Thermoplastics in Aerospace Composites Outlook, 2014-2023

Capable of volume production, thermoplastic composites will gain new market share in the aerospace industry.

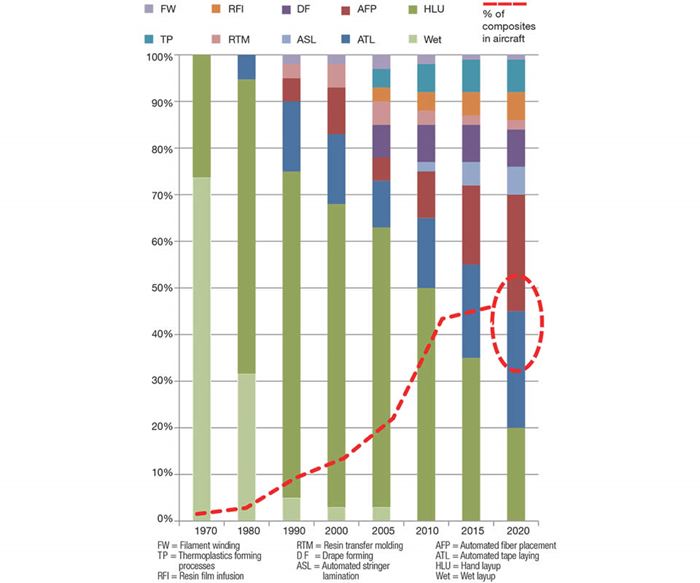

Thermoset resins and autoclave curing have been the mainstays of aerospace composites since their introduction to aircraft. During the 1960s and 1970s, most aerocomposites manufacturers borrowed heavily from the wet layup techniques used in the boatbuilding industry. But the inconsistencies and variability of the wet layup process gave way in the 1980s to more consistent, repeatable hand layup of prepreg materials. In the 1990s, prepreg layup gave way to more productive automated tape laying and fiber placement technologies. In all cases, the autoclave was considered necessary to ensure that laminates met void content targets. The first decade of this century, however, saw out-of-autoclave (OOA) processing techniques attract interest, with promises of speedier production and lower fabrication costs.

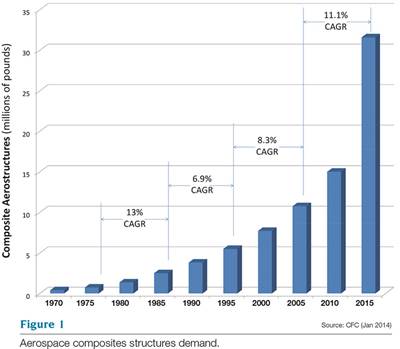

As a consequence of this paradigm shift toward process/cost efficiency, reinforced thermoplastics now appear on the cusp of capturing a significant piece of the aerospace raw materials market (see Fig. 1, at left) on the strength of a significant distinction. Unlike thermosets, thermoplastics do not need to crosslink (cure). These polymers shape easily under sufficient heat and simply harden and maintain those shapes (at speeds much faster than thermosets can cure) when cooled. Further, they retain their plasticity — that is, they will remelt and can be reshaped by reheating them above their processing temperatures. This characteristic offers intriguing possibilities for both faster and more innovative composite processing techniques compared to their thermoset counterparts.

The introduction of OOA processes and thermoplastics to the aerospace industry has complicated the aeromanufacturer’s palette of material/process options: OOA processing can involve either thermosets or thermoplastics. At the same time, manufacturing with thermoplastic composites (TPCs) can sometimes involve the use of an autoclave. For these reasons, this TPC-focused market outlook adapts some data that was included in a recent HPC OOA Market Outlook (see “The market for OOA aerocomposites, 2013-2022” under "Editor's Picks" at right), but includes a number of significant differences and benefits from a number of critical updates and continued research.

