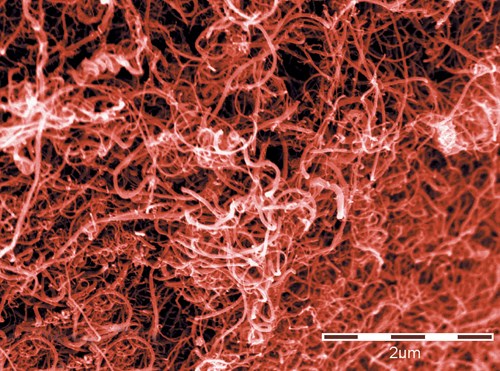

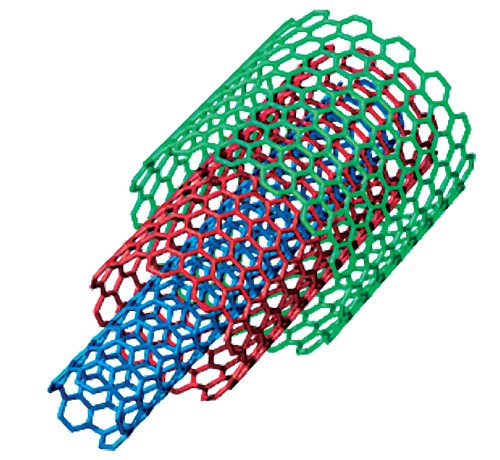

Carbon nanotubes are crystalline, lattice graphene sheets rolled into tube-shaped structures, closed on each end and measuring 1 to 3 nm in diameter — about 1/10,000th the width of a human hair. CNTs can measure up to several 10,000 nm long and thus exhibit the unusually high aspect (length-to-diameter) ratios (as great as 10,000:1) that are a key factor in their performance. For composites applications, the most common CNTs are single-walled and multiwalled (SWCNT and MWCNT). Single-walled carbon nanotubes, as the name implies, are comprised of a single tube with one wall. Multiwalled carbon nanotubes comprise two or more tubes of progressively larger diameter — tubes within tubes. Because of this, MWCNTs tend to be slightly larger in diameter (8 to 10 nm). SWCNTs are more electrically conductive than MWCNTs, but also more expensive and difficult to manufacture. Therefore, MWCNTs are more often used in composite parts today.

CNTs, per unit weight, range from 10 to 100 times stronger than steel, and derive their strength from the chemical bonding of the carbon atoms in their lattice structure — modulus of MWCNTs is typically about 1.0 TPa; tensile strength is about 10 to 60 GPa (compare to stainless steel, which tops out at 3 GPa). This structure also makes CNTs highly electrically conductive, with an electrical current density of 4 x 109 A/cm², more than 1,000 times greater than copper.

CNTs are also great thermal conductors and considered a good candidate material for management of high-heat environments. Finally, CNTs are noted for providing good crack propagation resistance, able in many cases to “bridge” cracks and maintain structural integrity.

CNT producers and optimizers

There are now more than 40 CNT suppliers globally (see sidebar, below), but only a few relatively large producers have a significant presence in the composites industry: Bayer MaterialScience (Pittsburgh, Pa. and Leverkusen, Germany) produces CNTs in Germany under the Baytubes trademark. Arkema Inc. (King of Prussia, Pa.) manufactures Graphistrength CNTs. Nanocyl (Sambreville, Belgium) commercializes its CNTs under the trade name NC7000.

Joe Ventura, business development manager of the Baytubes product line, says Bayer currently produces 60 metric tonnes (132,230 lb) of MWCNTs per year out of a pilot plant in Germany, but expects, in 2010, to begin operation of another plant (also in Germany) that will increase the company’s capacity by 200 metric tonnes/year. Arkema, which currently operates a pilot plant capable of 20 metric tonnes/yr (440,925 lb/yr), announced in September the construction of a 400 metric tonnes/yr (881,850 lb/yr) facility in Mont, France, which the company says will use entirely bio-sourced raw material (ethanol). Thibaud Vaugien, structural composites sales and marketing manager at Nanocyl, says the company manufactures 60 metric tonnes of MWCNTs annually, and announced in December that by July 2010 it will have an additional reactor of 400 metric tonnes to produce its MWCNTs.

