Resin shortages continue to affect composites supply chain

Power outages caused by mid-February’s U.S. winter storms led to immediate shortages from Gulf Coast petrochemical companies. Fabricators continue to report shortages.

A supply shortage of epoxy, polyester and vinyl ester resins, caused by U.S. winter storms and a variety of factors, continue to make headlines and affect the composites industry.

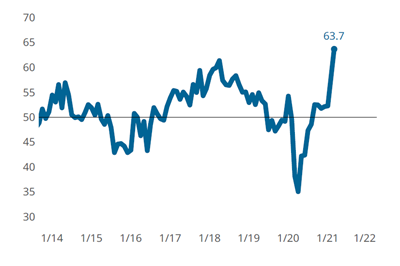

As reported by Gardner Intelligence chief economist Michael Guckes in his latest Composites Fabricating Index column, supply chain difficulties continue to restrict production, “which, in the face of strong demand, has caused a meteoric rise in backlog activity.” (See the latest Business Index columns here: compositesworld.com/hashtag/economics)

In response to this data and other industry reports, CW, with Gardner Intelligence, recently surveyed 144 composites fabricators to learn more about what the industry is experiencing.

Of the respondents, 69% reported experiencing or hearing of supply shortages over the past few months; 66% reported experiencing issues with lead times; 50% reported workforce or labor shortages; 21% reported wage rate escalation.

Winter storm impacts lead to continued resin shortages

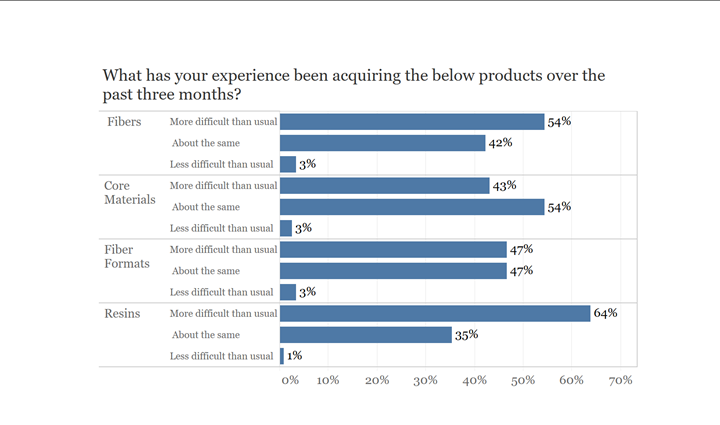

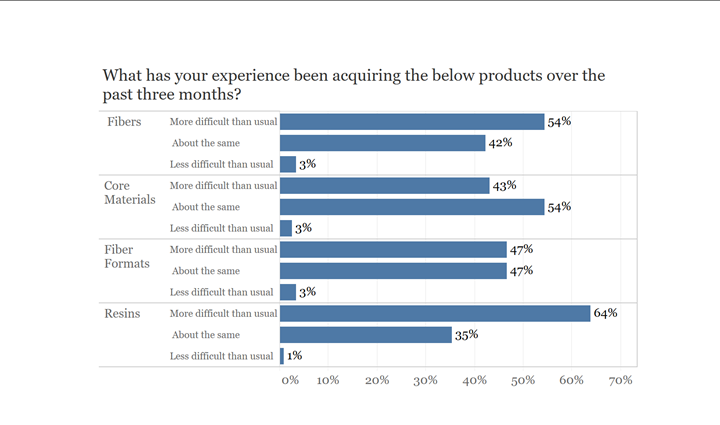

From those surveyed, 62% of respondents reported that resins were a little or a lot more difficult than usual to acquire over the past three months. Polyester and vinyl ester ranked as the types most difficult to acquire, followed by epoxy.

Global supply chain shortages for many products have been impacting industries since the start of the pandemic in 2020, caused by pandemic-related and economic issues in transportation, rising demand and labor shortages.

Hexion CEO Craig Rogerson, during Hexion’s 2020 earnings call on March 10, acknowledged that the severe cold weather that hit Texas in February disrupted water service and raw materials supply to the company’s bisphenol A (BPA) plant in Deer Park, Texas, U.S., which compelled the company to declare force majeure and cease operations at the plant. The loss of Hexion’s BPA capacity led, subsequently, to a tightening in supply of epoxy and vinyl ester, for which BPA is a feedstock. Rogerson said Hexion expects to feel negative financial impact from the shutdown: “We will have a strong first quarter despite all of this, but there will be an impact.”The resin shortage, in particular, began as mid-February’s sub-zero temperatures and Winter Storm Uri affected much of the United States, hitting Texas and the Gulf Coast particularly hard. Widespread power outages and damage to water systems and infrastructure were experienced in the region for several days and weeks, causing temporary closures to oil refineries and petrochemical companies in the area, including local facilities of companies like Hexion (Columbus, Ohio, U.S.).

In reaction to the closures, many resin manufacturers and distributors declared force majeure on epoxy, polyester and vinyl ester products. Affected companies have reportedly included Olin (Clayton, Miss., U.S.), INEOS (Dublin, Ohio, U.S.), Covestro (Pittsburgh, Pa., U.S.), DuPont (Wilmington, Dela., U.S.), SABIC (Houston, Texas, U.S.), BASF Corp. (Florham Park, N.J., U.S.) and others.