Thermoplastic composites: What and why

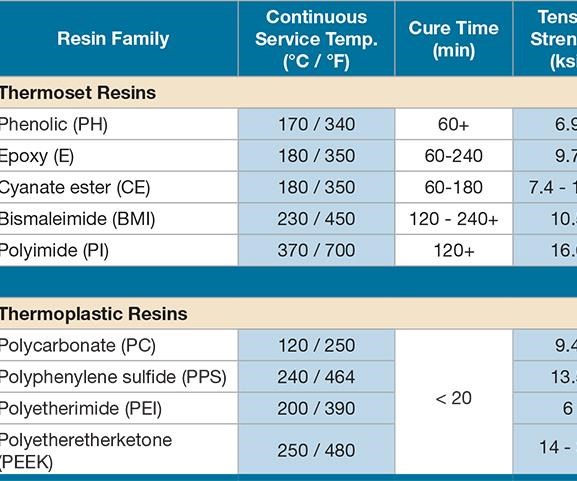

There is a wide range of thermoplastic materials now used in advanced composites components for the aerospace industry. Six general classes of thermoplastics are seen most frequently (see Table 1, at left):

- Polycarbonates (PC)

- Polyamides (nylon, PA-6, PA-12)

- Polyphenylene Sulfide (PPS)

- Polyetherimide (PEI)

- Polyetheretherketone (PEEK)

- Polyetherketoneketone (PEKK)

Within this context, many of these thermoplastic polymers have raw material prices comparable to, and the high tensile strength of, common thermosetting resins, including:

- Phenolics (PH)

- Epoxies (E)

- Bismaleimides (BMI)

- Cyanate esters (CE)

- Polyimides (PI)

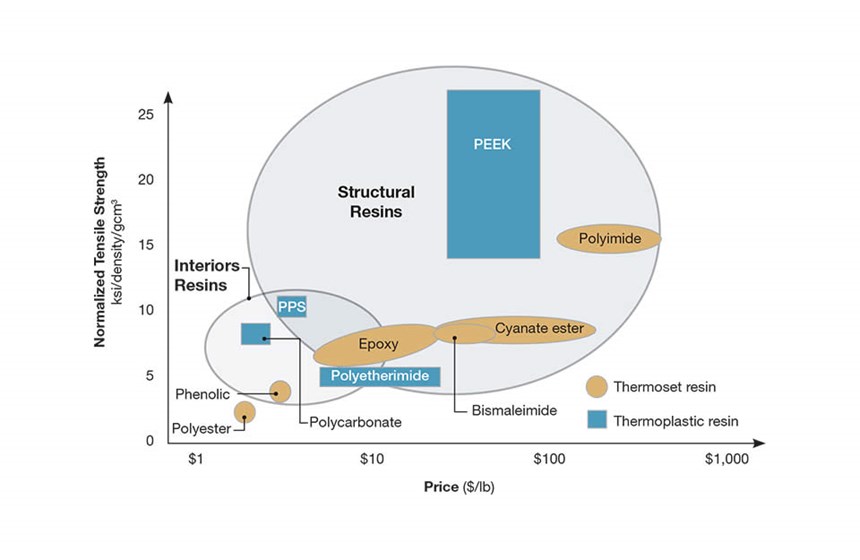

The potential value that thermoplastics bring to the aerospace market becomes more apparent when neat resin performance characteristics are compared with raw material costs (see Fig. 2). Thermoplastics generally exhibit superior impact toughness, fire/smoke/toxicity (FST) performance and, with the exception of PEIs, chemical resistance. (PEIs are susceptible to attack by anti-icing fluids and to moisture absorption, which limits their use in aircraft skins.) Thermoplastics also exhibit a near-infinite shelf life at room temperature. This compares quite favorably to a shelf life of fewer than six months in refrigerated storage for typical prepregged thermoset materials.

PEEK, PPS, PEI and PC show many favorable characteristics for application in both aerospace structures and interior components. Although the raw material costs of aerospace thermoplastics can — in some cases — be higher than competing thermosets, the cost of the finished component can be roughly 20 to 40 percent lower due to reduced handling, processing and assembly costs. Thermoplastics also offer the option to fuse or weld molded subcomponents, which can reduce assembly weight and stress concentrations by eliminating fasteners and adhesives.