These manufacturers differ in how they deliver their CNTs to the composites market. Bayer is a supplier of multiwalled carbon nanotubes to resin engineering firms and composites manufacturers who integrate them into composite structures. Arkema produces thermoplastic masterbatch products that feature CNTs. Nanocyl, by contrast, integrates its CNTs into thermoplastic and thermoset masterbatches, water-based systems, raw powder and carbon fiber prepreg.

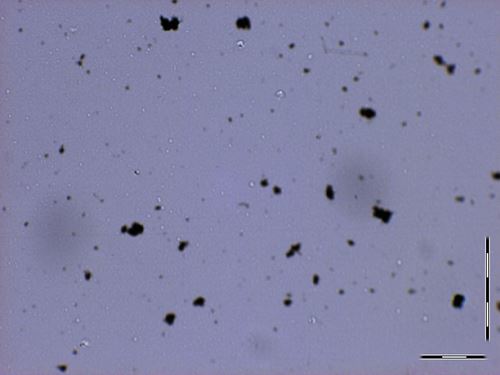

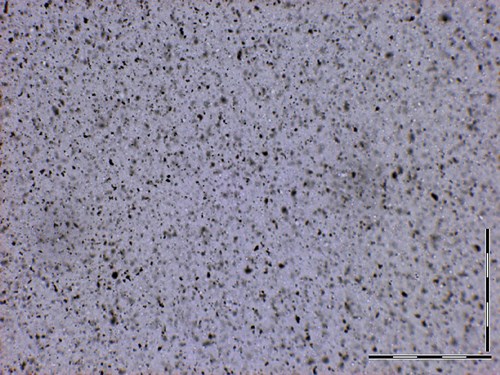

Functionalization is the means by which the gap is bridged between CNTs in their raw form and CNTs as a well-integrated component in a resin system that will deliver expected performance in a composite. And that gap is not crossed easily. For all the mechanical strength and conductivity properties they provide, CNTs also can destabilize a resin/fiber system if not properly incorporated. CNTs do not, for example, naturally mix and disperse in either water or solvents, thus eliminating agglomeration is critical to achieving optimal mechanical, thermal and electrical properties. Bayer’s Ventura notes that at about 1 percent CNT loading in resin formulations in composites, mechanical property benefits begin to plateau, but loadings of 3 percent in engineering resins are typically required to achieve the electrical conductivity benefits of CNTs. But he points out that CNTs dramatically increase a resin’s viscosity even at low loadings, forcing a significant trade-off. For these and other reasons, integration and optimization of CNTs in any composite part requires process and materials engineering expertise typically beyond that available internally to a composite parts manufacturer. Consequently, in the CNT market for composites applications, we see the development of a two-tier supply structure: Suppliers that focus primarily on manufacture of raw CNTs, and a number of specialists that engineer resin or resin/fiber systems that incorporate those CNTs.

One of the most active nano-engineering firms, Zyvex Technologies Inc. (Columbus, Ohio), manufactures carbon fiber prepreg, epoxy and adhesive enhanced with CNTs manufactured by Arkema. Russell Belden, global business manager at Zyvex, says the challenges of integrating CNTs are not trivial, noting the viscosity and agglomeration challenges. “Loadings right now of 3 percent in a water-like resin turn it to peanut butter,” quips Belden.

Zyvex has had the most success in the composites market with its Arovex carbon yet reportedly provides a 30 to 50 percent increase in stiffness and strength compared to the same prepreg without CNTs. It’s available with most woven fabrics and a range of unidirectional fibers. More recently, Zyvex introduced Epovex, a CNT-enhanced adhesive, as well as Nanosolve, a dispersion formulation designed to help users integrate CNTs with water- or solvent-based polymer systems. Belden says Zyvex also offers finished CNT-enhanced resins, but only by way of its engineering service, through which it customizes resins for the customer’s particular application.