One response from suppliers has been increasing prices for vinyl ester, polyester and other products from companies such as AOC (Collierville, Tenn, U.S.), Polynt Composites (Carpentersville, Ill., U.S.) and Lanxess (Pittsburgh, Pa., U.S.), as reported in CW’s frequently updated “Composite resins price change report.” In a March press release, AOC noted, “This action is due to the ongoing and significant escalation of costs for key raw material ingredients, packaging and freight resulting from Winter Storm Uri on February 15, 2021. AOC’s global purchasing resources continue to work with their network of suppliers to manage costs and meet customers’ needs.”

Shipping delays, other products affected

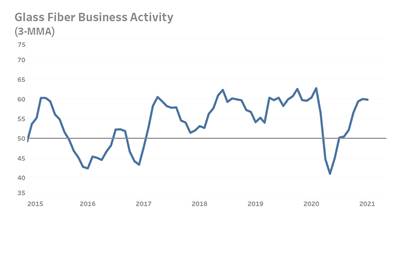

In addition to resins, 54% of survey respondents reported difficulty in acquiring fibers, with glass fiber topping the list, followed by carbon fiber (see “Glass fiber supply chain struggles amid pandemic, economic recovery” for recent CW coverage on the glass fiber supply chain). Among fiber formats, 51% of respondents reported challenges in acquiring fiber rovings; 42% reported chopped fibers; 35% woven fabric; 20% unidirectional tape; 14% multiaxial fabric. Forty three percent reported difficulty in acquiring core materials, particularly foam.

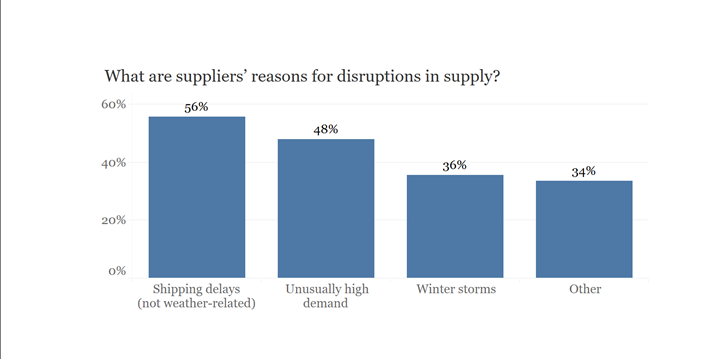

What’s causing all of these delays? One survey question asked respondents what suppliers are citing as reasons for supply disruptions; 55% of respondents reported shipping delays not related to weather; 48% reported unusually high demand; 35% reported inclement weather and winter storms; the remaining gave other responses.

For general information on pandemic supply chain issues related to shipping, see the below video from the Wall Street Journal:

Impact on fabricators

More than 54% of survey respondents reported that they are moderately or extremely concerned about ways the supply chain disruption may affect their operations.

How have fabricators been able to respond? More than 64% of survey respondents reported that they have been communicating with customers about potential delays; 41% reported seeking the same supplies from other suppliers; and 38% reported using alternative materials. Smaller percentages reported reduced shifts or layoffs/furloughs.

CW has also had the opportunity to connect with several fabricators about their experiences. Greg McLaughlin, composites manager at Sea Force Center Consoles (Palmetto, Fla., U.S.), reports, “Resin distributors are rationing resin deliveries, with large-volume builders first in line. We’re hearing the industry could face a four- to six-week delay in resin products due to the Texas freeze from damages related to processing plants’ piping and fittings.”

Faced with shortages on some resins and high prices on the resins that are available, he notes that boatbuilders and other fabricators are having to make decisions to use alternative resins for certain products. “The trickle-down effect of the Texas freeze has just started, and the bottom line is that boat manufacturers will be forced to make changes to fabrications, bill of material pricing, lead times and quality assurances, all of which will get passed down to the buyer.”

“We have production contracts where we were counting on ongoing supply of resin, and are now being told [by resin distributors] that it could be a month or more before we can get more in. Polyester, vinyl ester, gelcoat, epoxy – they’re all being impacted. As it trickles down, I’ll be unable to fulfill my own production contracts,” says Phil Locker, president of Competition Composites (Arnprior, Canada).

Returning to normal

Of respondents to the CW/Gardner Intelligence survey, 27% said they expect the supply chain situation to return to normal more than 16 weeks from now, and 41% said they did not know.

CW and Gardner Intelligence will continue to monitor and report on the situation. If you have any feedback or other information to share with us, please email CW editor-in-chief Jeff Sloan at jeff@compositesworld.com.

Related Content

Infinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreRead Next

Lessons learned, a year later

When the pandemic struck, we yearned for normality. Getting back there will take time and patience.

Read MoreComposites Index jumps five points to an all-time high

Volatile March survey finds troubled supply chains and strong demand.

Read MoreGlass fiber supply chain struggles amid pandemic, economic recovery

Transportation issues, rising demands and other factors have led to higher costs or delays for gun rovings and more. Suppliers and Gardner Intelligence share their perspectives.

Read More

.jpg;width=70;height=70;mode=crop)