For high-temperature applications, PPS, PEI and PEEK polymers also offer excellent thermal stability — a critical property in a number of military, aeroengine and prospective supersonic business jet programs where aerofrictional heating can generate continuous service temperatures beyond the capabilities of high-temperature epoxy thermosets (~180°C/~350°F). At these elevated temperatures, PEEK and PPS thermoplastics, priced between $4 and $72/lb ($9 and $160/kg) can offer potentially substantial savings compared to BMI and PI thermosets, priced between $42 and $400/lb ($92 and $880/kg).

Structural TPCs: on the rise

Despite the intrinsic appeal of TPCs, their adoption has been slow. European manufacturers are leading the way. One of the first successful structural applications was the undercarriage door for the now out-of-production Fokker 50. This door included ribs and spars made from carbon fiber/PPS prepregs. An ongoing example would be the pressure and nonpressure floor panels that Fokker Aerostructures BV (Hoogeveen, The Netherlands) has supplied to aircraft manufacturer Gulfstream Aerospace Corp. (Savannah, Ga.) for its intercontinental luxury jets since the mid-1990s.

Only in the past 10 years, however, have applications appeared for TPCs that can legitimately be considered “large” and “high-volume.” The Airbus (Toulouse, France) A340-600 and A380, which entered into service, respectively, in 2002 and 2007, feature some of the largest structural thermoplastic components currently in service. These include thermoplastic skins reinforced with welded ribs, which reportedly weigh about 20 percent less than comparable aluminum structures. Savings per shipset for the A380 run about 200 kg/441 lb. The 18m/59-ft long keel beam for the A340-600 features a large number of carbon fiber/PPS ribs and angle brackets for the keel’s internal structure. These components exhibit a 20 to 50 percent weight savings compared to their aluminum and titanium alternatives. The A340-600 ailerons feature a number of TPC ribs in the main body of the component, as well as angle brackets and panels for the structures’ leading edges. Although the majority of these TPC components are relatively small, they quickly add up to considerable volume. Within the A380 airframe, TPCs account for more than 1,000 individual part numbers, representing a mass of more than 5,000 lb/2.27 metric tonnes or about 7.5 percent of the aircraft’s total composite airframe flyaway weight.

The all-composite fuselages on mid-size, twin-aisle transports present myriad opportunities for small TPC parts. An army of carbon fiber/PPS clips and cleats help secure exterior skins to their circular frame sections. Reports are that The Boeing Co.’s (Seattle, Wash.) 787 family requires between 10,000 and 15,000 such composite parts per aircraft, while the Airbus A350 XWB is believed to use fewer — around 8,000 per aircraft. Although these components are fairly uniform in size, there are more than 100 unique configurations in production. TPCs also are used to provide localized reinforcement between some of the fuselage frames, in the form of shear webs, on the 787 (about 150 per aircraft). Daher-Socata (Tarbes, France) and Dutch Thermoplastics Co. (Amsterdam, The Netherlands) are among the leading producers of these components (see “Learn More”). Both report that they are actively busy scaling up capacity to meet demand.

Previously mentioned, Gulfstream’s G450, G550 and now the G650 business jets all include TPC floor panels. Beyond business jets, however, TPCs are now finding homes in other aircraft flooring systems. Airbus Military’s A400M’s cockpit flooring is composed of a variety of TPC profiles. The cargo floors of Sikorsky Aircraft’s (Stratford, Conn.) CH-53K heavy-lift helicopter for the U.S. Marine Corps represent another effective application of low-cost TPC manufacturing and assembly — one that is expected to extend to other large rotorcraft (including the V-22 Osprey) during the remainder of the decade.

Notably, the CH-53K cargo floor, which is quite large, measuring 8.5 ft/2.6m by 44 ft/13.6m, could soon weigh less than 1,500 lb/680 kg, thanks to TPCs. [Editor’s note: At HPC press time, Sikorsky was reportedly considering aluminum floors for test aircraft while it pursues final selection of a composite flooring system.]

Gulfstream’s G650 also features a first-of-its-kind welded thermoplastic composite rudder and elevator tail section, developed by Fokker. Designed and developed to take advantage of a new induction welding method that joins the components into an inseparable unit, the fabricating and joining process yields parts that are 10 percent lighter and 20 percent less costly than the preceding carbon/epoxy sandwich construction. Similar components are now in development for Dassault Aviation’s (Paris, France) Falcon 5X and 8X business jets.