Zyvex has logged several applications of its prepreg, the most notable is the Piranha unmanned surface vehicle (USV) being developed for the U.S. Navy. The craft, like its cousin, the unmanned aerial vehicle, is designed for long-range, unmanned ocean surveillance. The USV, 50 ft/15m long and 12 ft/3.7 ft wide, has a range of 2,000 miles and, with the help of CNTs, has an empty weight of only 8,000 lb/3,629 kg. Yet with its high payload capacity, the craft can operate at an overall weight as high as 23,000 lb/10,433 kg.

A producer of raw MWCNTs, Nanocyl also makes and markets CNT-enhanced resin and fiber systems. The company offers three product lines to the composites market: Epocyl epoxy resin, Sizicyl sizing agent and Pregcyl prepreg. Thibaud Vaugien, Nanocyl’s structural composites sales and marketing manager, says Epocyl provides CNT-improved fiber anchoring and good conductivity properties. Pregcyl is available in carbon, glass or aramid fiber forms and its CNT content reportedly increases finished part toughness by 100 percent and interlaminar shear strength by 15 percent. Further, Vaugien reports, the prepreg maintains good Tg and offers a 15 percent reduction in coefficient of thermal expansion. Other benefits include resistance to fatigue and crack propagation. Such enhancements without tradeoffs are unique in the field of composites and can be achieved only with CNTs, he claims.

Vaugien says the company is targeting applications in aerospace and entered this market via a collaboration with Compact Compositi for the Millenium Aircraft (strength and conductivity). Other markets include automotive (strength and surface conductivity to facilitate E-coat painting), ballistics protection and wind blades. Nanocyl also is working with a Taiwanese company called XPACE to produce innovative bike rims capable of withstanding high impact with good torsional resistance. Nanocyl’s Sizicyl product seems best suited for antiballistics applications, reports Vaugien, and Nanocyl has demonstrated a 10 to 30 percent increase in material rigidity in bullet-proof vest testing. In wind, he says, Nanocyl has demonstrated a three-fold decrease in cyclic fatigue, and is in the early stages of lightning strike protection development for turbine blades. Although Nanocyl would not disclose its CNT loading percentages, Vaugien does report that the company has been able to achieve good electrical conductivity at loadings of less than 3 percent. Nanocyl also reports that its Pregcyl prepreg only costs 7 percent more than a comparable non-CNT carbon fiber pregreg.

Located in Lahti, Finland, Amroy Europe Oy entered the CNT-enhanced epoxy market in 2006 with the launch of Hybtonite, which incorporates Bayer’s Baytubes. The company grew out of research done at the Nanoscience Centre at the University of Jyväskylä (Finland) that brought forth a now patented method for attaching CNTs to resin epoxy resin molecules using covalent bonds. Amroy markets only the resin system, but works with prepreggers to integrate it into their products. The company offers a line of Hybtonite variants for several end-uses (e.g., fire resistance, conductivity) and processes, including filament winding, infusion, resin transfer molding (RTM) and pultrusion. Most of Amroy’s applications are in the sporting goods, marine and wind energy markets.

Nanoledge Inc. (Boucherville, Québec, Canada) incorporates Baytubes into several epoxy formulations. Among them is the Innovium Materials Pack, with two semi-solid resin films designed for dry layup and for fusion with carbon or glass fabrics/uni tapes to make prepregs with a flexural modulus of 2,700 MPa and a flex ultimate strength of 120 MPa. Notched Izod impact resistance is 8 kJ/m². The company’s Innovium Formulation Pack is designed for hot-melt prepreg. Most of Nanoledge’s applications have been in bicycles and wind energy systems.

One of the pioneers in CNT-enhanced resin formulation is Hyperion Catalysis International (Cambridge, Mass.), which makes its FIBRIL product line available as a masterbatch or as a ready-to-mold compound, mostly for thermoplastic resins. The masterbatch is a high-viscosity resin with CNT loadings of 15 to 20 percent that are diluted into the final concentration to achieve loadings of 2 to 8 percent. Masterbatches are available for epoxy, polyethertherketone (PEEK), polyamide, polycarbonate, polystyrene and others. Ready-to-mold versions of FIBRIL also are available in the thermoplastics.