Aircraft engine applications are also on the rise. Carbon fiber/PEI materials have been used in the acoustic liners for several major turbofan engines. Many of the engine brackets for both civil and military jet engines, and supporting hoses, cables and printed circuit boards, are now produced with carbon fiber/PEEK tapes and molding compounds — replacing conventional milled titanium hardware. Ishikawajima-Harima Heavy Industries (Tokyo, Japan) recently announced that it will pioneer the use of TPC guide vanes in a new engine program. TPC engine seals, shielding components, trusses and other structures also are being made and planned for future engine families. And TPC use extends to some of the smallest aircraft, including unmanned aerial vehicles (UAVs). In Lockheed Martin’s (Bethesda, Md.) Desert Hawk III, for example, TPCs find use in lightweight propellers.

Thermoplastics creeping into the cabin

Although advancements in processing techniques are opening opportunities for TPCs in structural/airframe components, the largest opportunity in the foreseeable future is in the aircraft interiors market. For many of the current and emerging components within cabin interiors, dozens, hundreds and, in some cases, even thousands of identical components may be required for each new aircraft or cabin retrofit.

TPCs have been particularly effective at displacing metals in the aircraft cabin. Several studies have shown component weight reductions of as much as 40 to 50 percent, compared to aluminum, with a 20 percent reduction in delivered part costs. Further, TPC’s excellent FST performance and inherent toughness and short process cycle times make them promising candidates for aircraft interiors.

There is a downside, however. Despite demanding performance requirements, cabin components are cost-sensitive. Accordingly, PEI- and PPS-based TPCs tend to be the most commonly used.

As they have in emerging structural applications, TPC clips, brackets and support rails are becoming common interior features across a number of aircraft platforms. Standout applications include:

- Stowage bin brackets produced by Quatro Composites (Orange City, Iowa) for the Boeing 787.

- Sidewall and ceiling attachment rails produced by xperion GmbH & Co. KG (Herford, Germany) for the Airbus A330 and A340 families.

- Pans, backs and trays, and even seat frames, for premium and coach passenger seats.

- Panels for lavatories, galley equipment and service trolleys.

The examples noted, thus far, show how thermoplastic composites can be used to replace existing metal components. But some of the newest opportunities for TPCs involve replacements for glass fiber/phenolic and carbon fiber/phenolic components. In this case, the thermoplastic polymers offer solutions that are inherently more robust, process in a fraction of the time required for thermoset composites and offer an 18 percent reduction in density as well as enhanced FST performance. From a manufacturer’s perspective, thermoplastics also eliminate the outgassing of formaldehyde and/or water vapor that occurs during the phenolic resin cure cycle.

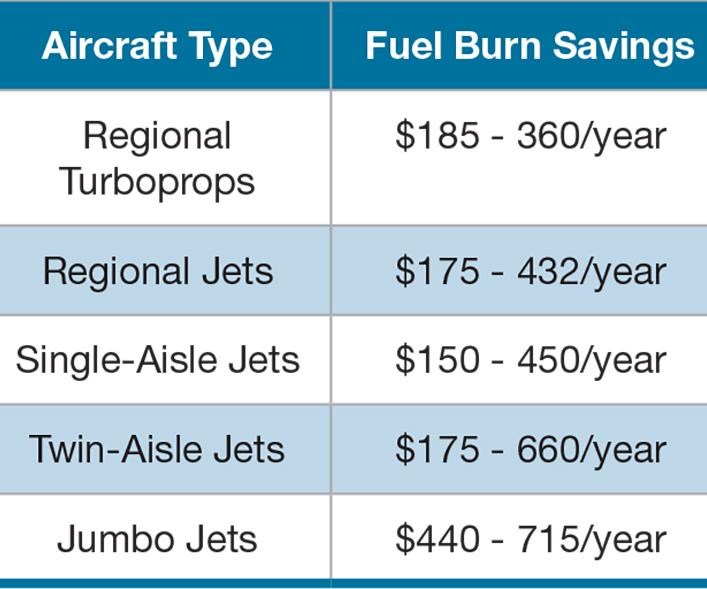

For this reason, a small number of demonstration trials have explored the use of PEEK polymers with continuous and discontinuous carbon fibers to replace phenolic composites in cabin ceilings and sidewalls as well as cargo compartment panels. For smaller regional jets, these components could total around 1,400 lb/635 kg per aircraft. On larger planes, these components could account for 3,000 lb/1,630 kg or more of total weight. Assuming a modest 10 percent reduction in the overall weight of fiberglass and carbon phenolic composite components, carbon fiber/thermoplastics could reduce aircraft fuel burn by 10,000 to 72,000 gal annually (see Table 2). Fleet operators could potentially save tens- or hundreds-of-millions of dollars each year based on this materials substitution. These annual savings are compounded by an expected service life of about eight years between refurbishment cycles. And for new aircraft, the savings could be accrued over more than two decades of passenger service.

Aerospace thermoplastics outlook

Scarce in civilian and military aerospace segments a decade ago, TPCs now can be found in virtually every major segment of the market. To quantify TPC use for this Market Outlook, more than 400 programs, including fixed-wing aircraft (transports, business jets, general aviation, fighters, etc.), rotorcraft, turbofan engines, UAVs, and missile systems were studied from around the world.

Considering only manned aircraft, nearly 7,700 units were delivered during 2013 — an increase of about 6.5 percent over 2012. Civil aircraft led growth, posting almost 25 percent more deliveries compared to the market bottom in 2010. Continuing strength in the commercial, business and general-aviation aircraft and rotorcraft sectors is expected to push up annual deliveries by nearly 30 percent in the coming two years.

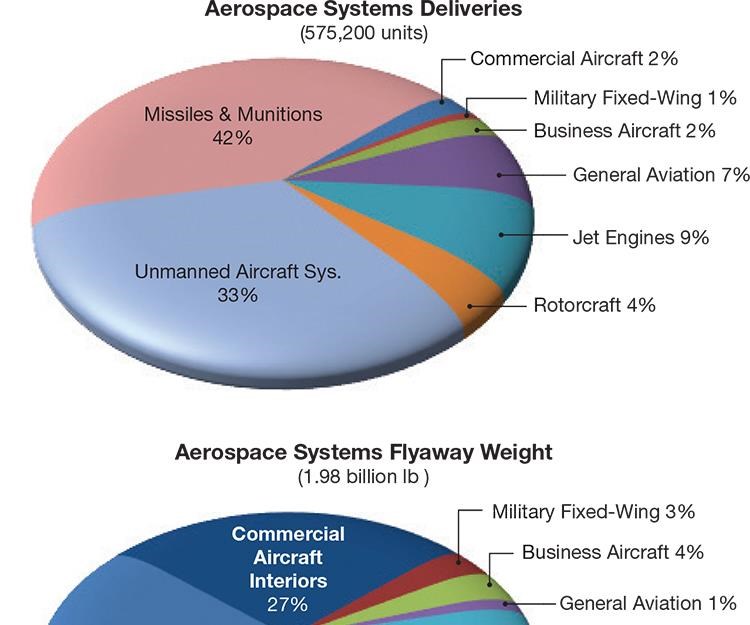

As unmanned aircraft become common in civil airspace during the next four years, annual aerosystem deliveries (aircraft, engines and munitions) are expected to nearly triple in the next 10 years. During the 2014-2023 forecast period, we predict that approximately 575,200 UAVs will be produced (see Fig. 3).

Increased activity on OEM assembly lines is expected to offer excellent growth for those who manufacture and supply raw materials to aerospace composites manufacturers. The 400-plus programs reviewed for this report required an estimated 175 million lb (79,128 metric tonnes) of finished parts and structures in 2013. By the end of 2014, that number is expected to reach 185 million lb (83,938 metric tonnes). It’s not surprising, then, that over the 2014-2023 forecast, commercial aircraft will consume nearly 75 percent of the 2 billion lb (907,441 metric tonnes) global aerospace market’s raw materials — in commercial aircraft structures (45 percent) plus interiors (27 percent). The turbofan jet engine manufacturers, many of which support the commercial aircraft industry, represent the next largest consumer, and could account for 15 percent of aerospace structure deliveries, by volume, through 2023.