Operating somewhat on the margins of traditional CNT manufacturing and integration is a relatively new startup company called Nanocomp (Concord, N.H.), which produces CNTs in sheet form for incorporation into composite laminate systems. The company is evolving out of pilot plant production and has announced a series of production, research and development and application programs that indicate the company’s line of CNT sheets is making strong headway in antiballistic, aerospace and electromagnetic shielding parts and structures. Peter Antoinette, president and CEO of the company, says Nanocomp is now making 4 ft by 8 ft (1.2m by 2.4m) CNT sheets in roll stock 25 ft to 100 ft long (7.6m to 30.5m) in a 4,000-ft²/371m² facility, with plans to expand to 100,000 ft²/9,290m² by 2013. The company expects eventually to produce as much as 4 to 6 metric tonnes (8,820 to 13,230 lb) of its CNTs annually.

Antoinette says the company’s line of CNT sheets is finding application in electromagnetic shielding and antiballistic products. In particular, Nanocomp is working with the U.S. Army Natick Soldier Center to develop material for body armor, providing a laminate layer on the strike plate and back face to augment current materials. The laminates are typically about 2 mm/0.08 inch thick, comprising 200 layers. Tests have shown that Nanocomp-enhanced body armor can stop a 9-mm bullet.

Pyrograf Products Inc., a subsidiary of Applied Sciences Inc. (Cedarville, Ohio), manufactures 70,000 lb/31,751 kg of its Pyrograf-III each year, a vapor-grown carbon nanotube. Efforts are under way at Pyrograf to double production capacity.

The crystal ball

Despite significant progress in CNT functionalization, it’s clear that this segment of the composites industry is far from mature. “We’re at the very early phase of CNTs and their potential,” says Zyvex’ Belden. There are several challenges for CNTs as they enter the composites market: Cost/benefit concerns, unrealistic expectations, health and safety concerns, and product quality monitoring.

Cost is the biggest hurdle. Today, pricing starts at about $100/kg ($45/lb). CNTs have to show substantial mechanical benefits and overall lifecycle cost savings to “buy” their way into projects. As production matures and capacity increases, the cost of CNTs will come down, but until then, they’ll be eyed critically.

Nanocyl’s Vaugien says there are two common misconceptions about CNTs: “First, that CNTs can solve all problems. They are multifunctional, but not a super material. They will efficiently fulfill the task for which they have been identified, but we now know that we are only at the early stages of the maturation of CNTs for the composite market. Second, there are concerns about environmental health. This topic is addressed in a responsible manner by Nanocyl by building extensive knowledge on the topic while supporting our customers and answering their queries on EHS.” Health concerns are centered on the small size of CNTs and the difficulty that creates for managing them in loose form, when they can easily become airborne and inhaled or lost. Inhalation, in particular, has been a concern.

Finally, Belden notes that CNTs have a short history. There hasn’t been time to establish standard procedures or methods for inspecting and assessing their quality. Impurities in CNTs degrade mechanical properties and can prove difficult to remove, although Zyvex, he says, has developed internal technology to help purify the CNTs it uses.

Despite the concerns, CNTs are here to stay. Belden is optimistic, noting that the composites industry is only beginning to discover how best to use them: “I think, in five years, we’ll have a CNT prepreg that is double or triple the strength and stiffness of current CF prepregs.”

Bayer, for its part, is involved in several projects that it hopes will demonstrate real potential for its Baytubes — notably a wind turbine project in Asia that, through a combination of redesign and resin reformulation, reduced the weight of a 49m/161-ft wind blade from 16,000 lb/7,257 kg to 12,800 lb/5,806 kg.

Tom Delay, market manager, closed mold group, at BYK USA (Wallingford, Conn.), which is developing dispersion technologies for CNTs, acknowledges that the sales job for carbon nanotubes is rigorous, but emphasizes that “this is a technology that people won’t be able to ignore much longer. And as aerospace adopts it, it will trickle down throughout the entire composites industry.

Related Content

Honda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

Nanoparticles, nanotubes and nanocomposites

The first generation of nanofillers is emerging from R&D into commercial application in composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More