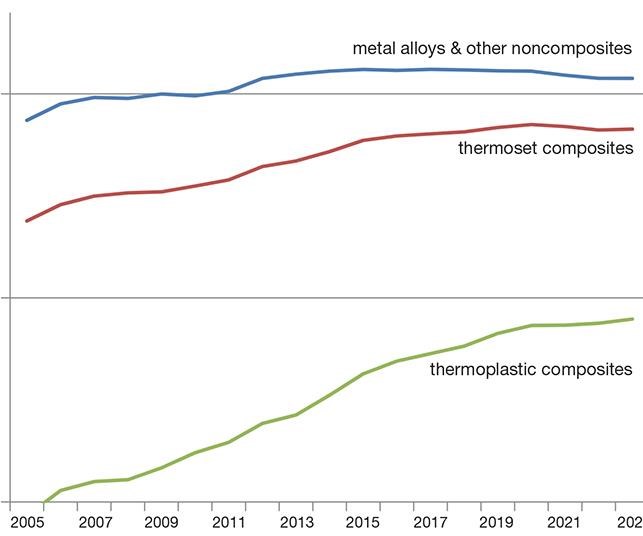

The distribution of composite structures tracks fairly closely with the overall aerosystems flyaway weights detailed in Fig 3. When considered separately, the 10-year aerostructures and interiors total shows some interesting trends that pertain to thermoset and thermoplastic composites. In 2005, composites made up about 15.5 percent of finished aerospace components, by weight. By 2013, this share grew to 19 percent. By the time the market reaches its next expected peak, around 2018-2019, composites should represent about 25 percent of total aerospace component deliveries, yet would still represent only about 4 percent of total raw material purchases, due to the considerable amount of metals that are machined or trimmed away during fabrication. In some applications, more than 90 percent of a metal billet is turned into “revert” on the shop floor.

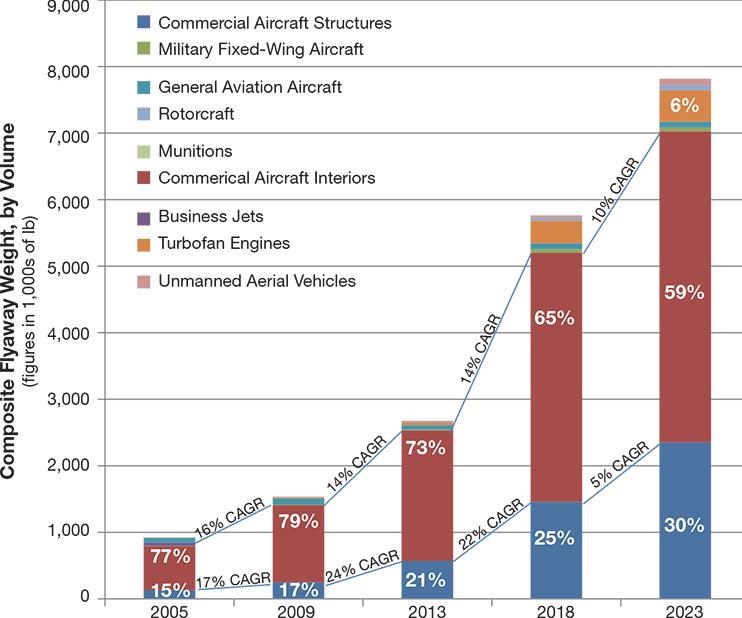

This analysis shows that thermoset composites continue to gain market share in the aerospace industry until around the end of this decade, at which point the trend lines (see Fig. 4) become increasingly parallel. Over this same period, however, thermoplastic composites volumes will show considerable upward momentum. During 2005, the analysis found approximately 923,000 lb (419 metric tonnes) of TPC components were delivered to the aerospace industry. At this volume, thermoplastic composites made up about 0.6 percent of total aerostructures (all materials) and about 3.7 percent of total composite shipments. In less than a decade, the aerospace industry has increased its demand for TPCs by roughly 400 percent.

This rate of adoption has exceeded previous expectations. In HPC’s coverage of this subject in 2009 (see “Thermoplastic composites: Inside story," under "Editor's Picks," at top right), author Ginger Gardiner provided details about a number of emerging applications within commercial aircraft. Based on those limited applications, TPC aircraft interiors were projected to reach between 300,000 and 625,000 lb (134 and 283 metric tonnes) this year. This more recent analysis shows that current volumes are much closer to 2.3 million lb (1,044 metric tonnes). Based on the aircraft production forecast, the volume of TPCs in interiors could easily double or triple again over the 2014 to 2023 forecast (see Fig. 5). By the end of our forecast period, TPCs should represent at least 11 percent of the total market for aerospace composites (structures and interiors), with plenty of additional potential for adoption in the OEM aircraft cabin, the interiors aftermarket, and secondary structural components.

Challenges and opportunities ahead

Given the wide range of TPC components employed in the aerospace industry today, it’s obvious that a lot of progress already has been made. Based on existing applications alone, it is anticipated that the tonnage of these materials will increase 200 to 300 percent in the coming decade, encroaching on market share now owned by metals and thermoset composites. Advances in thermoforming, welding and bonding are opening up new opportunities for TPCs in secondary and primary structures, as well as high-volume interior components. In five years, that could vastly expand our TPC tonnage and market-share estimates.

That said, hurdles remain. Manufacturing complex forms with continuous fiber-reinforced thermoplastics still poses a considerable challenge. For the more structurally demanding composite components made from PEEK and PEKK, the raw material cost can be significantly higher than alternatives that feature toughened epoxy or BMI matrices. Additionally, most thermoplastic prepregs are delivered as preconsolidated sheets or boards. Therefore, they must be preheated to more than 400°F/205°C to become pliable for forming — often done outside of the mold tools (an added process step). Further, the requirements for optimal laminate properties often require complex temperature-controlled tooling as well. As a result, upfront investment can be greater than that required for thermoset composites, an undesirable scenario especially in low-volume production.

These tooling and heating requirements often limit an engineer’s freedom to consider large, complex TPC parts. The diaphragm forming process, for example, uses an autoclave to ensure high-quality parts — lengthening processing time from minutes to about an hour — and employs a disposable diaphragm, typically made from expensive superplastic-formed aluminum or polyimides which vastly increase recurring process costs.

Although developments in continuous compression molding are making TPC parts longer than 10ft/3m practical, component geometries are still somewhat limited. Automated fiber placement is a workable alternative for more complicated TPC shapes with varying part thickness (e.g., fuselage shells, wing and stabilizer torsion boxes and stringers), but one of the challenges is void removal — more difficult with thermoplastics than with thermosets. Another promising solution for making larger parts affordable is the 3-axis pick-and-place robot, which can build ply stacks rapidly but requires less capital investment — an approach already in use on the G650 business jet.

TPCs will certainly challenge thermoset composites for pride of place. TPC heat and pressure processing methods bear a greater resemblance to those used with metals than they do to thermoset processes. That fact has encouraged rapidly expanding use of TPCs in place of aluminum and titanium in clips, brackets, trays and other simple parts. In the next several years, continuing research could broaden the practical range of part sizes and shapes — soon enough to potentially sway the material selection processes for the Airbus A320neo and Boeing 737 MAX.

Related Content

Thermoset-thermoplastic joining, natural fibers enable sustainability-focused brake cover

Award-winning motorcycle brake disc cover showcases potential for KTM Technologies’ Conexus joining technology and flax fiber composites.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MoreRead Next

Thermoplastic composites: Inside story

Reinforced thermoplastics buy their way into structural aircraft interior components.

Read MoreInside a thermoplastic composites hotbed

As production of the A350 XWB ramps up, so does manufacture of the thermoplastic fuselage clips the plane requires. HPC sees how it’s done.

Read MoreThe market for OOA aerocomposites, 2013-2022

In the coming decade, out-of-autoclave technologies will increase composites penetration into primary flight structures.

Read More